August 17, 2022

CPI

- Canada's CPI continued to rise—albeit slower than last month—at 7.6%.

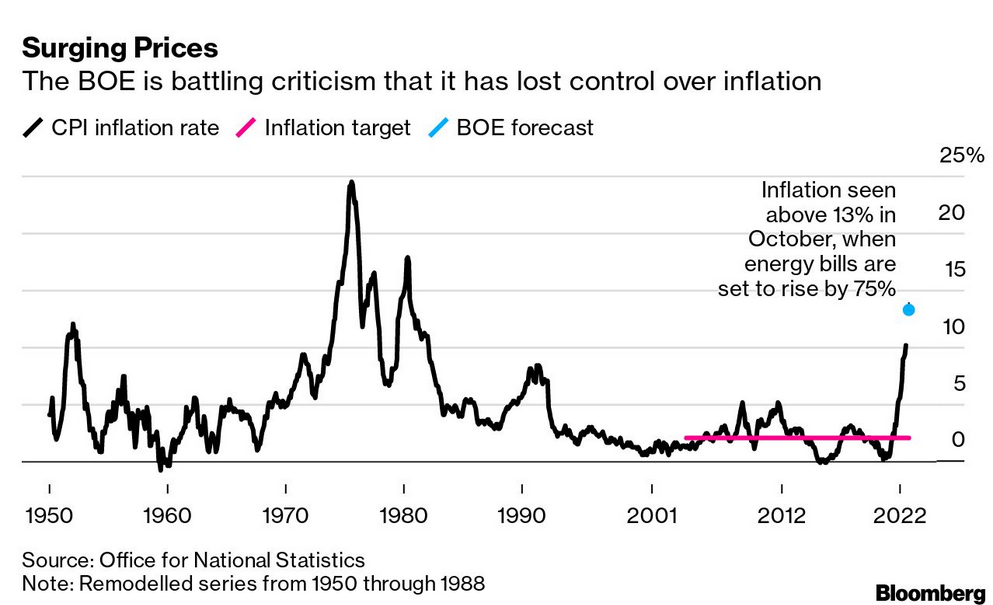

- UK's CPI was 10.1% (highest since 1982)

The response continues to be to blame workers' wages (even though their wages are not growing) and the central banks for not pushing the economy into recession fast enough.

Andrew Sentance, a former BOE official, said the benchmark rate may need to rise to 3% or 4% because policy makers have “fallen behind the curve.”

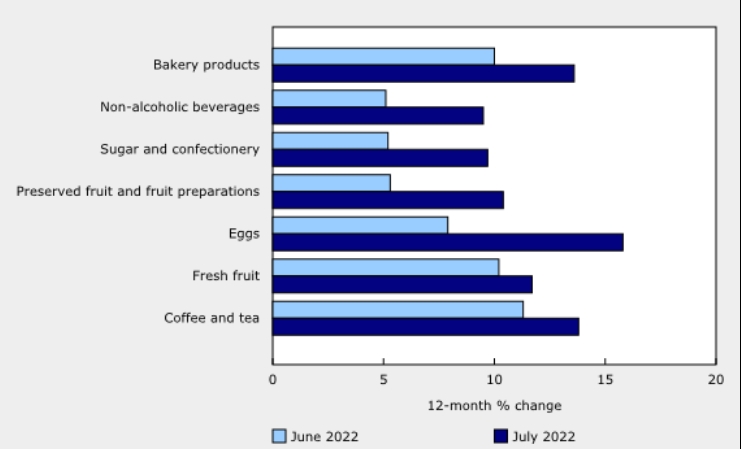

And, it is clear that the poor are suffering the impacts of high prices on these goods the most:

The poorest 10% suffered an inflation rate of 8.7% in the year to June. That’s well above the 7.8% felt by the richest 10th of households. The gap between the two is the widest since 2010.

The issue is that the main drivers of prices are food, oil prices, continued supply chain bottlenecks on basic goods.

None of these numbers should be shocking to people. Inflation is supposed to reach 13% in the Fall in the UK, just based on general prices seen through the production process.

