December 14, 2023

Central Bank direction (USA edition)

The Federal Reserve in the USA is starting to shovel its path away from higher rates. Europe and UK banks are expected to follow today.

The debate for 2024 now revolves around how soon the central banking system starts reducing their rate, how large each time, and how many times they do this.

Federal reserve officials currently have outlined three rate reductions.

GoldmanSachs in guessing 4. Evercore IS says 5 JPMorgan Chase says they will start in June. Goldman says March.

All rate reductions are estimated around .25

However, this is rate speculation matched with end-of-year guessing. No one really knows, not even the central banks, what they are going to do or what next year is going to look like.

There were some funny comments that went along with this guess work. Federal Research officials (even Powell) have been saying that getting inflation down has been "easier" than they thought.

We can all laugh at such a statement since they also admit that inflation went up faster than they thought it should. But, keen observers will notice that this tends to be a common refrain from the central banks and is akin to admitting they do not have a model for what is happening.

They have one lever. OK, they have two levers if you count QE/QT. But, one of those levers is tied to a piece of string that broke a long time ago.

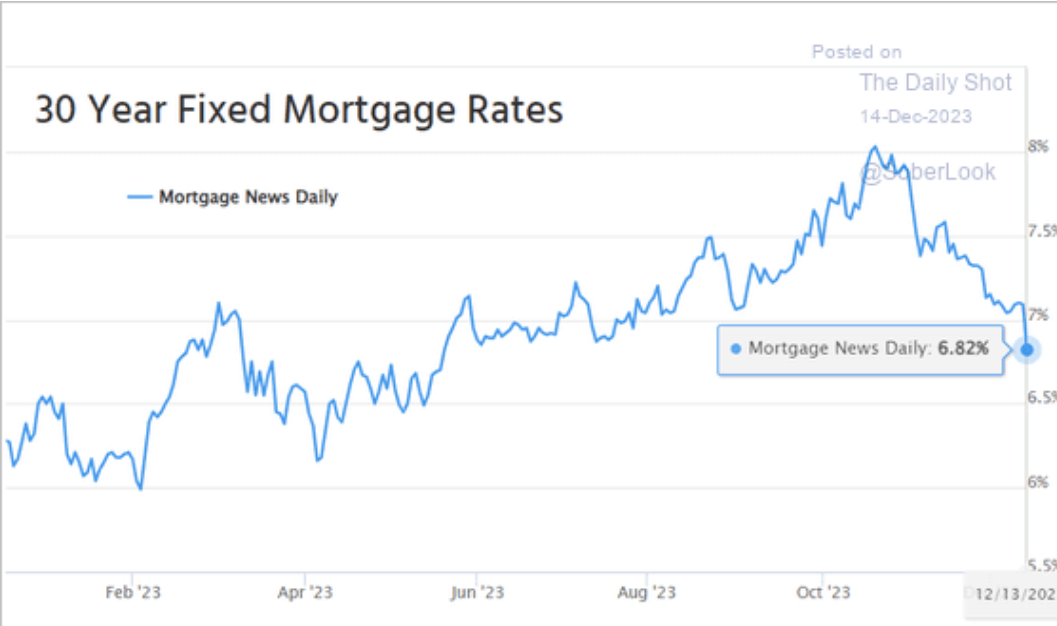

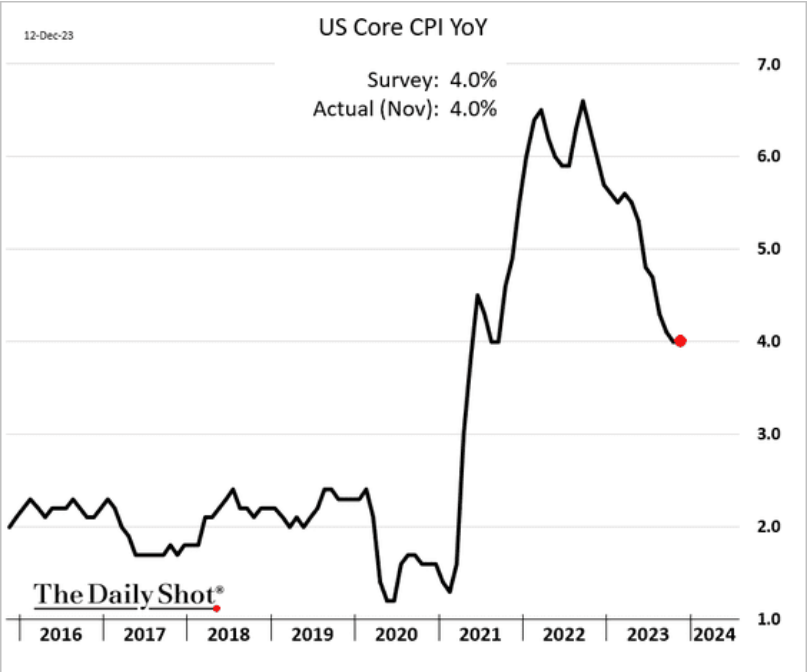

The reality is that price pressures in the USA are coming down because energy prices have dropped, but they are not coming down fast because housing prices continue to be high. Guess which one is more affected by interest rates. Mortgage rates are continuing to fall, but they are still high enough to cause a drag on borrowing.

Price increases for primary residence are still well above pre-2022 levels at 0.5% per month.

There are also two things that have nothing to do with interest rates:

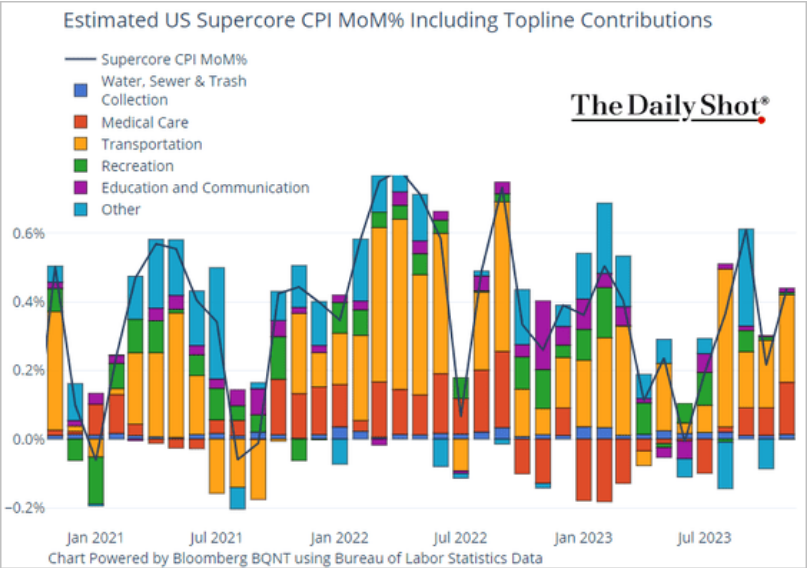

- "Super core" inflation and purchasing indexes remain elevated.

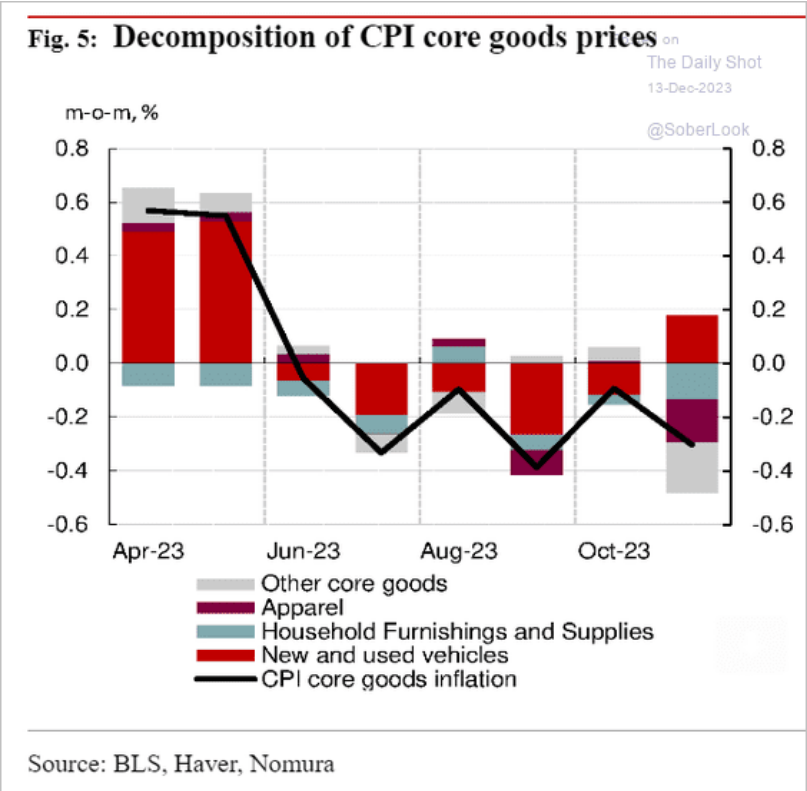

- Core goods are in deflation.

