August 2, 2022

Have we reach the bottom yet?

The analysis is dubious. On both sides.

One side thinks that we have reached the bottom of the market slump and are buying because they believe that history shows a 30% growth in stock value if you buy at the bottom.

This assumes that the central banks:

- Affect the economy in subtle ways

- Can avoid a recession

- That inflation has something to do with employment rates

- That the economy is just raring to go if only someone would let it.

It also kind of assumes that stock valuations were correct before the collapse and are not correct now.

The other side thinks that this moment has not come yet as the Federal Reserve has opted for recession to tame inflation (what they call "returning to prices stability").

Looking at the data, it seems to me that:

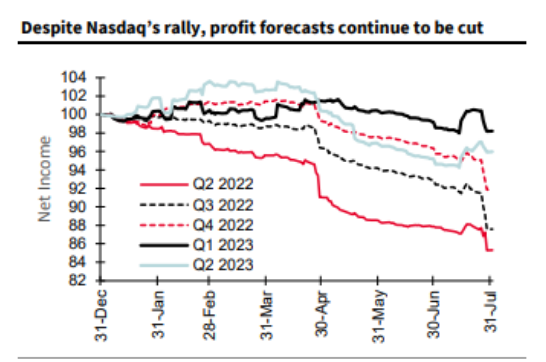

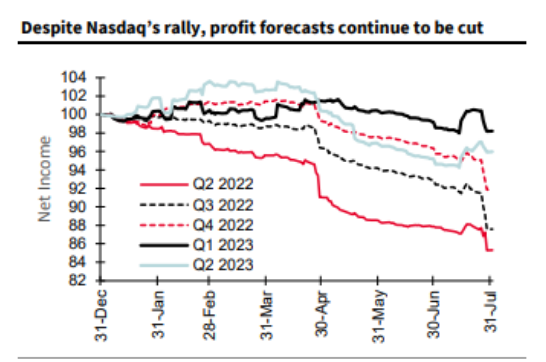

- companies are not investing

- companies are in a situation of low profitability

- price growth in some major sections of the economy will continue

- there will not be an even return to profitability across the market

- emerging economies will take longer to recover

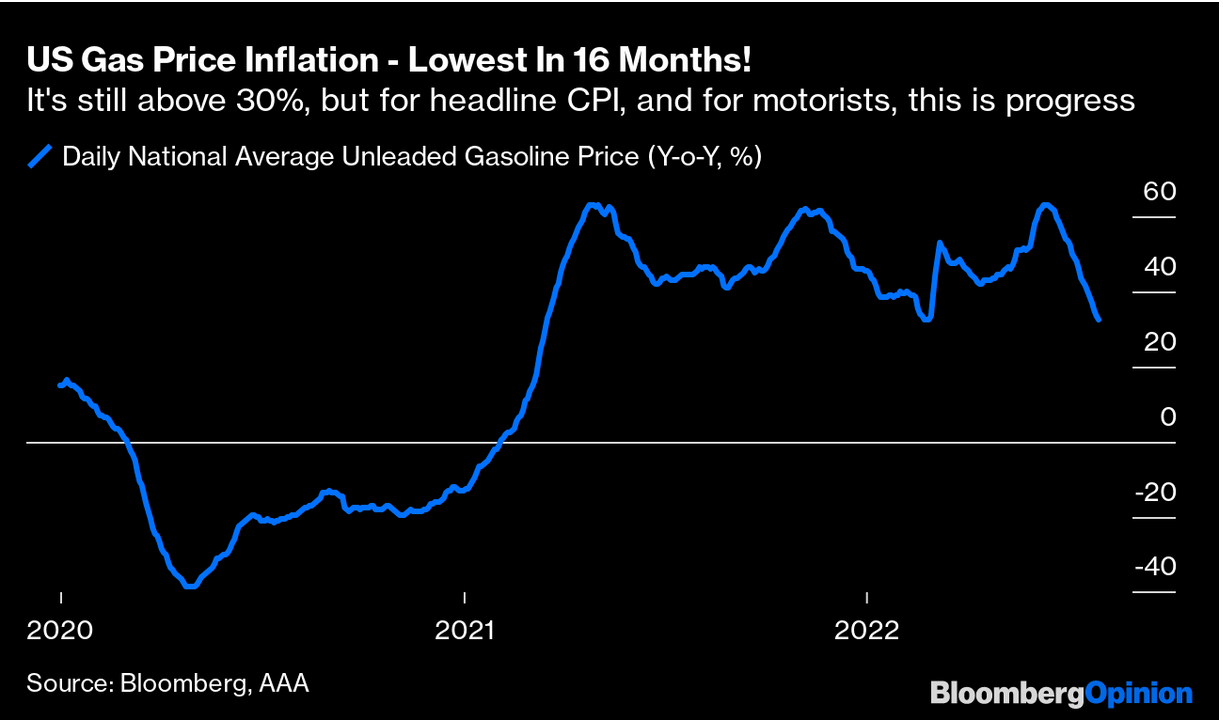

Add the fact that the bump right now is simply due to pre-election political fidgeting around gas prices and supply chain disruptions easing slightly. So, we have a situation of uncertainty.

Both of these analyses are wrong for the same reason. They rely on the faith in the Federal Reserve to restore their profits easily and quickly. A faith very much misplaced.

Two graphs from a John Authers' column:

With declining profitability caused by increased borrowing rates and slowing economic activity, there is little reason for companies to invest in growth.

What does this mean? Investing based on large cycles in the market is a fool's game unless you are an institutional investor and can balance-out the risk. Even then, the past does not predict the future unless you are measuring the correct things and it is pretty clear that no one is measuring the correct things.

