December 3, 2024

Manufacturing in Canada

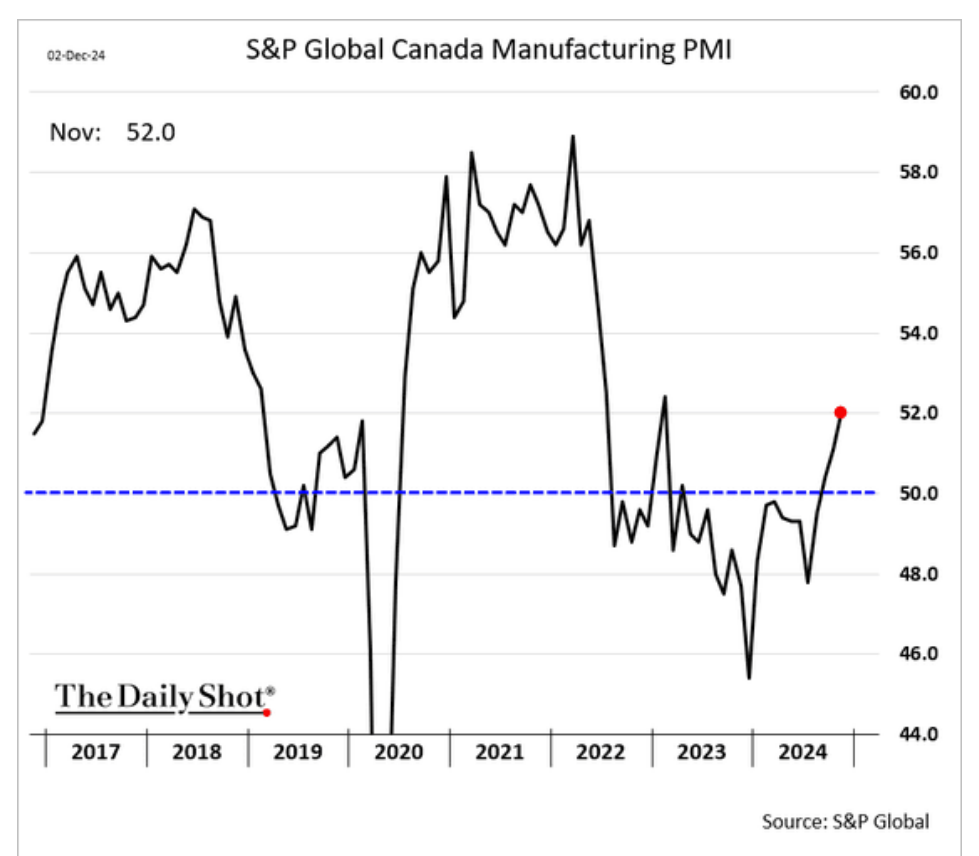

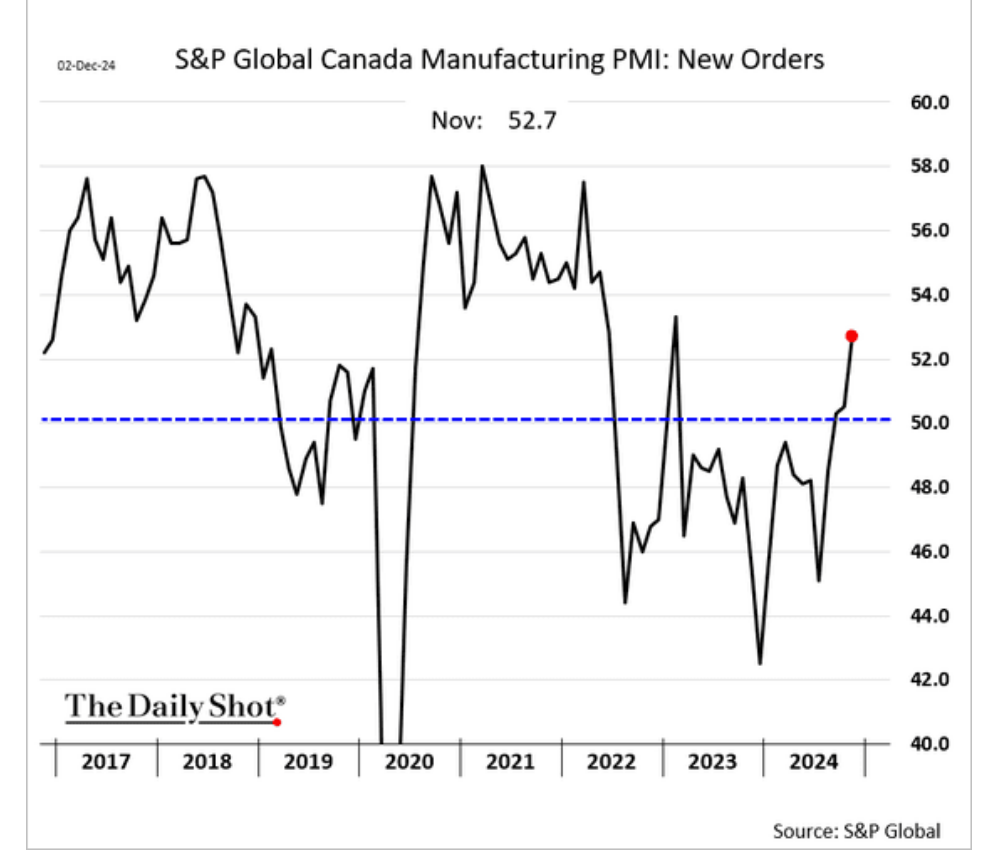

In a not-so-surprising move, the PMI for manufacturing in Canada rose substantially for November, continuing the trend from September.

The manufacturing sector starts spending when debt rates come down. We shall have to wait until the