December 19, 2022

Canada Housing

The housing market in Canada is dragging a little.

There are somethings to note:

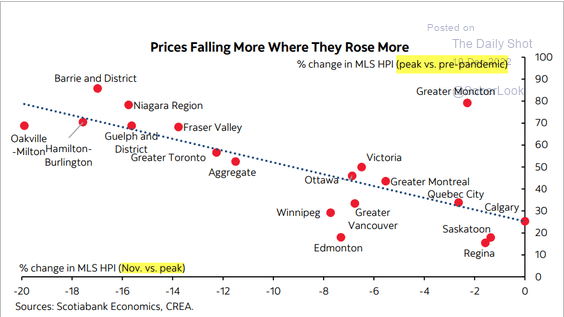

- Average house prices look to have been in a bubble as average prices by city have fallen more now where they grew more before.

However, they have all fallen.

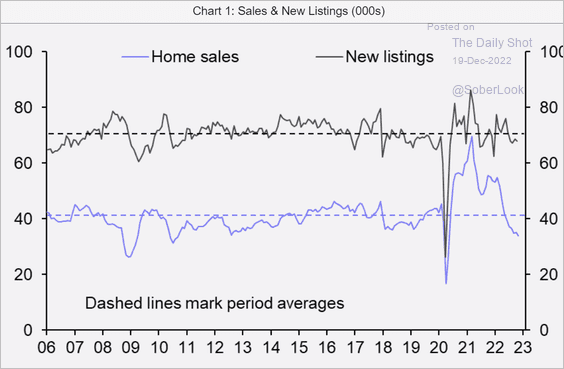

- New listings are flat, but sales are down.

- New homes are still being started. Seems like this is rather unsustainable given the above, but there you have it.

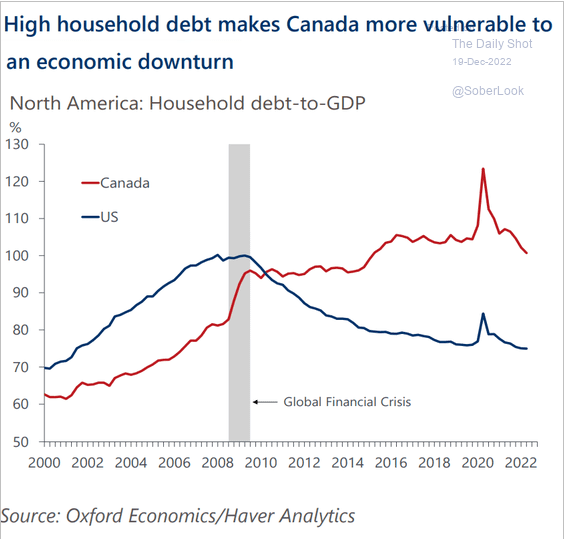

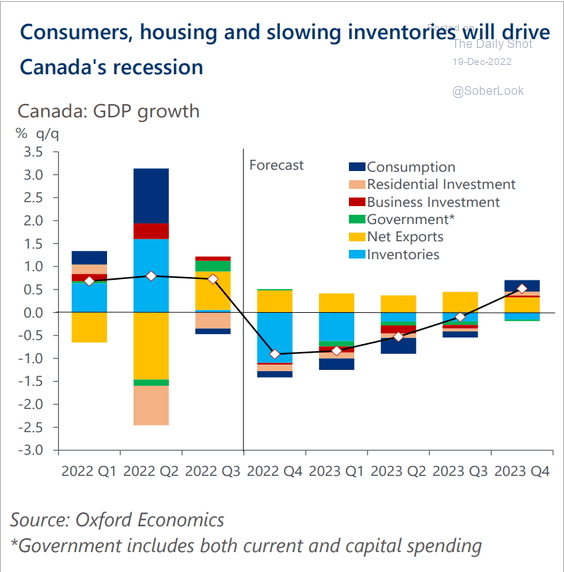

Canada's economic growth

According to many private sector economists (who are terrible at predicting what is going on in the future), we are heading into a recession in Canada.

This one is a little easier to predict since the economic "managers" of the economy are desperately trying to push us there.

The Central Banker's anti-charm and being offensive

Across the world, the cabal of central bankers—who have been wrong about most things in the economy over the previous few years—are on the talk circuit telling people why they are now correct.

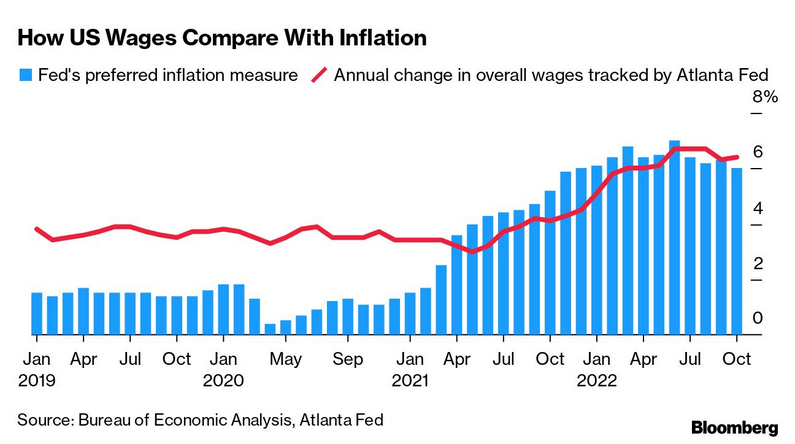

Here is their graph that is supposed to show wages pushing inflation up. But, what it actually shows is wages catching-up to inflation. Which anyone without ideological blinder on should be able to see.

