August 22, 2022

Markets, inflation, and growth

- The central bankers are meeting this week at Jackson Hole.

- The markets are looking on to see if they announce if their bets are correct on rates, recession, and profits.

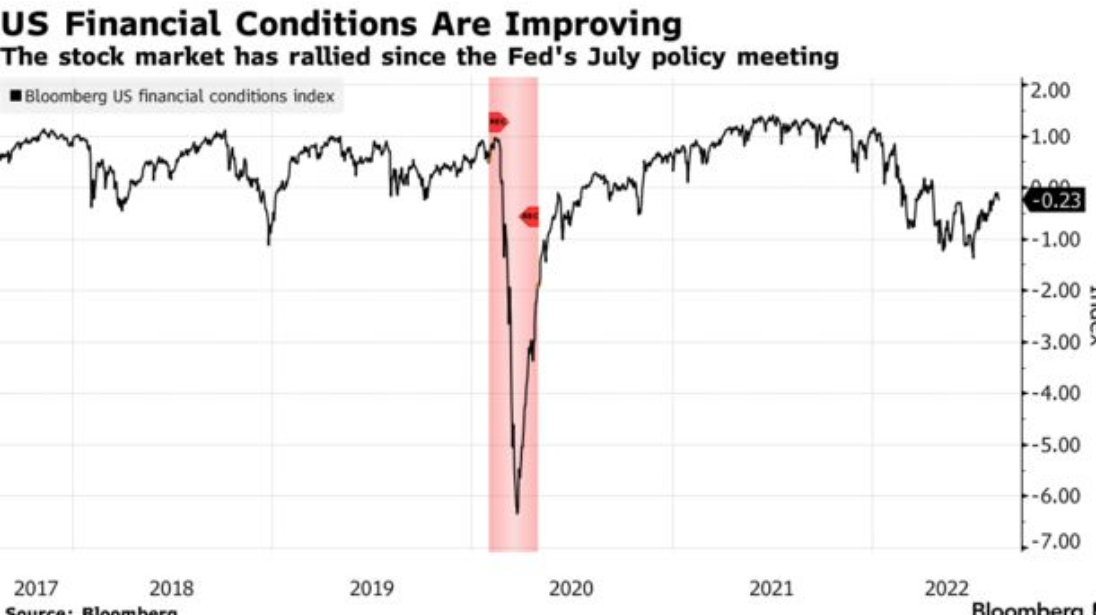

Most of the market seems to think that we are out of the worst of recession and inflation woes with some bounce in the equity markets from their lows.

It all seems a little optimistic:

- Some think inflation in the UK is going to hit 18%.

- Workers continue to strike for wage growth.

About 2,000 dockers at the Port of Felixstowe began an eight-day walkout on Sunday, halting the flow of goods through the UK’s largest gateway for containerized imports and exports.

Handling about a third of Britain’s total container volume and an even bigger share of direct trade with Asia, the east coast settlement of about 25,000 people is the economic equivalent of the neighboring US ports of Los Angeles and Long Beach or the European Union’s premier trade hub in Rotterdam. (BN)

- Countries continue to announce large target rate increases.

