April 5, 2023

Overwork

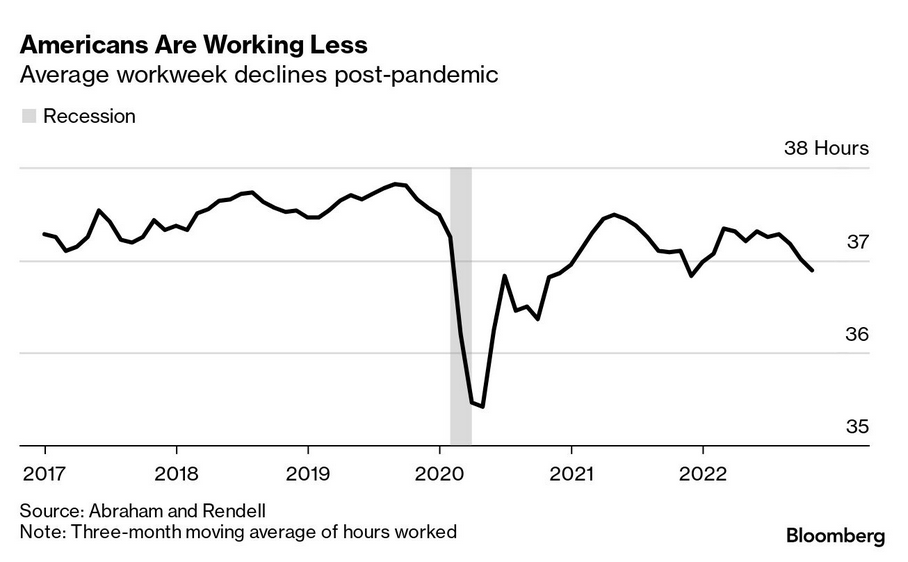

In the land of the myth of the Protestant Work Ethic, workers who can make the choice (and some who have no choice) are starting to work fewer hours.

- COVID explains some of the data

- Burnout explains a lot of the data

The call for the reduction in the work week is from the higher paid parts of society. Those who can cut hours and still maintain (or even increase) their standard of living when doing so.

For this to be meaningful, we must increase minimum wages to a base living wage and then raise those wages by 1/5th. Then the American worker can actually take Fridays off. Until then, the dream of the four day work week is only in sight for the most affluent workers.

- Educated young men

- High-earners – who cut their workweek by 1.5 hours

- Workaholics – who reduced time on the job to “only” 52 hours on average, from 55 in 2019.

People who have access to remote work or hybrid work are also more prone to shortening hours. “Nobody will notice if you call it a day a little bit earlier on a Friday,” Shin explained.

Chicago Mayor

Progressive Democrat Brandon Johnson has won the mayoral election in Chicago.

Capital is already threatening to leave the city (following Boeing). And, according to the idiot police chief, "1000 police officers" are set to resign because they hate democracy or something.

Johnson had the support of the Chicago Teachers Union (and most of the people of Chicago).

Johnson is a leftist among large city mayors in the USA in that he suggests that tax increases could increase city budgets for services.

The biggest issue for Chicago is the pension debt —though some would point to "crime"—and to cover that shortfall taxes are going to have to go up. Johnson wants that cost to fall on the more wealthy corporate owners.

New Zealand's interest rates go up

They keep saying it, but no one seems to be listening: The central bankers are going to keep their interest rates higher for longer.

Inflation navigation. The Fed’s Loretta Mester said rates should rise above 5% and stay there for some time. Her comments preceded a surprise 50-bp hike in New Zealand, with the RNBZ citing “high and persistent” inflation. (BN)

Climate finance group shrinks, investors want to own fossil fuels

The only things growing right now are some tech companies and fossil fuel energy companies. Growth is where investors want to be and so they are leaving the GFANZ (Glasgow Financial Alliance for Net Zero) side show that came out of the previous COP meetings.

Gfaz has $11tn in assets across its member's portfolios. Much of it pension money and long-term investment capital.

Energy companies, like Exxon, are investing green energy, but it pales in comparison to their investment in new oil and gas at about one dollar for (the imaginary) carbon capture and storage or hydrogen to every 10 dollars spent ensuring the creation of atmospheric carbon.

