December 13, 2022

Public vs Private Sector

The distinction between the public sector and the private sector has never been smaller, but the gap between private market set wages and public sector wages have never been larger.

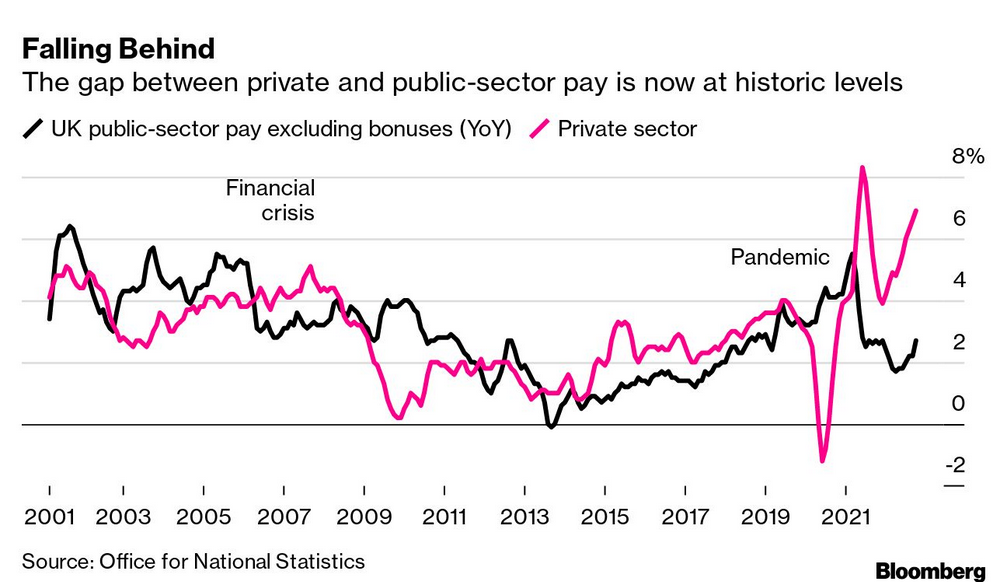

Take the UK:

Basically, public sector pay is higher only during major downturns in the economy over the previous two decades—higher only because of union contract coverage. Public sector pay freezes, cuts to funding, privatization and outsourcing, and low labour militancy have all contributed to low public sector wage growth. Public sector wages are quite simply a proxy for public sector investment.

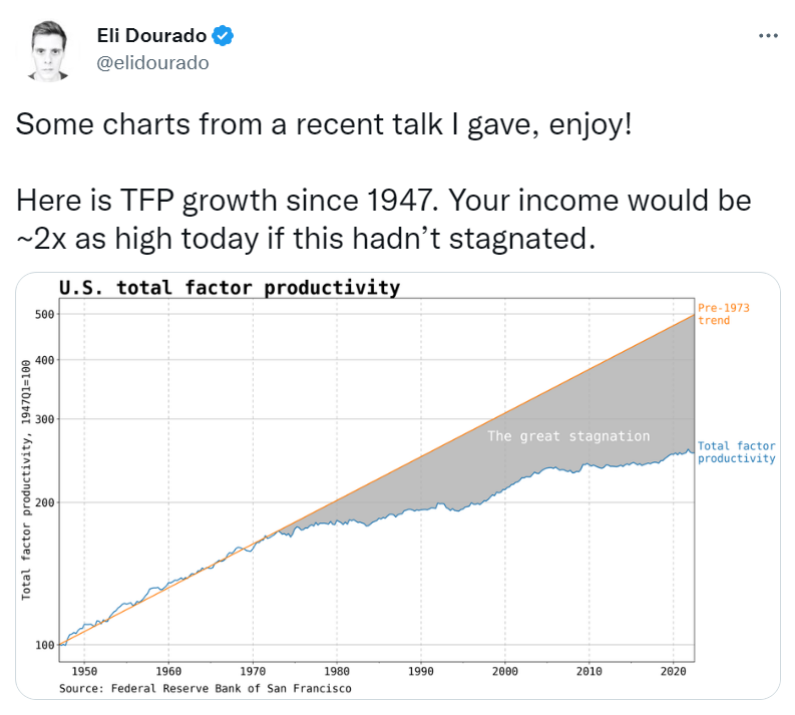

Most people do not understand how government is funded or what a "public sector wage" is. This is not surprising though. Most people do not understand what a "private sector wage is" or how it is funded.

Most people include economists:

While it may not be surprising, it is a major problem. If workers do not understand their relationship to the production process, how their work contributes to value creation, their wages relation to profit, or their relation to capital, then workers are not going to be able to know when and how to struggle for fair wages effectively.

Right now, workers are angry because their wages are not keeping up with inflation. Capital is responding that wages cannot go up because wages are driving inflation.

Union leadership are talking about monopoly profits and fair wages—though few are demanding above inflation increases. Capital's leadership are responding by complaining about the lack of free investment money from the government and a "new phase" of slowly declining, but high, interest rates.

The result of everyone talking about the economy in very different and unhelpful ways in search for the clever sound bite is a lost plot. The economy exists as a result of human activity and choices about value creation and use. It is not magical and it is tethered to physical reality.

The economy is materialistic.

Repeating

The adage of history repeating exists for a reason. We are about to swing back towards a history that has not existed for a while. One where collective investment is done in a different, less privatized way. This is, unfortunately, not because of political mobilization of people, but because of the political realities of the materialist economy.

