February 16, 2023

Housing is slowing

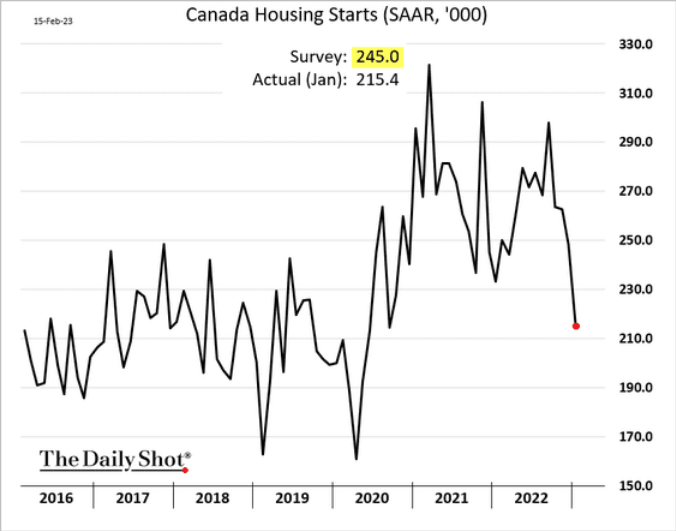

Housing starts—the starting of the building of new homes—has collapsed.

Housing starts in January across Canada fell to a seasonally adjusted annualized rate of 215,365 units, a 13% decline from December's revised level of 248,296 units, Canada Mortgage and Housing Corp. said Wednesday. Urban starts of multi-family units, such as condominiums and row houses, dropped 20% to 146,267 units, while starts for single-detached units rose 3% to 45,224 units.(MW)

The impact of slowing housing starts is a slowing of the house price collapse, as unsold inventories of houses rise.

Does that mean house prices will go down farther? That is unclear at this point. But, the private investment market in housing is starting to worry their investments are not going to make money. For me, this means that regular people looking to buy a mortgage to buy a home should also change the way they consider the home an asset. That is, it is a place to live and not necessarily a good place to invest your money.

Interestingly, if you look south of the border, you see the opposite story with housing starts growing.

This data is a little confusing as the investment returns in housing are down. There may be a lag in the USA housing data that is to blame, but it is worth watching.

The USA's response to the global economic situation is significantly different from Canada's as the USA pushes for more profit and production subsidies through the IRA. Will Canada be forced to follow suit?

Inflation

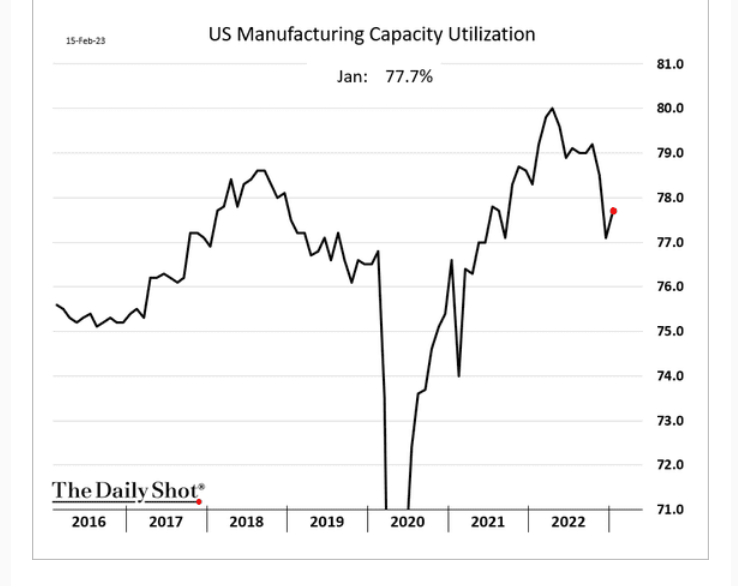

Yesterday we pointed to the large increase in the rate of growth of general costs to business to replace machines in the previous quarter. This increasing rate of cost growth could squeeze profits for industry and slow investment in new and current automation and inorganic capital.

