December 5, 2022

Canadian Economy

Some graphs for you folks.

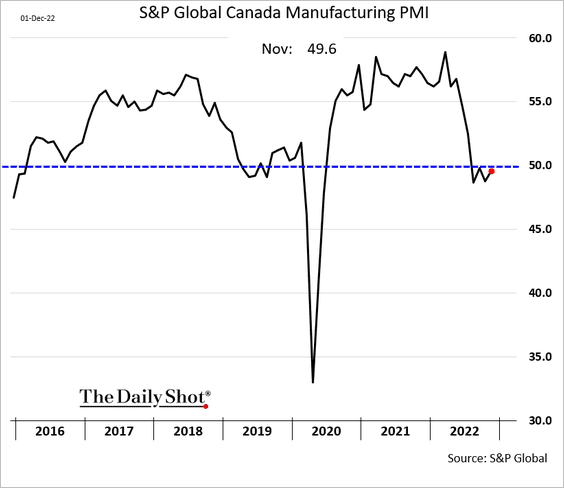

Manufacturing activity is in neutral

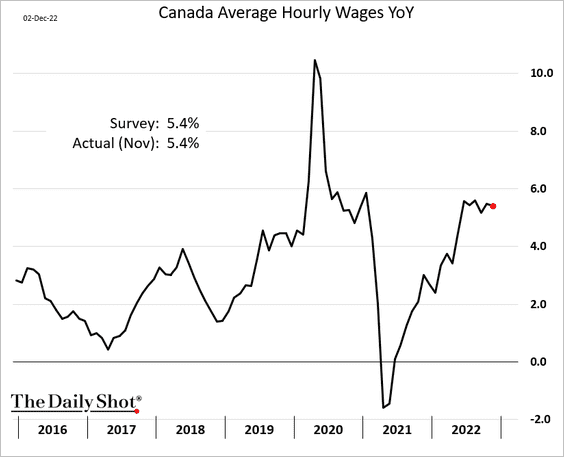

Hourly wage growth in Canada is at 5.4% (non-union and union).

- 2022 Private sector bargained wage growth 3% (Canada).

- 2022 Public sector bargained wage growth 1% (Canada).

- Headline price increases near 7%

In Ontario:

- 2022 Private sector bargained wage growth 4.1%.

- 2022 Construction sector bargained wage growth 4.3%.

- 2022 Non-construction private sector bargained wage growth 3%.

- 2022 Public sector bargained wage growth 1.4%.

- Public sector wage growth 2% (outside Bill 124).

Canada all workers wage growth:

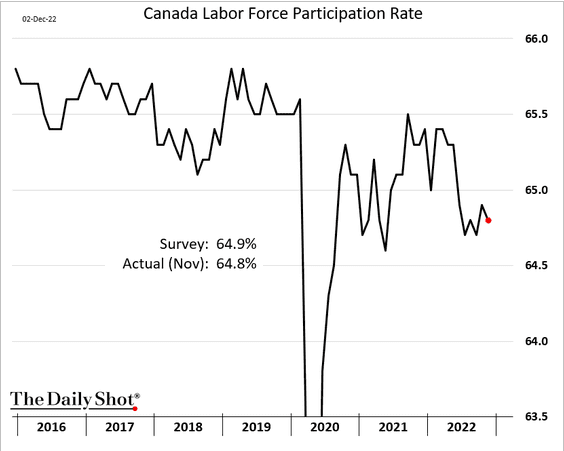

Labour force participation is stabilizing well below trend which means we are not recovered.

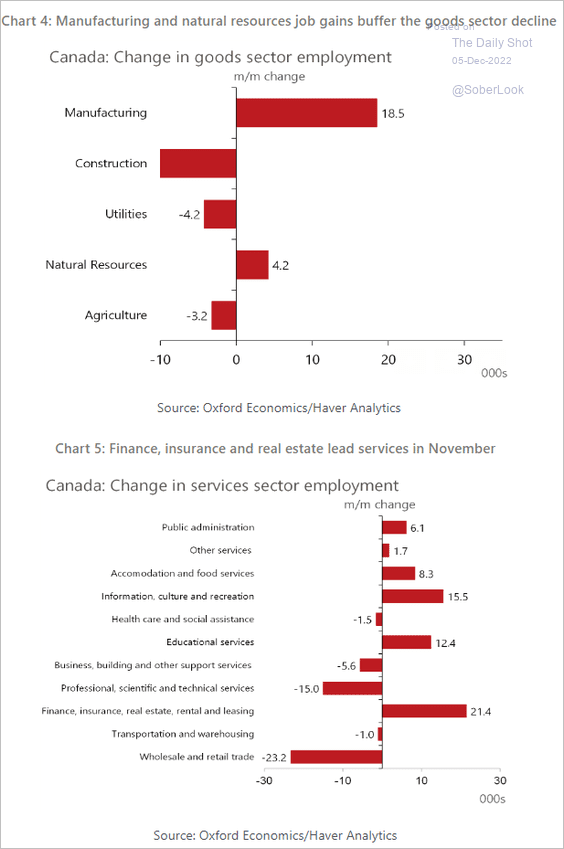

Changes point to a slow-down in value creation within production:

- Monthly CPI 6.9% (3.4% 2021)

- 2023 predictions for CPI is 4-5%.

And, finally, the yield curve is very much inverted. This all points to recession for Canada.

As the Bank of Canada considers ditching oversized interest rate hikes, it is dealing with an economy likely more overheated than previously thought but also the bond market's clearest signal yet that recession and lower inflation lie ahead.

Canada's central bank says that the economy needs to slow from overheated levels in order to ease inflation. If its tightening campaign overshoots to achieve that objective it could trigger a deeper downturn than expected.

The bond market could be flagging that risk. The yield on the Canadian 10-year government bond has fallen nearly 100 basis points below the 2-year yield, marking the biggest inversion of Canada's yield curve in Refinitiv data going back to 1994 and deeper than the U.S. Treasury yield curve inversion. (Reuters)