February 22, 2024

Supply Chains and inputs

Making sure that the supply chain of critical minerals and critical metals for batteries is the focus of the world right now.

The government in the USA is concerned. Western firms are behind in investing in Made in Not China supply of inputs. Battery, car, machine, minding, processing, and tech firms have been relying on cheap inputs, but that does not get you access to Inflation Reduction Act profit subsidies. And, these firms need those profit subsidies as the fear that a competitor might get access to them increases.

Here are the things to be concerned about:

-

USA government pushing companies back into Congo for EV metals

- Along with a new $2.3B rail link to get those metals out.

- China controls more of the critical mineral processing than OPEC's control over oil.

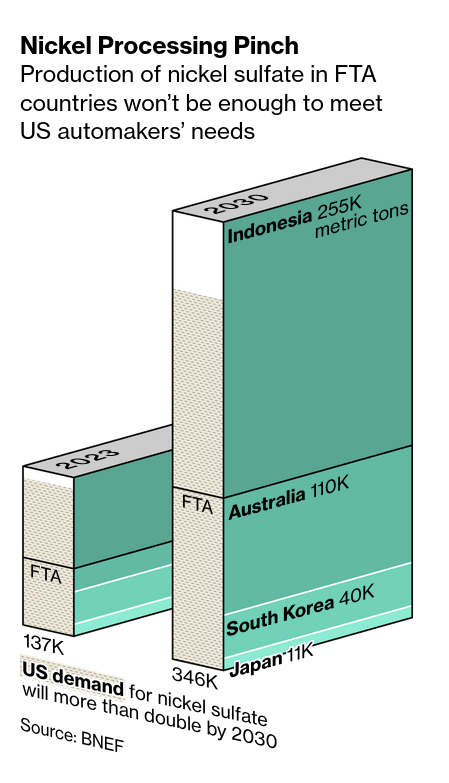

- There is not enough raw materials for car manufactures in USA "friendly" countries, despite commitments to spend hundreds of billions of dollars on US mines, refineries and battery plants.

- Old Batteries will be equivalent to 30 mines (for lithium and other critical minerals) by 2040 if recycled.

- Car makers (Tesla and Ford) are lobbying hard to eliminate the "not made in China" rules in the IRA because they have invested billions in this supply chain.

- China reduced exports of graphite, squeezing supplies.

Canada is the world's 6th largest nickel producer, but we do not even rank high enough to make it on the list of inputs to the USA supply chain conversations. Canada's nickel production was reduced by 10% this year compared to 2022 because of spot prices of nickel.

