December 4, 2024

Energy, oil, and prices

We are producing and consuming more oil and oil products now than ever before.

The global plastics compact discussions have failed. They failed because there simply is no one who thinks that plastics production will even level off any time soon, never mind decline.

The climate change discussions have failed to reach consensus. These failed because no one really thinks that governments are serious about limiting the profits of oil companies. And, some of us think that the market is just so tied to the global economy that pulling on that string has all sorts of unforeseen consequences.

Even Trump's bluster is not going to have much impact on oil production and use.

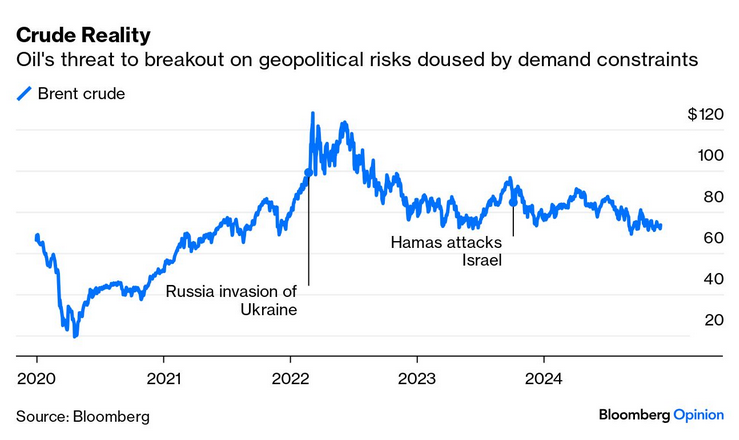

- prices are near $73 per barrel

- producer breakeven price is near $64 per barrel

- to increase drilling the price needs to be $89 per barrel (30% higher)

The simple fact that there is slow demand growth for oil and oil products because the global economy is not going gangbusters is keeping a lid on production. And, while an increased price is good for profits, it only plays out that way if there is someone to buy it.

The point here is that all the conversation about producing more oil or more gas is not really a conversation about anything but economic activity. We fight around the margins, but until we look at replacing demand there is nothing much different today than if we had not spent all that time hand-wringing about the climate.

This opens up an opportunity for the Left. We must stake out our alternative program for investment and redirected profits of oil and gas. One that is not based on making oil and gas more expensive or twiddling with financial markets. Instead, it must be based on real economics of investments where it matters: use.

Bubbles

Discussion of bubbles are cropping-up in the financial press.

Unhedged is full in that it is a bubble, Ruchir Sharma of Rockefeller Capital thinks it is a bubble, and Michael Roberts knows it is a bubble.

But, what is the bubble they are talking about?

The bubble is on US stock valuations. That is, many folks think that the valuation are completely out of joint with reality. The analysis is applied to history and to other indexes showing that there is a broad overvaluation based on this or that metric in the different between now and the average of those metrics.

The problem is that bubbles may not mean what they used to mean. I think we have learned that bubbles do not pop the way they did last time.

The increased valuations of USA stocks in relation to other markets can be explained by underlying differences in productivity and wealth transfer.

In the USA, the productivity and capital investment is above other places, but below points in history where we see the level of equity valuation we see now.

Most authors are pointing to broad discrepancies, not just the (Magnificent) 7 extremely large tech companies. Some point to AI driving productivity growth in the USA.

It is likely that much of this disparity in valuations is that wealth transfer in the USA is just moving faster than in Europe (and other places). Since the pandemic, prices went up faster than wages and that growth in prices continued to outstrip wage growth for most of that time.

While populations were angry at the inflation, most union wage negotiations have made up the difference, but apart from a short period of time where tight labour markets tilted wage growth in favour of workers, things have looked bad.

Real wage growth is now back at the levels we saw pre-pandemic. That means, in real terms, both the mass of profits and the total percentage of the value created since the pandemic has shifted to capital's side of the ledger.

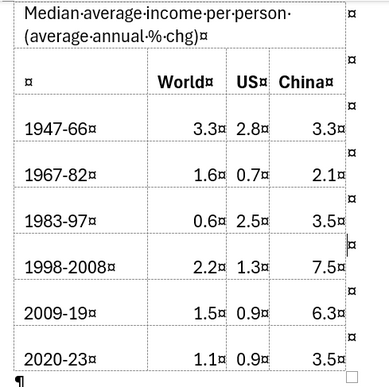

Michael Roberts has a table that shows just how much this is true from the world inequality database.

There isn't much to be surprised about here, but does this transfer of wealth drive bubbles? Probably not, it just sustains USA capital profits. What drives bubbles are empty promises that profits will grow in the future.

Trump is managing that all on his own. There is a sense that profits will be lifted with the attack on regulations and any limits on exploiting people or the natural world. That the USA tax bill will decline so much that profits will be sustained.

This is unlikely for the same reason that we will see more oil production as explained above. The limits of profitability are controlled by both sides: production and demand; or, investment and profits from that investment.

There may be a bubble, but it is a result of over-extended belief that profits are going to be sustained through the magic of wealth transfer. This has a limit and when we hit that limit it is not going to look like last time.

The concern is, because the way that people feel about the economy and the rejection of the status quo, that it may look like something farther back in history.