History has shifted and we need to change how we talk about the economy. "Public" and "private" sectors are not split the way we seem to pretend they are, especially after 40 years of neoliberalism.

Production must be put back on the agenda for the state. Public sector cannot be synonymous with "services" any more and the private sector cannot be seen as a magical answer to problems we do not have a solution for. There is not a magical, invisible hand from the sky that is going to save us.

The solution seems clear when we re-frame the issues of production around production of needed value versus the "free" market. We have so much needed value creation that is not being invested in, it is hard to see how any of this can happen without democratic, science-informed state intervention.

We do, however, feel very far from this.

The first step is understanding the difference.

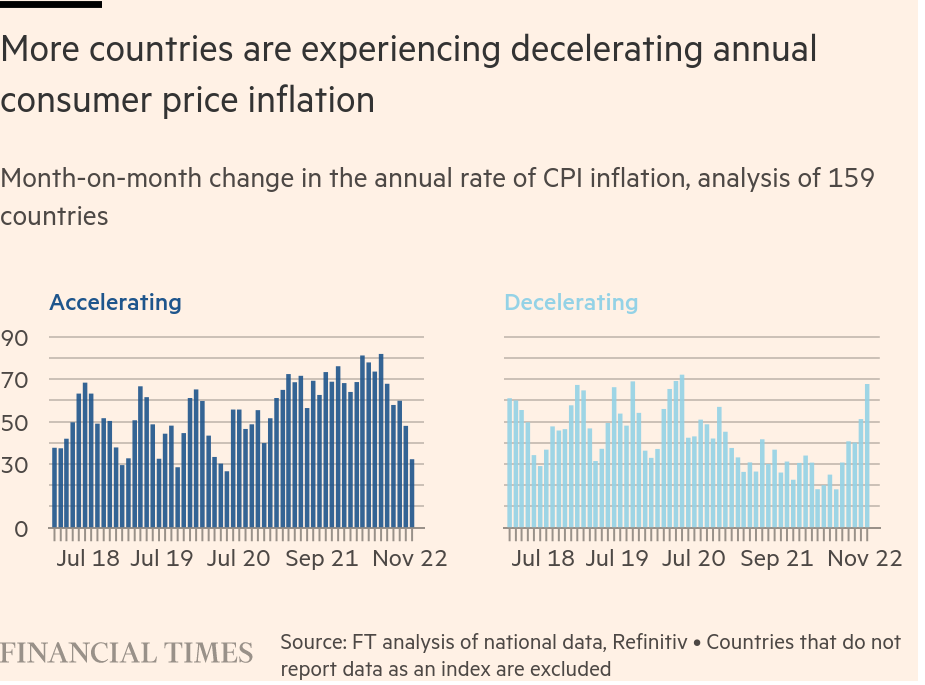

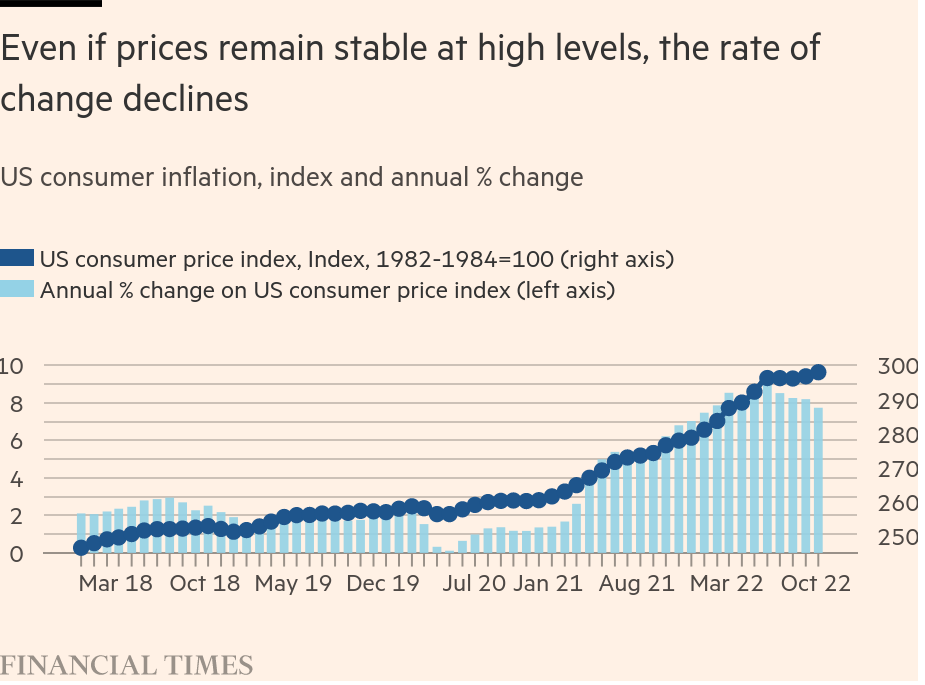

Disinflation, not deflation

Prices are growing at a slower rate than they were when they were growing at a very fast rate earlier in the year.

They are still growing, however.

The process of "reality reasserting itself" looks like this. There was too much profit subsidy, too much printing of money given to capital where nothing of value was created. That pretend money increased the cost of everything.

However, we are not done with higher prices. Higher prices are not just from money printing right now. They are also a result of supply chains being screwed-up, war, trade disruptions, disruptions in production, energy system changes (fossil fuels), and climate change.

All these hit their peak in terms of limiting price increases. This means price increases are still on the menu unless workers are pushed into poverty.

Interest rates will not fix any of these issues.