December 15, 2023

Food safety

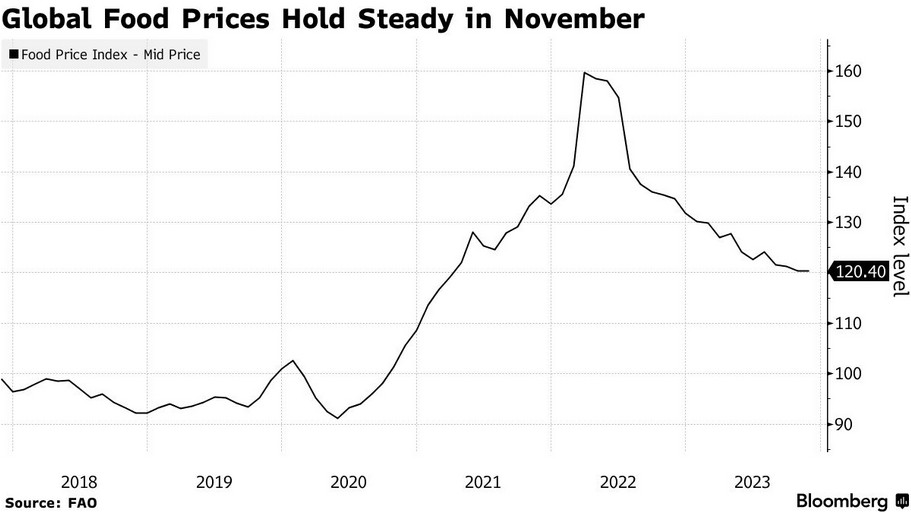

The Food and Agricultural Organization (FAO) of the UN report on food safety highlights several issues:

- climate change

- consumer preference and food consumption patterns

- New food sources

- food safety in urban areas

- microbiomes

- plastic

- technology in food production

We have touched on climate change a lot and the impact on food production and transportation costs. A simple example is the climate change related worst-ever global bird flu outbreaks that happened in 2022. The outbreak affected a significant number of the 35 billion birds produced for consumption, double production of 1999, resulting in 72M birds being destroyed in the USA and a quadrupling of prices of eggs.

There is also the ongoing climate change related production issues for coffee, chocolate, and sugar leading to Mondelez and other producers to give notice of price increases next year.

There are other sources of concern for the FAO that are more of the standard variety of concerns.

The FAO is concerned about the impact of commercially marketed types of food, packaged in different ways, and the impacts this has on consumption patterns.

National food regulations respond slowly, usually for very good reasons. Food safety systems are not generally something that should be changing very fast as it causes confusion for producers and consumers. However, increased speed of food fads seem to be having an impact on the ability of the food safety system to respond in time.

In addition to types of food, where consumers get their food is also changing the ability to self-manage food safety. Delivery services for basics or "pre-prepared" meals have driven some food safety concerns and food fraud, not to mention the price of food.

The convenience and the corresponding increase prices also have an effect on what is consumed, so there is a bit of a feed-back loop.

Major changes in diets drive allergies, shift established supply chains to new and sometimes untested ones, and some under surveilled products can move into the mainstream driving negative impacts.

Rapid urbanization has a similar impact in many emerging economies. Food safety regimes have to respond to these changing dynamics to sustain trust in food.

Some examples raised by the FAO include:

- increased turmeric use leading to increase rates of hepatotoxicity

- Newly (mostly un-) regulated cannabis sativa being a vector for heavy metals, toxigenic fungi (Aspergillus sp. and Penicillium sp.) and pathogenic bacteria (Salmonella sp., Escherichia coli).

- increased use of Vitamin-C

- increased negative reactions to foods like Goji berries, soy, almond, peanut, pea because of increased consumption levels in fad diets

- meat protein substitutions to lower-quality meat in packaged delivery pre-made food leading to increased mercury and lead intake.

- decreased standards in safely in the (almost) completely unregulated handling food in the "last mile" of production/processing for prepared foods for delivery.

- increased plastic use and ingestion because of changes in packaging and preparing food for delivery.

New "technologies" or methods are also being used to increase the shelf-life of prepared or marginally prepared foods which are unregulated.

Never mind the changing supply of some foods that are demanded by consumers. Changing weather patterns can shift where foods are procured by distributors which can change the risk of contamination. So, you buy the same fruit or vegetables as last year, but it might be from a completely different place and handled under a different regulatory regime.

Dealing with all these issues is possible, but takes increased investment in the food safety system. Which also adds costs to food production and distribution. The global and local agencies responsible for this are turning to technology as a saviour for cost containment, but are starting to realize that there is no magic bullet.