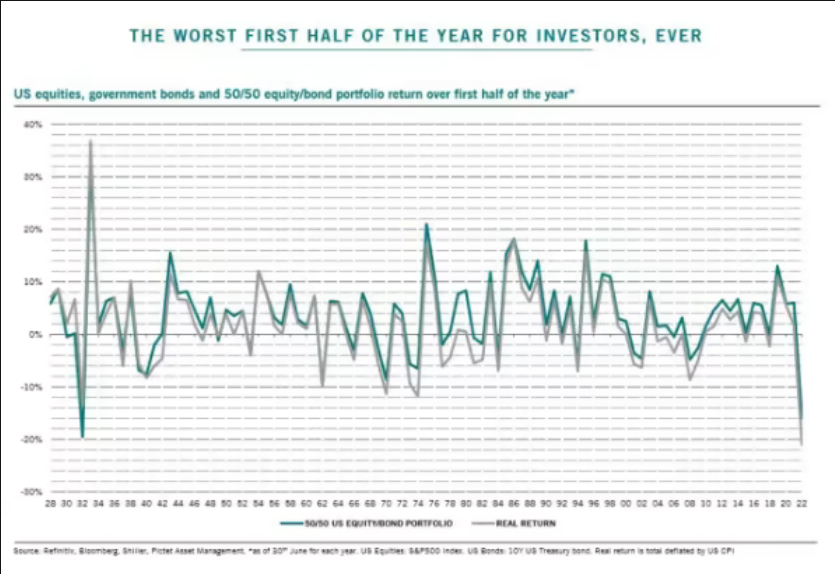

To be fair, the reason that people really believe we have reached the "bottom" is probably just to do with this:

It has never been this bad for investors. To me, it seems a little obvious that this was for a very good reason: the magic money printing machine failed and valuations have collapsed as the fake money on the fictious capital markets evaporated.

Which is to say, reality has reasserted itself. How long for, will be up to the political forces and the investments that come out of energy profits.

Democrats love risking war

Pelosi is visiting Taiwan. This is an odd time to do such a thing, but it is likely a political move designed to distract the US electorate from their slide into recession.

Why fight one war when you can have multiple proxy wars against the supposed enemies of freedom and democracy. This is especially the case during USA elections.

Of course, remember the "supply chains are easing a little" statement above? Well, Taiwan Strait is where all that might be put at risk.

Energy profits

Your pension plan may not be benefiting from the oil profits, but your government sure is:

BP says hard to cut fuel prices for motorists despite surging profits Oil major says UK government must decide how to use revenues from its windfall tax (FT)

That's right, the BP company is reminding UK voters that their government "taxed" their profits—which somehow drove-up prices for motorists. It is all nonsense, of course. Profits are a percentage of revenues for these oil companies the same as taxes and revenues are being driven by an petrol price increase across the market.

Either way,

BP’s underlying profits surged to $8.5bn in the second quarter, exceeding analysts’ estimates of $6.8bn and more than tripling the $2.8bn that the group made in the same period a year earlier. Shares in BP climbed 3 per cent in early afternoon trading. (FT)

Energy bills continue to gain ground and will continue up wards into winter as shortages—for a variety of reasons from war to lack of refining/production—will persist.