new year to see if this is sustained, or simply filling backlogs of failing machines.

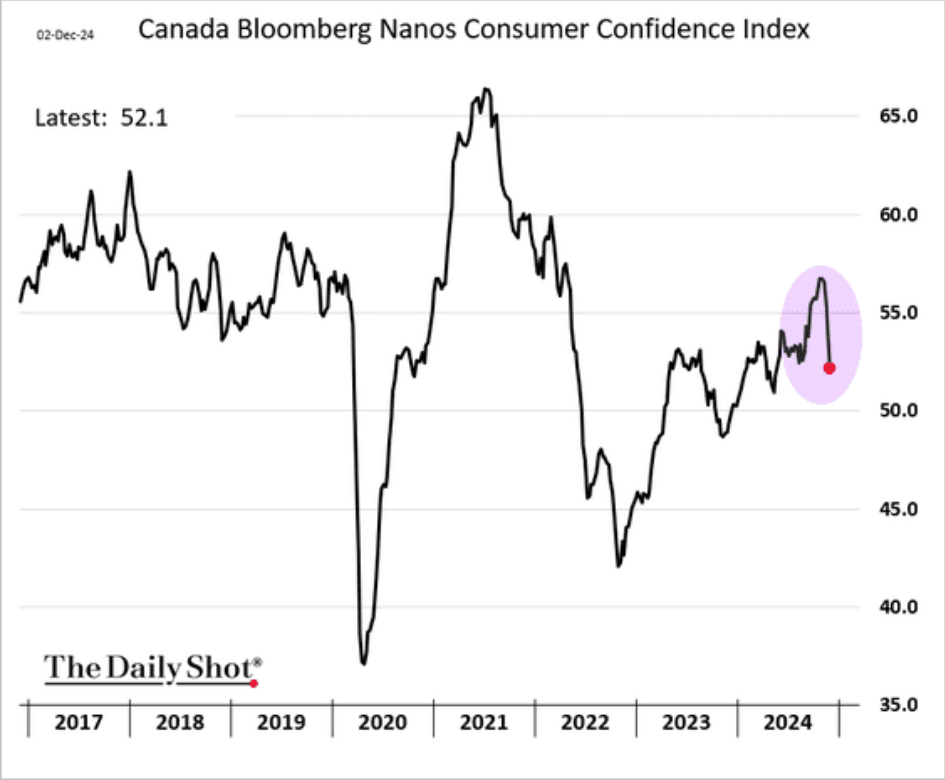

Unfortunately, consumer sentiment indicates that there is not much of a reason to continue to spend.

Both in Canada and the USA, real consumer appetite to spend money is depressed by the lack of money actually available to spend.

