February 9, 2024

Layoffs pay for dividends

Large layoffs have been announced recently in what is becoming the layoff season. Tech firms eye late January for layoffs and other firms are following suit.

Many of these mass layoffs are coming after announcements of dividend payout increases to shareholders. There is a reason for that. Layoffs pay for dividends.

In Canada, the TSX has some of the largest dividend-paying companies.

Enbridge, CN, Fortis, Canadian Utilities, TD, Telus, and now BCE/Bell Canada.

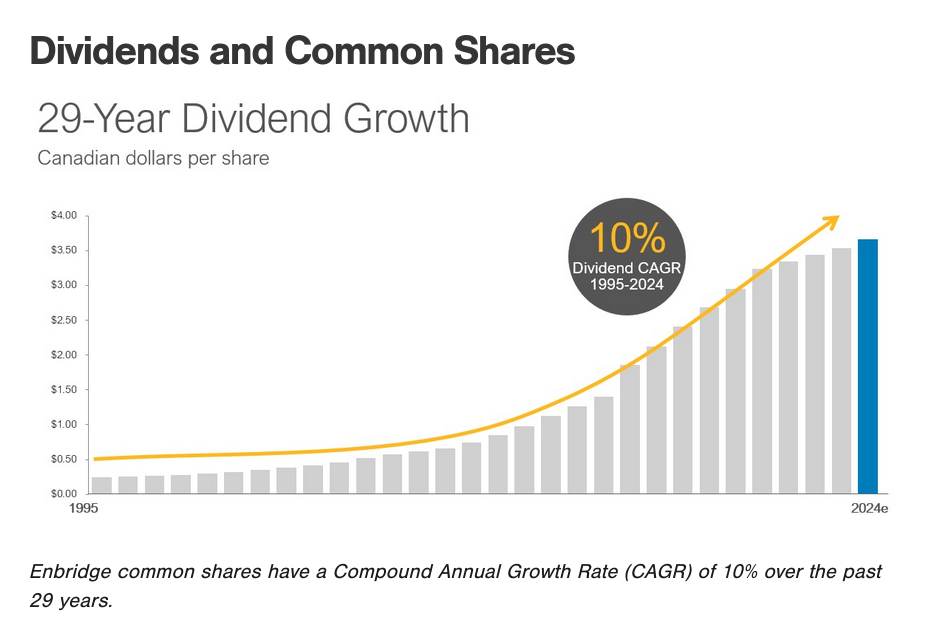

All these companies have been rather nasty with their employees to drive dividend growth for their shareholders. It is a corporate strategy to retain investment from US investors who forget about Canadian exchanges.

They have some things in common. They are rather old companies with slow-growing, utility-like investment programs, get lots of government support, are under light government regulation, who have consistently put shareholder payouts ahead of investments in Canada.

How do we know this? Well, we can look at their books, but the easiest way to tell that they are under this is that they all complain about being overly regulated and get no support.

Bell is one of the loudest complainers in the market about over-regulation, but it has benefited from decades of declining regulation. So little regulation falls on Bell that it is comparable to CN, which actually writes its own regulations.

Enbridge is just laying off a bunch of workers after a couple of years of trying to outsource work to contractors. It is blaming an Ontario Energy Board decision that called out its crappy, climate regulation-denying accounting and rejected its fee schedule. This has zero impact on short-term revenue.

