August 9, 2022

Inflation expectations and reality

For consumers, inflation growth expectations are down. Consumers are buying the story being fed to them by the Fed and the government, but they are also noticing the impact of this:

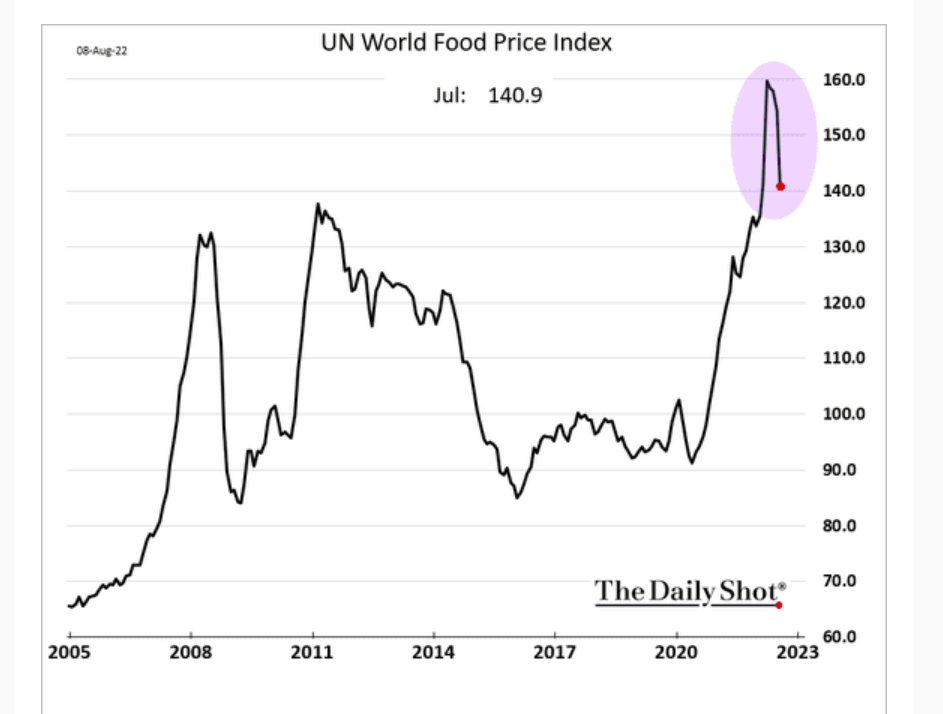

Food and fuel prices are not increasing as fast anymore.

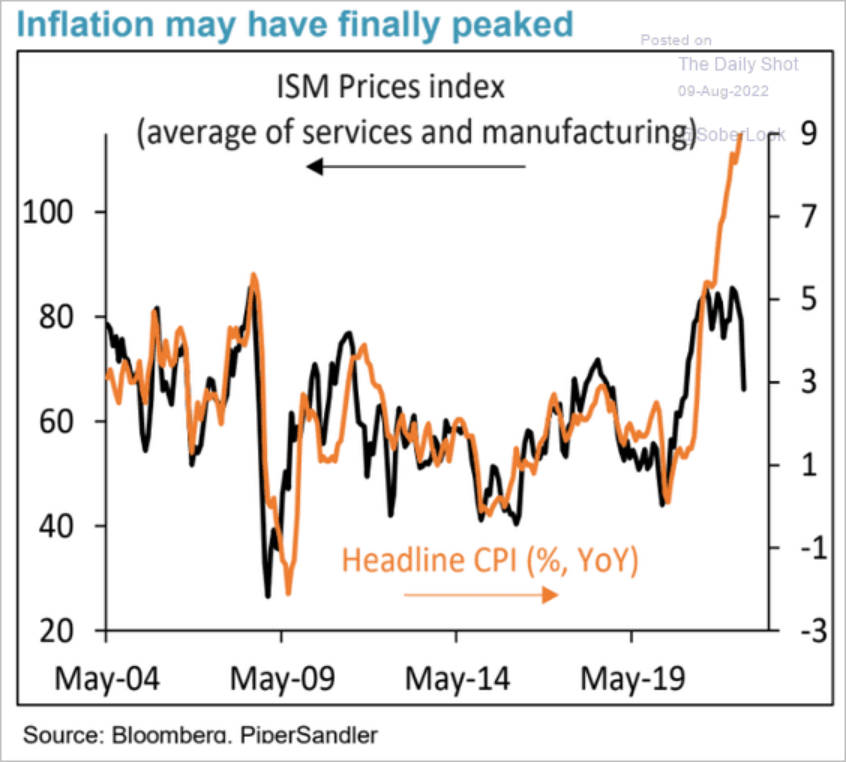

There is also some knock-on effects here as supply chains ease:

However, is this "inflation"? No, it isn't.

