December 14, 2022

USA Inflation

Good news yesterday? Well, maybe. And, maybe not.

John Authers of Bloomberg linked to some graphs that show the "New Keynesian" program's analysis.

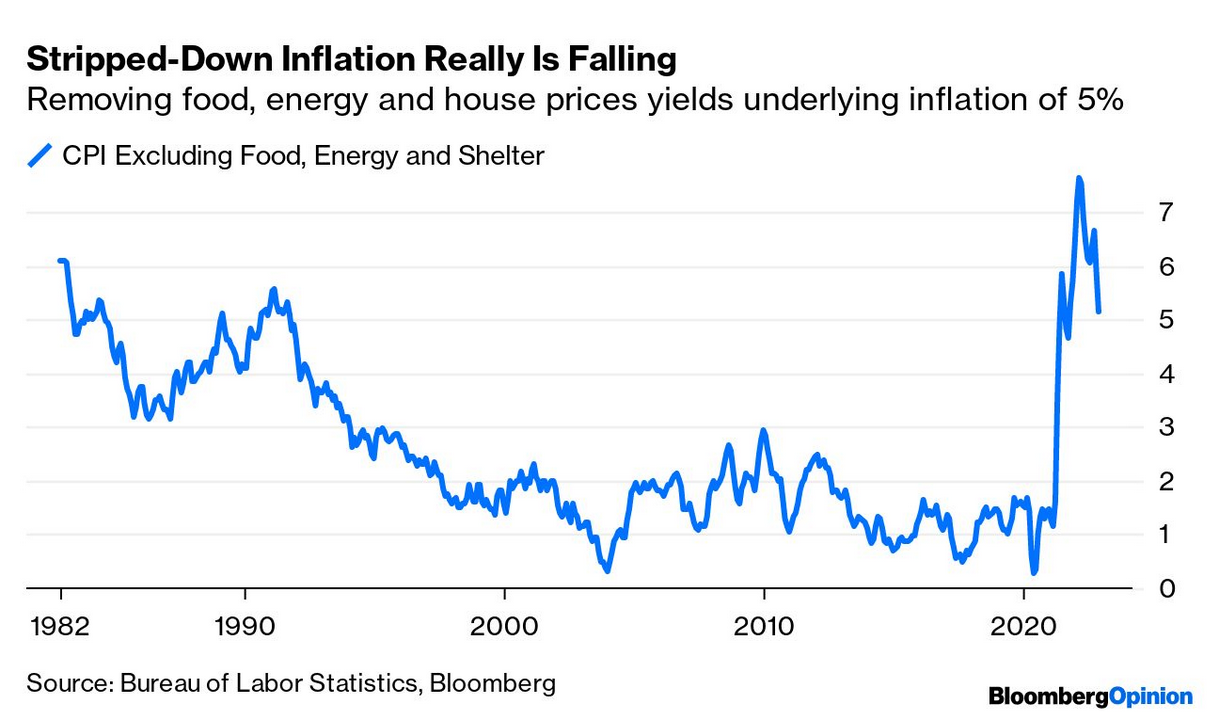

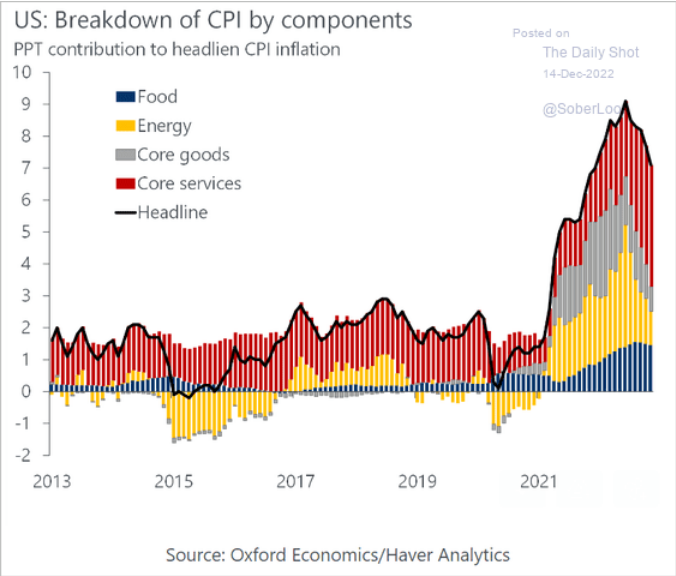

As discussed many times before, the Consumer Price Index graphs can be rather misleading if you do not pay attention to what is included in those lines:

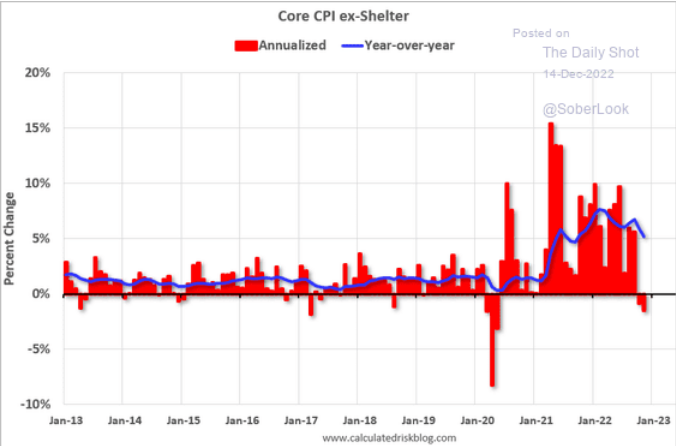

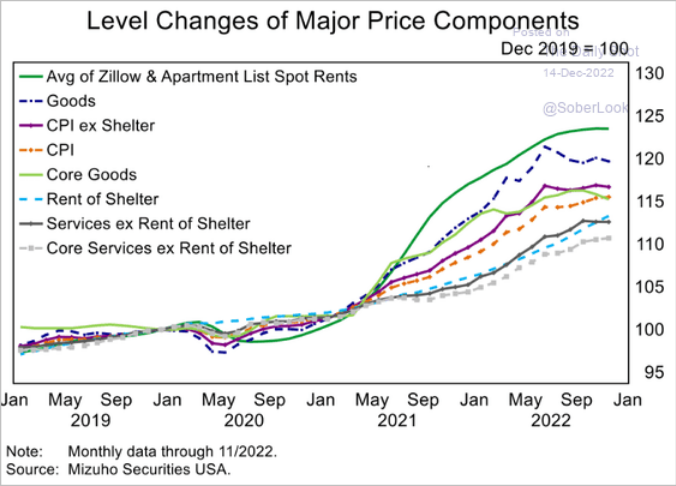

Looking at the price of things without looking at basics makes it look like things are not getting as expensive as fast:

