December 12, 2023

Interest Rate Predictions for 2024

Stable energy prices did not drive CPI last month in the USA, leading most analysts to predict that inflation will stay steady near 3%.

Bloomberg Economics has a prediction for 2024:

While Fed Chair Jerome Powell early this month said it was too soon to speculate about policy easing, the economic data should be clear enough by March to convince US policymakers to cut their benchmark by 25 basis points, the team says.

“We expect the Fed to lead the way with 125 basis points of cuts over the course of the year,” Bloomberg Economics says. The European Central Bank will lower rates in June. Bank of England policymakers are seen following in the second half of the year.

The US will see a “shallow” recession, beginning around now and continuing into early 2024

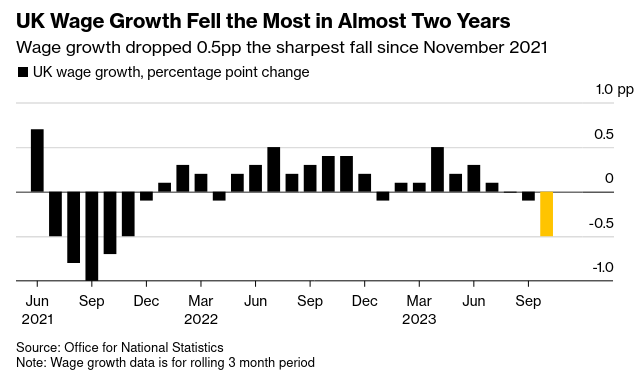

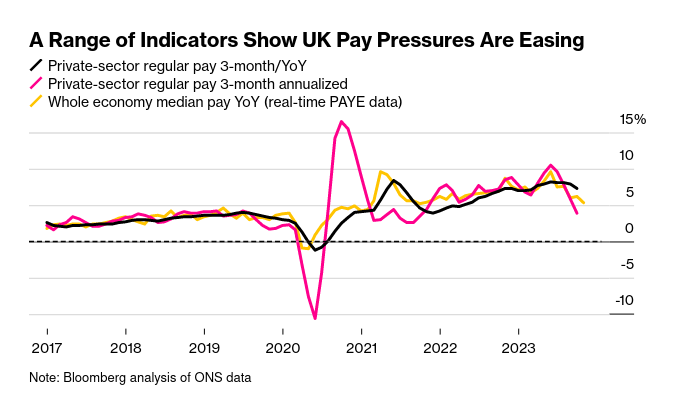

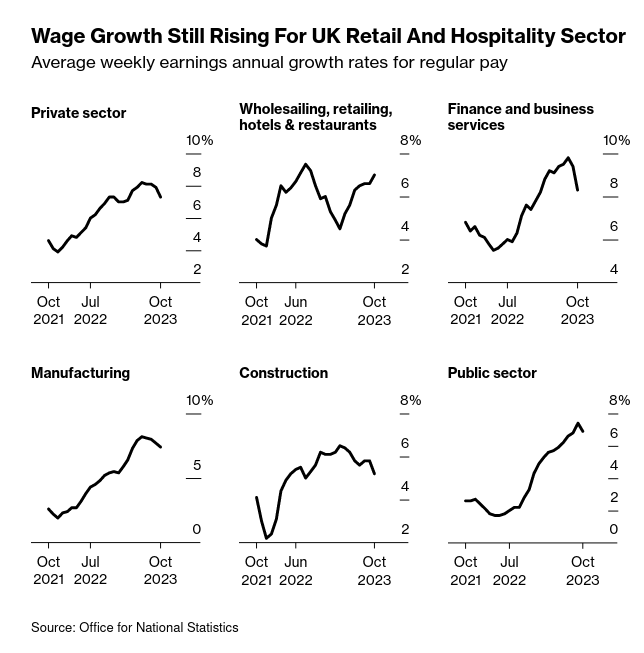

They also predict the UK is going to be in bad shape for longer. A bad sign for the rest of us given these graphs:

Wages are falling, but that just means central bankers are achieving their aim.

Expect more graphs that look like these in the coming months. Even as union wage settlements across the private and public sectors look decent after a slew of strike action, folks at the whim of the broader labour market are at the top of the mountain.

In October:

- 131,000 working days lost to labor disputes, mostly health and social care

- 49,000 workers, the lowest number since June 2022.

The Bank of England is even more tied to the fictitious connection between wages and inflation than most central banks.

