December 15, 2022

Inflation, expectations, and the Bank of Canada

Now, there are several ideologies when it comes to inflation and its causes. And, far be it for me to question the soundness of some of these ideologies, but I cannot get a newish one adopted by the Bank of Canada in explaining its interest rate rises.

Some at the Bank are claiming that it is expectations of inflation that disrupt inflation targeting by the bank. They believe that inflation is higher because expectations of people in Canada are that inflation will go up.

Here is the paper written by the Deputy Governor of the Bank of Canada:

I don't know what an appropriate response is to this (laughter?), but they seem to really believe that expectations drive inflation:

We’ve been forceful in our interest rate increases since last March for this very reason—to try to keep inflation expectations anchored.

I’d like to spend a little time explaining why the Bank has been closely monitoring what is happening with inflation expectations. It’s because history has shown us that high inflation expectations can lead to higher and more persistent inflation

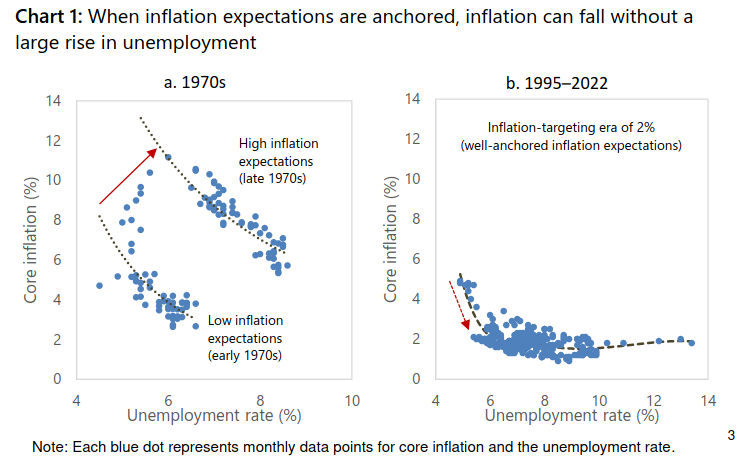

This was the bitter experience of the 1970s. During that decade, we saw both high unemployment and high inflation. A key challenge at that time was that inflation expectations kept rising. Remember, this was before central banks adopted inflation targeting. This means there was no target to anchor expected inflation. As a result, households and businesses saw no reason to believe that prices wouldn’t simply continue to climb at a rapid pace. They then baked this assumption into their decisions and plans. As a result, even as the economy cooled, inflation remained stubbornly high

They then post this:

Their take-home?

They believe that inflation is driven by sentiment of the population and that's why they have to increase interest rates. Increasing interest rates makes people believe inflation will be lower and so inflation will be lower.

What?

I think that our central bankers have been reading too many 1990's business self-help books:

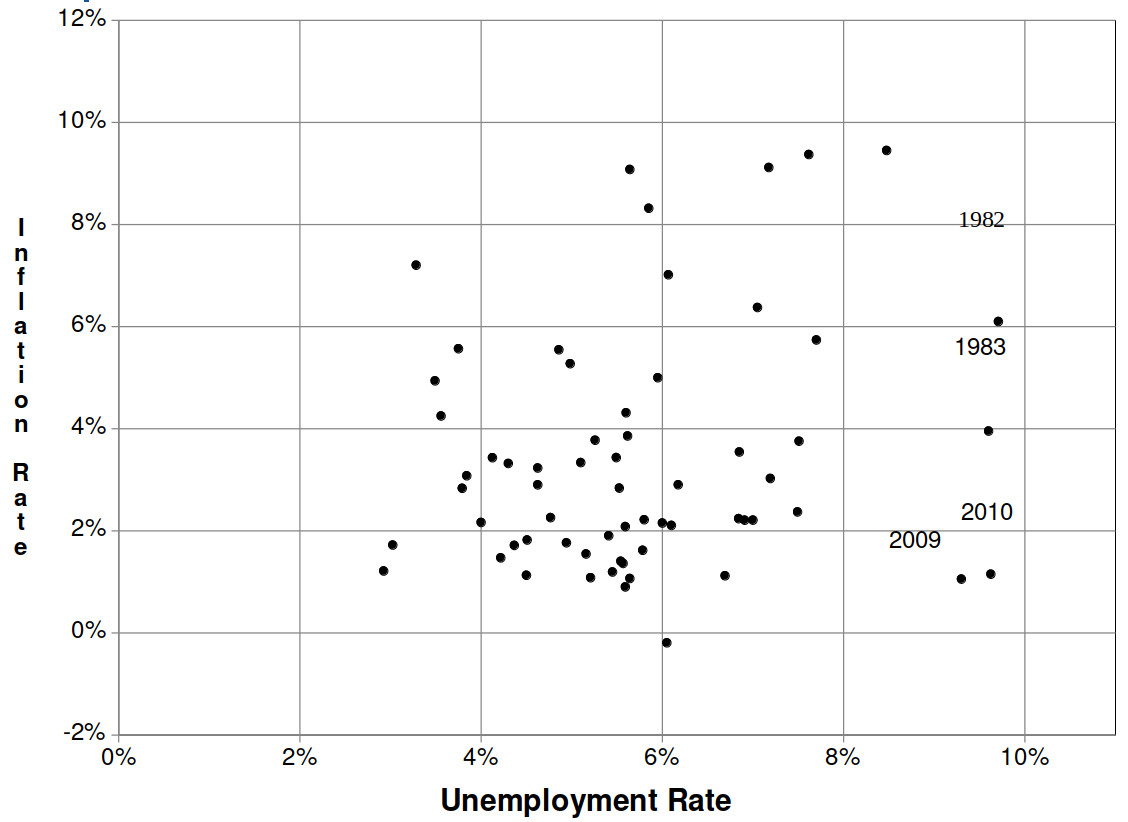

We have seen some of these graphs before of inflation and unemployment.