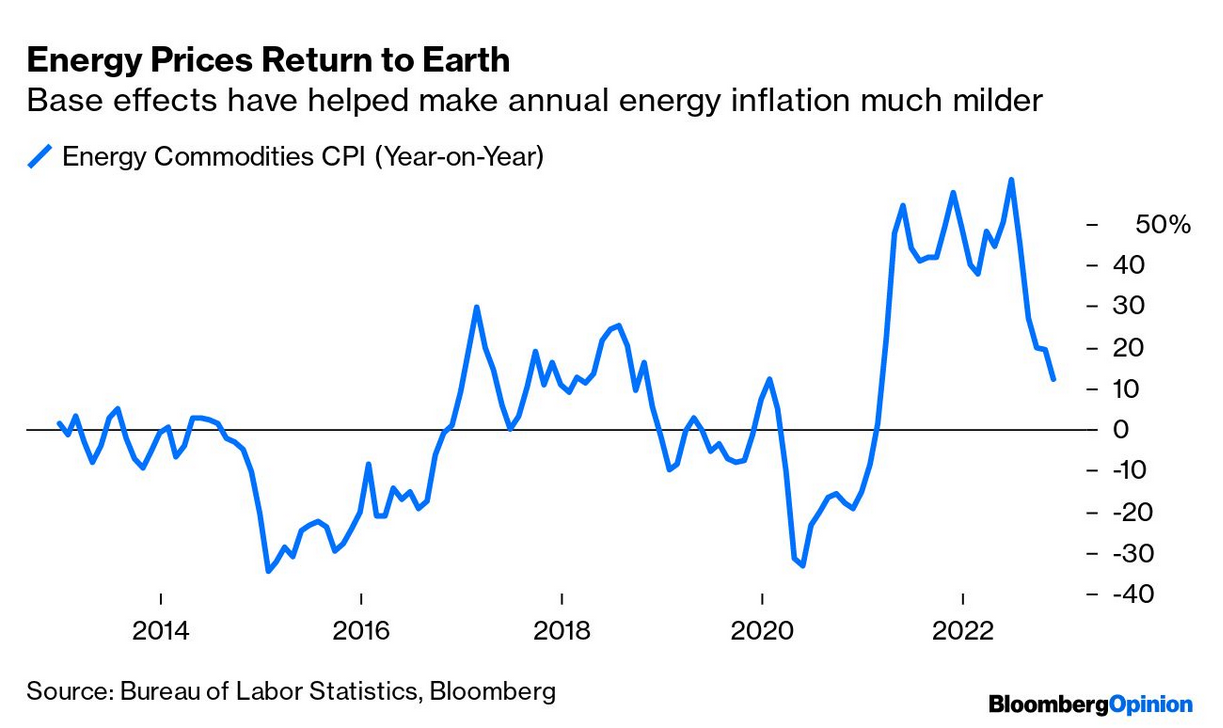

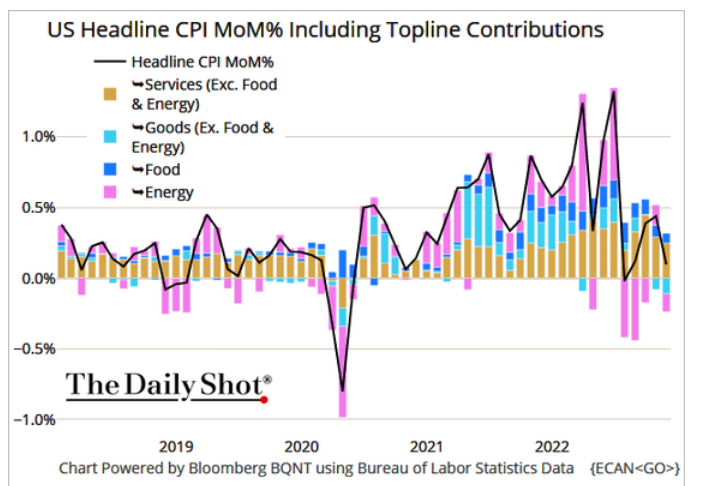

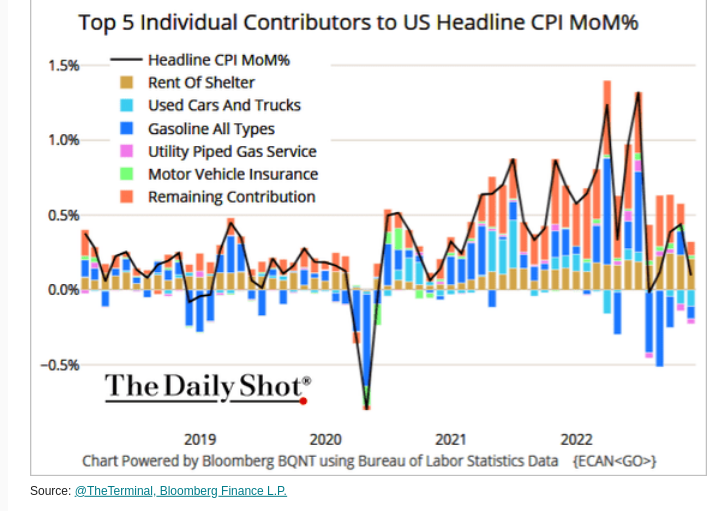

But, this is really because the price of energy is falling and while the price of energy can be excluded as a consumable, its price affects all other prices:

Again, have a look at the price of consumer goods and the price of energy. You will see a rather unmistakable correlation.

