January 10, 2024

Supply Chains

The USA is engaging in a new(ish) kind of foreign policy of "economic containment" in an attempt to control China's investment in technology. The focus is—supposedly—on Chinese military production through banning the export of specific technology.

My prediction is that the impact will be on a much broader swath of investment and trade with China, and is going to have knock-on effects without really denting investment in its military products. Money flows into military development even if it is harder to produce those products.

US Department of Commerce to restrict chip exports in October 2022, so China couldn’t use advanced processors such as Nvidia Corp.’s A100 and H100 to power AI engines.

Last August, in Executive Order 14105, President Joe Biden directed the Department of the Treasury to draw up rules barring US investments in entities suspected of helping to develop next-generation weaponry for China’s war machine.

The USA government's attitude to China is that American exceptionalism applies to its ability to produce high-end technology and anything China produces is "stolen". And, such stolen technology is a threat to the USA's national security. This is not so much of a departure from before, but it is strange that the USA is complaining so loudly about China's ability to develop technology and compete in some areas.

The shift around banning investment and trading tech is being met with responses from China. This would not be a problem if the myth that China doesn't have its own tech were true, but of course it isn't true.

China just cut off exports of tech for mid-stream processing of critical minerals. Technology that was invented, perfected, and invested in by Chinese state-owned companies. It has a near monopoly on some of these processes, so much so that Canada and USA mining companies actually export most of their raw critical minerals to China for mid-stream processing than build that capacity in the West. This is not just a cost issue, it is a knowledge capacity issue.

A huge part of the supply chain for batteries is tied-up in this, but also many other consumer goods and all are affected by this "friend-shoring".

The belief of the politicians in the USA, Canada, and Europe is that passing laws around goods will just be dealt with by the "market". This is not going to work out well.

Recent discussions I have had with the mining sector around critical minerals outlines the issue: companies do not produce things at a loss no matter how much governments "want" them to. Outcomes of these policies without some industrial strategy around developing these less than profitable sections of the supply chain are not so easily predicted.

Global Growth

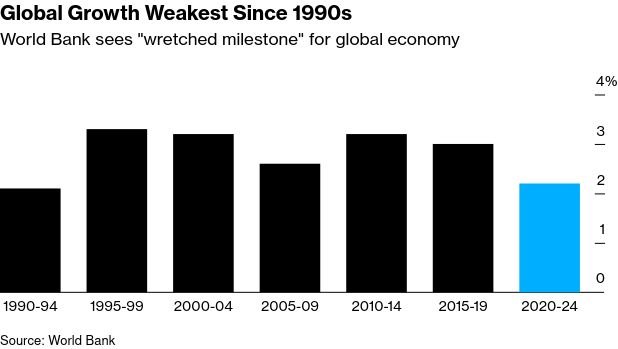

World Bank economists are lamenting that the world's economy is not growing fast enough. They do not outline it specifically, but this is mostly because of decelerated growth in China (4.5% growth) and the USA (1.6% growth).

Economic growth is only possible with investment and we do not have an over abundance of that going on.

Per-capita investment growth in developing economies over 2023-2024 will average 3.7%, about half the average of the previous 20 years, without policies designed to boost investments and strengthen fiscal policies.

World Bank predictions for global growth:

- 2024: 2.4% (down from 2.6% last year)

- 2025: 2.7% (revised down 0.3%)

Compare these to 3.1% global growth in the 2010s.

Global inflation prediction:

- 2024: 3.7%

- 2025: 3.4%

Well above what was considered "normal".

- 2020-2024 is expected to hit 2.2%, the slowest for a five-year period since 2.1% in 1990-1994.

On the up-side, growth in trade is back, expected to hit 2.3%.

This is all without expectation of global conflict and ignoring any climate related disasters that are sure to arrive.

The US endured a record number of 28 weather and climate disasters in 2023, each causing $1 billion or more in damage and collectively killing at least 492 people and 2024 is going to be even hotter.