December 12, 2022

Markets and Oil

Do they even believe what they are saying?

The White House’s chief energy adviser has described as “un-American” the refusal of US shale investors to ramp up drilling, even as Moscow’s invasion of Ukraine causes havoc on global oil and gas markets.

US oil groups have been under pressure from Wall Street to funnel record profits back to investors this year, despite repeated calls by President Joe Biden to pump more oil to help tame rampant inflation.

Hochstein added: “It is not only un-American, it is so unfair to the American public.”

In what can be the most American thing going, the government gives oil companies huge profit subsidies in they hope that they invest in what the state wants them to invest in. But, there is no profit it in, so the oil companies give those profit subsidies directly to their financial capital owners.

At some point the people of the West are going to have to see that their wants and the process to get them are on different planets.

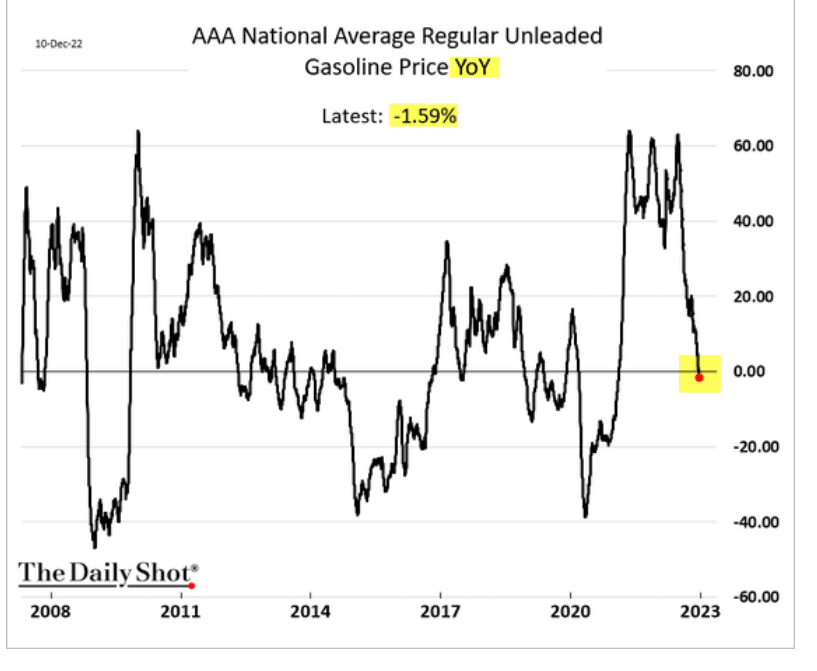

When the price of gas is falling like this, who would invest in making more?

The price of food and what to do about inflation

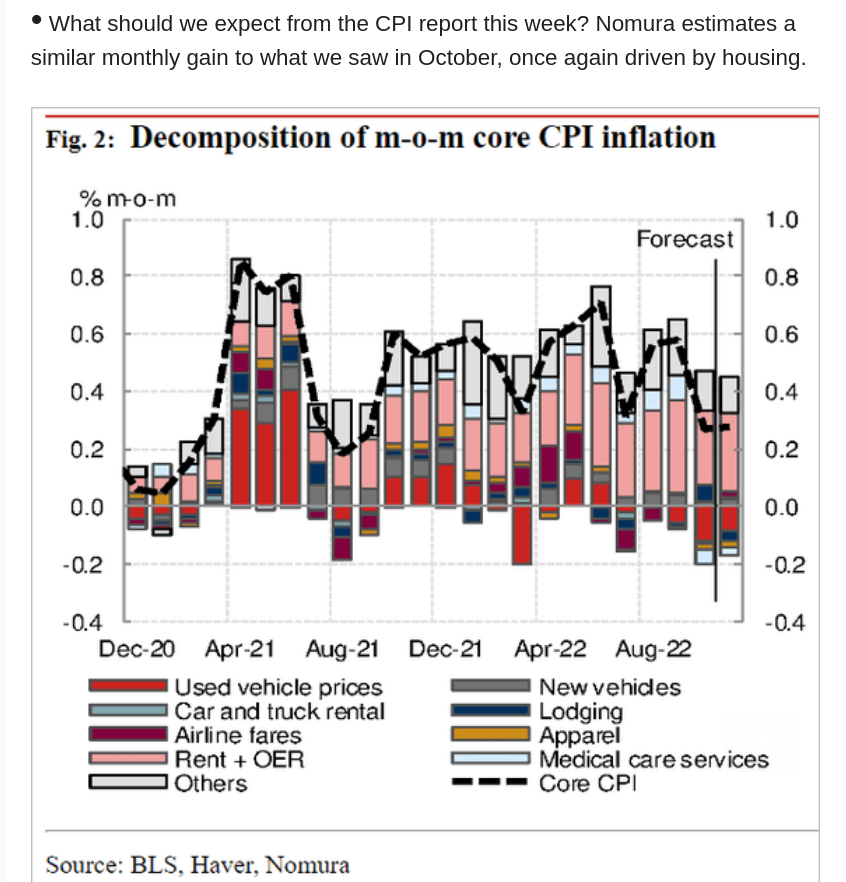

The debate on inflation will restart as tomorrow USA CPI will be announced for November. Some near the USA government (Yellen—who has been the broken clock on inflation from the start) are suggesting that inflation is falling and will be falling through 2023. This is hope based on the fall in average rents, transport costs, and general price increases as supply chains have partly recovered.

However, costs faced by working people are not going to come down just because inflation is not growing as quickly which has been suggested on the CBC over the weekend. Costs for basics and food have outstripped wages leaving workers very far behind. Continued increases in costs without subsequent increases in wages is going to become the most important issue for working people in the next few years. The other issue is the lack of investment in necessary production.

