February 1, 2024

Canada's economic growth

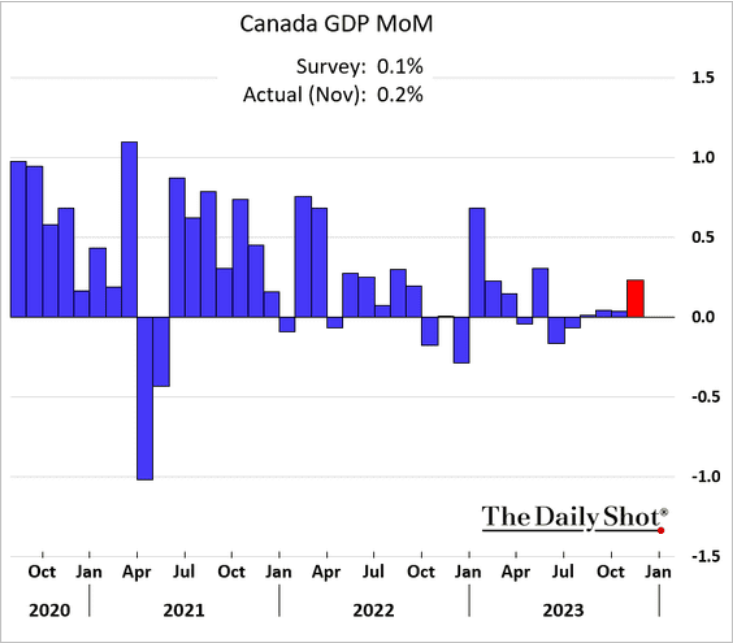

Canada's GDP surprised slightly to the upside in November of last year, according to numbers released yesterday.

While 0.2% does not seem like very much, it is only for one month. But, also, it isn't very much.

