April 8, 2024

Jobs data in Canada

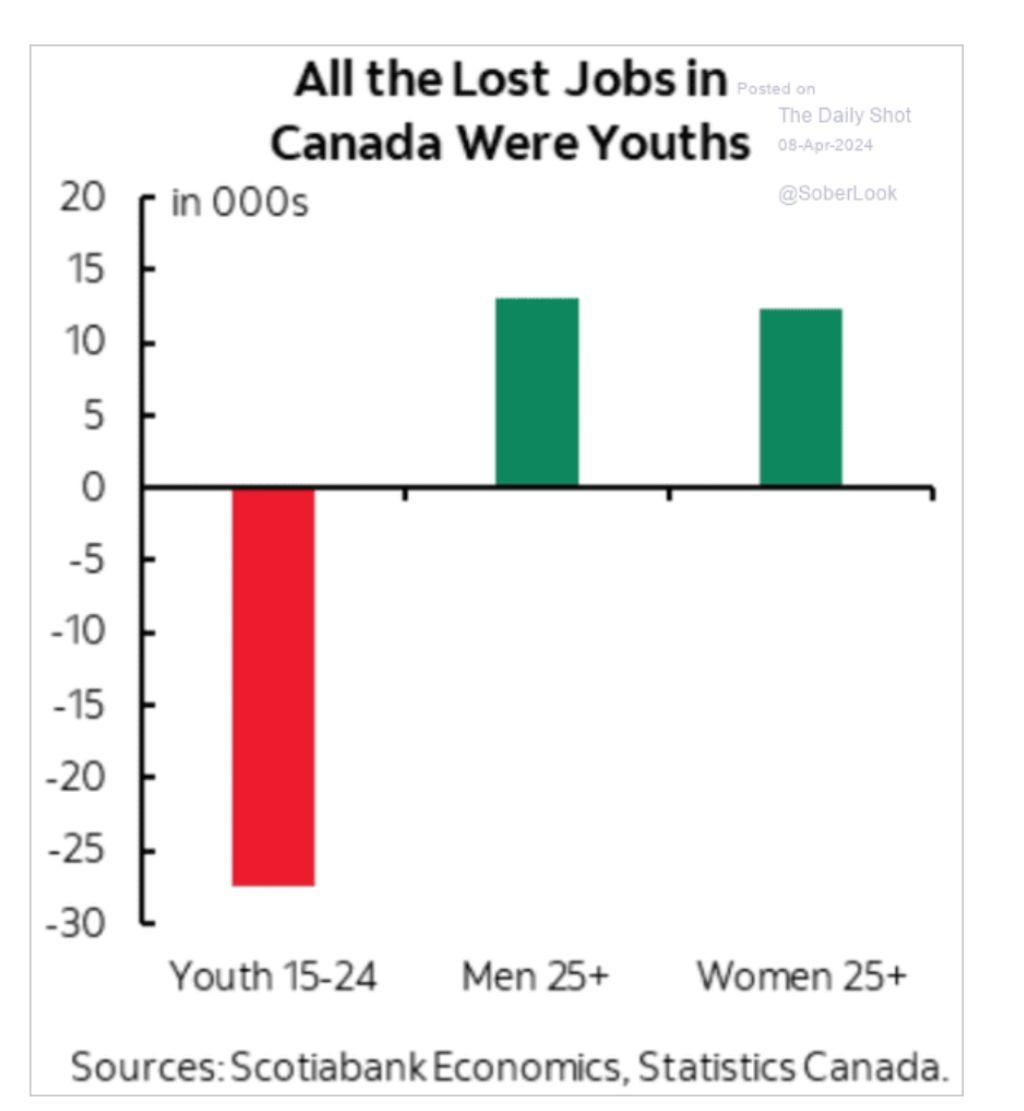

Employment fluctuations are mostly being felt by younger workers as firms lay off newer workers.