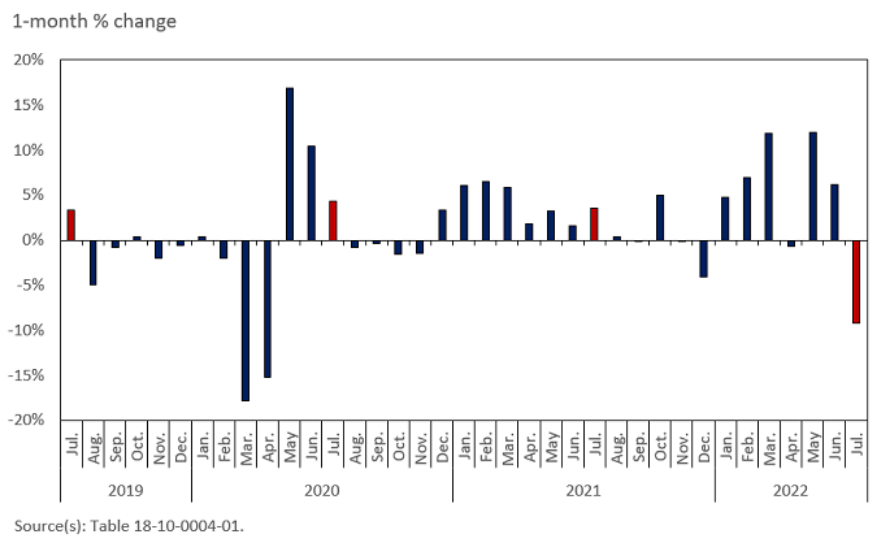

Canada's inflation growth slowed month over month because of the slow-down in gas price growth. Gas prices in Ontario actually declined 12.2% because the government reduced the gas tax.

So, the adjustment in CPI, like the adjustment in the USA recently, is a fake-out. Taxes are not inflation-causing and reducing them on a single good does not change inflation.

- Largest monthly decline in gas prices since the beginning of the pandemic (StatCan)

- Here is the real cost of living experienced by people. Still going up:

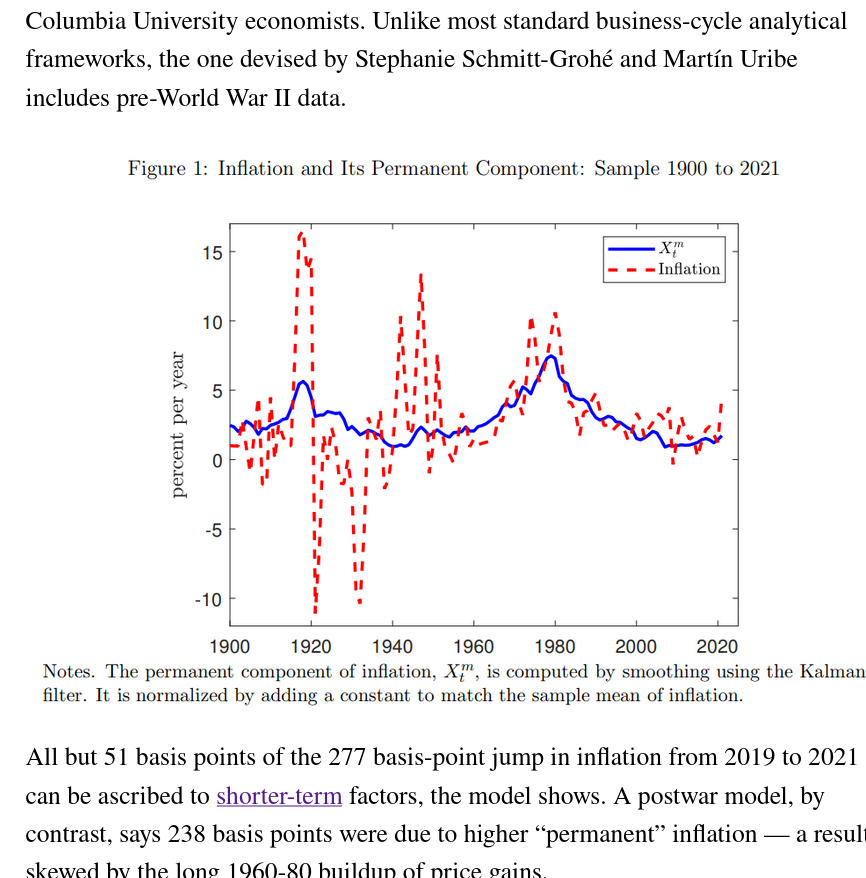

In the "we still call it inflation even though it clearly isn't" category of economic, a new paper looks at "temporary and permanent" inflation measures. It finds that real inflation (read: permanent changes in value of money/prices) follows but is not equal to the change in prices of select goods (read: temporary changes in prices).

They have it backwards. Inflation is actually the blue line and the red line is general price variability. You can see that they are not always the same.

This is not shocking if you look at price changes as different from "inflation" as we do. Prices are affected by supply and demand whereas inflation is affected by the ability to buy things with the money in your pocket without really considering availability. These two forces interact with each other, but they are not caused by the same thing.

As such, the policy solutions must be geared differently.

Shifts in production, distribution, and demand have affected prices of food and oil/energy. The ability to buy these things has been affected by other things (namely 50 years of profit subsidies, money printing, and the economic response to the pandemic).

Of course, capital is not going to tell workers that.