I also expect that private bank operating costs are actually in deflation territory. The bringing online of machine learning processes might take a while, but each time they automate a banking process properly it reduces costs. Banks' operating costs were much higher at the beginning of the year, but those costs curves are starting to level out. Operating cost reduction for private banks means that a high central bank rate will start to be a drag on profits.

Stock markets have seen large and broad gains for investors (90% of S&P500 are above their 50-day moving average) over the previous week partly because of the promise that interest rates are going to come down and partly because AI is driving corporate purchasing.

This bounce may prove to be overblown, however. The question we need answered is how far above the real interest rate is the central bank rate. If the central bank rate comes down faster than the real rate, then it will lead to subsidy for finance, but if it comes down slower than bank rates then it will drag on bank profits.

Never mind the drag that it is having on the economy as a whole. "Soft landing" refers to finance more than it refers to job losses for working people.

Energy use and commodity purchasing by firms are way down showing a slowdown in the economy is real and broad. The concern is that we have not seen the full impact of the slow-down yet.

Emerging market affected

An effect of higher central bank rates and lavish subsidies in the USA is that exchange rates and the price of debt in emerging markets are sky high. The price of this debt is worrying for anyone who went through the last emerging market investment slowdown. Too much has once again be put on private capital's promises of wealth creation. The likely result are continued cuts across the global South as those debts come due in US dollars and at higher interest rates.

Add to this increased pressure on state spending and price increases, you have the direct felt impacts of climate change. It leads to unrest.

Kenya Plans Rolling Blackouts to Guard Power System After Cuts

The East African nation requires $5.3 billion to revamp its entire electricity network, Energy Principal Secretary Alex Wachira said at the same briefing.

“The percentage of conflicts taking place in climate-vulnerable countries increased from 44% to 67% over the past three decades,” the IRC said. The countries on the watchlist contribute less than 2% of global carbon emissions, it said.

We have not turned the corner yet on the recession and things are already getting bad.

Brief explanation of the above reasoning around bank profits

Bank operating costs are:

- wages

- buildings as assets

- electricity

- technology hardware

- SAAS costs

- custom hardware/software maintenance

- purchasing start-up competitors

All these costs skyrocketed during the 2021-2023 period, which created a drag on bank profits.

In addition, the cap on lending was the interest rate increase while companies were struggling with their current and rolling debt. Zombie companies are not harmful to the broader economy necessarily, but they are to bank profits if they do not pay. Banks were renegotiating these terms throughout 2022-2023.

Many of these cost pressures have abated:

- hardware is cheaper

- developers are cheaper

- technology actually increases productivity for banks right now as opposed to just driving capital costs up

-

assets have been sold, written off, closed, de-leased, and the floor seems to have been reached in the commercial office space sector on price declines

- "The national office vacancy rate increased by only 10 basis points (bps) this quarter, as modest improvements in Class A buildings and a growing number of office conversions nearly offset the impact of rising Class B vacancy rates. "

- Building of new office complexes in major city centres have essentially ceased.

- Interest rates are no longer increasing and while there has been an uptick in people and businesses not paying their debt, more debt has been taken on. That has basically balanced out the losses.

- Energy costs have stopped rising.

- SAAS cost increases have peaked.

Essentially, we have a situation where bank costs are not growing anywhere near as fast and likely in deflationary territory.

Bank costs = real interest rates

Bank subsidy = real interest rate - central bank target lending rate

I do not think that the central bank target rate went above the real interest rate (or if it did, it was short-lived and only for a few smallish regional banks and highly leveraged ones like SVB).

If the central bank rate is too close to the real interest rate, then the banks will start being upset. Since the point of the central bank is to subsidize private bank operations (thus driving inflation), they will reduce their lending rate target as inflation falls down and bank costs are reduced. If they do not, it will be a drag on profitability because the subsidy will shrink more than expected.