While the unemployment rose slightly and the participation rate remains steady, the increased population growth that the country is experiencing means that the economy is not growing along with that population. However, we seem to be just returning to the pre-2019 situation of higher levels of unemployment of 6% and above.

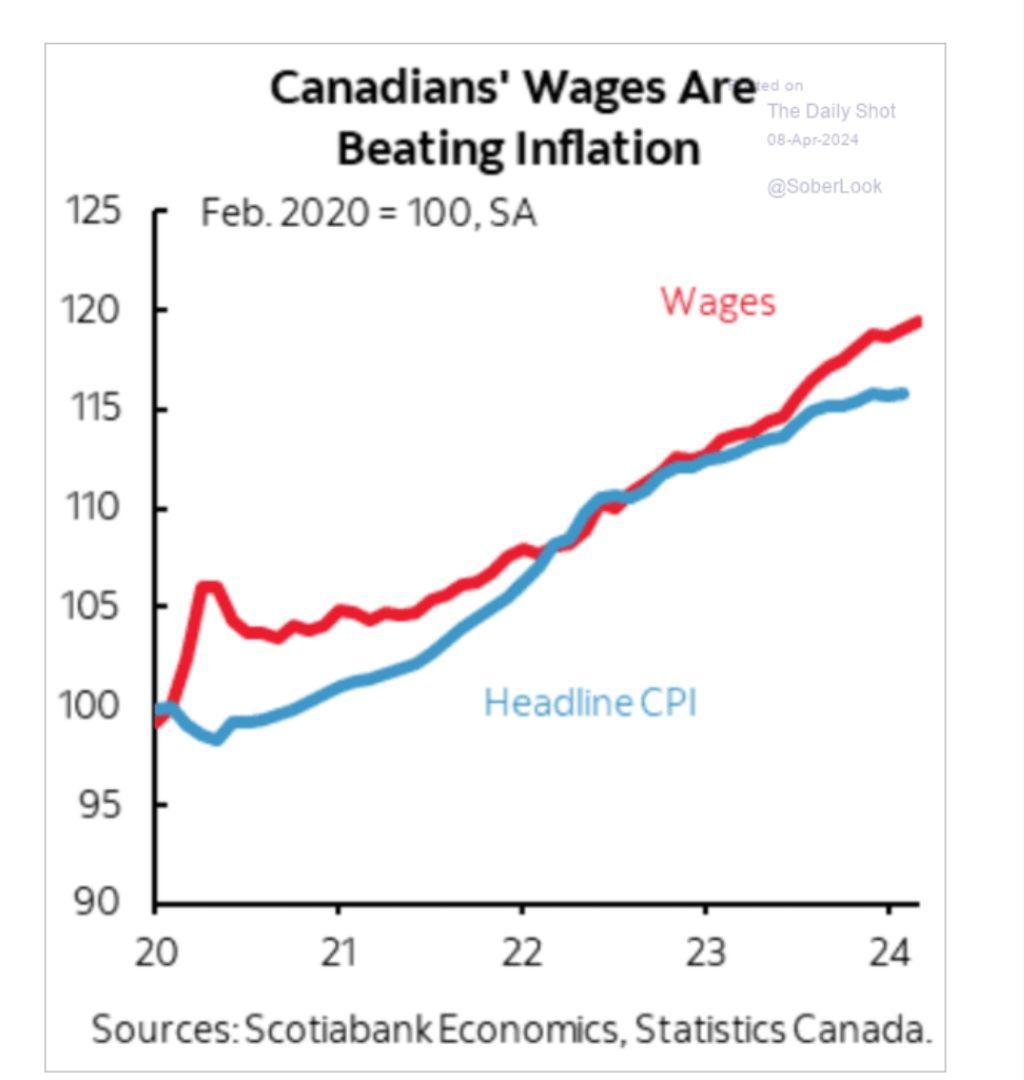

As expected when you remove the lower-waged newer and younger workers from the workforce (because of where the jobs were shed), wages "grew". This wage growth is still higher than inflation. Wage growth is about 5% and continues to outpace price growth since mid-2022.

