February 17, 2023

Tesla's recall

- Self-driving is deemed so dangerous that Tesla has had to recall its cars for an "upgrade".

- Self-driving cars are impossible to mass produce. They can only exist in places where everything is the same. Like Silicon Valley.

- Always look both ways and keep your distance from Teslas. They tend to act erratically. Mostly because of who is driving them.

The USA opened an investigation into Tesla's "self-driving" system in 2021

There is a decline in profit from providing credit to capital and the state

FT's Unhedged has outlined some of the debt market strangeness that comes with high and growing interest rates.

Essentially, no one is getting paid much to lend credit to the state or the private sector.

When a large chunk of your yield is coming from the risk-free Treasury rate, why pile on credit risk? As Jim Sarni of Payden & Rygel put it to me (speaking of the short end of the curve), it’s not smart to go down in credit quality when the risk-free rate is 80 per cent of the total return.

The point that I want to make is that without lending to risky investment ideas, capitalism's dynamism kind of halts. There were several a stories yesterday warning of "zombie venture capital financed firms". Basically, firms that were operating on no short-term profit expectation, but are about to run out of money from their previous VC funding round. This is the Uber model which worked when debt costs were subsidized by the Central Bank, but do not work now.

They layoffs of tech companies is part of this trend. These companies are getting rid of staff that they hired when the state was subsidizing their profit margins, but now that capital investors are seeking some actual returns on revenue-generating production CEOs are freaking-out.

The shift in the model is what the Central Banks are hoping for. The layoffs will lead to declines in income growth in the tech sector and push some of the unemployment numbers up. All the while pushing some of these companies that are debt-heavy out of business.

Every recession looks different from the previous one. This one is no different.

EU and USA fight over subsidies

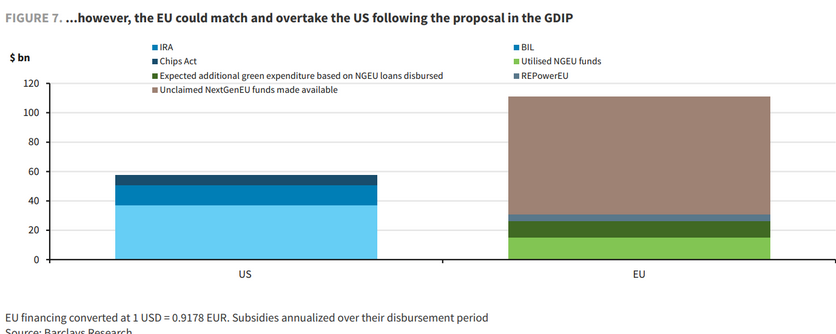

The USA's profit subsidy masquerading as a green spending splurge (IRA) is now being matched in the EU by the "Green Deal Industrial Plan" (GDIP). Yes. G-Dip. The EU sucks at naming things.

The estimate is that it is either as big (or could be larger) than the USA subsidy regime. However, the EU program is based on "free market" principles that are known not to work. Which is why the USA went the other way.

Anyway, it is going to be interesting which one "saves capitalism" from itself:

The main mechanisms of support in the EU plan will be "investment aid" (read: happy thoughts) and tax credits. There will also be some subsidies to capital from European funds to hydrogen and quantum computing projects.

It is reported that poorer countries are not so keen on the "tax credit" schemes, since they will only help large capital that already has the ability to invest.

If I was a poor EU country I would also be upset.