August 28, 2023

Privatized Monopoly Consortia

Privatization backfires in many different ways, but one of the more obvious ways is the private sector's tendency towards oligopoly.

Contract negotiations for funding privatized school bus service between a consortium of employers including First Student the consortium of Ontario Catholic school boards has hit a wall.

I think that these contract negotiations are standard fare right now across the industry. The outsourcing of school bus service is all about downward pressure on costs (wages) for school bus drivers.

With inflation and other increases in prices for keeping buses on the road, costs have gone way up for employers like First Student. Their contracts are up and they want more money.

This particular disagreement is also a result of new Ministry funding formulas for school transport which has capped funding to the boards. The privatization of school bus operations was supposed to be the answer to continued cuts to public funding for this service, but that isn't looking very smart right now:

- https://efis.fma.csc.gov.on.ca/faab/Memos/SB2023/SB07_EN.pdf

- https://efis.fma.csc.gov.on.ca/faab/Memos/B2023/B06_EN.pdf

The state's funding increase was not inline with what the companies who operate the bus fleets were expecting or probably what the school boards need to provide the funding. So, bus operators' (we usually call them "companies") profits are being squeezed. If the companies fail to provide the service, the school boards are going to have to find resources elsewhere.

The threat of alternative tendering is concerning since that would result in a contract flipping situation for the unionized drivers, but also because it will mean the cost savings being sought by the school boards will come at the expense of wages.

The operators not running is a capital strike, not a worker strike.

The bus companies are betting that the services are not going to be brought back in-house. Which is a good bet because school boards do not have the capital to buy the busses in time for the school year and likely do not have time to figure it out if they did.

The companies were first successful with this tactic in Quebec.

However, I am not sure that monopolies like this can really last in the face of legislation. When the state decides that their plan of making companies compete for the lowest bidder is undone by the companies forming a monopoly, the government eventually just balks and legislate their way around it.

In a follow-up email, Murray said STEO offered the bus operators a net increase of 13 per cent for the upcoming school year over what was paid in 2022/23.

“STEO’s best offer, which would provide for an additional $19 million over the proposed four-year term was rejected by the school bus companies, twice,” Murray said. Article content

“The school bus companies made a counteroffer valued at an additional $40 million over a proposed five-year term, double STEO’s stated best offer, and vastly exceeding the available funding for student transportation.”

That's not even close.

What's the answer? Well, it is likely legislation by right-wing governments to this blackmail by capital for profit subsidies will end in workers losing-out.

So, the response needs to be for unionized drivers to make their voices heard. In the fight between profits or wages, we must make the costs be bourne by reducing profits.

Super bugs

Slow end of August news day and super bugs finally make it to the front page.

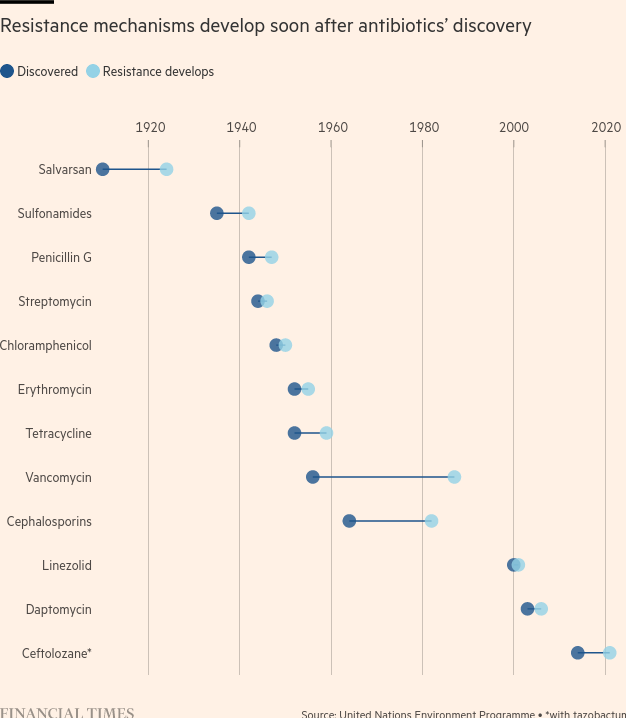

The problem is getting worse with time. In 2016, a UK review led by Lord Jim O’Neill, an economist and former Goldman Sachs banker, forecast the number of annual deaths from antimicrobial resistance would rise to 10mn by 2050 — approximately the number of people who currently die from cancer. But based on more recent data, he now believes that up to twice as many could die.

Private capital cannot save us from these pervasive microbes:

Investors have lost about $4bn on biotechs developing antibiotics, according to the impact investor the AMR Action Fund. The start-ups have either gone bankrupt, been sold off cheap, or pivoted to more lucrative areas. (FT)

The news today, of course, is focused on how AI might offer some cost savings on investment and therefore save us from this capital flight from the sector. However, AI-derived drugs apply to all other kind of treatments that make pharma companies more money—just like they do today. So, it is hardly a cure for this disease.

This kind of profit subsidy regime is also not going to cure things:

To create better incentives, attention is turning to changing how health systems buy antibiotics. This year, the UK has proposed expanding its novel subscription model, so drugmakers would receive up to £20mn a year for selling innovative antibiotics, no matter how many — or how few — are prescribed.

Patrick Holmes, global innovation policy lead at Pfizer, praised the UK for trying to value new antibiotics partly based on how they would affect resistance rates in the future. (FT)

The UK has also spent some millions on tracking the problem, which is a start to know how bad things will get.

In the USA, the subsidy is being debated and has already been reduced as Republicans try to cut funding support. That funding is still at $6B. Of course, even if they find some drugs they will not make their way to developing countries.

Capital is very happy to have the hand-out. But, the real research being done will only happen in directed public labs intent on production.

Resistance is from overuse of antibiotics and other drugs in large-scale livestock and food production. Capital-intensive, industrial farming—something referenced much these days—is essentially to blame.

Many of our issues stem from the Green Revolution in agriculture and finding solutions to this profit-drive food production that burns oil to create food is essential to survivability of the population. Unfortunately, it is not an easy fix as we now have decades of investment into a particular style of food production and distribution.

This historical constraint and the difficulty of moving away from it should sound familiar for those in sectors seeing the end of investment. Just Transition and the economics of shifting to new production processes must be expanded to include all aspects of industrial life that are unsustainable or we are going to be facing many different kinds of (related) crises all at the same time:

- climate change

- anti-microbial resistance

- food production collapse

- transportation gaps

- pandemics

- housing shortages

- production bottlenecks

- energy production shortages

- supply chain disruptions

This list goes on, but you get the picture. We have not even started to see the multitude of crises that could hit us all at once.

The way we finance and develop production, distribution, and final product access in the face of responding to these crises will set the stage for all policy debate in the coming years.

The socialist policy responses to these impending industrial development crises can be clearly stated. And, as I was reminded the other days, in many cases the rhetoric is being stated by the right when silence is coming from the left.

The left needs to be more confident in its historical analysis of the problems and solutions if we are going to prosper as a species. The alternatives seem bad.

The head of the UK study (and the FT article) into this ends with this quote:

antimicrobial resistance may cause a crisis that will make Covid-19 look like a “garden party”.

Fun times ahead.