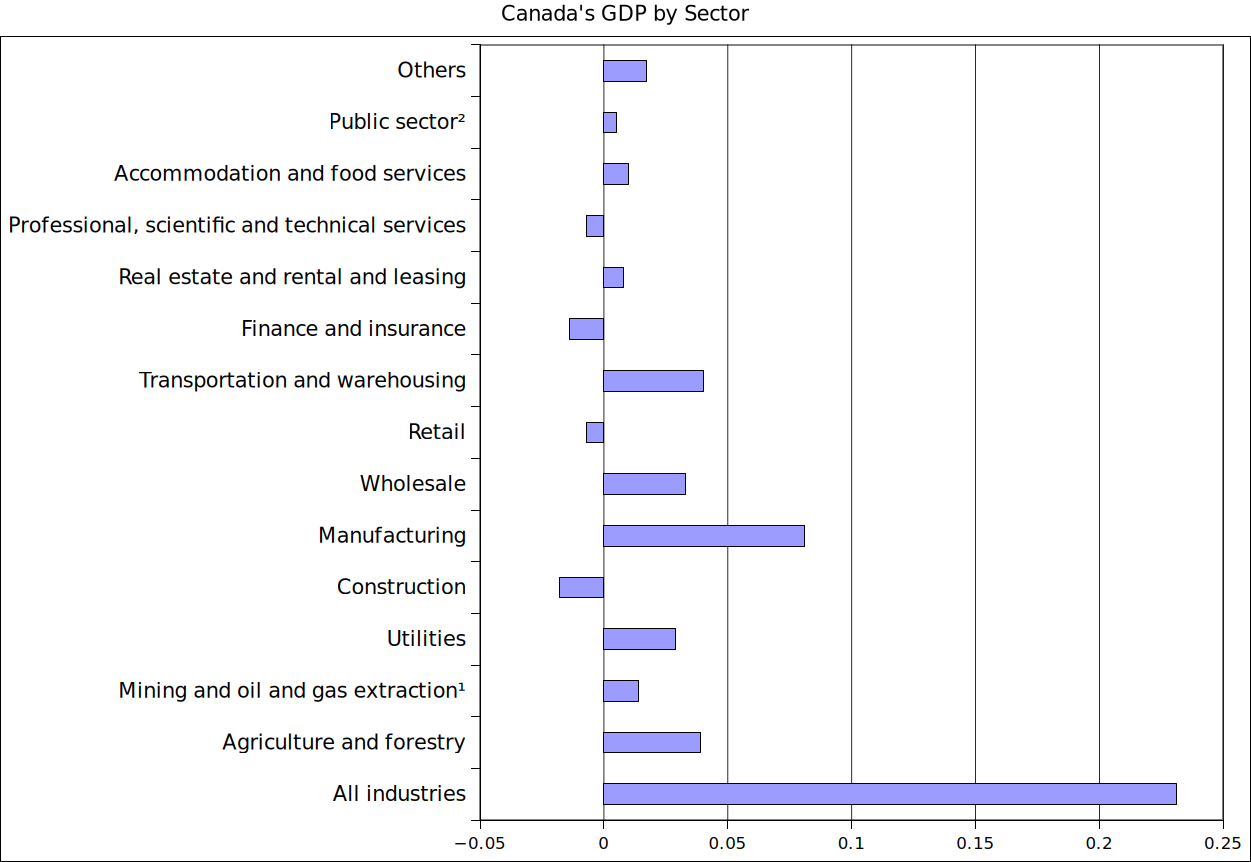

When looking at where "economic growth" is being driven from, you can see that the growth is rather broad and shallow across most industrial sectors. The reasons for the growth vary slightly, but most are related to "starting back-up" of machinery and production that was idled for one reason or another (repair, maintenance, strikes, new machinery installed, etc.). This is not so much economic growth from demand as economic growth from natural business cycles aligning accidentally across industries.

What is interesting is that the preliminary numbers for December also show an increase of near 0.3%. So, the bump that we see in November might have actually turned into a somewhat sustained manufacturing increase.

Much of the production is for export to our neighbor in the South which has kickstarted its economy with large procurement programs.

We cannot read too much into monthly GDP figures, but the yearly GDP for Canada is likely going to land around 1.5% for 2023.

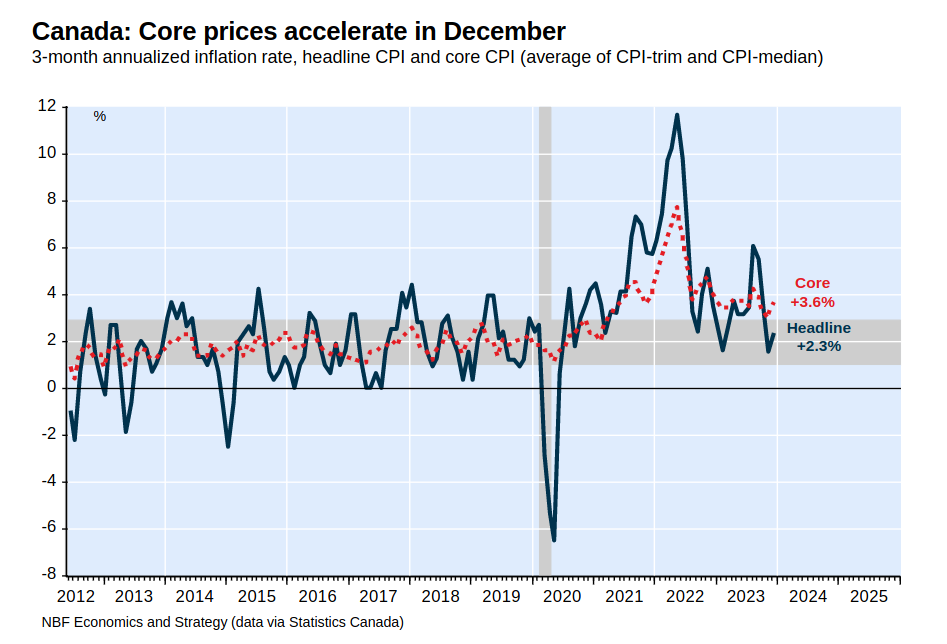

Match this with inflation measures and we have a bit of a conundrum for the central bank. Under their strict orthodox reading, they can only assume that interest rates must remain high if the economy is surprising on the upside along with inflation.