At the end of a year of massive monetary-policy tightening, Powell says he’s now looking at a price gauge that covers everything from haircuts to healthcare.

Because wages are an especially big cost for those service industries, “the labor market holds the key to understanding inflation in this category,” he told the Brookings Institution in November.

Last week, he said, wages are growing “well above what would be consistent with 2% inflation.” (BN)

The quote above from Powell of USA Federal Reserve.

These comments seem less absurd only with the correct context outlined: that the role of the Federal Reserve is to sustain profitability—which comes at the expense of wage growth. When there is low growth, wages have to be suppressed to sustain profitability.

The private market economists (who work for financial firms trying to make money) do not agree with Powell either. And, they are now sounding more like Post-Keynesians when it comes to wages an inflation. Unfortunately, the reasons for them disagreeing have less to do with real economic analysis than just desire not to lose money in an inflation.

“The wage-price spiral is a fear, not a fact,” says Derek Tang, an economist at LH Meyer in Washington. “Real wages are most certainly not in an upward spiral.” But clearly, he says, concern about lasting labor shortages and the implication for prices has “filtered up to Powell.” (BN)

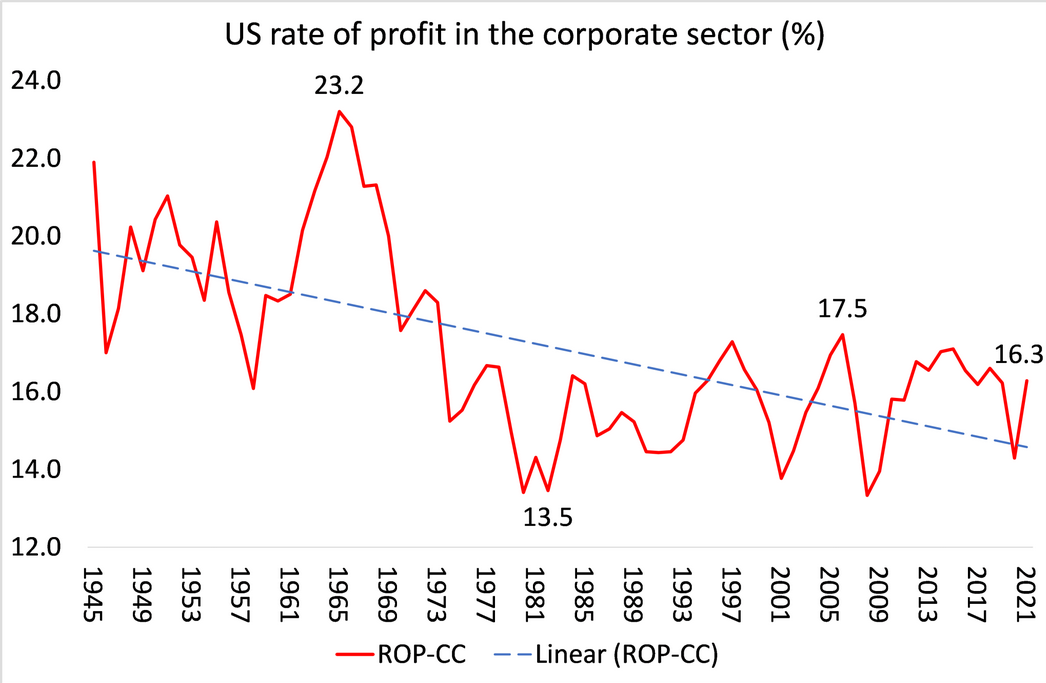

Unfortunately, Post Keynesians still believe that it profits are driving inflation—which is the other side of the same argument as saying "wages are driving inflation".

I think either side is a bad analysis to promote as inflation will be sustained above the "target" rate of the central banks, but profits will decline as we head into the recession. Then what?

Deepankur Basu and Evan Wasner calculations from Michael Roberts.

Indeed, US corporate profits fell from their highs in Q3 2022 (MR) because (as explained before) the restocking of goods sold during the original price growth period is done with more expensive goods.

There is a battle, of course, between wages and profits within capitalism. It is a fight for the surplus value created through capitalist owned production. But, neither are the main drivers of the price increases we are seeing right now.

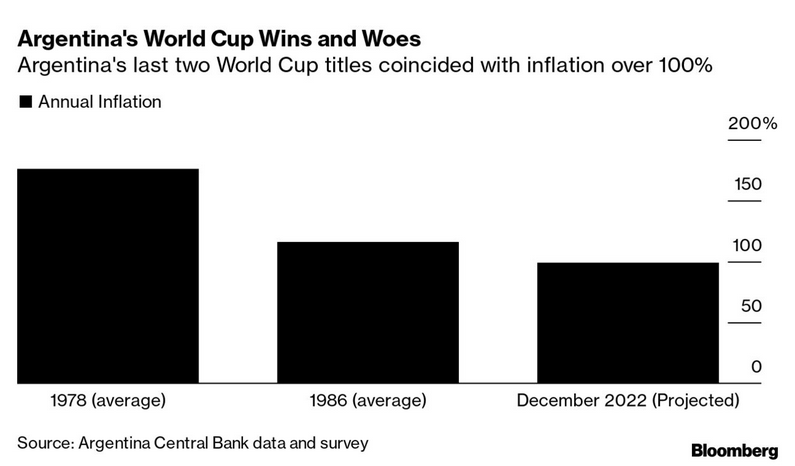

Argentina

Is winning on the inflation front giving a boost to their team.

While it looked like they won the World Cup, their inflation weighted score indicates they lost to France 20-1.