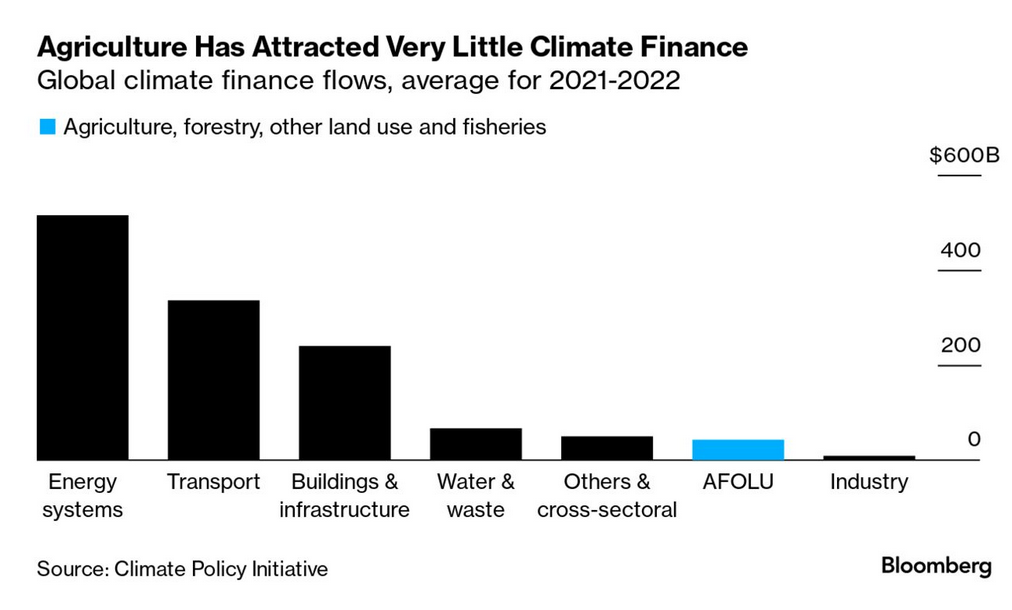

Investment in "innovation" (i.e., the commercialization of technology) in the food industry has mostly focused on increasing yield. The new focus for desired levels of investment are on emissions mitigation.

The investment here is low on the climate side:

It is even lower on the investment in tracking and regulatory oversight technology needed as we deal with changing supply and consumer patterns.

Obviously, food is essential. Unfortunately, the commodification of all aspects of the food system through a rather free and open market means that we are struggling to respond to challenges caused by modern marketing, food price increases, and changing production chains.

This make food very much like other changing supply systems like energy and transition to climate friendly production: in need of a strategy and investment in human oversight, data collection, regulatory systems, and managing.

However, unlike those other systems the result of not doing enough is not just too few batteries, but unhealthy and/or hungry people.

Oil demand

According to the International Energy Agency December report oil demand will drop as the global economy takes a downward trajectory over the next year.

This contradicts the other announcement by the IEA, Brazil, and the USA which is that production is way up of oil products.

Global 4Q23 demand growth has been revised down by almost 400 kb/d, with Europe making up more than half the decline. The slowdown is set to continue in 2024, with global gains halving to 1.1 mb/d, as GDP growth stays below trend in major economies. Efficiency improvements and a booming electric vehicle fleet also drag on demand.

Evidence of a slowdown in oil demand is mounting, with the pace of expansion set to ease from 2.8 mb/d y-o-y in 3Q23 to 1.9 mb/d in 4Q23.

Oil consumption growth is expected to ease significantly in 2024, to 1.1 mb/d.

US oil supply growth continues to defy expectations, with output shattering the 20 mb/d mark. This, combined with record Brazilian and Guyanese production along with surging Iranian flows will lift world output by 1.8 mb/d to 101.9 mb/d in 2023. Non-OPEC+ will again drive global gains in 2024, projected at 1.2 mb/d after OPEC+ deepens its voluntary oil cuts.

Coming out of the COP28 pronouncements, Brazil and the USA both announced increased production of oil again showing why the COP process is ridiculous.

As oil demand is increasing at a slower and slower rate, we have to wait until well after 2030 for oil production and demand growth to find the top of the curve. And, that's just the growth in demand, production will then continue at that level for a long time yet.

It is not a wonder why oil production is a hard habit to quit. And, it is not just because of the kingdoms in the Middle East's opposition to talk of reducing oil production at the COP:

The shift in global oil supply from key producers in the Middle East to the United States and other Atlantic Basin countries, and the dominant impact of China and its booming petrochemical sector on oil demand, are profoundly impacting global oil trade. (IEA)

At centre stage is the newly exploited oil deposits in the Americas and demand in China.

China accounts for 78% of this year’s increase in demand for oil.

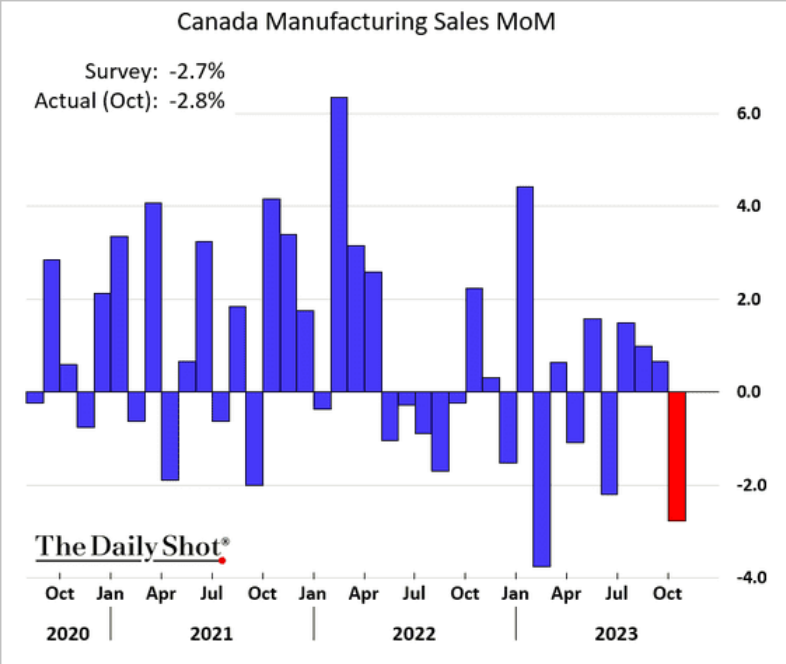

Canada Manufacturing

Ouch.