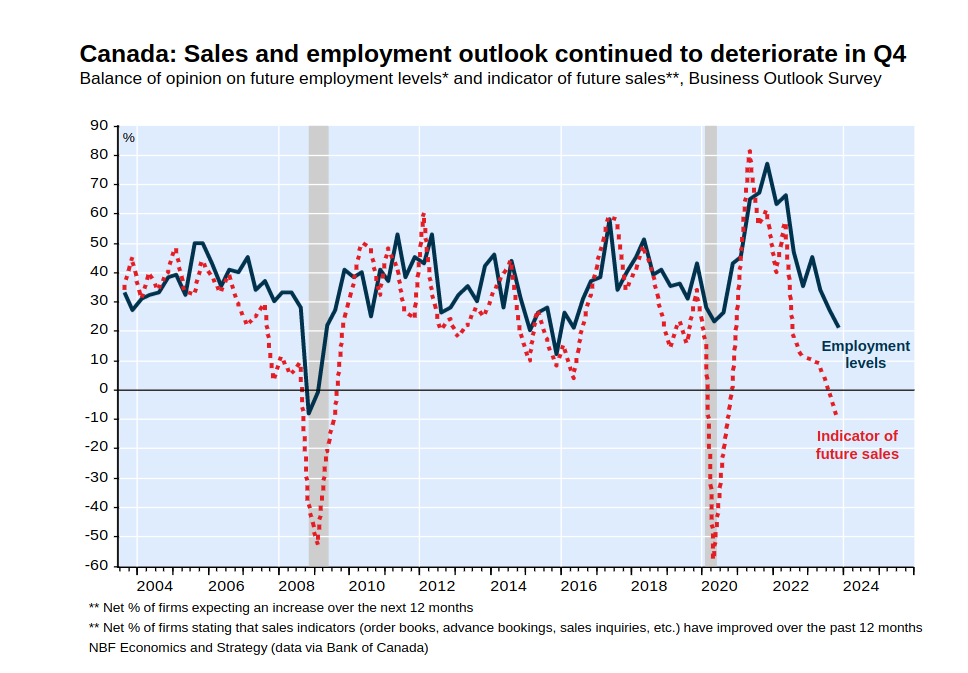

What this all means for workers is unclear. While economic growth might be doing alright, the future sales and employment levels do not seem so great:

Pausing USA LNG License Granting

There were 17 liquid natural gas projects in the pipeline that are affected by Biden's stopping of license granting for LNG export terminals.

A lot has been said in the press about this from both "moderate" (read "right wing) Democrats and Republicans (read "end-times accelerationists") about the impact of this move.

Democrats are saying that this is a positive "climate change" move. The far right are saying it will increase prices of gas.

There is no doubt that both of these statements comes with a tiny (tiny) bit of truth. Cutting off supply will do both those things. Eventually.

But, new LNG terminals take about a decade to set-up and the USA is currently the largest LNG exporter in the world. This may affect LNG export capacity after 2028, but there is a big if in there.

There will be no affect on local prices of gas or the gas's impact on climate change in the USA or around the world. There is currently excess capacity, though that will be blown through in the coming years if nothing else changes.

This is more about making sure that the USA can mediate exports of gas to their "allies" and control future prices.

The only impact on climate change might be that investors thinking that they were going to get a sweet deal on some super-cooled gas will have to put their money elsewhere. If they put that money into green energy projects, then maybe there will be a positive effect. More than likely though, they will put their money into building other natural gas infrastructure.

All the while, the USA is spending some time doing the economic analysis of just how much control they can have over LNG/gas export market.

So, no, it not really the thing it is being talked about as.

Global manufacturing

South Korea shows some indication that this year will be a year for a rebound in manufacturing. The advanced manufacturing powerhouse is usually seen as the go-to predictor for the rest of the world.

The purchasing managers index released Thursday for South Korea, Asia’s third-largest goods exporter, rose to 51.2. That’s the first time since mid-2022 that it’s been solidly above 50 — the dividing line between contraction and expansion. (BN)

Most Asian production is up. However, this increase might be a result in the continued weaker production rates coming out of China (though there is growth).

The manufacturing rates are an important measure of global production. There is pent-up demand for new manufacturing machine inputs as many companies have delayed updating those machines as borrowing costs remain high. However, companies can only put off buying new production machines for so long.

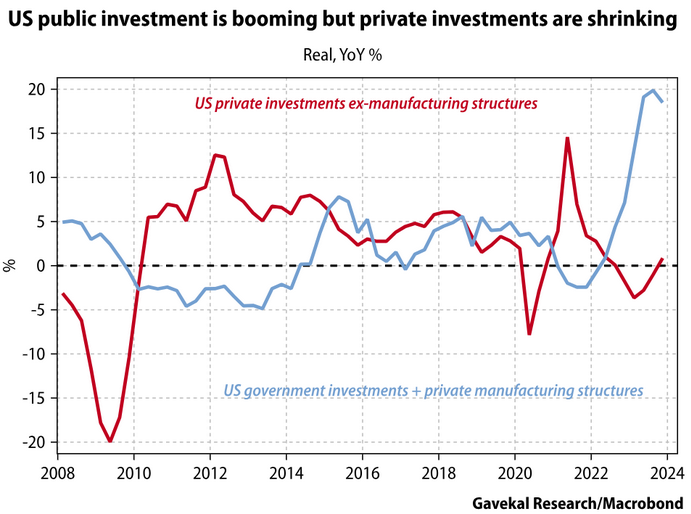

For USA capital investment is heavily weighted on the public side. Private capital investment in manufacturing that isn't directly subsidized is very much down:

Other news

- European inflation stays high

- USA's "personal consumption index" on inflation also is not declining as fast as other measures of inflation

- German transport strikes are today

- France votes to enshrine abortion rights into their Constitution.

- Mexico City joins BC an Alberta as they face a drought. Some in Mexico say there is a chance they run out of water by June.