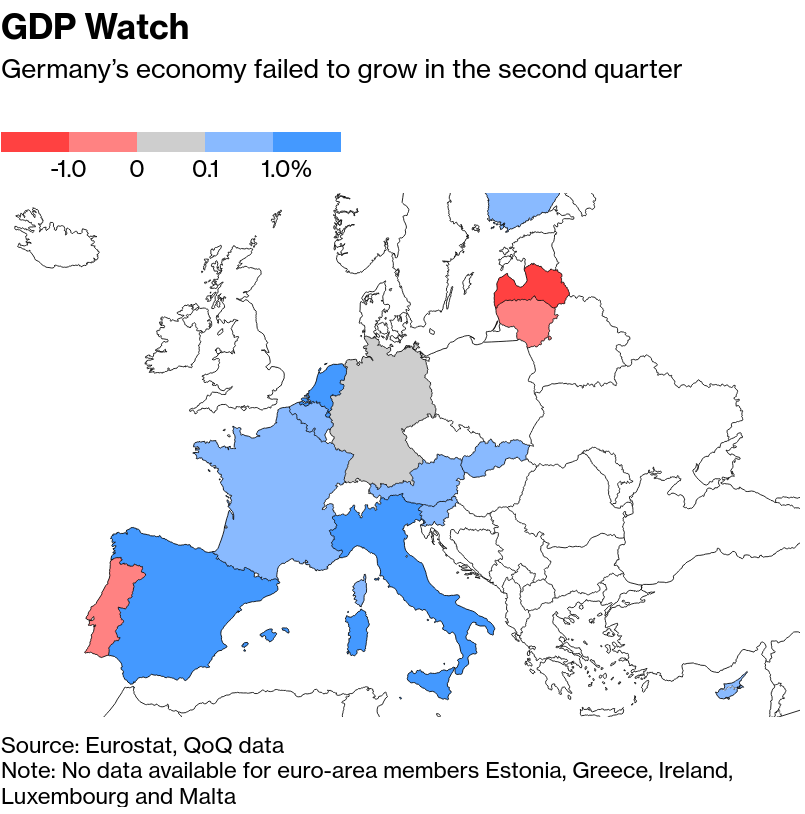

- GDP in Europe looks like a general recession is already here.

- Oil/gas prices do not look to be continuing their decline in price.

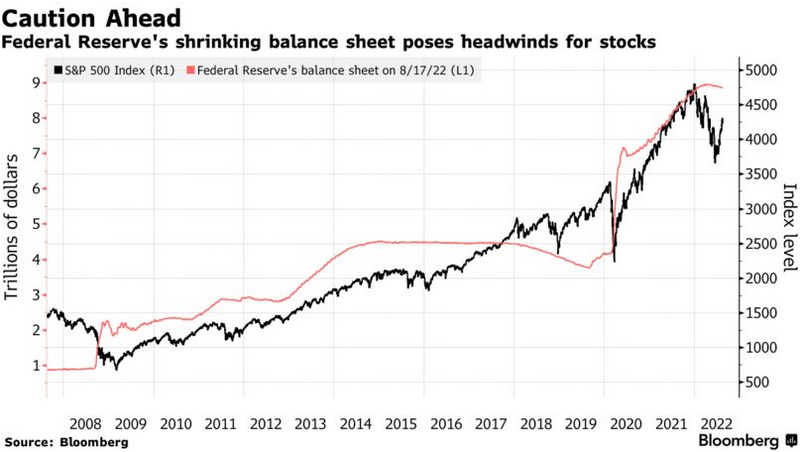

Also, all the free money from the central banks is drying-up, so markets are not exactly in free growth territory for the next little bit. Any little bump could bring them down again:

- In Canada, wages are not keeping pace with cost of living increases at all, which is not going to have a positive impact on the broader economy.

Good thing some (new) union leaders are pushing for higher wages in response—in direct opposition to central banks who want us all to be poorer.