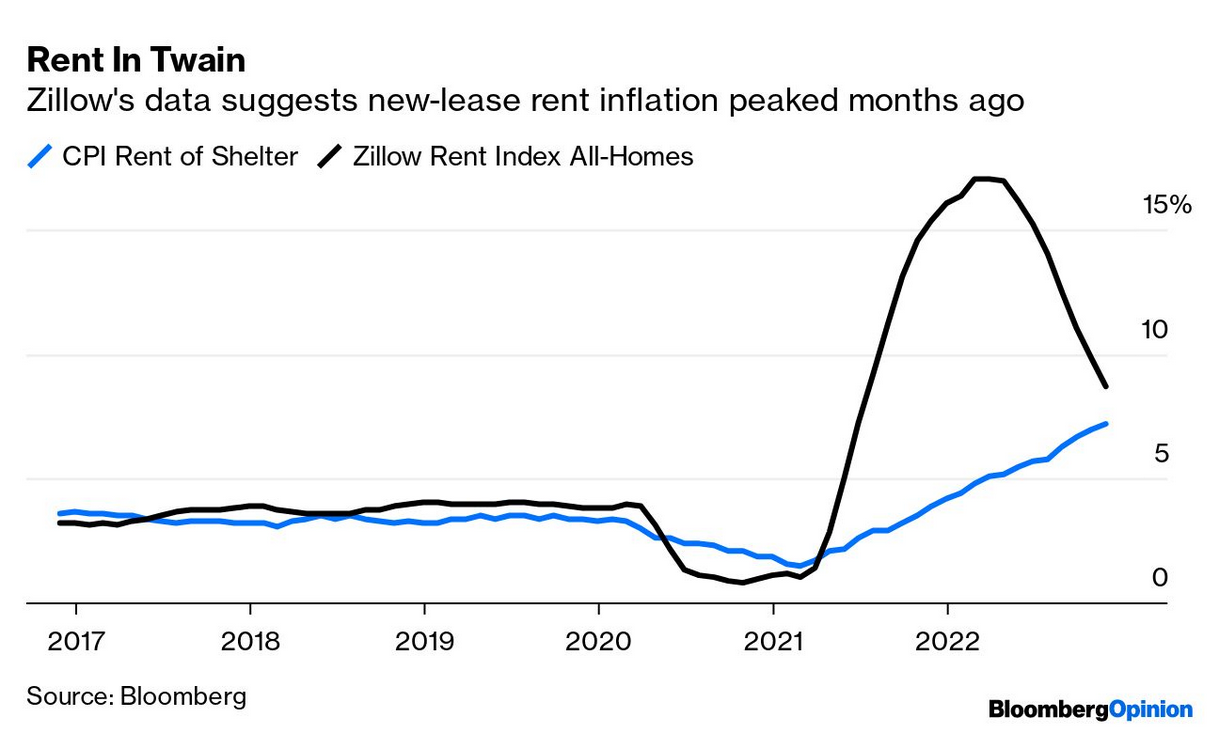

Housing costs (rent, specifically) bounced, but there is a growing cost of housing that is going to "stabilize" at a higher growth rate since interest rates are artificially high:

All that is to say that while consumer prices are not growing super fast, they are still growing faster than wages.

