December 4, 2023

Redistribution of wealth to deal with climate change

Figuring-out how to correct for historical theft of wealth in a way that addresses the impacts of those wrongs is a necessary, but also a near impossible conversation to have.

Within the current COP28 climate debate, an accounting for the historical impact of climate pollution by richer countries is a major stumbling block. A fact made harder still by the double cost for poorer countries: having wealth transferred out of this region through imperialism and those imperial countries not dealing with the climate change that resulted from how that wealth was used.

Value creation in the West over the previous 100 years has been supported by:

- borrowing from future generations' climate through the unmitigated use of fossil fuels and

- regressive distribution of that wealth from working people and their communities to capital

Capital from previous generations have borrowed from future generations by adopting an economic framework that purposely ignores the transfer of wealth from the environment and from working people.

The conversation is complicated by two things:

No one likes it when you point out that you have been living beyond your means in a way that has caused others pain.

And, no one who has been harmed is going to recognize their own impact causing harm until other side have admitted that they are the "real" or original cause of the problem.

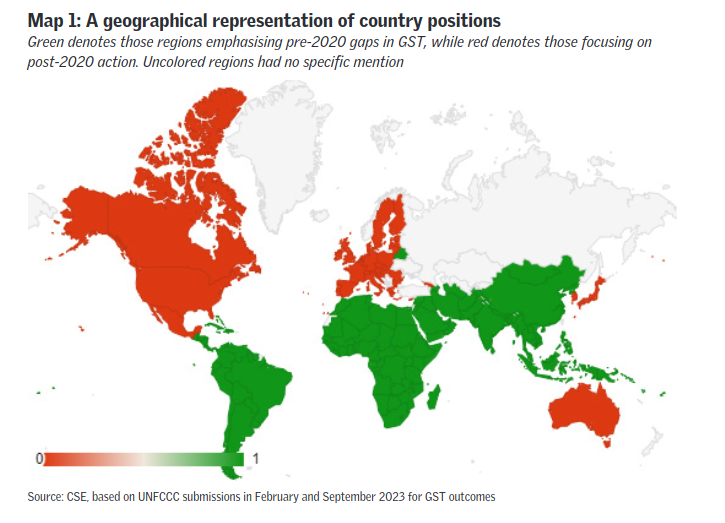

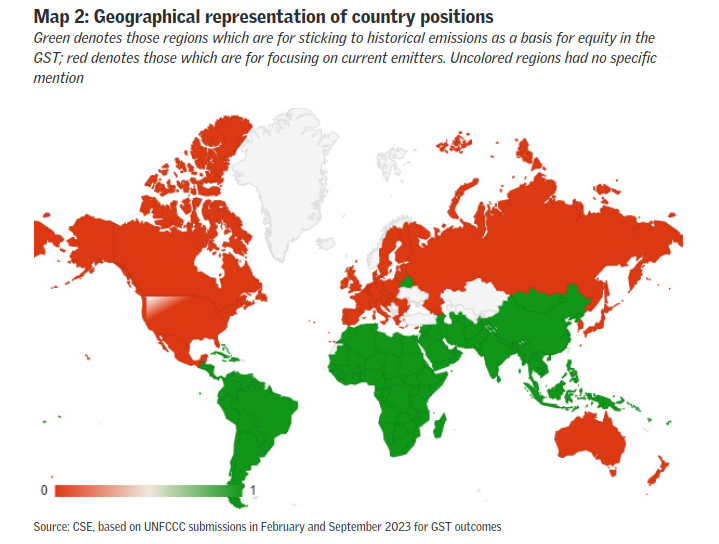

Case in point: different country positions on where the world should focus on "redistribution" of wealth to deal with climate change:

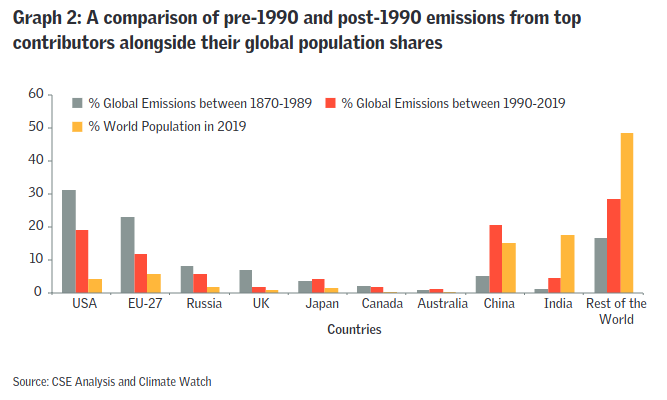

The principle of Common but Differentiated Responsibility" (CBDR), established under the UNFCCC is supposed to outline a solid basis for this conversation to start. But, as you can see in these maps, there is a very clear geopolitical split on what part of reality/history different countries want to ignore: the past or the present destruction of the climate.

It will take a particularly coherent framework for this discussion to be had. One that is so clearly missing from the Congress of the Parties 28 meeting happening right now.

