December 12, 2024

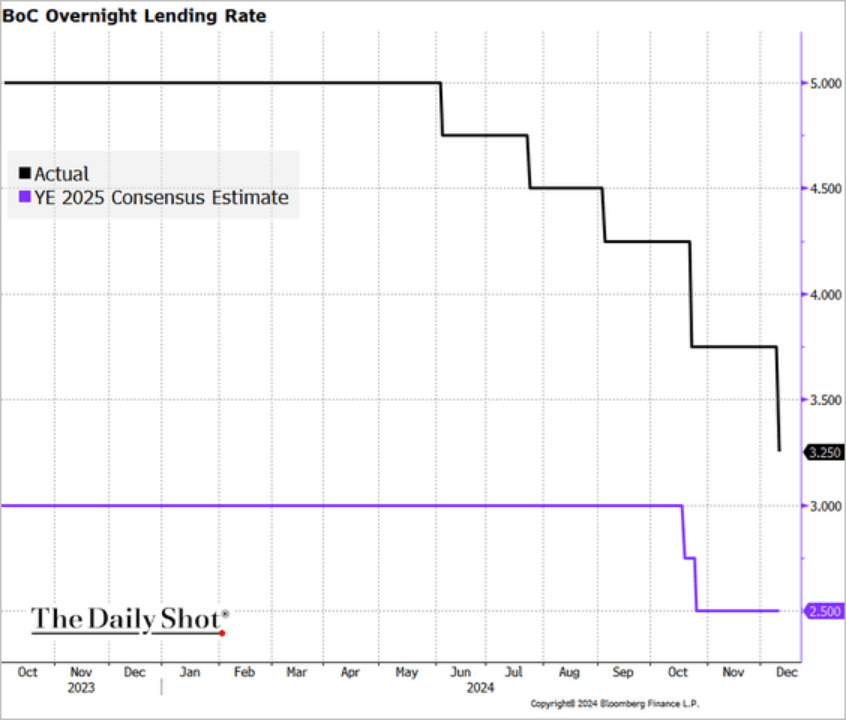

Rate Cut in Canada

No one should have been surprised at the cut in overnight lending rates by 0.5%. The Canadian economy is not doing well and under new threats by Trump.

However, one might have determined that it was not large enough given those threats to our economic growth. Capital's economists are predicting some large reductions coming for next year.

I will leave debating interest rates to those who think that they really affect much. Without major investments by the public sector in supports for industry and building housing (and not in the form of profit subsidies), low interest rates are not going to affect much.

The game right now is on investment. While lower interest rates may help that a long a bit, those rates do not make-up for an economy no one thinks is worth investing in.

Some folks are of the mind that we should just give in and flow with the tides of the global reorganization of trade and investment regimes.

- Liberal environmental groups wan cheap EVs into the country, along with cheap energy infrastructure that is not made here.

- Many think that mining should happen "somewhere else".

- There is a blind spot on the left in relation to the oil and gas sector and its impact on the economy—driven mostly by a reaction to the new ridiculous ads they are putting out about "affordability".

- There is a severe misunderstanding around the impact of tariffs and free trade deals on actual trade and investment. There is little reason to believe that specific free trade deals are a essential to current investment programs.

- The news focuses on large firms instead of small ones, warping the public's and investors' sense of the economy.

I feel we are getting lost in the extremely and ever growing complex air war—one that has progressed to a stage where the left cannot even compete. If we ever had the ability to engage in this way, it is clear that we now no longer have the tools, the resources, or the ability to engage through some of these mediums.

Recent presentations to workers from a classical economic analysis outlining their place in work and the economy have been even more positively received recently. Union members have approached me after presentations and lamented that they do not see anything from the left even approaching sensible. Indeed, they cannot tell the difference between the political programs presented because they all look the same.

Activists on the left must start to set their political analysis on a firm footing and start to speak to workers with clear alternatives to the madness that is floating in the air.

As we head into the depths of winter and things start to slow over the break, politically active folks need to start talking to their neighbours about the future we want in Canada.

That future is a choice between being more independent from the USA or continuing to become a protectorate of USA's capital with voice but no vote.

There is an alternative to win. But, we cannot get there if no one knows about it.

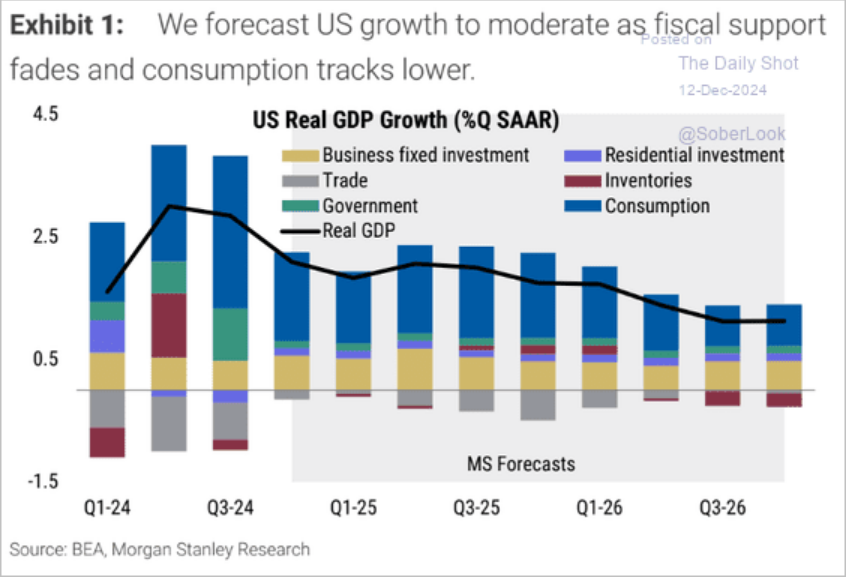

USA economy is not going well

Contrary to much of everything being touted by the USA corporate media machine, their economy is not going well.