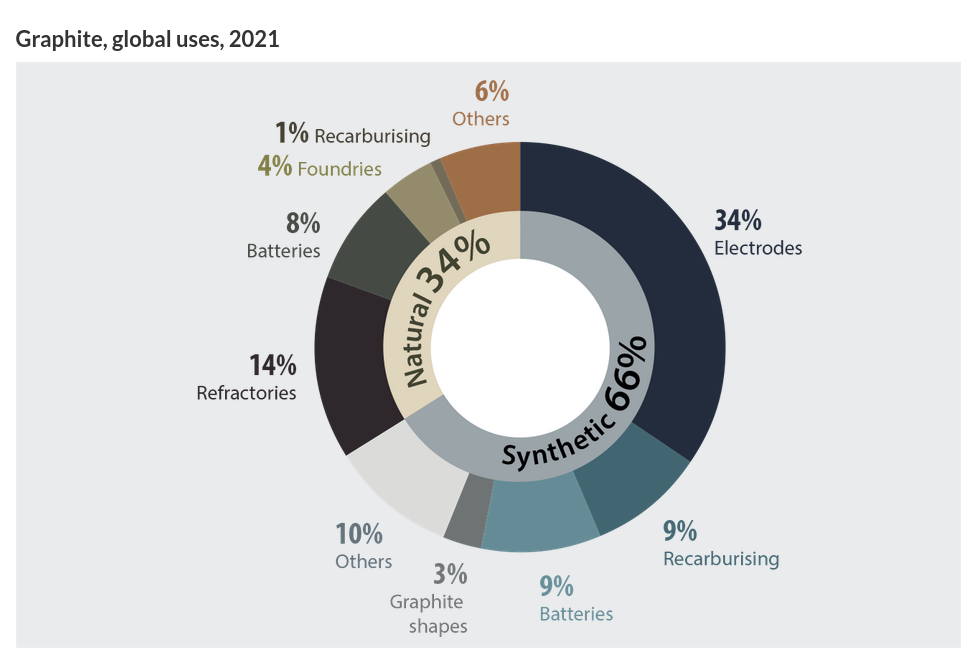

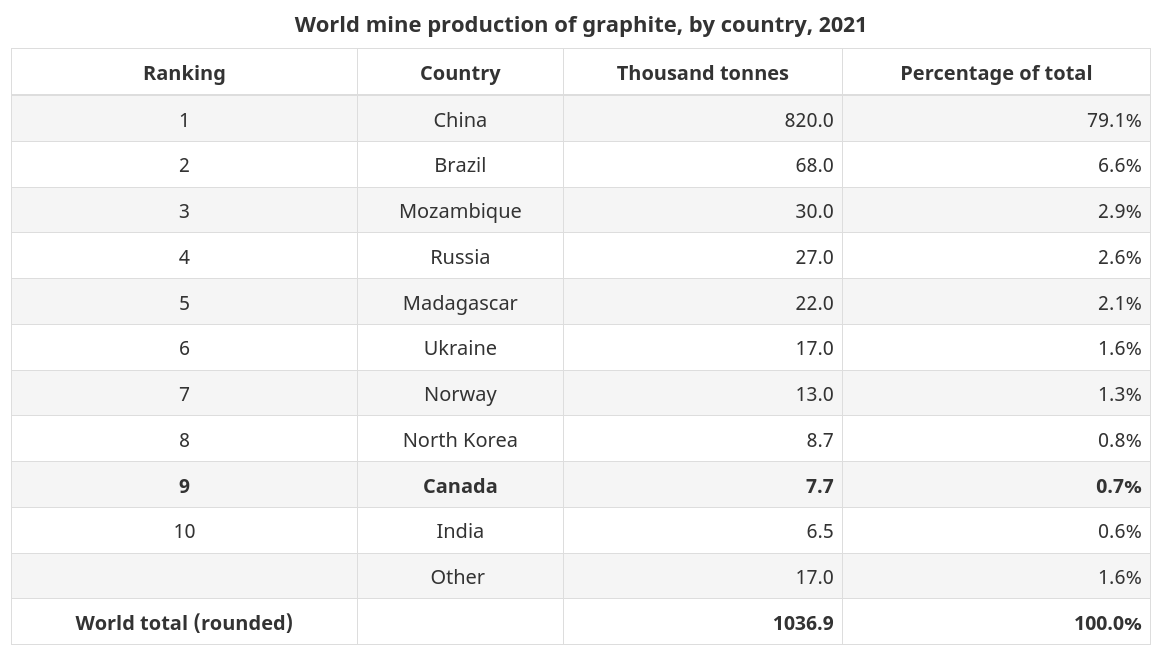

One example is graphite. Canada produces natural and synthetic graphite (9th largest producer and reserves in the world).

But, synthetic graphite is produced with coal tar or petroleum coke. This is hardly a green product.

However, it has not scaled-up production of other critical minerals to support USA's demands. Mostly because the Canadian government believes that it does not have to invest for this to happen.

Canada must invest in research and development at the level of industry and build capacity for processing if it is going to get in on this market. Leaving the expansion of critical mineral production to the market is a losing proposition.

And, that's just graphite. All critical minerals are like this in Canada. Without significant investment in R&D through our research councils on mid-stream processing and Canadian-specific uses, state supported or owned processing, and sustainable supply, Canada is not going to be part of the energy transition.

Canada and Commodified Carbon

Canada's 2030 climate target is to reduce emissions by at least 40% below 2005 levels. That's not going to happen without massive investments. And, they just are not happening.

- The Canadian government cannot subsidize private companies enough for them to invest in lowering their emissions. It is just too profitable under the current regulatory regime.

- Carbon Capture and Storage is a major part of Canada's emission reduction goal. But, of course, it doesn't work and no one is investing in it.

- Carbon markets only work under special magical situations and where massive profit guarantees are in place. Governments like Canada's cannot afford to do this.

Energy companies are hedging their bets that a future Conservative government will cancel the carbon pricing scheme that the Liberals have brought in. That means they are very reluctant to engage in the carbon trading mechanism. This is leading the government to meeting with each individual company to further subsidize the carbon market.

The Canadian government has only recently started to lock in carbon contracts with heavy industry. It signed the first one in December, a contract worth as much as C$1 billion with an Alberta-based carbon capture firm called Entropy. (BN)

Pathways — which includes Cenovus, Suncor Energy Inc., Imperial Oil Ltd., MEG Energy Corp. and Canadian Natural Resources Ltd. — plans to invest C$16.3 billion ($12 billion) in a carbon capture and storage system to reduce emissions by 22 million metric tons by 2030.

But, Pathways is not going to invest unless they get the federal government to guarantee zero risk to them on carbon credit subsidies. That means the government will be on the hook for massive profit supports for a technology that basically does not work.

This is all happening while the same companies are scaling up production of oil to push along the much expanded TransMountain Pipeline when it comes online this year.

So, climate-supporting investments in Canada's energy sector are currently going nowhere.