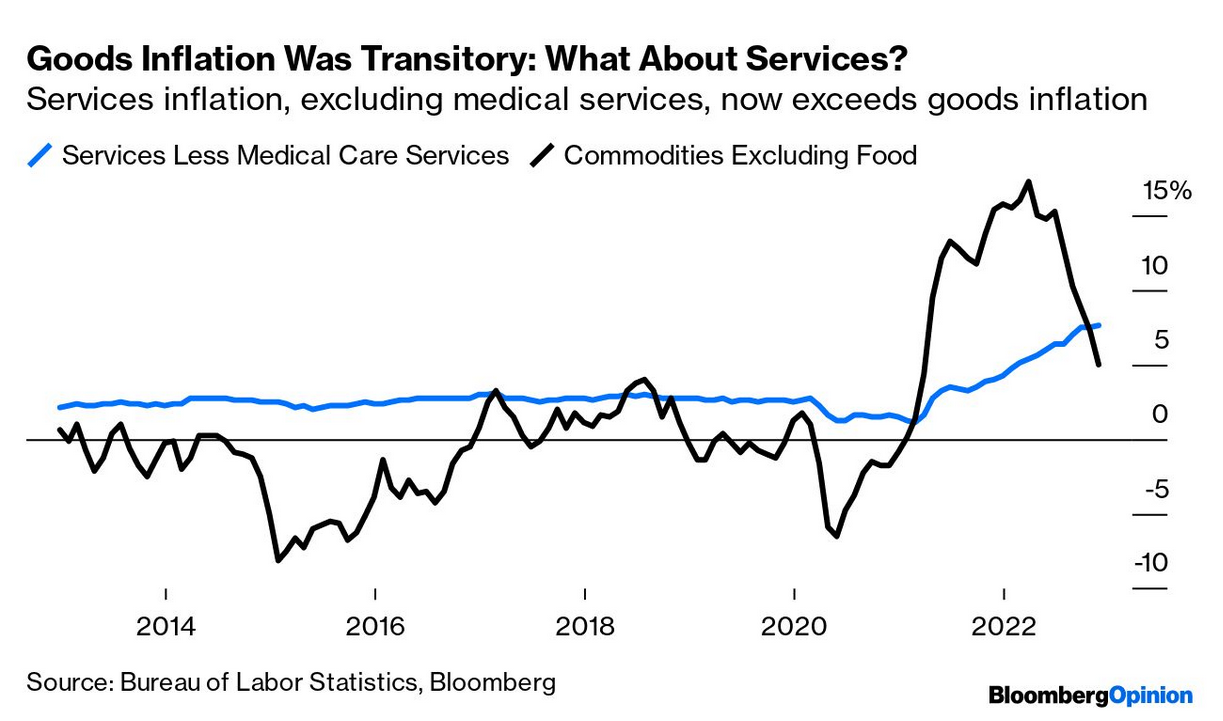

The "services" section of that graph is also interesting. Services costs are driven by the cost of owning and running those services. The orthodox economists would like us to believe that this is because of wages. It is not. Wages have not increased and did not drive the costs in the first place.

Even mainstream economists are starting to question what the Fed is doing. Claudia Sahm, who used to be a Fed Economist:

While a number of economists are pointing with alarm to strong wage gains as a sign inflation will remain high into 2023, Sahm in a note last week argued there’s no consensus “in cutting-edge, peer-reviewed empirical research finding a solid link between wage growth and inflation.”

“Solid wage growth will provide income to buffer families, especially those with little savings, when the full effect of the Fed rate hikes comes next year,” she says. “Inflation is coming down, and workers are doing well. That is the only path to a soft landing, which is increasingly likely.” (BN)

The reason for the increase in costs is the other inputs to "services", namely capital, property, technology upgrades, and growth in the need of services. Healthcare is included in this as these graphs are the USA, but health service costs have collapsed for November.

Some other graphs of this show month-over-month changes in prices:

And a breakdown of what is pushing CPI. As you can clearly see, energy and food costs are a major factor. While energy prices may be declining, food will continue to be an upward pressure on general price increases experienced by workers.

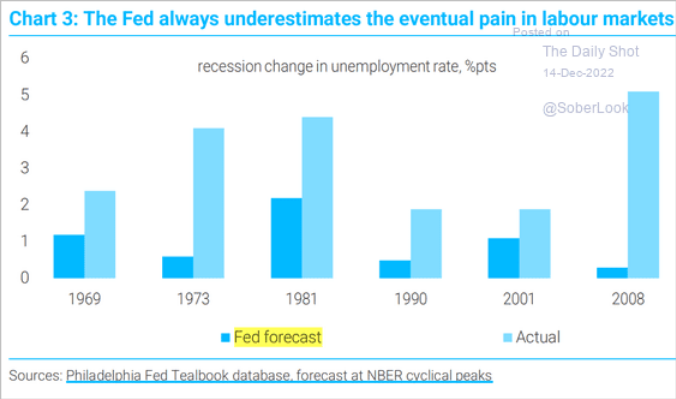

This was a lot of graphs for one point. There is increasing pressure on the central bank in the USA (the Federal Reserve) to slow down its interest rate hikes. The bet is now that they will reduce the rate of increase in interest rates in January.