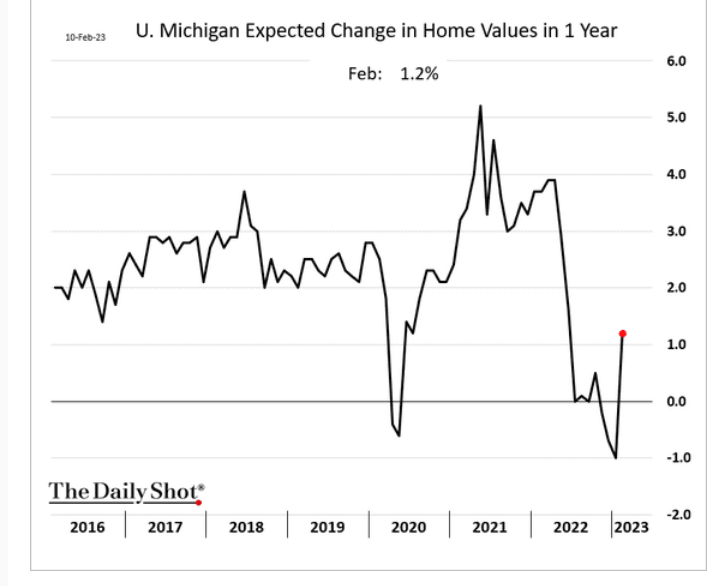

Indeed, it seems we are seeing that in our favourite measure of expected inflation: Capacity Utilization.

With capacity utilization bouncing up again and expectations of recession still around, it is likely that price growth might continue to be high because of a squeeze on production.

This could change if general economic activity and jobs are reduced first. This reduction in workers' wages and employment is the goal of the Central Bank and why they will continue their upward push on interest rates.

As interest rates go up, the investment decisions of large industrial capital may change from debt-supported capital/automation investment to finding cheap labour.

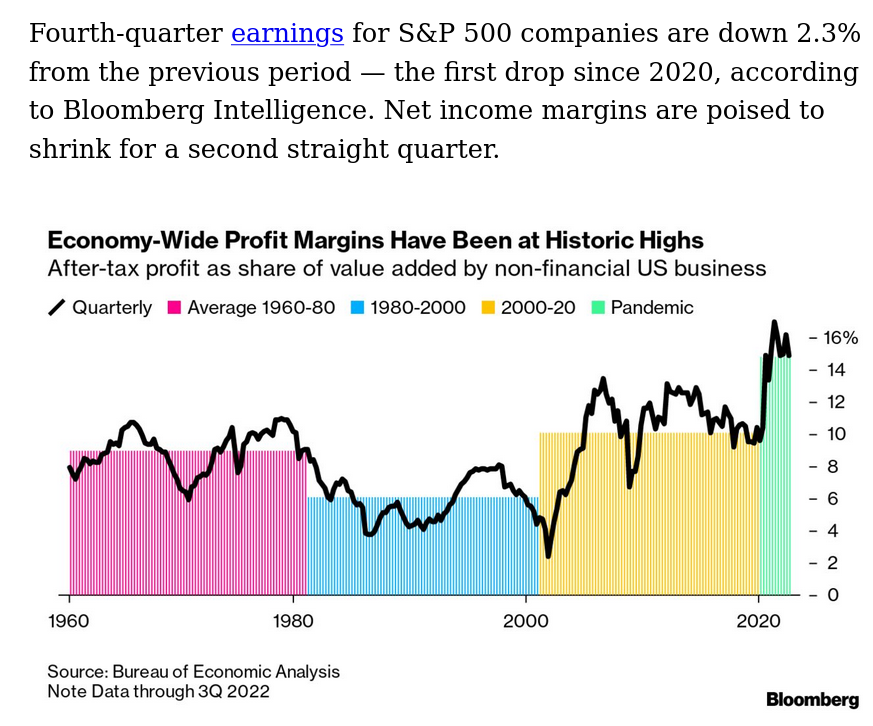

Profits

Corporate Profits have been high for companies that sell things because inflation growth has meant their profit rate was on top of price increases. Stuff companies bought when prices were lower have been sold when prices where higher.

This profit bump has come to an end as the re-stocking of shelves and production of new things (to replace the things sold) now comes with the increased inflation costs.

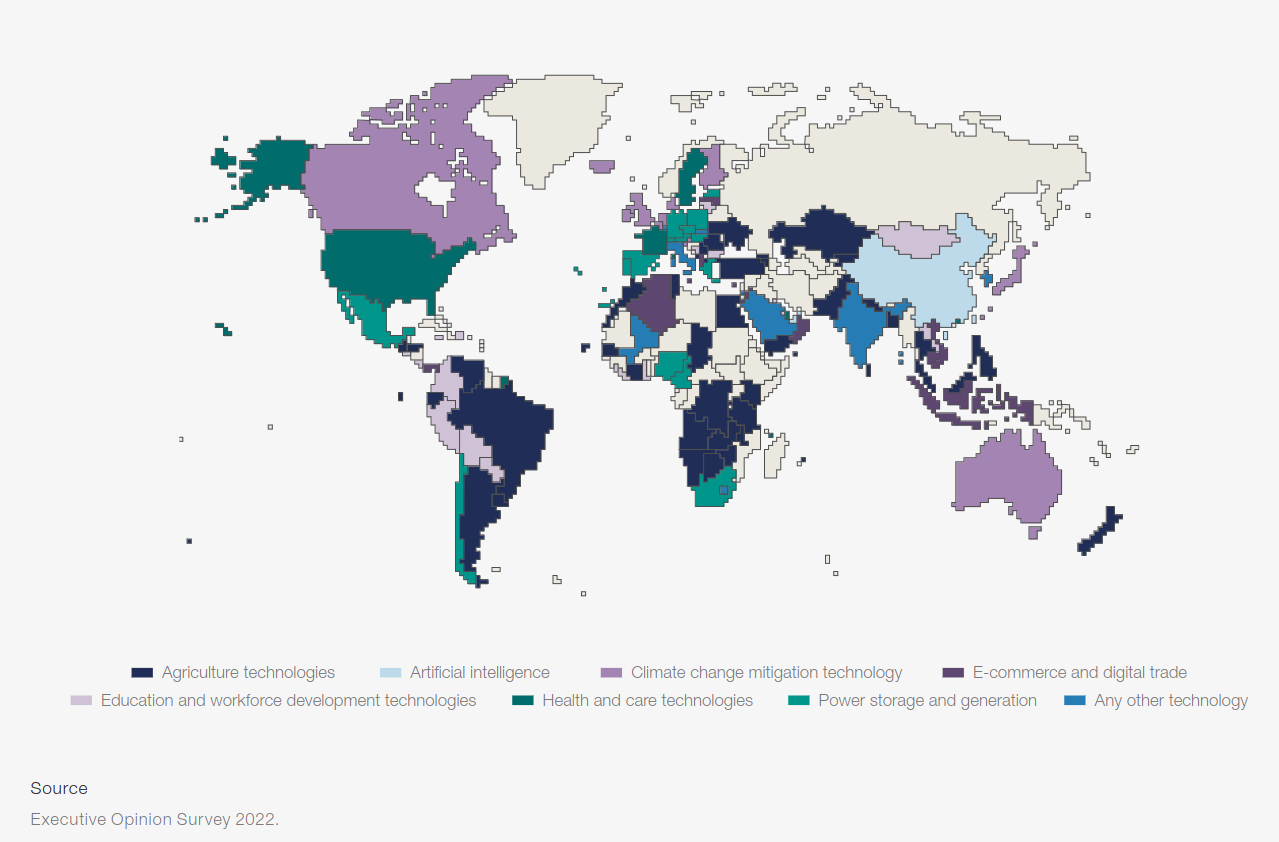

The technology of highest strategic importance in each economy

According to the World Economic Forum survey of CEOs, the higest strategic importance for technology investment is the following:

That's right. Climate change mitigation technology is the most strategic investment. Because, we are not going to stop climate change.