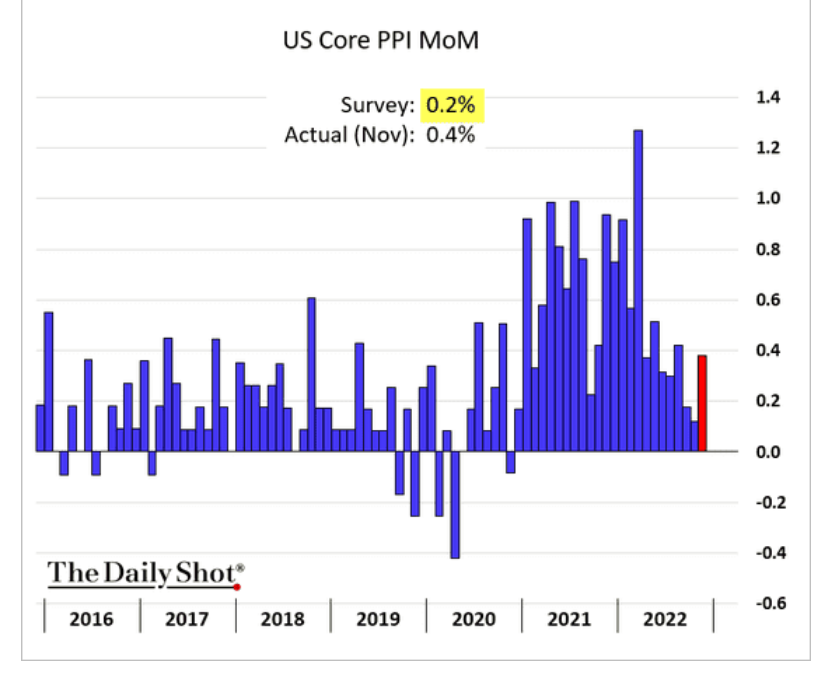

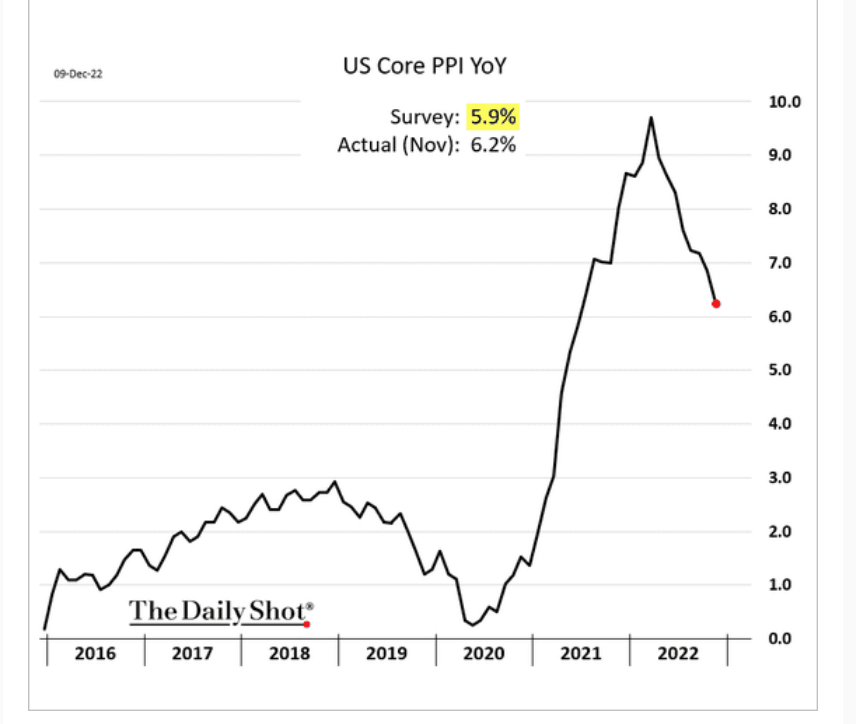

Purchasers Price Index in the USA does not indicate continued price decline at the rate "expected" by investors.

Bankers in Canada

Watch what the spokesperson for Capital will be saying today. More about keeping workers poor wrapped in slightly nicer/obscured language is my bet. Perhaps some offloading of blame onto Capital might be likely too.

Monetary policy Bank of Canada governor Tiff Macklem is scheduled to take part in a fireside chat hosted by the Business Council of British Columbia. The discussion comes less than a week after the central bank raised interest rates by half a percentage point and laid the groundwork for a potential pause in its tightening of monetary policy.

Canada has announced that it is seeking battery investment

Again, it is wishful thinking that capital is going to invest here without some reason to do so (profits).

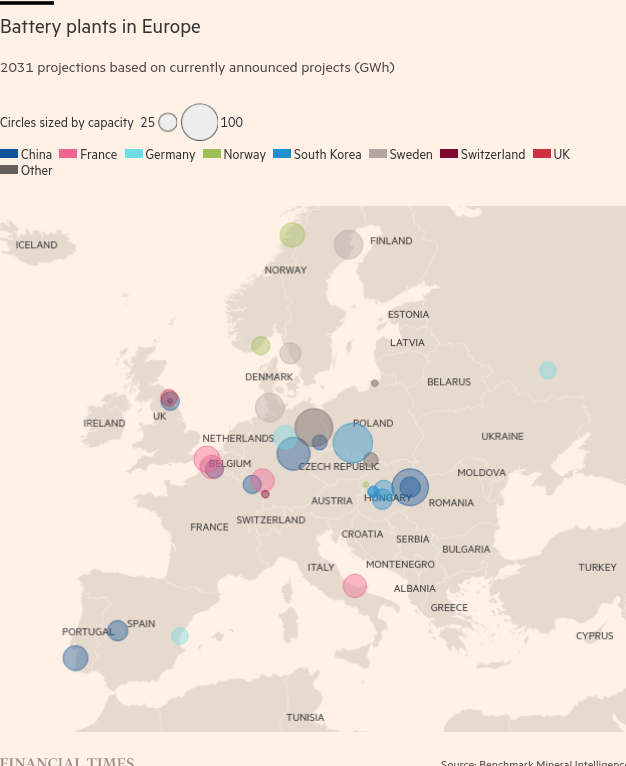

Europe, on the other hand, is driving their battery production. It looks like a lot, until you look closer at those numbers.

VW is foremost among European manufacturers trying to expand their battery capacity and reduce their reliance on external suppliers.

It wants to build five factories in Europe, as well as one in North America. But in the meantime it has a supply deal with China’s CATL, the world’s largest battery maker.

China’s growing presence in Europe’s auto industry is a result of deals to supply car manufacturers in the region, where electrification is being driven by ambitious decarbonisation plans that aim to end the sale of combustion engine vehicles by 2035.

CATL is a supplier to VW and Mercedes-Benz, while BYD — which also makes its own batteries — has a deal with Stellantis. Envision AESC, a battery group backed by China’s Envision, supplies Nissan in the UK and may build more plants in France and Spain.

“This is independent of where the headquarters of the company that you’re working with is located,” chief executive Ola Källenius told the FT. “Even if you would have an Asian company come to Europe and build a [battery] factory for you, you would still work with that Asian company.”

They might be building battery assembly, but the batteries are coming from China. We always used to say that China is not a energy superpower. That may change as energy changes and is part of the reason that the USA has a full anti-China policy.

UK emergency services walk off

The military in the UK are covering ambulance services as Unison walks off the job in health care and postal.

Nurses, postal workers, and ambulance drivers are among the workers across the UK’s public and private sectors who have scheduled December walkouts.

Lofthouse said that the military’s help would not “go anywhere near” stopping walkouts planned for December 21. Although staff would ensure “life and limb” care is provided to people in critical conditions such as cardiac arrest, urgent care would be “most disrupted”, he said. (FT)