April 4, 2023

Purchasing Managers' Index (USA & Canada)

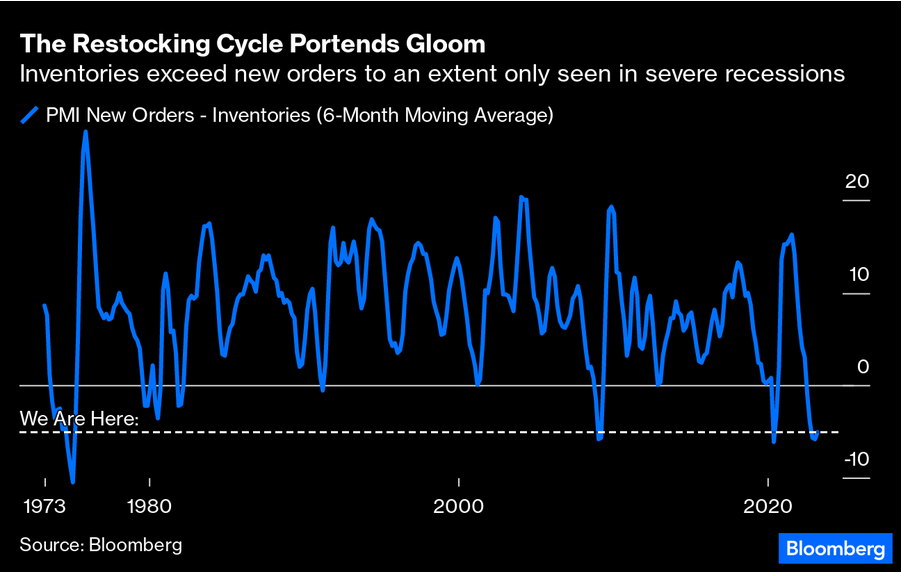

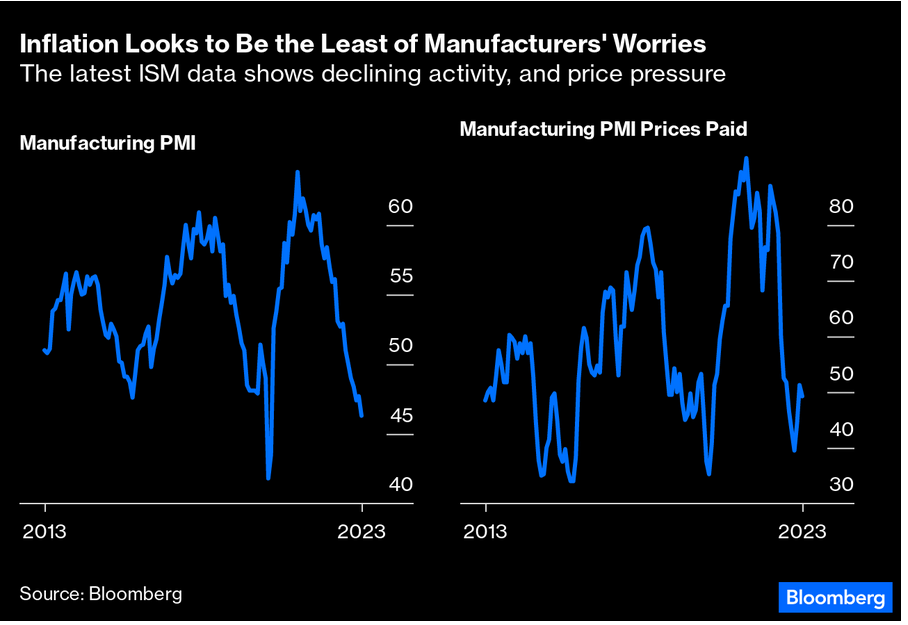

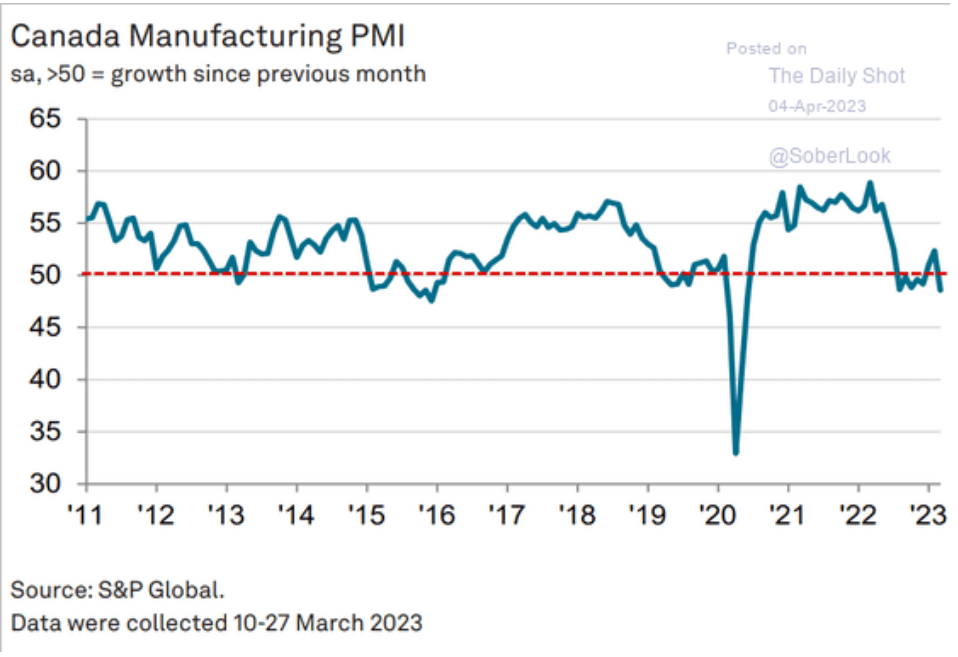

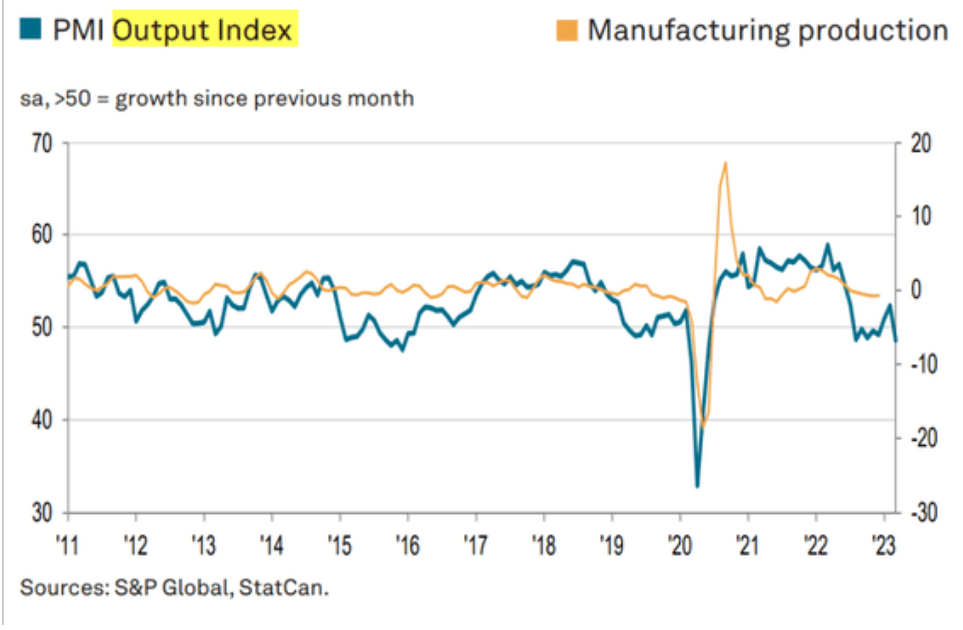

The purchasing Managers' Index is a survey of those who restock and buy for new production or replacement production goods.

When the PMI is negative, it indicates that there is less of that purchasing going on.

Manufacturing production usually follows PMI.

… next quarter’s earnings will be “really, really critical,” according to Bitterly, as the lagged impact of financial tightening flows into corporate results. This can be seen through the lens of expense control. “Not a lot of great stories about topline revenue growth,” she added. That means that companies will have to cut costs — which is after all what the Fed wants them to do to control inflation if they wish to maintain their profits.

But most of the guessing will soon come to an end. Earnings season in the US will kick off at the end of next week. Investors had better hope that it will not be as punishing as Harvey (Chris Harvey, head of equity strategy at Wells Fargo & Co.) predicts. (BN)