Complicated still, there are many "ways" to see this data on emissions (historical versus recent growth). But, here the different ways of knowing are not equally valid under a sensible economic framework. Wealth has been transferred from a group to another group. That wealth is needed to make amends for climate change (both mitigation and transition) and the group that had their wealth taken from, again by definition, does not have the wealth to make things right on their own.

Economics of transfer

Another issue with the current COP discussion is the economic ideology supposedly underlying it.

Neoclassical economics does not identify labour as value creating. And, it does not account for borrowing from the natural world.

Those negatives (not paying workers their full value and not paying for resource freely extracted) are "externalities", things for someone else to pay for.

Poverty, unemployment, global redistribution of resources, imperialism, war, famine, housing crises, pollution, plastic waste, chemicals in our own water supply, climate change, insufficient investment in infrastructure, insufficient investment in supporting the elderly, lack of valuing social reproduction. The list is extremely long of "externalities" that neoclassical economists "try" to either justify or establish new pseudo markets to price those externalities so their models can work.

Carbon pricing has been a very good example of how this system of economics cannot be made to work.

The current discussion at COP28 is around carbon pricing and redistribution of current value creation (and extraction) activities.

It is not the historical damage to nature nature that carbon markets are set to price. Instead, it is only the current damage being done that prices carbon. But, it is even bad at such a limited focus for this price mechanism.

The conceptual idea of carbon markets is not terrible: as rich countries continue to create value cheaply by polluting the environment, they pay a fine and then part of that fine is distributed to people who are overly negatively impacted. The workers' movement calls it just transition investment, politicians call it a gas tax funding subsidies, and the COP negotiators call it a Loss and Damage Fund.

The UN's Loss and Damage Fund is supposed to be a global fund that rich countries pay into to fund poor countries negatively impacted by climate change.

However, the economic discussion around carbon markets is bizarre and extremely awkward. The neoclassical (and some Post Keynesian) economists are bending themselves into knots trying to describe how it is going to/should work at the same time explaining why it is not currently working at all.

The price of carbon was supposed to be high enough to move private capital away from polluting industry investment and towards renewable investment. The idea was that a carbon tax based on a carbon price, itself based on a free(ish) market price, would drive up costs enough for polluters that non-polluters would benefit.

It has not worked out that way for a variety of reasons. Almost all of them because this is not how capitalism works nor is it how neoclassical economics is actually structured.

The carbon pricing system assumes some very important things that are just not true. Namely, that:

- there is such a thing as a free market that can price things fairly.

- investors only invest in one company.

- companies only do one thing (a good thing or a bad thing).

- a pseudo market based on this price will actually be able to put some businesses out of businesses because bad things get expensive.

If any of these things were true, we would have been able to solve all the above issues already.

It isn't just about specific power of this or that country or government either. The economic system itself is not set-up to cost things in the way that we need them to because capitalism is an exploitative system that runs on the specific devaluing of certain inputs.

For example, carbon pollution cannot be "priced" appropriately for the transport sector to force it to easily move away from oil products because the very economics of private transport are made possible by exactly not pricing the impact of burning of fossil fuels.

If you price the impact of the environment properly, the wealth created by exploiting the environment would be off-set by the wealth destroyed elsewhere. The result would be much less "growth" in the economy than currently measured and result in some very strange things under orthodox economic theory.

We can describe this as one of the fundamental aspects of capitalism left-over from the merchant capitalist days.

It is called profit on transfer.

Wealth is transferred from something/someone to someone else. Some call it theft, a merchant would call it price of arbitrage. Essentially, it is the net wealth kept by the owners of the process.

Here is a bad example.

If you take something from someone (if you steal their phone) you have gained something for "free" to you. But, the economy at large has not gained anything because your gain is an equal loss for someone else.

The environment is like this. A gain for capital in profit through pollution is just wealth transfer from someone temporally, usually through degradation of their livable environment.

This transfer is part of the reason that carbon pricing cannot work as outlined.

Carbon pricing is by definition paying only part of the cost of this degradation. Even at "full price" under the model we are not paying the full price for the degradation.

This should not be a controversial analysis, carbon pricing is about letting polluters to continue to pollute for a price. It is supposed to help pay other capitals who want to do nicer things do those nicer things.

What is controversial, for some reason, is when folks suggest that this cannot and will not solve the climate problem.

Never mind that this carbon price is only on the costs of current damage to the environment, not the historical damage. Literally no one is talking about accounting for that. But, when we talk about investment needed for mitigation and response to climate change, most of the investment models show we run out of money/bankrupt countries if we try to do that on top of redistribution some money through a carbon pricing.

Also, this all ignores that model does not really even account for the full price. The carbon price and the carbon tax is a market-set price on an exchange. A fake exchange that is manipulated similarly to how central banks manipulate the interest rate of financial institutions. Both are inherently flawed for the same reason. The price is kept at a level that continues the profit subsidies as a wealth transfer to capital.