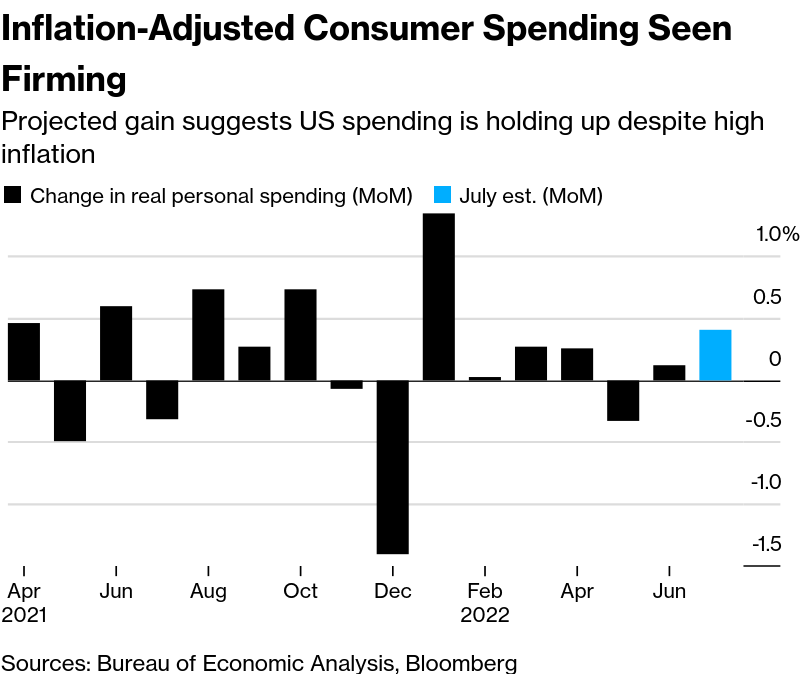

- Some have outlined that because consumer spending is holding pace in the US that things are looking decent.

- The problem is that this could be that people are buying now because they think prices will continue to rise. Meaning that is a bad indicator of much.

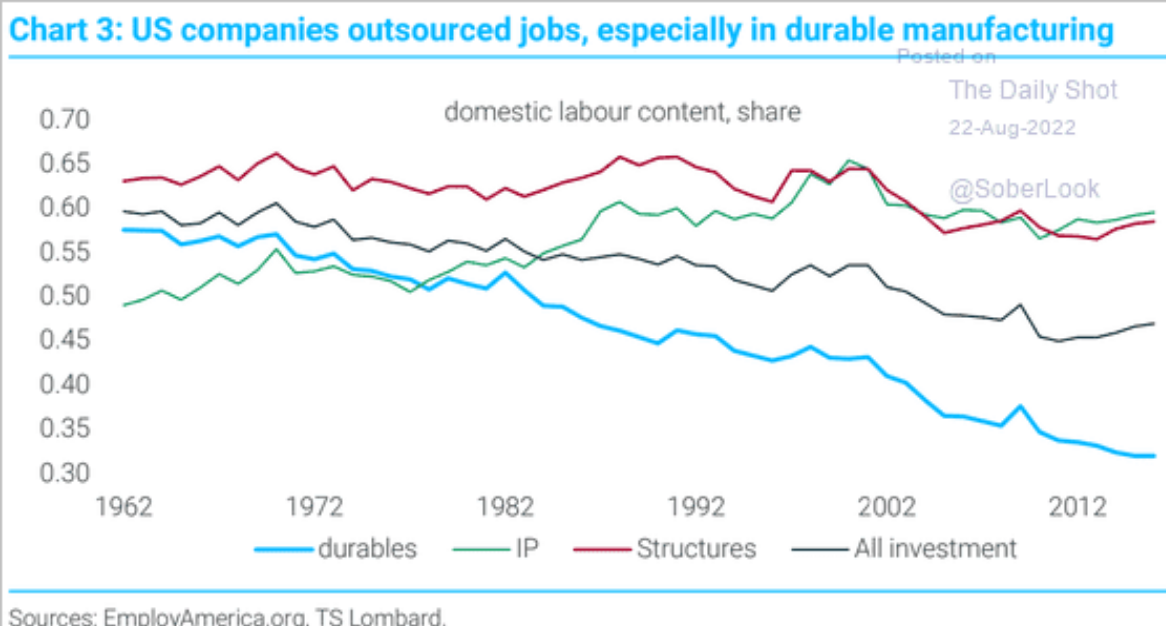

- Offshoring jobs is a major issue in the USA and it is the reason why the job numbers and wages are hard to interpret compared to previous decades when it comes to the economy:

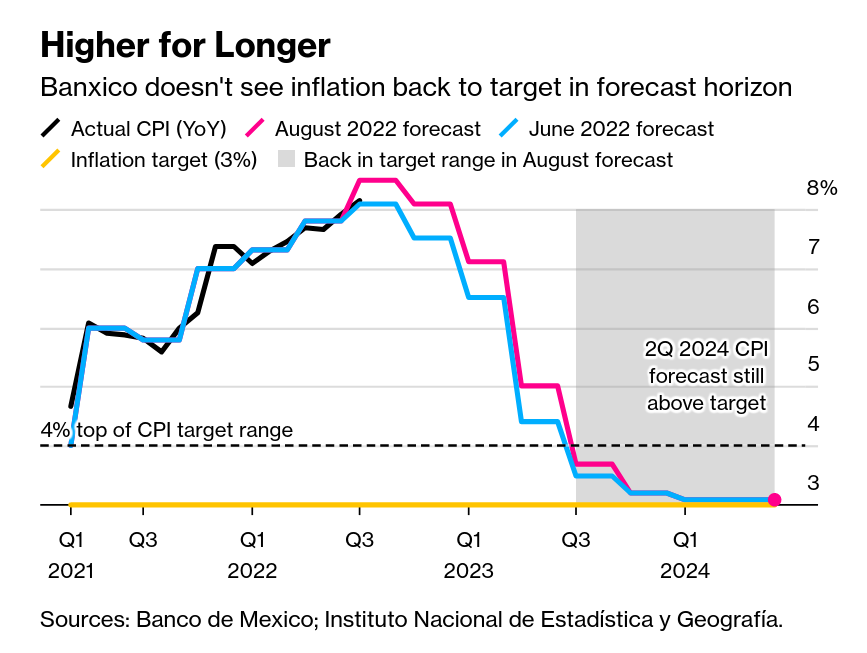

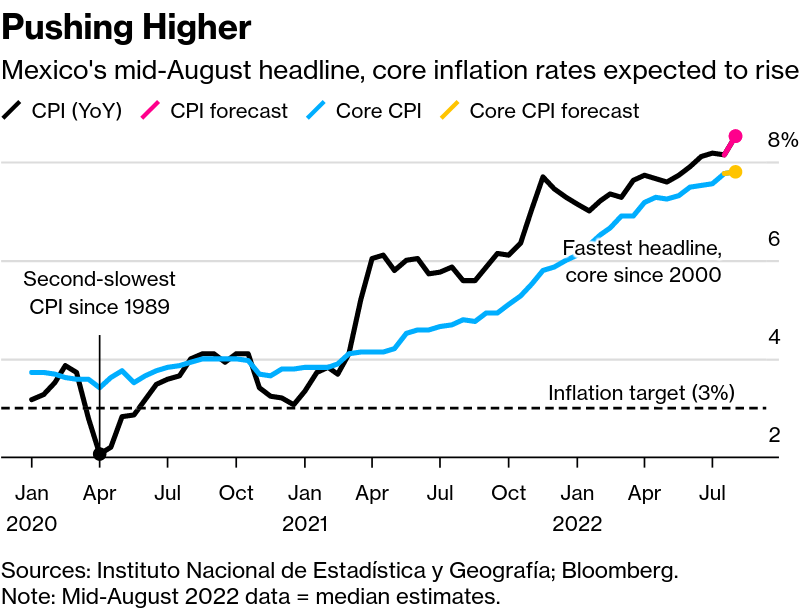

Mexico's central bank is looking at prolonged inflation and continues to shift its predictions up.

Cyber Security

- Pension funds, unions, and trusts need to be wary:

Norway’s oil fund warns cyber security is top concern

Hacking eclipses turbulent markets as Norges’ biggest worry with three ‘serious’ attempts a day (FT)

The fund, which reported its biggest half-year dollar loss last week after inflation and recession fears shook markets, suffers about 100,000 cyber attacks a year, of which it classifies more than 1,000 as serious, according to its top executives.