April 9, 2024

Making profit from high rates

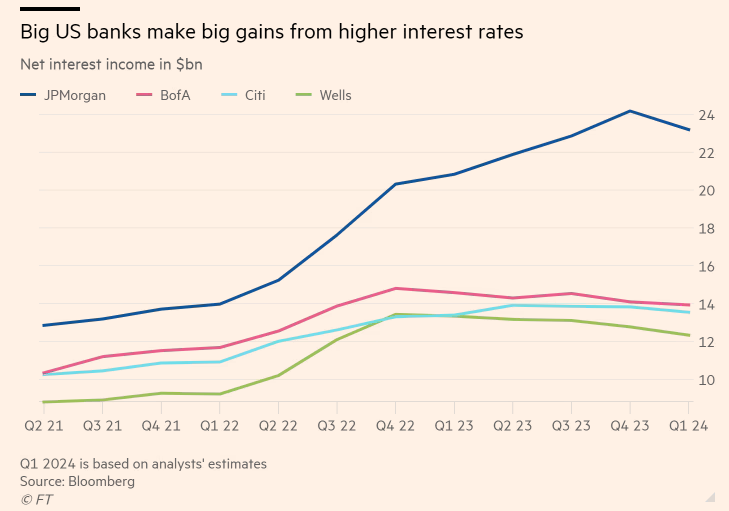

It will not shock anyone that the large banks are making out like the bandits they are from the "higher for longer" interest rates.

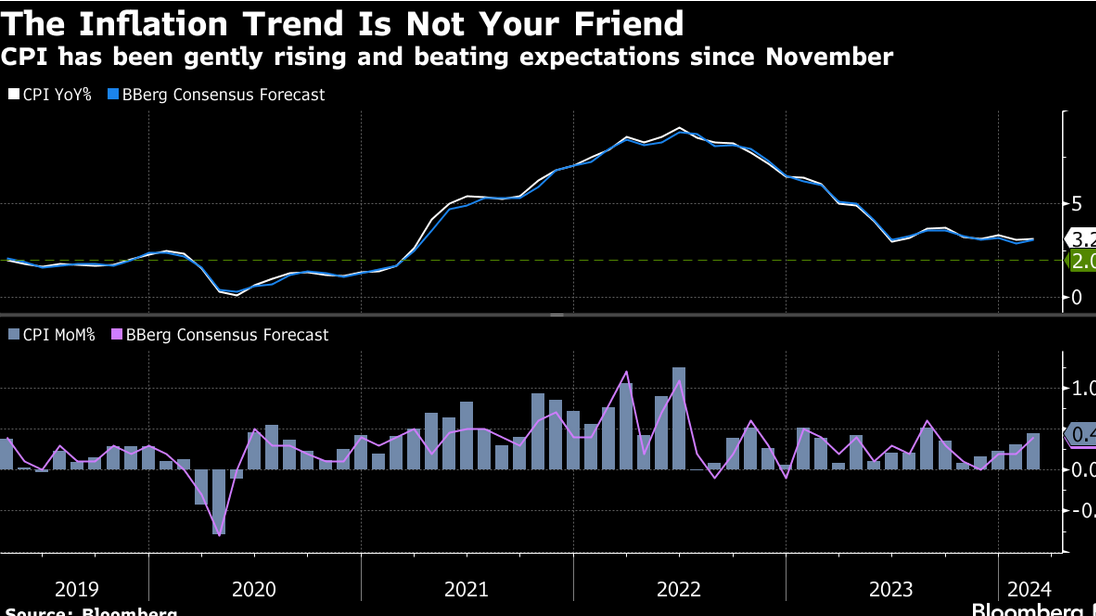

Inflation does not seem to coming down and the economy seems to be doing "fine" under the neoclassical measures of growth (that ignore reality discussed yesterday).

The banks did this through increasing interest rates on loans, but not on deposits.

Private credit has also been actively lending to firms who are attempting to refinance hoping for a delay in paying until rates come down. This is also acting to increase risk of firms going bankrupt in the "higher for longer" situation created by central banks.

