February 13, 2024

USA inflation continues to surprise on the upside

Business economists continue to be surprised by inflation numbers. They were off 0.2%, which is a lot.

USA inflation slowed to 3.1% in January.

Core inflation was at 3.9%.

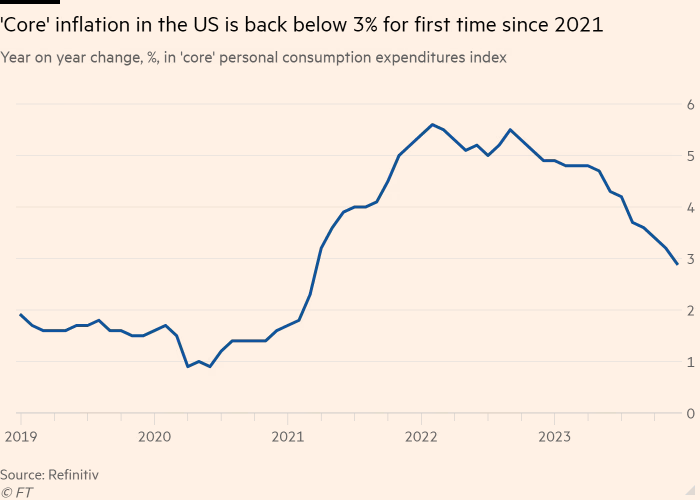

Core Personal Consumption Expenditures index was at 2.9%. The movement of PCE is what the central banks look to because it aligns well with their ideological orientation to inflation being demand-driven.

These are not numbers that investors were hoping for, and are now looking to extend their forecast for rate reductions in the USA. It also took a chunk out of the market which was flying high on expected deflation on some services.

The fact that these numbers continue to be a surprise to business economists should worry people. They claim to have their fingers on the real-time data and understand the economy so well that we should all just trust them with big money decisions. But, all the way through the rise of inflation and the fall of inflation, these folks still cannot figure out what is driving these numbers.

Grocery prices are up the largest amount in a year.

Some goods are in deflationary territory, but mostly because consumers are not able to buy them.

This is not the economy we are looking for.

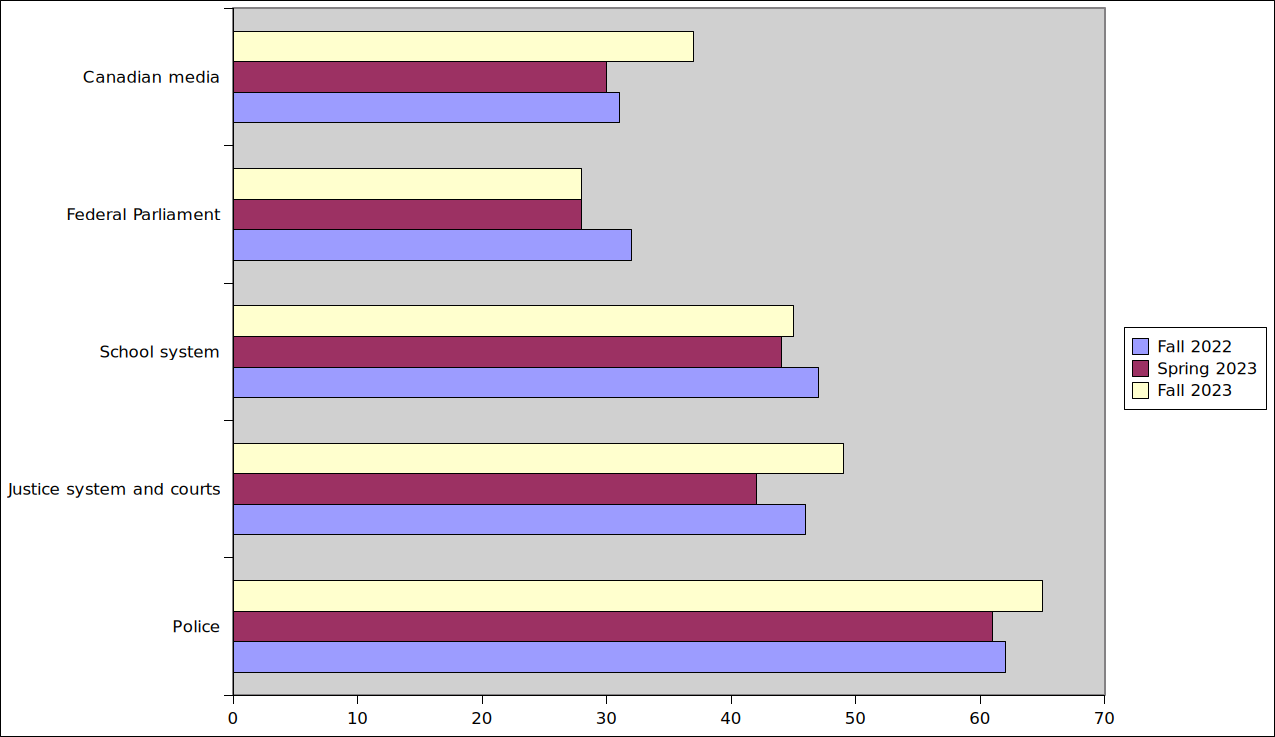

Canadian confidence in institutions are up

This might be good for journalism. Or, it might all be within the margin of error.

Some interesting lines:

- the less healthy you are, the less you trust institutions

- confidence in other institutions is correlated with your trust in meida

- low personal satisfaction correlates with hating most things

- climate issue awareness related to trust in institutions

Not surprising, but also shows why financial support for public broadcasters and the journalism generally is so important for the left.