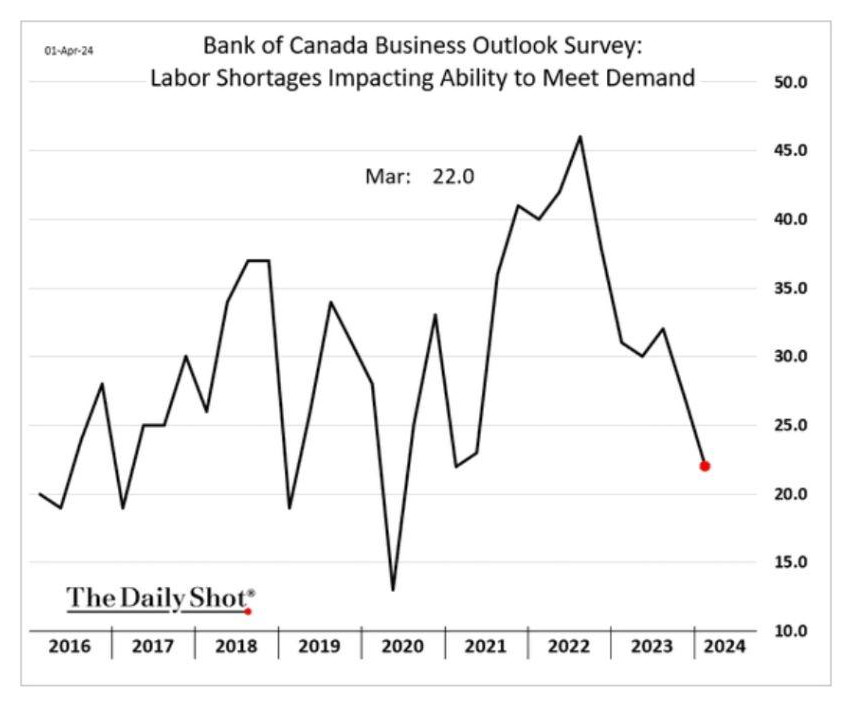

Though, that tight labour market is being dismantled by lackluster economic growth.

So, while wage growth continues to be sustained above inflation, it is unlikely to stay there without some continued push by unions.

