February 16, 2024

Fruit production in Canada

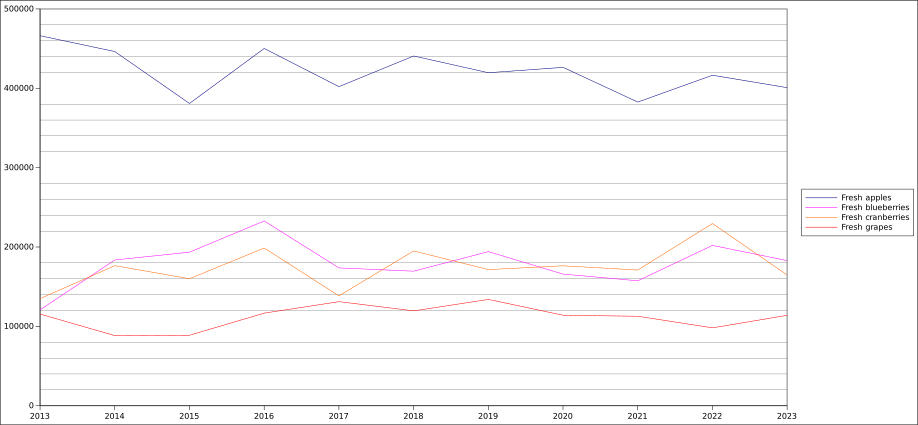

Climate change is directly affecting fruit production in Canada, including grapes, peaches, apples, blueberries, cranberries, and blackberries.

Terrible growing seasons saw between 2% and 4% reduction in production, leading to higher prices. And, for some large producers higher profits, but across the sector total value of fruit was down over 4%.

Quebec also saw a reduction vegetable production because of extreme weather.

While that may not seem a significant dent in production, it is not great that Canada has either a non-growing or a slowly declining production in fruit even as our population grows.

Decline in response rate of the Labour Force Survey

Statistics Canada are concerned that the response rate for their main survey is declining. Many statistics agencies around the Western world are seeing this after they did away with in-person interviews and governments tried to do stats on the cheap.

In January 2024, the LFS response rate was 72.1% compared to an average of 87.0% in 2019.

About 68,500 households in Canada are supposed to be contacted in the LFS each month with a sixth of that shifted to new households to allow for proper sampling.

Statistics Canada has announced that it is moving to an "online first" approach with follow-up for LFS gathering done in person if the household contact does not fill in the survey. This is similar to the new Census model.

While this may save money and allow scarce StatCan resources to be put into getting lower-income households to answer the questionnaire, it is a bit disappointing that the agency and others are not working on more robust stats gathering. I do wonder what StatCan would do if it had significantly more (as in reasonable) resources available to it.

Ontario Energy Board Distribution System Regulations

The OEB has announced that it is moving ahead on its distribution regulations for the province. This announcement comes after most of the decisions on the roll-out were already decided and a minimum consultation with private EV charging interests and a couple major energy distributors occurred. The only folks organized enough to put forward submissions to these changes were:

- Building Owners and Managers Association

- Environmental Defence

- Electricity Distributors Association

- Global Automakers of Canada

- Hydro One Networks Inc.

- Kingston Hydro Corporation

- Tesla Motors Canada

- Toronto Hydro-Electric System Limited

The OEB is calling it "Distributed Energy Resources", but it really just means the transition to using electricity as a transportation fuel (supplied by businesses) and distributed generation (read: firm-based solar and wind).

This is extremely important work and it is necessary for the OEB to get a decent response from the public and knowledgeable parties to off-set the general call of privatization of generation and market-determined investment. Unfortunately, that is not happening as the process is geared to market demand instead of planning.

While there is no question regulation needs to continue to evolve in this space, it seems to be evolving only after decisions of private investors of EV infrastructure providers have decided to move forward. These changes are mostly to streamline the application process of businesses (including local distribution companies) of installing corporate charging stations. The goal is for the OEB to be able to recommend to generators and transmission companies how they should invest in infrastructure to provide these "users" (ie, re-sellers of electricity) with energy.

It is backwards and I think is going to leave gaps in the regulatory system, but also major gaps in the roll-out of charging infrastructure.

Chocolatey Hedge Funds

Hedge funds are piling into certain foods being hit by climate-related growing pressures that are leading to price hikes. That action is making those price hikes worse.

Many of these price movements are made worse by these hedge fund investment strategies driven by algorithmic investment programs. This make it harder for the original hedge investors known as cartels producers.

The cartels are complaining that the larger USA financial firms are skimming their profits.

Higher prices in futures markets do not flow directly to growers in Ghana and Ivory Coast, which together produce the bulk of the world’s supply of beans.

Of course, cocoa farmers are not exactly engaged in the best labour practices because of the intense cost pressures and lack of international and local state infrastructure to support income and labour in the industry.

In the end, all the important people lose out. Never mind it doing nothing for protecting the production of coca.