That's profit (in the short term) in the private credit market and profit in the public banking markets.

This is not profit made through value production, this is simple wealth transfer from the workers to capital. A very old version of class war.

USA banks will release their numbers this week on profits they expect to make through these ill gotten gains. We currently have little in the way of policy that addresses this kind of behaviour of the private banking system. Indeed, we tend to celebrate it.

These firms are also going to be making out from the investment side of things as they hold most of the growth in the public markets as well.

One might ask, what good is a bank if it lends for predatory means and does not use those proceeds to support investment in production? One might ask the central bankers this question as well, given that it is their policy framework that is making this possible.

The "higher for longer" policy based on the fact that the economy is doing just fine in the USA should not apply to Canada's system. It is likely that the federal government is not going to be providing a lifeline for workers or the firms that employ them. This means that the only thing left in the neoclassical bag is cheaper lending rates to support economic activity.

Such a policy shift would mean breaking with the USA central banks. If this does not happen, Canada's bankers and their politicians are actively undermining the investment environment in the country.

The classical view is rather different, of course. The state should be using this opportunity of high private lending rates and relatively lower public lending rates to expand public investment (and ownership) over productive ends of the economy. Such a move is necessary to deal with the current crisis in an equitable way for workers and their communities.

Food inflation

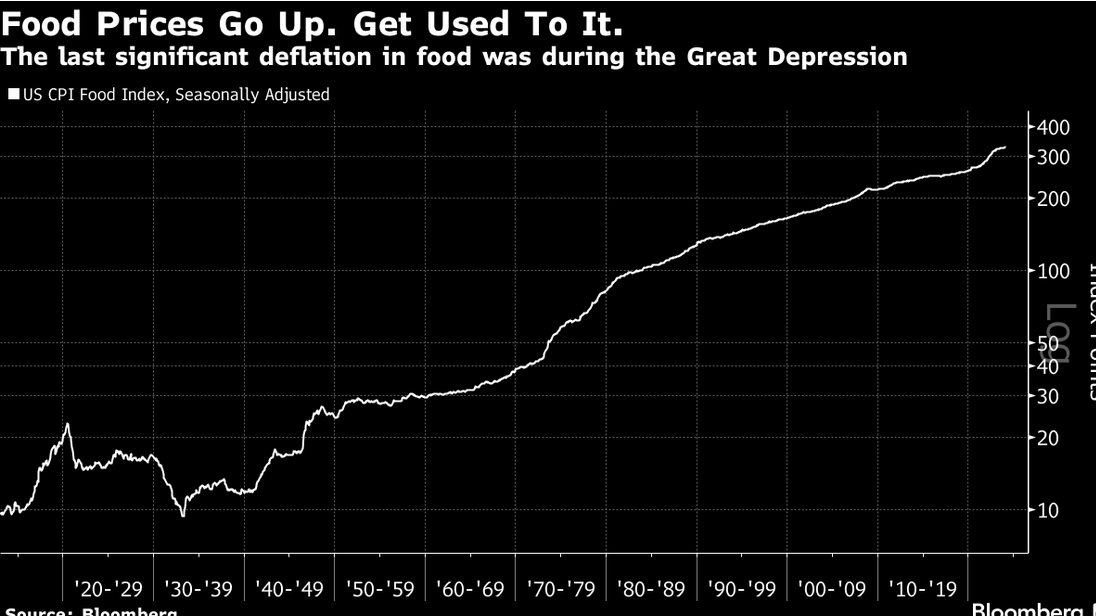

Food inflation is one of those things that is discussed constantly. While food CPI has come down across the planet, it is important to continue to say there is no deflation when it comes to food prices:

This means prices are high, getting higher, and will still high.

Economists think that there is nothing we can do about this. Essentially, we have maxed-out the "borrow money, slash land, burn oil, get food" approach of the Green Revolution.

With climate change, this is going to continue to get much worse. The solution to this is only possible through a planned and executed approach. When people push back on this idea, we must remind them that the Green Revolution was itself a planned and globally coordinated approach to mechanize and globalize food production.

Food production is simply too important to continue this reality-untethered faith the private market will solve.