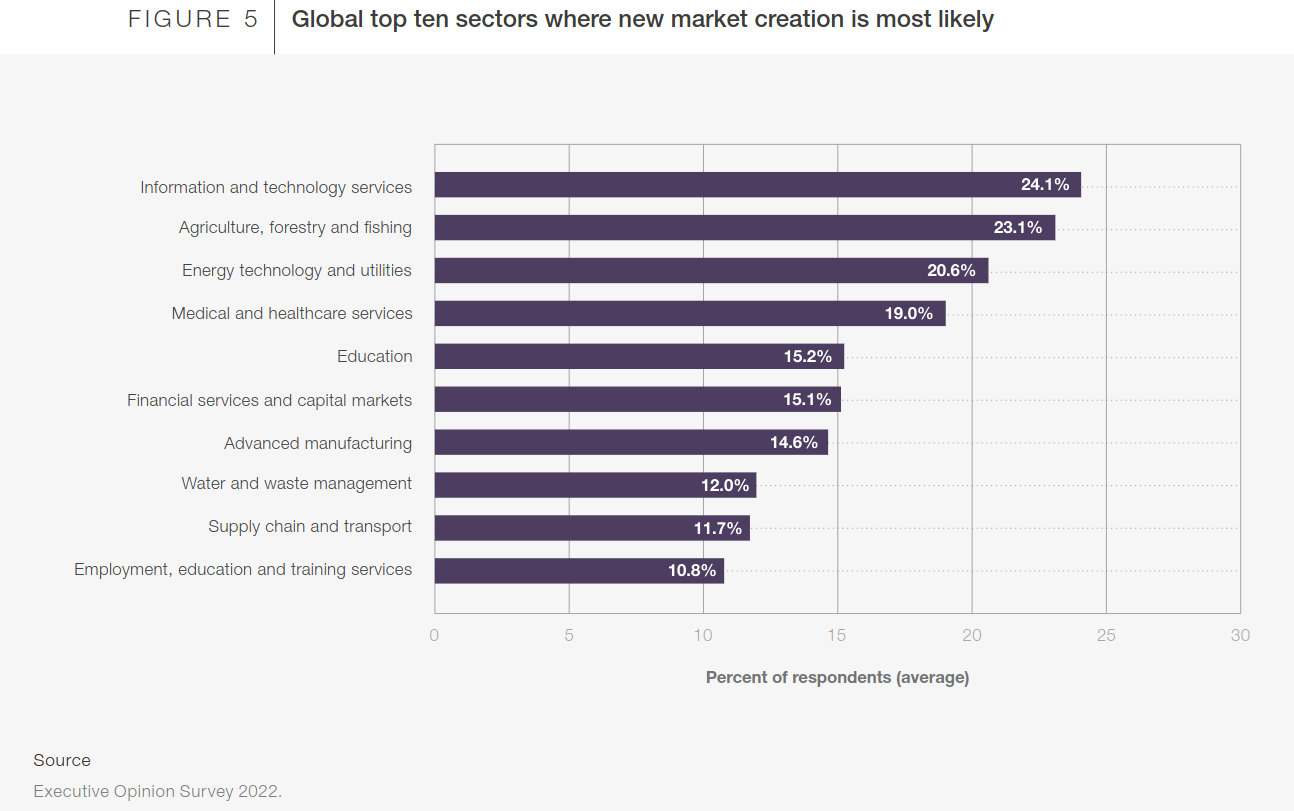

And, where is market creation (read: wealth transfer from the public to the private sector) going to happen?

While this is not a surprise, it is clear the left needs to focus on these areas in defending public ownership and control.

Tesla Fired Workers

The workers announce an organizing drive, the employer fires them all. It is almost like we do not have a balance of power.

Tesla Inc. terminated dozens of employees Wednesday at its plant in Buffalo, New York, one day after Autopilot workers at the facility announced a union campaign, organizers said in a complaint. (BN)

Tesla’s Buffalo factory employs more than 800 Autopilot analysts, non-engineering roles that contribute to Tesla’s automated-driving development, including by identifying objects in images its vehicles capture and helping its systems recognize them on the road, according to the union.