Even Capital's economists are predicting slowing USA growth under simple structural analysis. The impact of a Trump administration may support or drag down the economy depending on what they actually do.

Even the Walmart index shows that there is a recession coming in the USA.

“It’s odd when so many signals currently indicate stock market optimism, that investors are favoring the quintessential ‘defensive’ retailer (which relatively would do best if a recession was imminent) over the most aggressive luxury stocks,” Paulsen wrote this week in his newsletter.

“While bond investors continue to suggest confidence (perhaps exuberance?) in the economy, stock investors seem very anxious about the financial integrity of Main Street consumers,’’ he wrote. (BN)

The impact of a downturn in the USA is going to be even more pressure to shift investment away from the USA trading nations. And, that's leaving aside the notion that some historians have that the USA has a tendency to solve recessions by going to war.

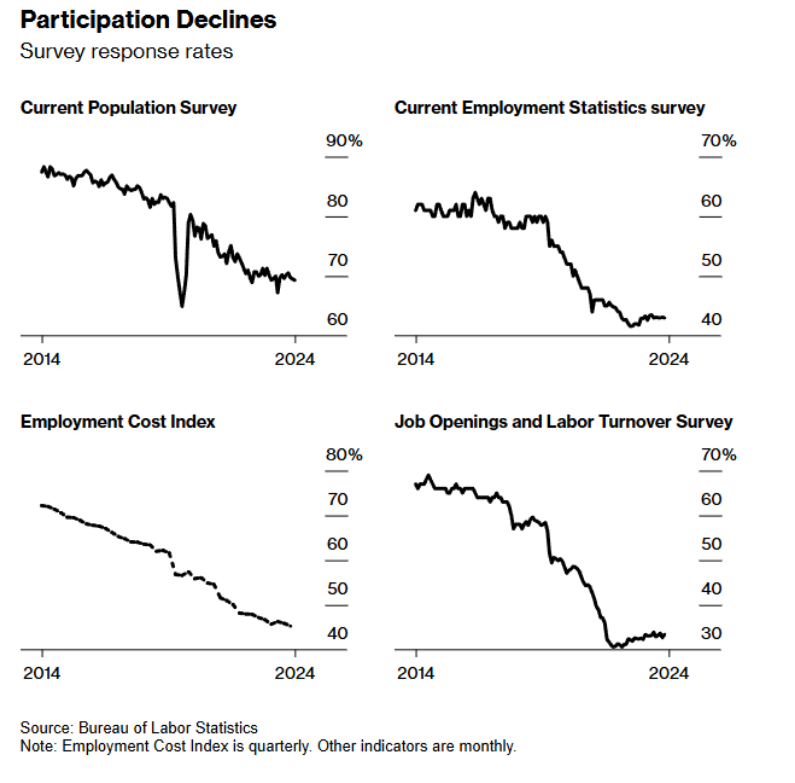

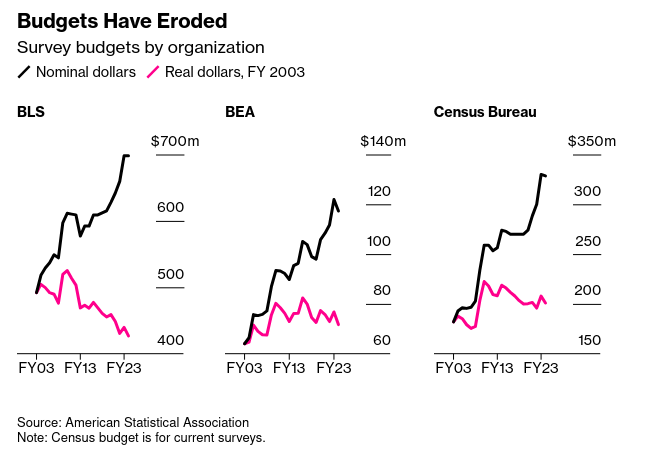

Data missing

That said, we might never find out. Along with the UK's data fight, the USA is also having trouble with its economic data collection.

This must be linked directly to the focus on de-funding NOAA climate and weather services. Along with underfunding, a new report shows there is also a culture in government agencies of not raising issues or trying to improve things.

Both economic and weather data are giving the Republicans (and many Democrats) information that does not align to their world view. The problem there is obvious.

What is not so obvious to people is that unlike a battle between government and privatization on infrastructure, there really is no alternative to international government coordination on collecting this data.