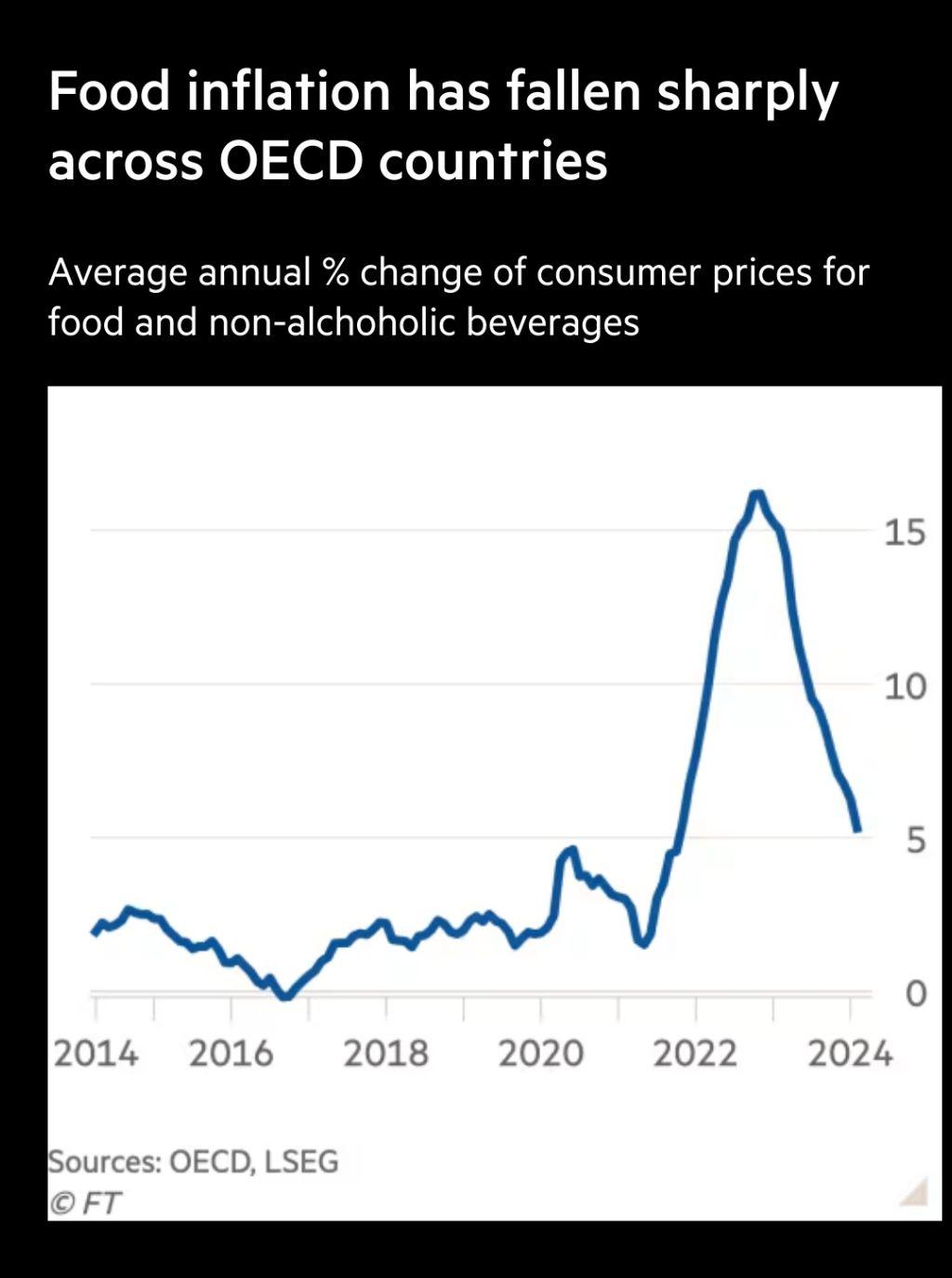

Headline CPI growth has remained near a steady rate because annual food price inflation has come down to growing to just above 5% globally.