The short of it is that you actually need to pay for the transition with money not gained from polluting. The current system of economics makes that very difficult.

We need production and value creation that is not damaging to the environment and you need to direct investment paid for by that value creation into mitigation. The non-polluting production cannot be dependent on polluting production to finance itself, since this undoes that non-polluting investment's impact. And, the only way you can get this is through a democratic decision not to extract wealth from the future's environment, which is not a market-based one.

That means regulation and state-lead directed investment.

That is not a great sounding solution, but it is the only one that actually works. And, in the end it is better than making people pay twice: once on the financial debt needed to fund transition and again on the mitigation of the impacts of climate change caused by not transitioning fast enough.

Canadian economy

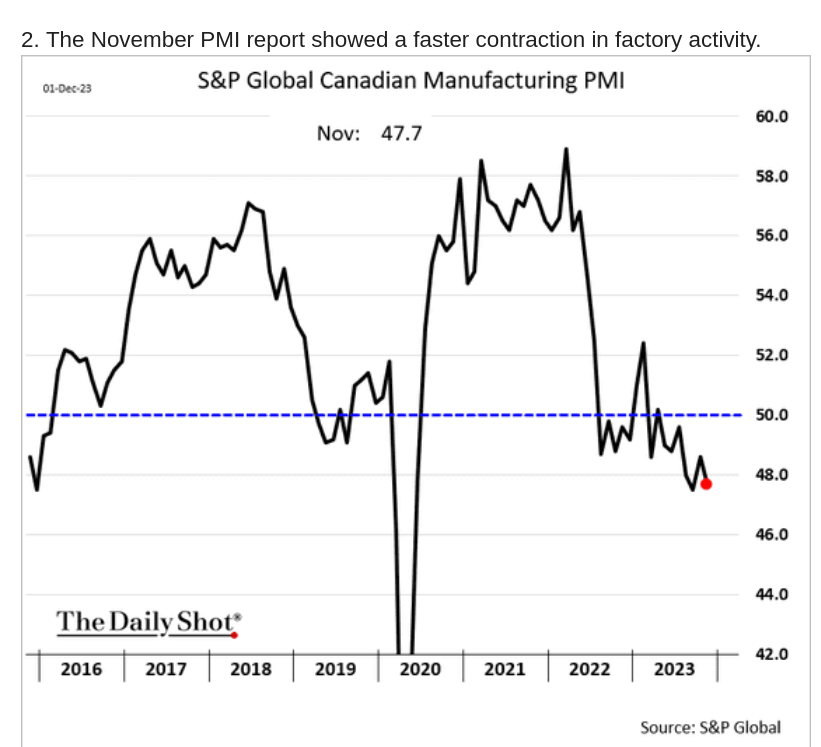

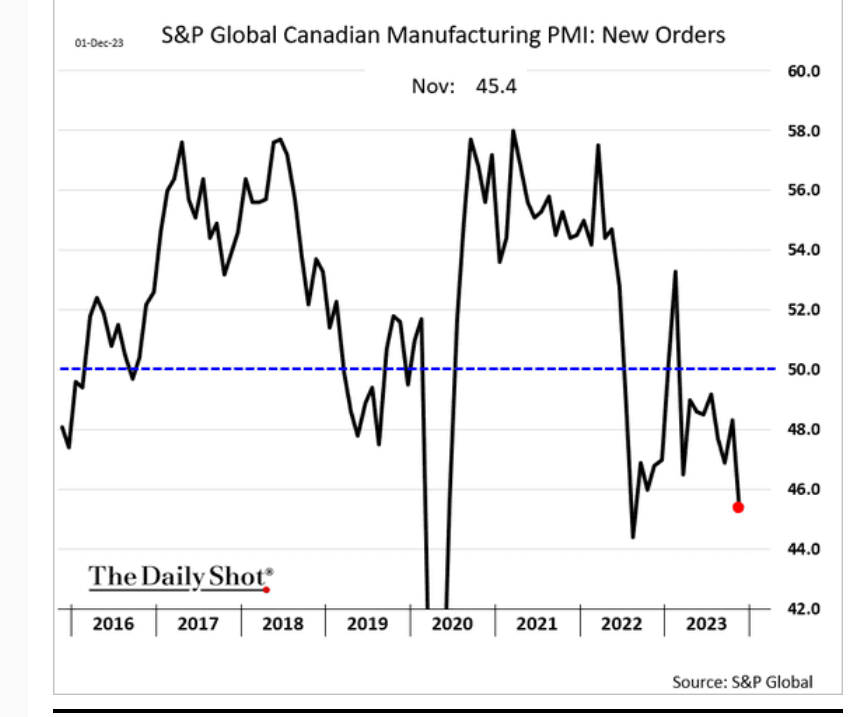

Better indicators of the Canadian economy than the job numbers are new orders and manufacturing activity.

Both are not doing well