There are fluctuations in price pressures on goods sold in the USA. However, the question remains if this will bring inflation growth down (disinflation), or will the new spending bill subsidize capital profits in a way to keep it high?

Of course, the Federal Reserve barely cares, it is pushing the economy into recession anyway.

PSE and costs of living

- Alberta has cut student financial aid.

The province has hiked tuition fees, driven student loans increases, raided university transfers, and now made it difficult to access grants.

But as a result, students will receive less money per month than they did a year ago. Last year's monthly maximum was $375, but that was clipped by one third to $250 this coming school year. (CBC)

In Nova Scotia, Kaplan has arbitrated a settlement with the faculty union at Acadia that leaves the issue of final year wage increases open to cost of living allowances. The faculty were seeking inflationary increases while the university was complaining it has no money because it loves to spend too much on lavish technology and keeping its campus nice looking.

Kaplan agreed with a four-year term, in part to provide "some needed stability," and he set wages to increase by one per cent on Jan. 1 and July 1 of each year retroactive to July 1, 2021. Kaplan left the final year's increase subject to reopening given the uncertainty of inflation.

The bargaining situation in universities in Canada are not good. University budgets have been cut as conservatives hate an educated working population. The problem is that the tight labour market and idiotic short-term training decisions of right-wing policy makers means that we have a severe mismatch in skill and need in public services and front-line workers.

In Ontario, public sector skilled trades continue to lose ground with their private sector counterparts making it even harder to diversify those classifications. And, the private sector wage growth means female dominated work is increasing losing gains won over the previous two decades.

Undervaluing higher education is not a good economic strategy.

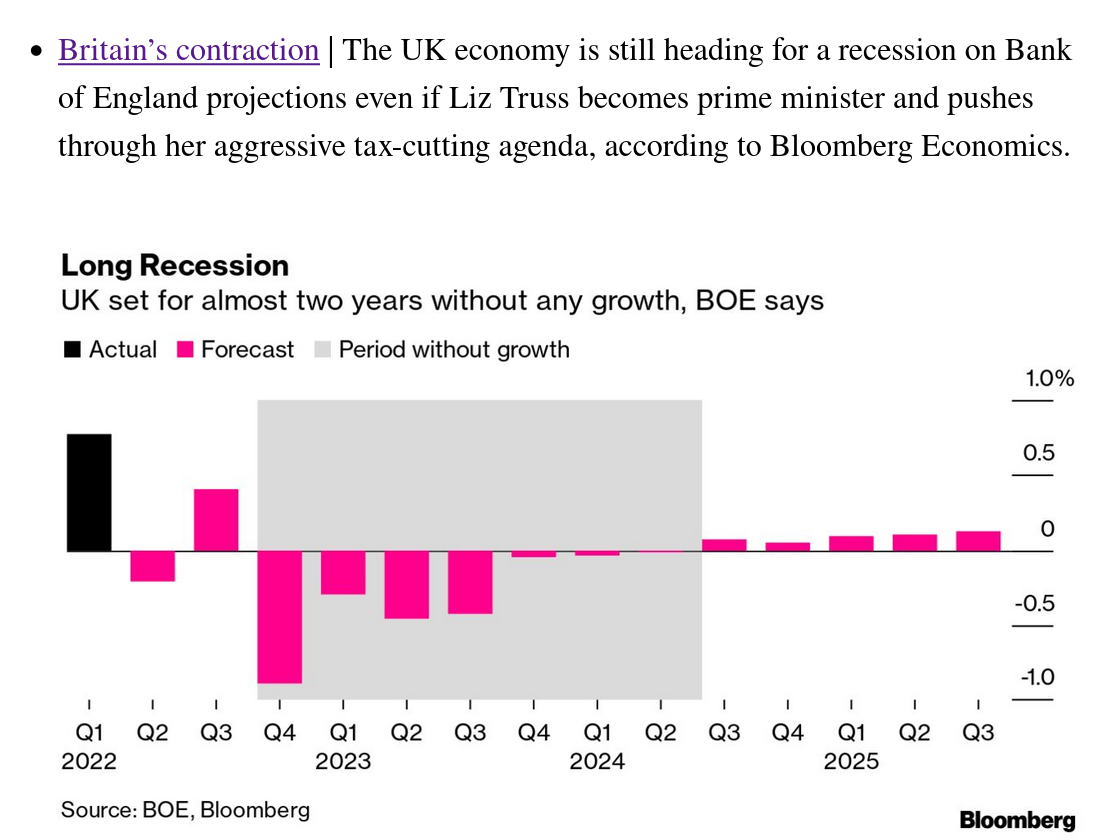

UK Economy under tax cuts

We are about to relive the 90s in more than just nostalgic music playlists.