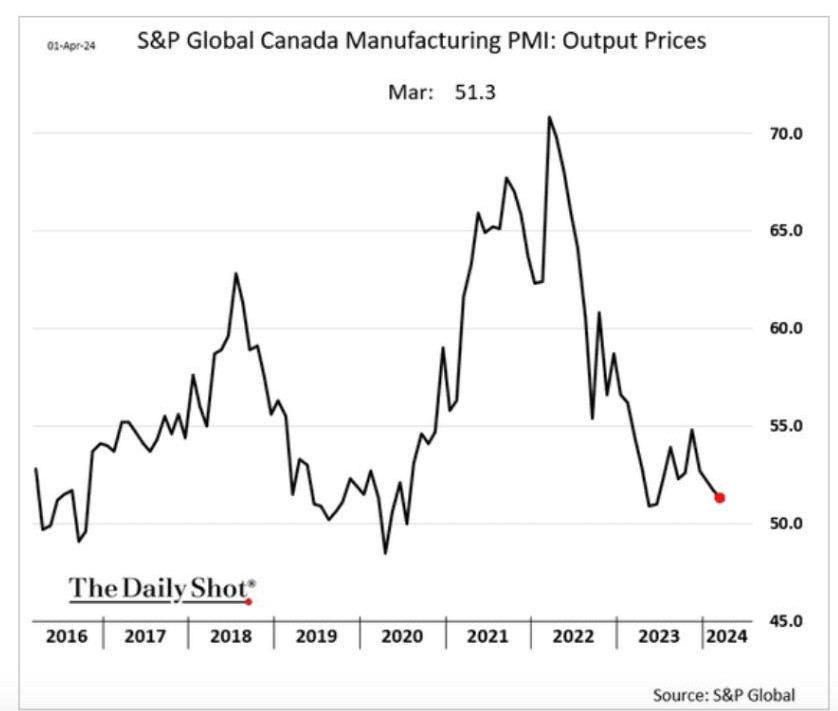

The Purchase Managers Index shows some declining price pressures and some increase in "economic activity" at their level. This means that those surveyed are showing some positive demand by companies. This is a somewhat sustained growth since mid-2023.

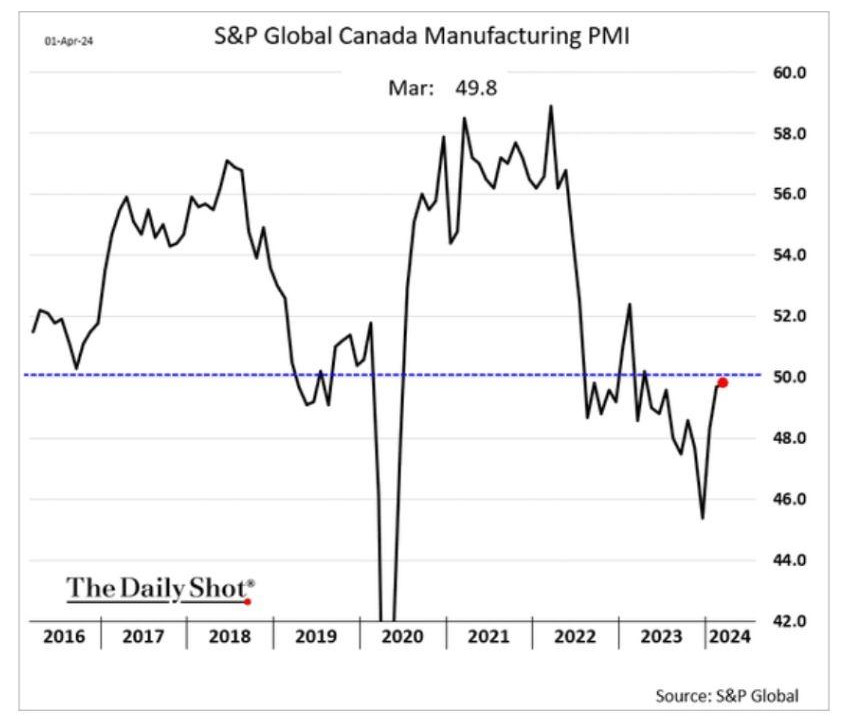

However, this has to be balanced against the same PMI data for manufacturing showing no growth in output.

