December 16, 2022

Inflation is always workers' fault. Especially when it clearly isn't.

No matter what the issue is with the economy, it always seems to be workers' fault and therefore they should be forced to pay for it. At least according to neoclassical and Post Keynesian economists.

There continues to be shifting in the basis for the arguments that inflation is wage-related. Now the orthodox economists are saying that it is because "services" are mostly wages and that this will drive (persistent!) inflation.

The argument is that the "services" side of the economy—arguably not a very scientific term for anything in the economy—is the part of the economy where people are employed to do things as opposed to make things. This is supposed to mean that it isn't capital-intensive and therefore wage increases will have a direct impact on price increases.

Even Post Keynesian Martin Wolf thinks it is wages that are going to drive persistent inflation. Which is classic since Post Keynesians always—deep down—blame workers for price increases. Indeed, there is no place in their ideology for class struggle over wage share because they believe in a natural rate of profit and that wages are just an input cost (or they believe in monopoly pricing).

So, now it is not just sentiment, but purchasing power of the masses that is to blame too. That's right, workers' predictions that inflation will go up and their too fat wallets allowing them to continue to buy things they need at the higher price drive inflation.

How is this any different than before inflation went up? What has structurally changed? They cannot explain it, so it must be magic inflation thoughts and making ends meet.

It is ridiculous.

The central banks are saying that firms will increase prices because they know consumers will pay more for things because consumer expect inflation and therefore understand they should pay more for things.

As if price setting could ever work this way. The assumption that all firms sets prices at whatever they want just doesn't play out in any reality. Firms set prices, but those prices are bound by the reality of competition (bringing prices down) and costs (putting a floor on prices).

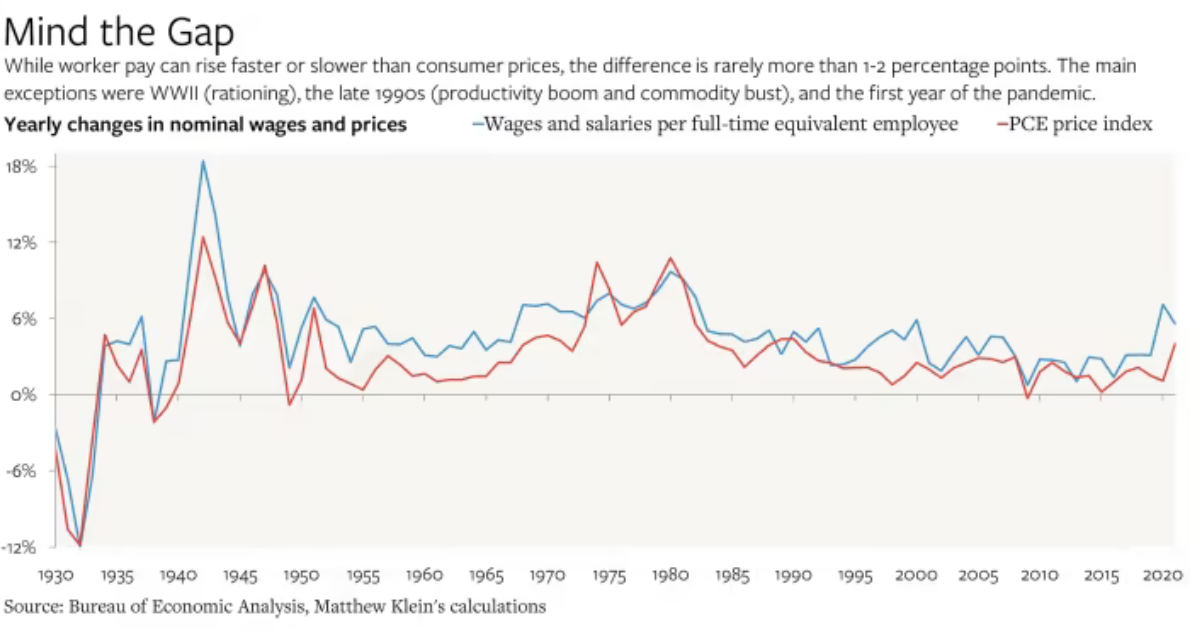

Also, these graphs of correlating wages to prices are especially silly. You will see them throughout the financial and central bank publications.

But, how else could the economy work but to have wages and prices track? If they didn't track then capitalism would cease to function as workers would either all became wealthy (wages grow faster than prices) or all became destitute (prices grow faster than wages).

The current situation really does expose that neoclassical theory has no real theory of inflation. It is just whatever they can say that matches "it is workers' fault".

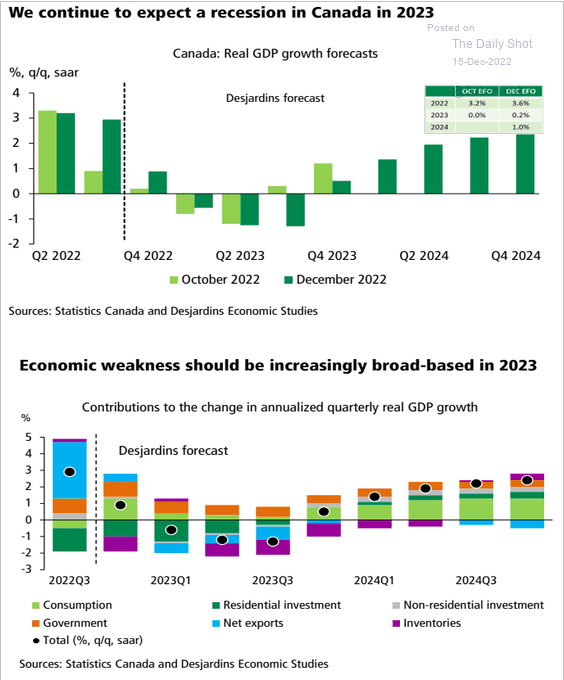

Recession in Canada