I will leave the betting on this to others, but I think that the calculations that drive the central bank interest rates have more to do with reflating profit rather than "fighting inflation". As such, we have to look elsewhere to see what the central banks will do.

Along this line, unemployment is expected to rise because the central banks think that unemployment has something to do with the string they are pushing on. They are always wrong:

Energy

A couple of unrelated energy things today.

Climate change skepticism

A new poll done by the French company EDF shows that there are changing dynamics of people's orientation to climate change. I do not think any of these outcomes are surprising, but it is important to know where people are and how bad capitalism is at dealing with existential issues.

The first take-away from the poll is that caring about climate change mitigation is undermined when immediate life needs are not met. Second, there is a reactionary element pushing a selection of narratives to not deal with climate change. These narratives range from you cannot do anything to nothing will happen to it isn't really a big enough issue to deal with. These are not just embedded in the older generation which means "waiting for the youth to run things" isn't an answer.

War, the economy, and energy

War and energy has always been interconnected. If the USA's defense services was a country, it would be the 4th largest emitter of CO2 and burner of fossil fuels. But, there is a second part to this.

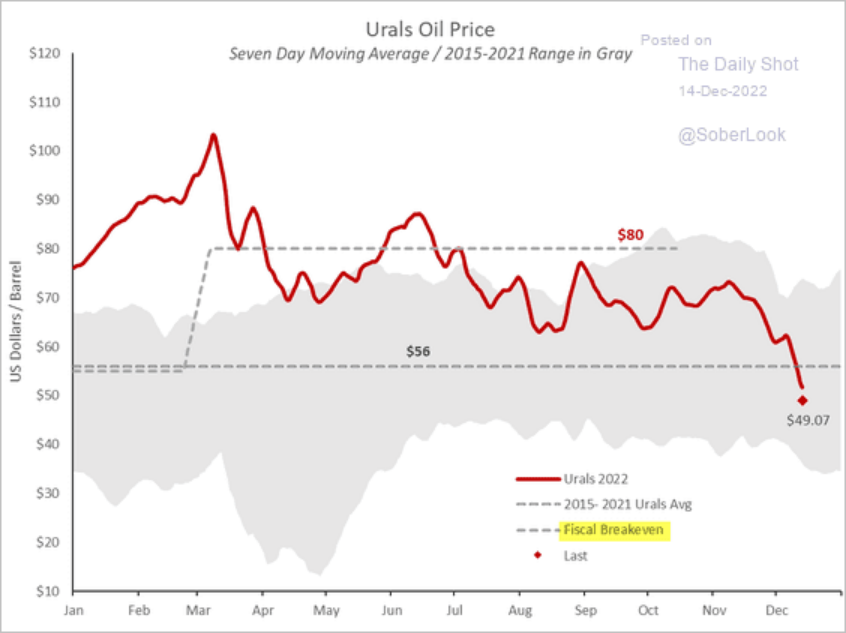

If the USA's economic activity slows, it affects other countries' economies. Right now, it is expected that if the USA goes into recession Russia will not be able to finance its war in Ukraine. This is because the price of oil will decline below the break-even point.

The shift in types of energy production is taking all sorts of turns. There is a push in the UK to use Hydrogen, the main thrust of the USA inflation fighting bill is to subsidize renewable installation, and the global system of distributing fossil fuels is shifting.

All this creates a situation where energy generation over the medium term will continue to be a very important geopolitical issue for states.

Mars devils

Photographed for decades at Mars but never heard until now, dust devils are common at the red planet. This one was in the average range: at least 400 feet (118 meters) tall and 80 feet (25 meters) across, traveling at 16 feet (5 meters) per second. (BN)

Click the links below for the stories: