December 10, 2024

Global economic confusion

The world's policy makers are a little all over the place when it comes to the economy.

Business groups are lining-up to try to convince the incoming Trump Administration not to implement tariffs or their radical economic experiment.

The studies are coming from the standard pro-capital think tanks and financial institutions:

- National Institute of Economic and Social Research

- National Bureau for Economic Research

- UBS

- Capital Economics

- Liberty Street Economics

- Federal Reserve Bank of New York

They will keep coming on an almost daily trudge. Report after report will announce that major changes in economic policy of the USA government will hurt people and capital in the USA.

The arguments are:

- tariffs will increase costs for American companies

- increased costs will translate into increased prices

- increased prices cause increased inflation

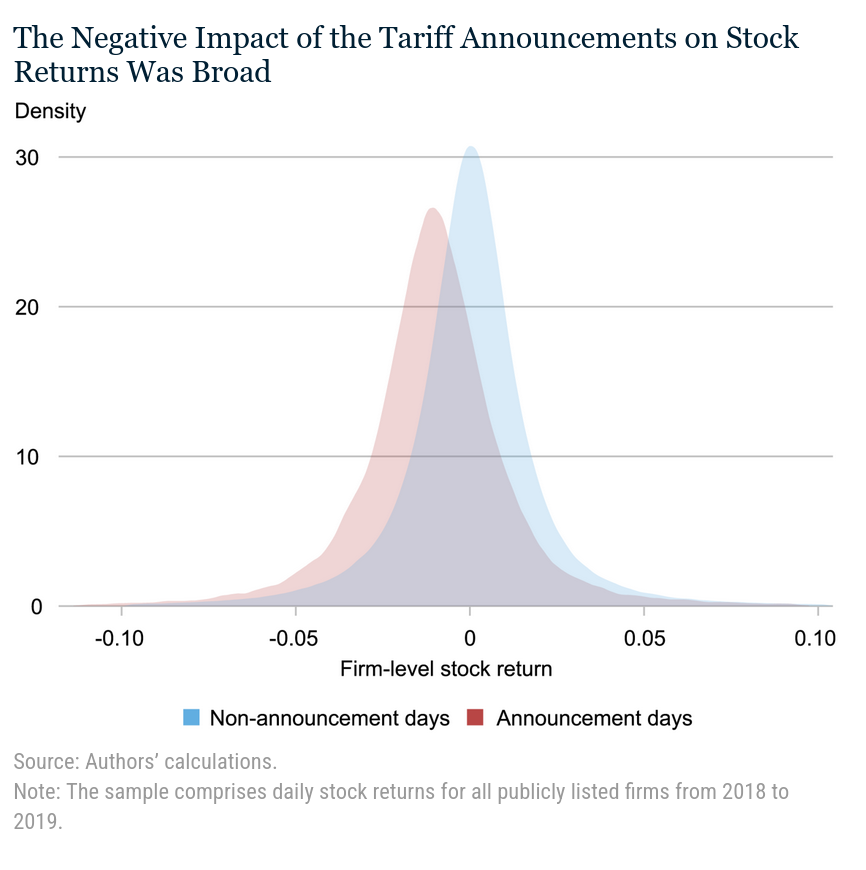

- tariffs will hit stock-market valuations of American firms

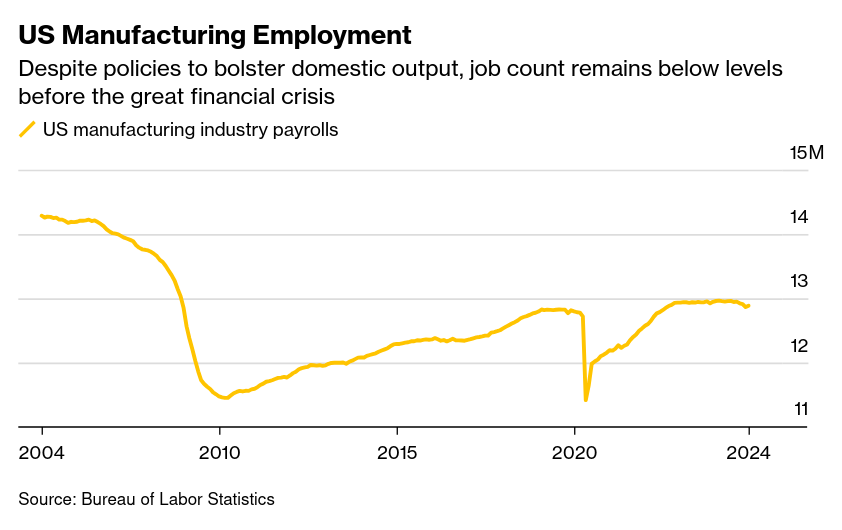

- the first Trump Administration's Buy America policies didn't increase manufacturing employment

- tariffs hurt total "welfare" (systemic growth) of the American economic system

- tariff announcement did not positively impacted American firms

- reducing independence of the Federal Reserve system will negatively impact inflation growth

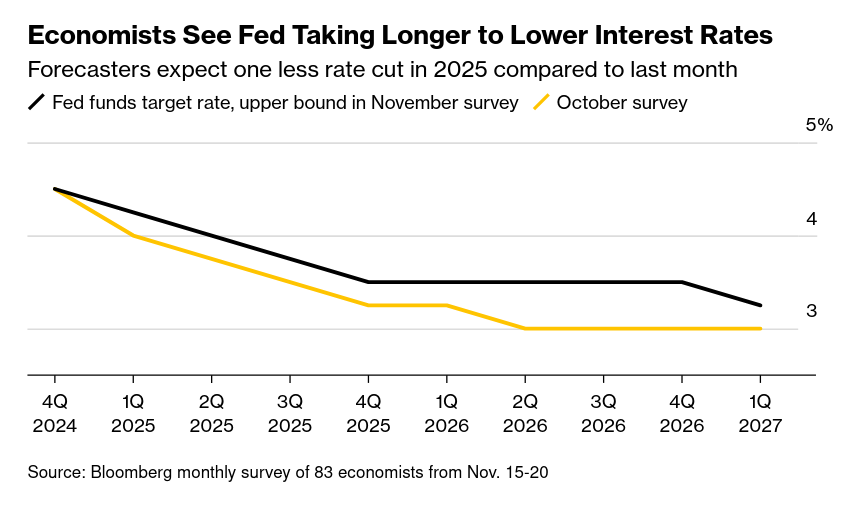

- inflation is stubborn and will likely stay high without economic policy changes, so changes will be even worse than imagined

Taking a peek at the impact of the first Trump Administration's trade policies:

The problem with these analyses are numerous, but the main one is that the USA stock market is on one of the largest increases in growth ever.

So, how can the economists from the institutions that are supposed to support capitalism be so out of step with the economists who work for capital?

The answer is investment, expected growth, and profits.

The negative impact on Americans is not the focus or the interest of American capital. All they care about is about profits.

Profits are about about wages, productivity, taxes and input costs.

Trump has vowed to decrease taxes, reduce regulation, and provide certain capital with increased profit subsidies from government. He has also said that the Administration will protect some industries through American military and economic power.

Financial investment is flowing into those firms that will benefit from these policies. That's why crypto currencies are high.

This does not mean that all these and other firms will invest in new production. Productive investments will be made in companies that produce things that will be profitable. But, we do not know who that will be yet.

Right now it is all about financial flows. This is the first step in denying other regions access to capital. It affects the US dollar which affects other currencies.

The point is that we have to wait to see where capital is actually going to invest net revenue.

The think tanks and financial research firms are plugging those investment numbers into their models trying to see who will benefit. The NEBR report mentioned above outlines one gamble, which is that firms who did not benefit from financial investment inflows during the days of talk about tariffs are not where you should invest. This is broad direction and not that helpful for investment decisions, but it shows where things are going to get specific.

The take-home is that we all have to wait and see where things go in the new year. But, the impact is going to be a lot of volatility and a likely large shift in allocation of money.

In the mean time, we need to think about how the rest of the countries on the planet respond.

Trade and Tariff responses

As we head into the end of the year (and before CPress Brief takes a break), we are going to re-post some articles that appear on news sites you probably missed and that we agree with.

Today's is by Stuart Trew

Stuart is a senior researcher at the Canadian Centre for Policy Alternatives, where he directs the centre’s Trade and Investment Research Project.

Since Nov. 6, when it became clear that Donald Trump had won the U.S. presidency for a second time, Canadians have been swamped by hot takes about what it could mean for us. The speculation has been near constant, to the point of feeding panic.

Will Trump raise tariffs on Canadian exports? Will we see hundreds of people fleeing north to avoid a crackdown on migrants in the U.S.? What will Trump say or do about Canadian defence spending, the digital services tax, or dairy supply management? Etc., etc.

Deputy Prime Minister Chrystia Freeland reassured us that “Canada will be absolutely fine.” Canada is more than a neighbour; we’re a “strategic partner” of the U.S., claimed Industry Minister François-Phillippe Champagne, who boasted that Trump’s people are responding to his texts, “So, this is good.”

“Canada is aligned with the U.S. already, and we’re going to be able to do good things together,” said Prime Minister Justin Trudeau.

Let’s be clear. In no universe will Canada – or anyone else – be “absolutely fine” after Trump is officially installed in January. Freeland doesn’t seem to believe this herself. If she did, she wouldn’t be throwing President Claudia Sheinbaum under the bus by claiming Mexico is not as enthusiastic as Canada about shutting Chinese investment out of North America.

Freeland’s comments, which parroted Ontario Premier Doug Ford’s electioneering call to remove Mexico from the renegotiated Canada-U.S.-Mexico Agreement (CUSMA), make Canada look panicked and defenceless, desperate for a “Great Work!” sticker from Trump.

We would be far better off adopting a position of strategic differentiation rather than knee-jerk alignment with Trump’s agenda. This is not what Canada’s business elite would like to see, but it’s the soundest long-term strategy for dealing with political instability in Washington.

Differentiation is a business term that feels right under the circumstances, what with one CEO in the White House and another, Elon Musk, tasked with downsizing government spending by trillions of dollars. It means capitalizing on the uniqueness of your product or brand against those of the competition.

For instance, in 2016, not long after renegotiating NAFTA – on Trump’s terms – the Trudeau government found itself competing for investment with the Biden administration’s trillion-dollar tax incentives for green infrastructure and manufacturing. Canada’s copycat strategy paid off in some ways for Canada’s important automotive sector, but at a significant cost to the government.

Now Trump is back with an economic plan that may compromise these positive investments in Canada’s electric vehicle supply chain. He wants to scrap EV incentives, cut corporate taxes, deregulate health and safety rules, and “drill, baby, drill.” Canada’s business lobbies are urging the Trudeau government to follow Trump’s lead.

But more than that, they want Trudeau to unilaterally disarm any policy that Trump may now, or at some future date, find irritating. These include Canada’s digital services tax on tax-dodging internet firms and Canada’s dairy supply management system.

While the threat of U.S. tax cuts and tariffs to Canadian jobs is real, Canada cannot possibly compete in another race to the bottom. What’s more, Trump is extremely unpopular in Canada. It would be hazardous for any government to be seen doing Trump’s bidding out of fear and panic.

What’s the solution? A policy of strategic differentiation would acknowledge Canada’s present economic dependency on the U.S. while taking gradual steps to lessen it and the threat of unilateral U.S. trade actions.

Such a policy would re-engage the world realistically in a way that acknowledges multipolarity and the rise of regional powers while committing far more resources to the financial and development needs of the Global South.

If Trump defunds green infrastructure projects and floods markets with cheap oil and gas, Canada should refine its sustainable jobs strategy to support domestic manufacturing, for example, with Buy Canadian preferences on public energy and transit projects.

Where Trump and Elon Musk hollow out health care and education, we expand both. This would lower the cost of living and create thousands of jobs while enticing companies to set up in Canada based on quality of life, not low taxes.

Canada needs to prepare, not panic, for Trump – but also for what comes after Trump. We can do that by charting an independent, forward-looking, internationalist alternative that can withstand any U.S. administration.