Like this one showing no relationship between inflation and unemployment:

The BoC graph above is just for the 1970s and it is the monthly inflation report.

But, I think you have to really believe in the Phillips Curve to draw the lines they have drawn through those dots. And, you really have to zoom into the data to even pretend that there is something interesting about 1970 monthly CPI readings.

The Bank wants us to believe that the reason that they are increasing interest rates is that it changes expectations. I guess they are not completely wrong about that. The expectation is that recession will drive down inflation by high interest rates kicking the chair out from under the economy and putting people out of work.

That's not what they are saying is the mechanism here. It isn't the recession that they are causing that is bringing down inflation, it is the expectation of the recession.

That's how these folks are running the economy. Sophisticated and grounded in reality, it is not.

What's the alternative?

The classical economists, including Anwar Shaikh, outlines the mechanistic behaviour of the economy that explains the movement of inflation.

But, there is more here and I will outline the real issue as it relates to the above Bank of Canada speech.

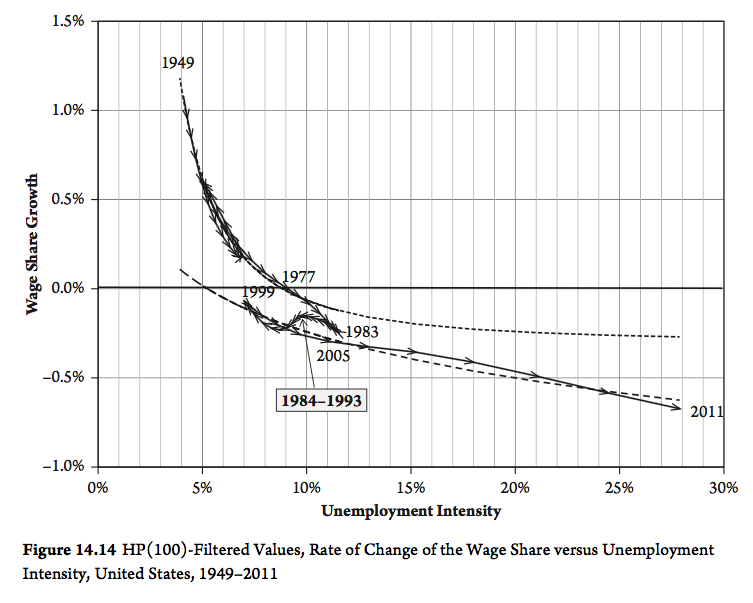

From Shaikh's textbook on Capitalism

The above is the real "Phillips Curve". It isn't unemployment versus inflation rate. It is the rate of change in the wage share of growth and the unemployment intensity.

Change in wage share is whether workers are getting wealthier or poorer year over year.

The unemployment intensity is the number of unemployed along with the length of time they are unemployed. More unemployed longer equals higher unemployment intensity.

You see the impact of policy here. Not some magical relationship imposed by sentiment or some belief.

The economy can shift under one policy up and down that curve based on the amount of stimulus in the economy and the overall situation of capital investment and labour struggle.

Then in the late 1970's you get a major policy shift starting. The policy was to drive down the wage share of worker and drive up the profitability of capital.

This pushed the curve lower so there was lower wage growth with higher unemployment intensity.

This was accomplished by artificially driving down interest rates, attacking labour unions, and supporting "globalization" (the internationalization of labour wage competition).

We know this story. It is called neoliberalism.

The current situation we are facing is the end of the neoliberal policy frame as reality comes to reassert itself. Turns out that you cannot suppress wage rates, costs of production, and interest rates forever. At some point, one of those "externalities" becomes too big to ignore.

Right now, all the externalities are too big to ignore.

That's what is causing inflation and price increases—not sentiment, not God, not the desire of capital to make more profit—reality.

We must move history on this

It is similar to just before we get Darwin's theories of evolution as mainstream.

At that time, Lamarck's ideas reigned as orthodoxy. Sure, the Lamarckians could describe change in form of organisms through geologic history, but the mechanism was ascribed to God and animal "desires" for different forms.

Lamarck's ideas made no sense, but that was Orthodoxy at the time. So much so, Darwin delayed his publication of the Origin of Species because of the ridicule he faced by the top. Even though most naturalists understood that the Orthodoxy was completely wrong.

We have been here for for much longer now in economics. Marx's ideas and the classical understanding of the economy was written at the same time as Darwin (and have been developed by many since then). But, think about how far ahead we would be now if the economists understood the economy was materialistic and mechanistic and not designed by God and sentiment.

Of course, there are still some people in pointy hats that believe in Lamarck's theories. And some people in the Evangelical parts of the USA that believe death is because of sin an therefore there cannot be evolution before humans.

But, no one in the academy takes this seriously. Economists who believe in the theory of "sentiment" should be as openly questioned.

It is as hard to listen to these mouthpieces for Capital go on and on about sentiment and inflation and the need for recession as it is to listen to a creationist talk about the age of the Earth.

We need to get passed this.

In the mean time, workers need to demand their wealth back. They must demand higher wages. And we must demand policies that allow for investment in, the production of, and the supply in the things we need to maintain costs.

There is not another way forward where workers make gains.