In what has to be an inside joke:

Even if Truss becomes PM and cuts fiscal capacity of the state? They mean especially if that happens.

Tory leadership favorite has pledged £39 billion of tax cuts

Bloomberg Economics, using its SHOK model of the UK economy, estimates her plans would see GDP shrink by 1.3% between the end of 2022 and the end of 2023, slightly less than the 2.1% assumed by BOE’s Monetary Policy Committee. A package of direct support similar in scale to the £15 billion announced by Sunak in May when he chancellor would limit the damage to 1.1%.

In other words, they are both bad for the economy, but the farther right you go, the worse it is.

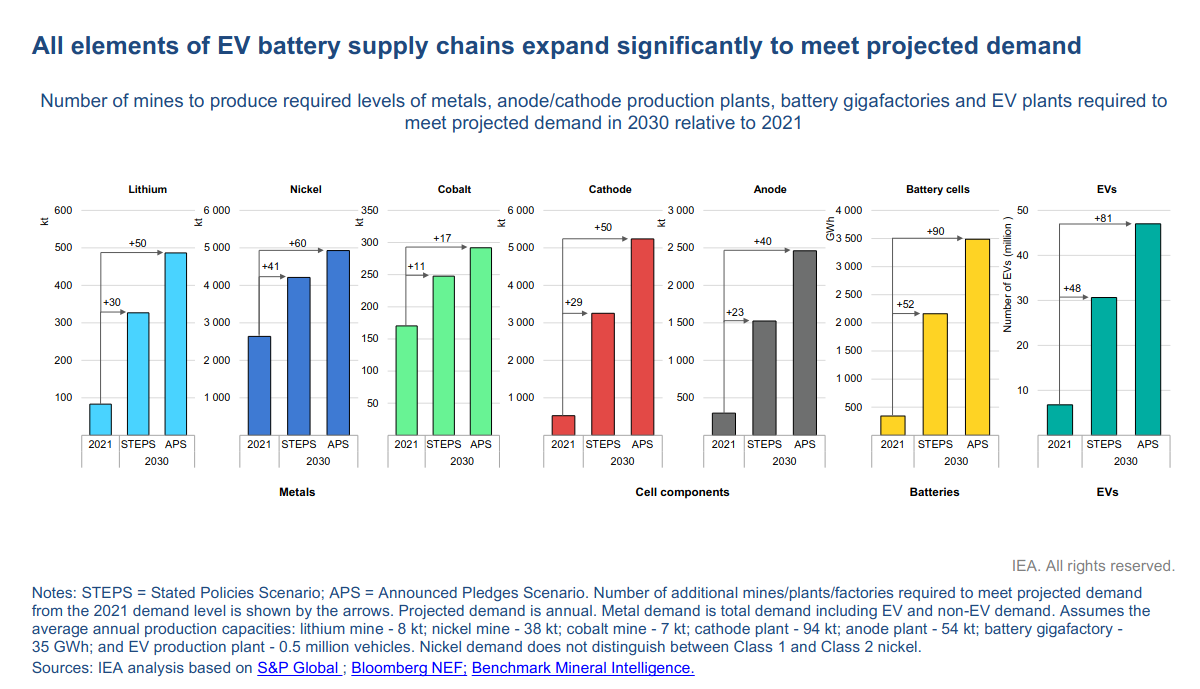

EV supply chains

The number of new mines by 2030 needed to meet EV goals:

- This report from the IEA.

No problem, right?

Mainstream economic sociopaths

Here is quality work by the St. Louis Fed. They found that if you stop giving people jobless benefits, some of them (about 1/3) will find some sort of work. A shocking conclusion, I know.

For the sociopathic tendencies of economists, look no farther than the "conclusion" section where they state boldly that when looking at poor people struggling we may miss all their positive impacts on capital profits at the macro level:

For example, if a person increases consumption upon losing emergency benefits and then taking a job (e.g., from spending on clothes, fuel and car maintenance for travelling to and from work), then this may drive up demand for goods in the rest of the economy. This may in turn stimulate employment in the state indirectly. This indirect positive effect would be missed in individual-level regressions and thus bias downward the macroeconomic jobs effect of halting UI benefits. One could envision negative spillovers on the other hand that would reverse the direction of the bias.

Indeed, one could imagine negative spillovers of pushing people off benefits. If one was not a sociopathic neoclassical economist.