February 29, 2024

Gas and Industry

Too much gas being produced? Or, just enough to keep some industries going because it is now super cheap?

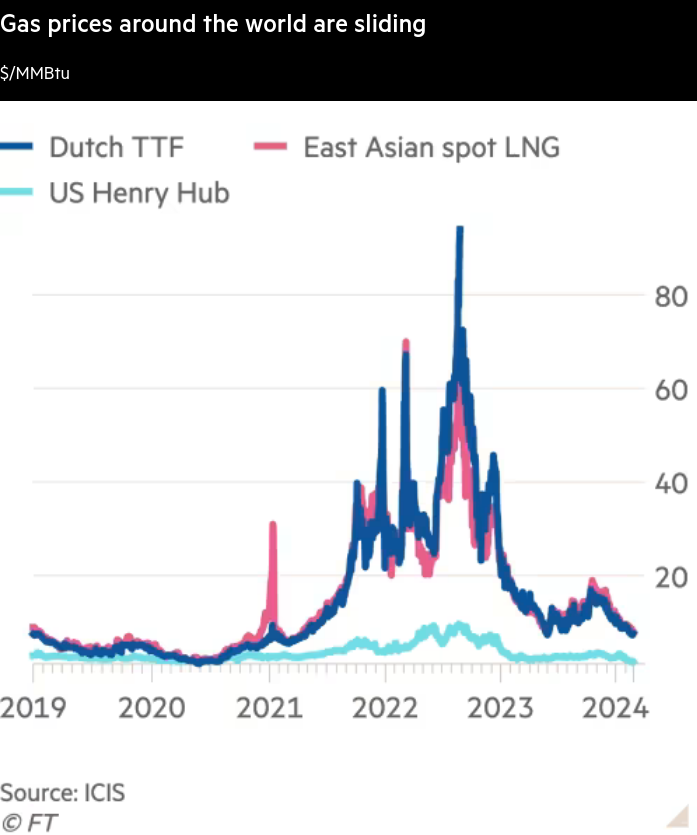

Lower gas prices have implications for the energy transition, potentially keeping consumers hooked on the fuel for longer.

It could also boost gas’s image as a transition fuel from coal to renewables, especially in Asia, the biggest source of new gas demand growth.

Example: Qatar announced it will increase LNG capacity by 85 per cent in the next 5 years.

Even with fluctuations in gas prices being what they are (large), people still make large comments about the fossil fuel being an easy cheap transition fuel.

“When we make long-term investment decisions for the energy transition, we should not base them on current spot prices, but we inevitably do,” said Michael Stoppard at S&P Global Commodity Insights. “There was a big shift against natural gas, of course, when the price was very high, and it was seen as unreliable. Now there’s a feeling that natural gas is back again . . . and it will make competitive support for renewables more difficult.” (FT)

What most folks do not realize is that natural gas and other liquid petroleum products like propane, are heavily used in industrial production. With the invasion of Ukraine and the sanctions on Russian gas in Europe, we saw a lot of chemical production collapse and the industrial sector along with it in Germany. With some lower gas prices now and maybe on the horizon that lost production has rebounded some.

This is why the USA cancelled its LNG export terminal licenses, it wants to make sure that its supply of LNG does not suppress prices too much.