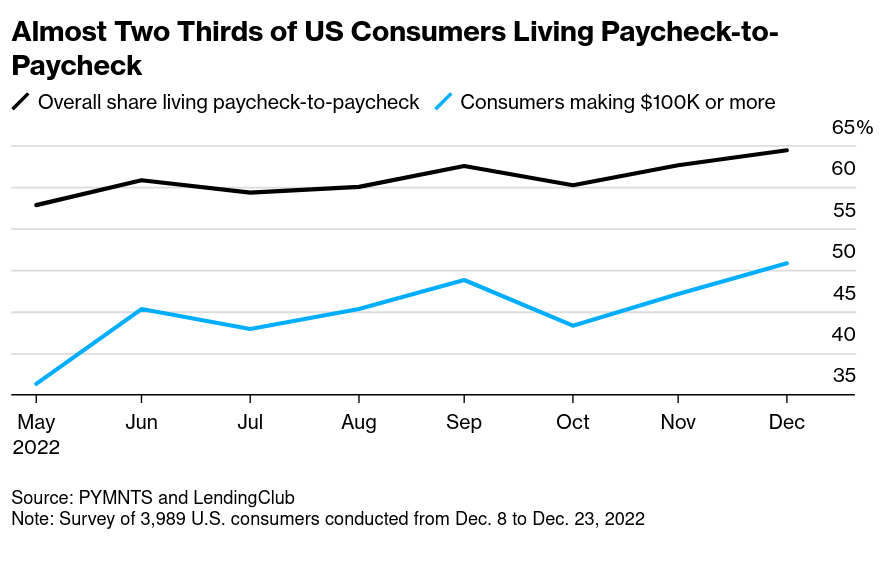

In the USA, things look rather terrible. A survey of Americans by payment companies found this:

It found that 24% of respondents had issues paying their bills in December. Among those earning more than $100,000 and living paycheck-to-paycheck, the share rose to 16% from 11% a year earlier.

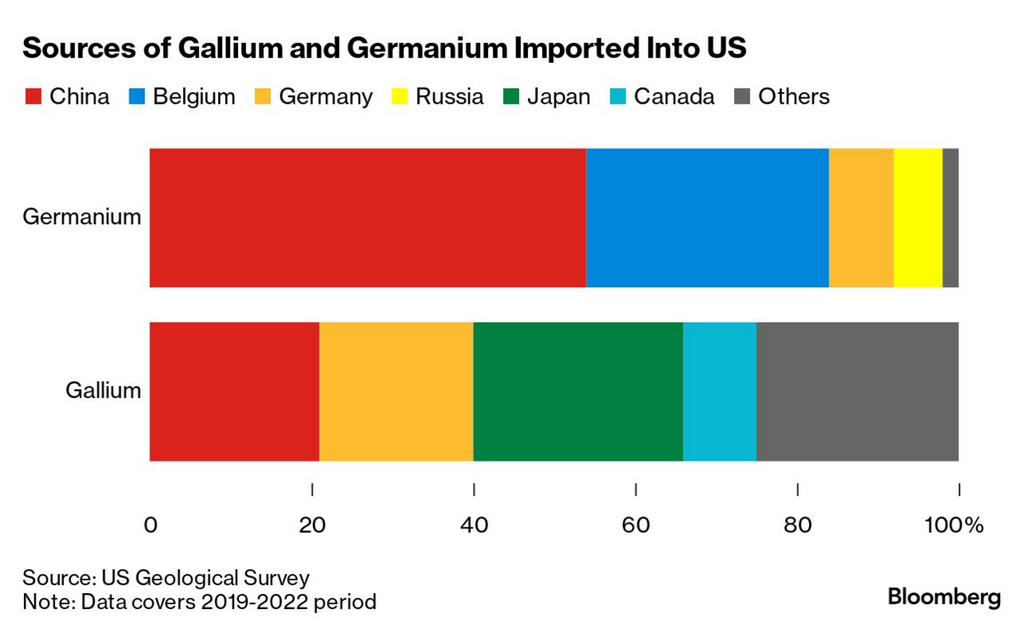

China critical mineral trade

China has cut off its global trade of critical minerals. While some of these minerals are available in Canada, China's supply is not easily replaced.

The reason for this is that we do not mine critical minerals the same way we mine, say, gold and diamonds. Critical minerals are mined and, more importantly, processed due to their price point. Critical minerals come from mining other commodities.

Canada, like the rest of the world, has not had any companies invest in the development of refining and separation processes at their mines. They basically do it on an ad-hoc basis depending on price. And, because the minerals are rare, it usually costs a lot to collect.

This might increase the price, but it will take more than that to increase the total output.

Most mining companies are calling for state intervention (and state companies) to do that work for them.

Lastly, we should be concerned that Canada has signed a trade deal with Indonesia (Canada-Indonesia Comprehensive Economic Partnership Agreement (CEPA)). It is likely that some mining investment will flow there instead of into Canada. That's not really great for either economy, given the human rights abuses by our companies there.