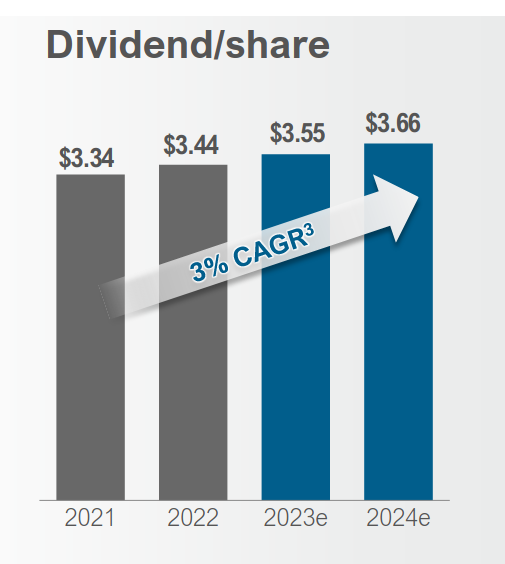

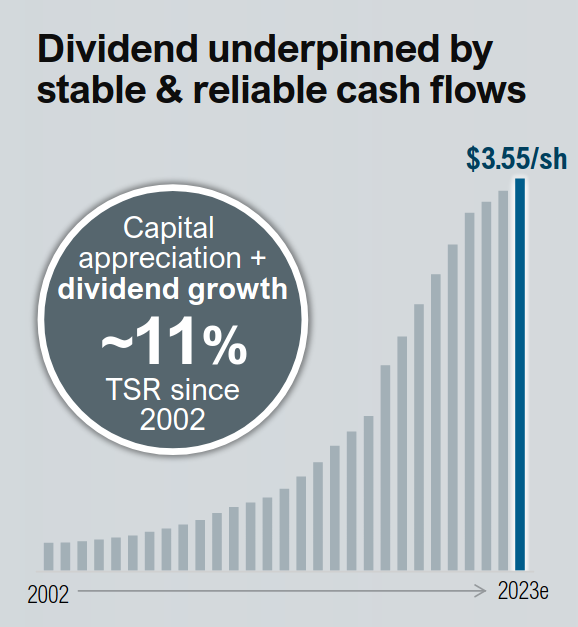

The OEB decision makes a good scapegoat for Enbridge, but it is pretty clear from its November filing that it had no interest in a change in investment in its Canadian assets (and resulting employment) and decided to spend money buying USA utilities and boosting its dividend payout. Layoffs are a short-term way to increase liquidity to do this and then slowly hire folks back through contractors as they are forced to maintain new investments.

U.S. gas utilities acquisition enhances all 5 components of Enbridge’s value proposition (EG)

Same goes for Bell's announcement to cut it loss-leading section of the company (journalism) and invest in its shareholders.

These companies basically print profits through the relaxed regulatory regime and little need to invest their profits back into infrastructure as they rely on handouts from the government. Government is "tricked" into giving them money because they own essential parts of our critical infrastructure.

While we should point out the ridiculousness of company heads saying one thing and doing another, we cannot at all be surprised by the moves. These are profit-driven firms. They would not control these parts of our infrastructure if they were not interested in profiting from them. A clear-eyed view of this is needed to push back against the real drivers of these decisions.

People will complain that they have a "monopoly", but the reality is that they are competing on two levels: withing their respective industries of the real economy and in the financial system. It is real competition that is driving the behaviour of these fully financialized firms.

These are not the same firms running under the same system as when they were privatized. But, they are being regulated as if they were.

And, that's part of the problem. We have handed over industries that require constant investment and promise barely any profit generation to large profit-seeking companies under less and less regulation. The ownership of these low-profit assets are about stability through size and when that stops being a thing, they sell those assets off.

Journalism, rail transportation, banking, utilities, essential fossil fuel distribution, and media/communication infrastructure.

What do we expect? That capital will act altruistically and not pay their owners as much as they can get away with?

Instead of complaining about monopolies (that do not exist), the left needs to focus on the real reasons for the decisions that are being made. There are specific regulations and market forces operation here that push companies to make these decisions. These are regulations that capital has demanded based on the notion that they are going to use the savings from lax regulation and invest it.

Reducing regulation for investment is a lie. And we should do more to call it out.

It is only through tighter regulation, increased demand for investment, increases in relative profitability, directed procurement, and threats of state-level intervention that utility-scale companies ever invest.

For decades the system has attempted to usher investment through removing obstacles to investment. It has not worked.

Intervention in the economy looks different as we adapt to changes in capitalism. This is one of those moments that we must change to meet the new.