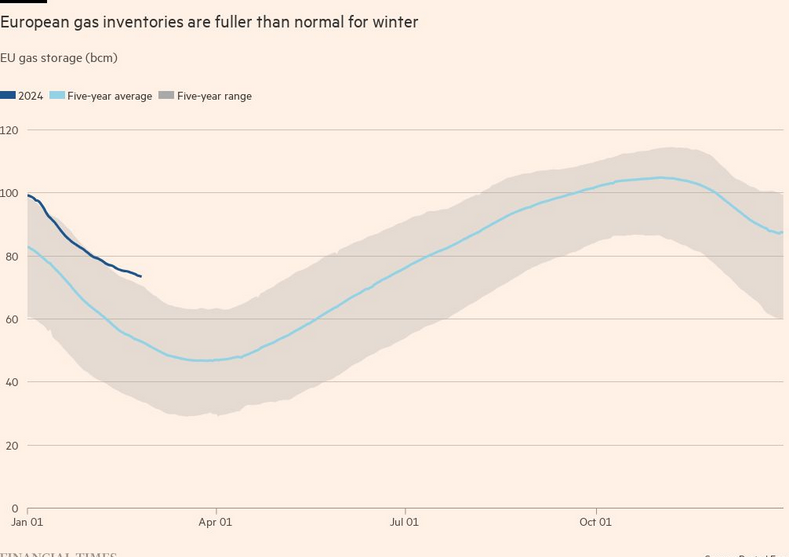

Goldman Sachs says Europe’s price situation is a “preview” of what it can expect at the end of the decade when a surge in LNG exports oversupplies the market, further pushing down prices and helping reduce the risks of industrial offshoring. The firm expects 204 mmtpa of new LNG supply by 2028, twice the amount of Russian supplies curtailed by Europe. (FT)

WTO and climate change

Climate change and the use of trade rules in an attempt enforce investment in greener energy, tech, and production is getting push-back at the WTO meetings happening right now.

India is taking the position it should not be penalized for burning lots of coal in its production facilities. India has a lot to lose in trade disputes over green energy as it tries to be the world's alternative outsourced production destination to China.

The West has not lived-up to investment and subsidy supports ($100B/year) for developing countries to transition to greener fuels that were made in 2009. Instead, the West has elected populist leaders, dealt with popular backlash about increased fuel prices, and ignited opposition to expensive transition in their own countries.

India has been caught-out of the two-faced aspect to these rules agreed to in the early 2000s that seem to still apply to developing countries, but not to rich countries. For example, demands through the WTO that it reduce subsidies to food production while also being hammered with import tariffs and bans due to high use of fossil fuels in production.

The real threat to India's growing industrial base are EU rules. Europe is a much closer destination for its products than the USA. EU rules have used emissions as a sort of non-tariff barrier to balance out its free trade deals.

The Green Revolution in food production was built on top of fossil fuels and off-shored production to places like India. Those countries that built up industrial food production are now being told that this is no good anymore.

You can see the problem. Private capital has invested in India in industrial food production and have a huge incentive to continue that cheap production process even though it harms Indians and the climate.

Turns out that private capital owning land and forcing cheap production of food using fossil fuels was a dead end for growth. But, the states that supported that are not interested in funding (or really even thinking about) the transition away from that style of production.

BYD fear

Speaking of trade restrictions, the Biden administration has brought in a slew of new restrictions on Chinese auto companies over "connected" cars made in China. The fear in the USA and Europe is that BYD and other Chinese made electric cars are going to flood their markets and take out their domestic auto production.

Any and all reasons are being used to throw tariffs up. Including this idea of Chinese "over-capacity" in production in electric cars.

It is funny how neoclassic trade economics can be turfed so quickly in the USA and EU when the auto sector is involved. "Over-capacity in production" is called comparative advantage when the USA produces things better, faster, and more cheaply than everyone else. But, for cars, it is a problem when other countries do that.

I guess free trade is not a universal maxim after all.

One thing holding BYD at bay right now easier in the USA than Europe is that the European market for cars leans towards small cars and short distances. The opposite is true in North America. But, this will not last for long. At these prices, it is hard to compare to a near $100K car:

The Spring, which is made in China, will have a starting price of less than €20,000 the company has said, with some reports putting it as low as £15,000 in the UK.

The question I have is will Canada follow suit and attempt to use national security (and other reasons) to ban cheap cars made in just certain countries? And, how long can such rules actually keep these cars (that are 1/3 the price of Canadian made alternatives) out?

Inflation and Wages

This is the kind of headline that stupid neoclassical misunderstanding over inflation gets you.