Canada vs USA

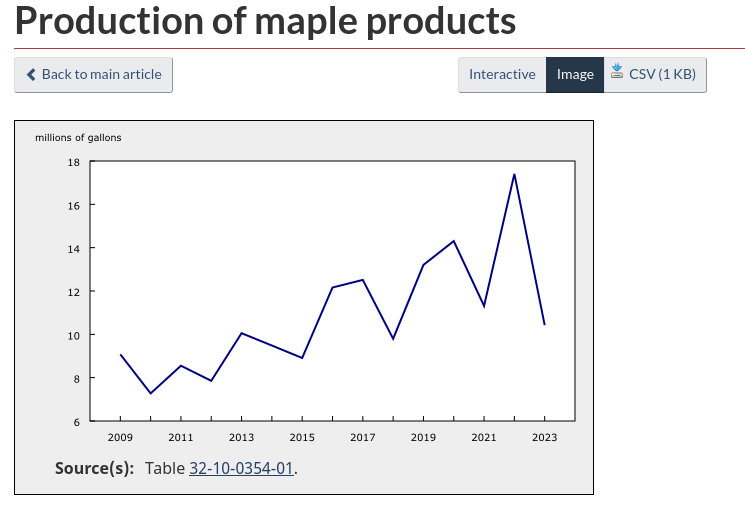

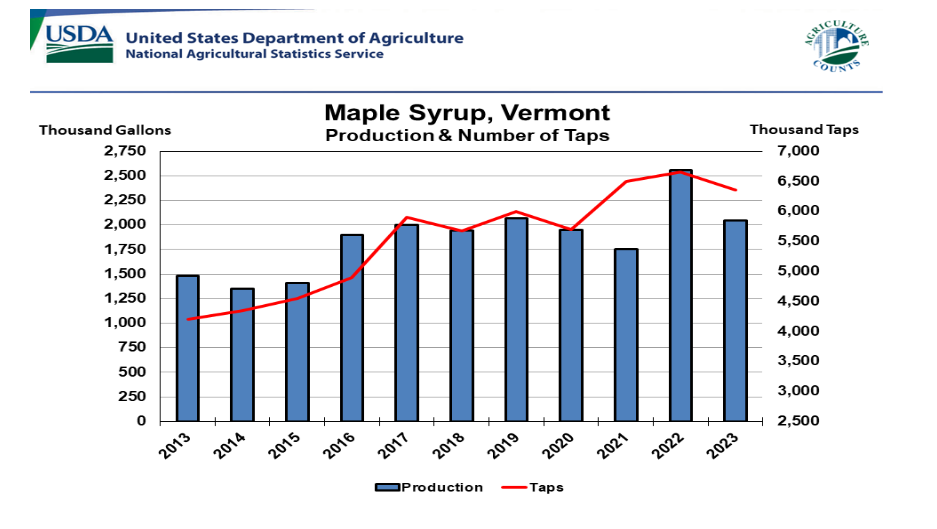

Maple production was down 40% compared to last year because of this year's weather.

It is a major Canadian export this time of year and that is down 8%.

Vermont, the world's top producer of the sugar sludge was also down, but not as much as Canada.

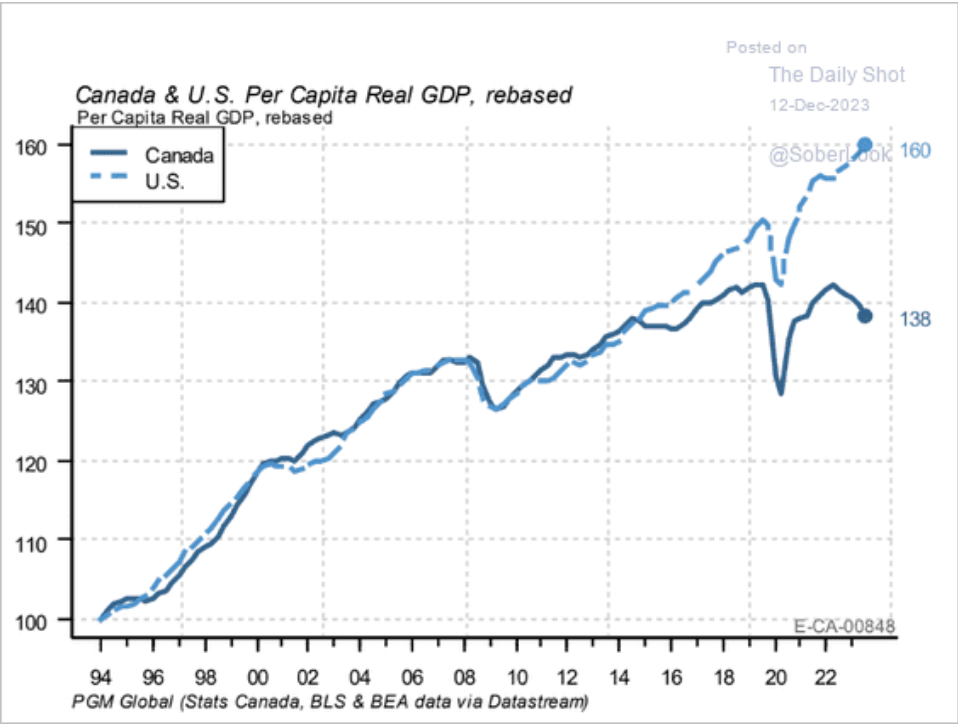

Speaking of Canada not doing as well as the USA, this is not a great graphic:

Productivity is way down in Canada, but as the USA pushes to re-shore some manufacturing, Canada with its stuck in the '90s economics, is going to continue to be lagging. The stagnant growth started in 2009, but did not recover as the USA's did during the mid 2010s.

The left have a response to this: industrial strategy.

Too bad no one in government has the capability of hearing that phrase.

China and USA war games

The USA sees war with China as near inevitable.

The Federal Reserve should be required to stress test US banks’ ability to “withstand a potential sudden loss of market access to China”, according to a congressional committee.

The proposed legislative change was among dozens of recommendations in a report on Tuesday from the US House of Representatives’ China committee about enhancing US economic competitiveness to counter the rise of China.

This is just after two war games that the committee held this year, including one with Wall Street executives.

USA's international economic interests are driving investment decisions in the USA and Canada is along for the ride. The question Canadian politicians are asking amount to how we can be the source of fuel and resources for the American war machine with this conflict on the horizon.