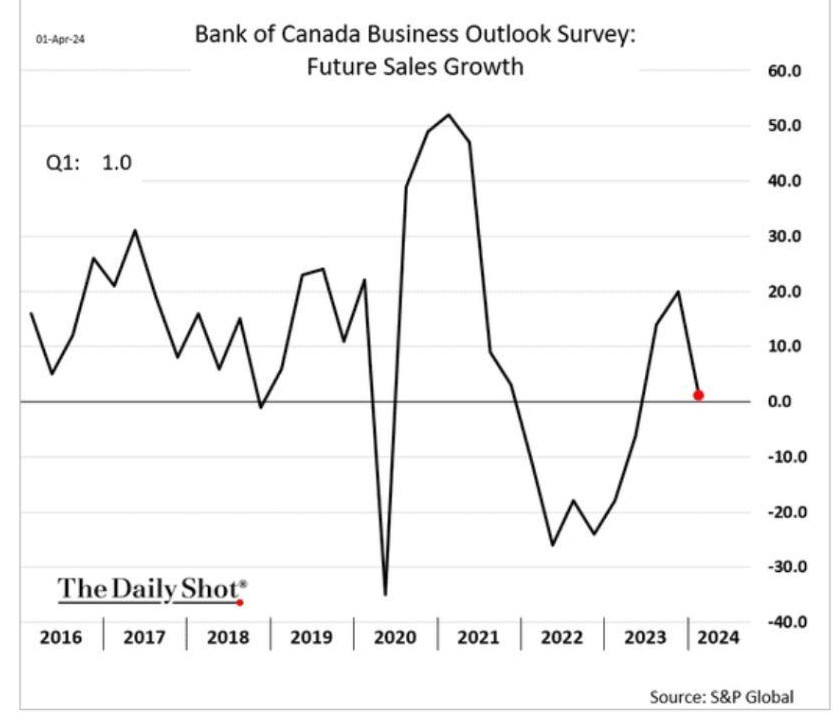

And the Bank of Canada's business survey showing no expected plans for growth.

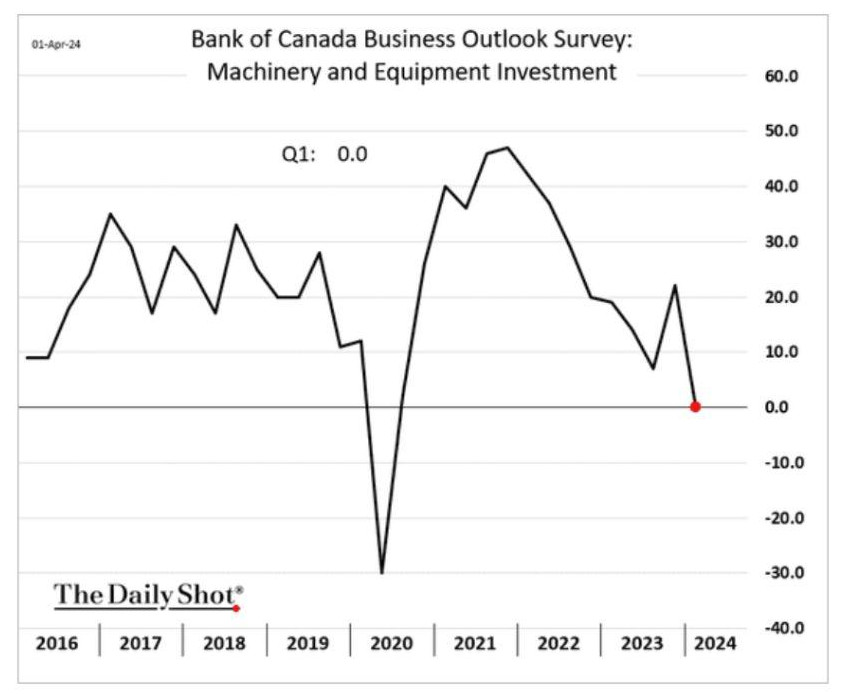

Which is backed-up by the expected spending on new machinery. This is bad news for productivity and brings us back to the call for industrial strategy to support higher levels of investment.

Services industries are being hit by the general squeeze on incomes as interest rates remain high for consumers.

Export in raw materials (such as gold) is keeping the economic indicators above water.

The difference between the PMI data and the official statistics has been discussed before. It is unclear if the data quality is affecting how we should read these reported trends. But, it is clear things are not looking "great" and could be looking quite bad.

The economy seems to be hobbling along, but not really growing in a way that makes people feel good about it. While it is tempting to look to the USA's economic performance for the reason that Canada's economy is doing decently. However, the USA is spending a lot of money trying to retool its manufacturing sector through procurement, other economic indicators show some trouble at the bottom end.