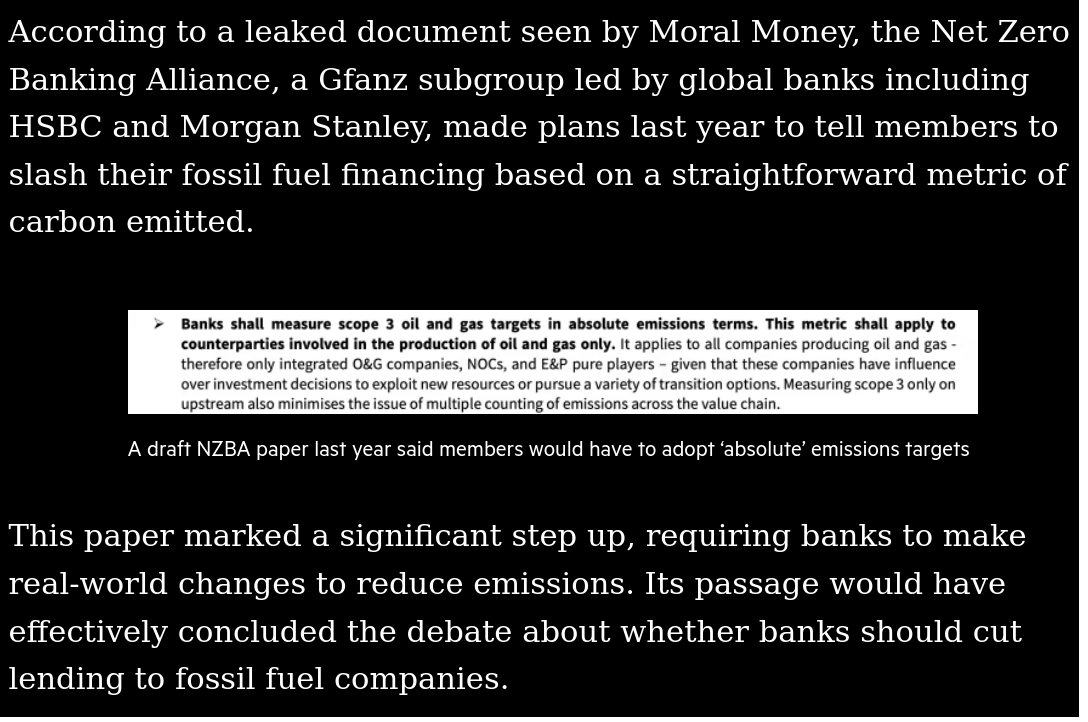

BP, TotalEnergies, and Shell all advised the working group and they failed to publish the report or the levels of investment goals:

It is almost a tax at this point. Create jobs building technologies that are either imaginary (CCS) or have a short life (hydrogen) in order to continue to reap profits from oil extraction. Do not worry, they can pay the tax and make their profits thanks to the tax credits from the USA's NRA.

The issue here is that we continue to not solve the demand for oil and gas. It is only through real investment in changing the technologies that use energy and in what form are we going to make the necessary transitions.

In the mean time, the fantasy that private capital and finance were going to invest "correctly" in supporting the transition is being exposed as a nightmare. Instead, they are investing in more climate destruction. It is amazing how much green washing you can buy for so little.

A "Net Zero" goal for investment through self-regulation but leaving the profit incentives for capital intact does not make sense even on its face.

When you look at the details you see that finance is up to its old tricks of pretending they do not know where investments actually come from at the corporate level:

When the group published new guidelines last week they had been noticeably softened. They said members should cut off project finance for oil and gasfields or baseload gas-fired power generation without carbon capture technology. But they did not refer to corporate bonds or equity stakes.

Greek train tragedy

The train route between Athens and Thessaloniki has reopened after the horrific crash a month ago. The crash killed 56 people and involved a passenger train and freight train. Capital, the European Central Bank, and the IMF are twisting themselves in knots trying to avert blame from the 2017 privatization they forced on Greece during their bailout in 2010.

One of the measures was to cut back on staff. Greece’s railways employed 12,500 people in 2010. After the troika’s involvement, just 2,600 remained employed by OSE and in 2021 numbers had further reduced to 2,000.

Privatization kills people. Don't let anyone tell you otherwise. Image attached to message

[the signalling] system was due to be installed in 2016, but it was postponed seven times. Experts argue that if the system had been in place the crash would have been avoided. “If the system existed, the possibility for an accident would be one in a million,” said Christos Retsinas, former head of security for Trainose, the company that owned the trains in Greece until it was privatised in 2017 as part of bailout conditions. (FT)