Economic growth in the USA is expected at about 2.5% for the first quarter of the year. As we arrive at the first quarter, publicly traded company are going to be announcing their earnings and with that economic growth, financial investors are expecting good returns.

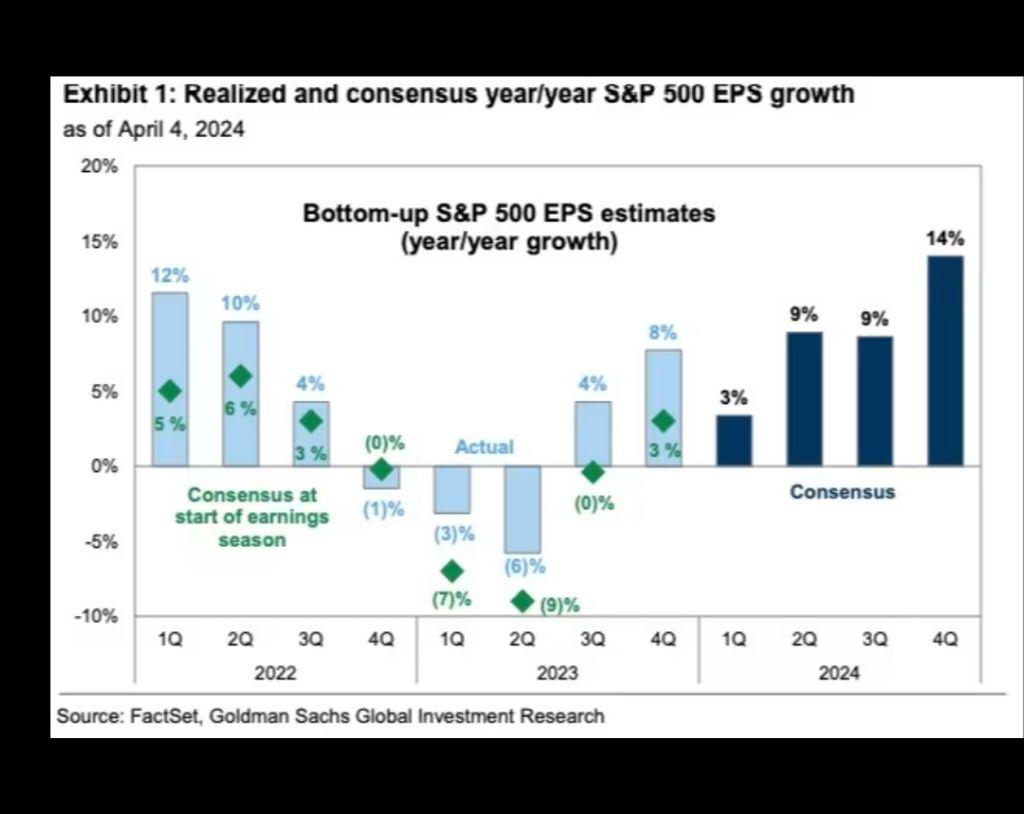

The optimism of financial capital is barely ever bourne out, however. Have a look at 2022 and last year's estimates for earnings per share. And where the expectations are this year. They never match-up.

Even companies doing poorly are giving their owners and capital nice returns. Even Boeing's now ex-CEO has gotten a 45% pay increase. Boeing is facing nearly weekly announcements of failures in its production processes and planes. But, that's not what these folks are measured by.

If you take out the largest 7-10 tech-ish companies, you get a different picture. Earnings of the bottom 95% of stocks have declined near 4% according to Goldman Sachs researchers. This includes energy and extraction sector earnings. It could be why energy companies were so big on dividends and share buy-backs at the end of last year.

Costco and McDonald's have also reported a decline in consumer activity at the lower economic end of the economy.

So, on the whole, without the federal government procurement and spending the USA's economy might be said to be doing about as well as the Canadian economy. But, there is a big difference in "without government procurement" and one where we are not. The difference is between growth in areas we need and not.