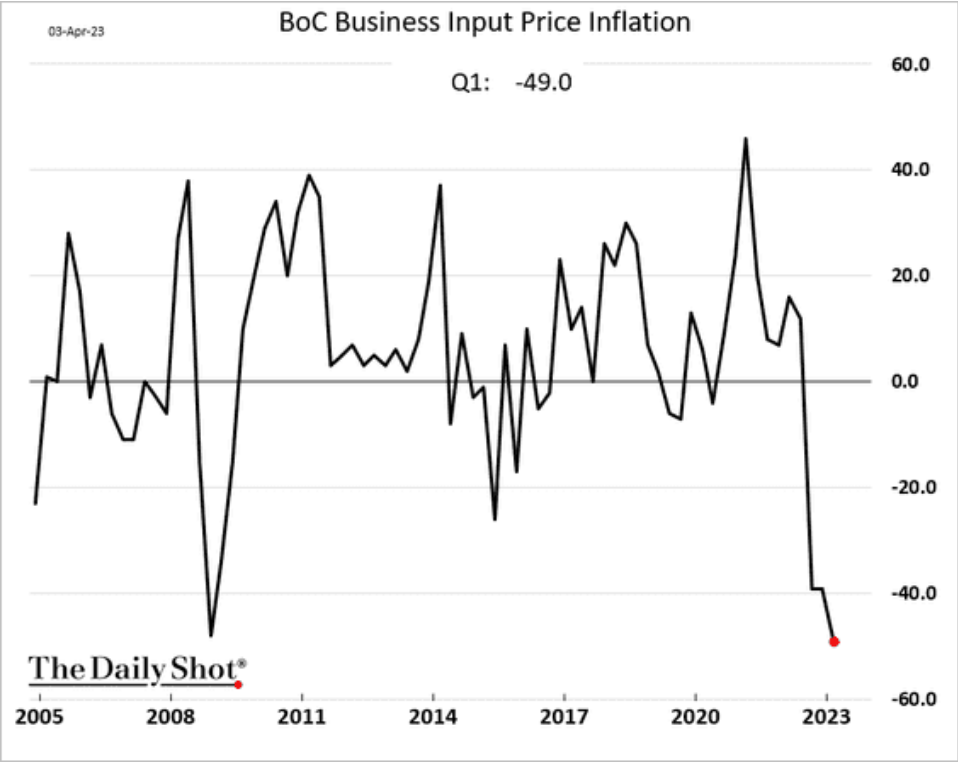

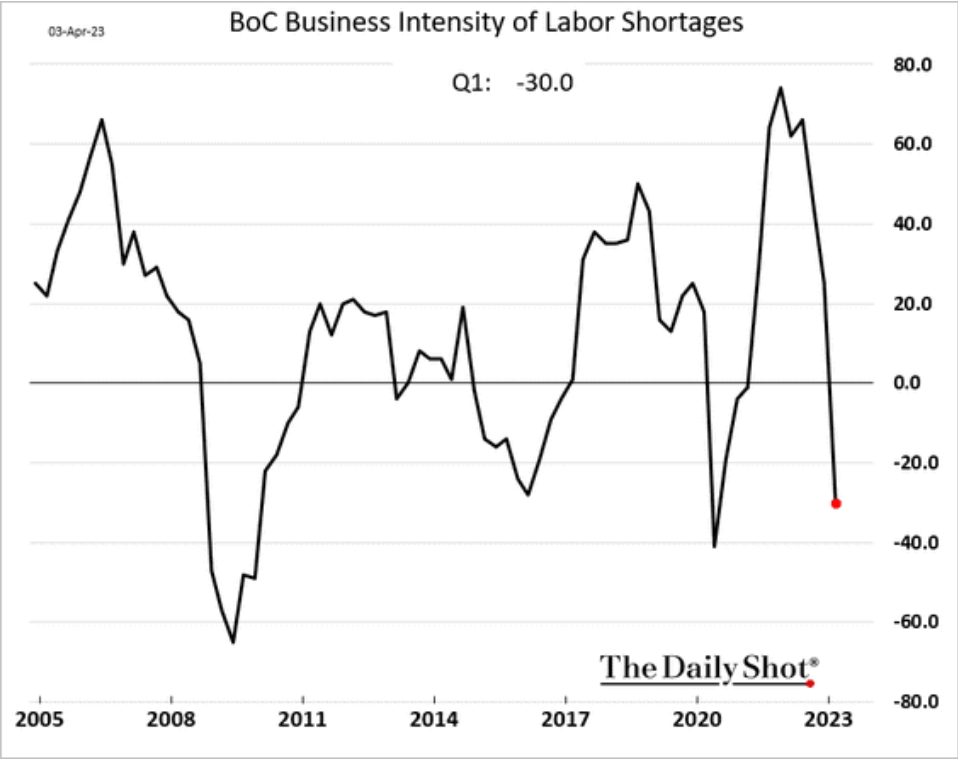

Businesses are in disinflation in Canada when purchasing new supply and there is a reduction in labour needs.

This indicates a reduction in inflation caused by a slowing of the economy. It looks like the central banks are getting what they want, which is not good for workers.

Oil prices a concern for the broader economy

Why? Because the single lever of the central banks around interest rates and their obsession with think that the lever is attached to inflation somehow:

Energy is 7 per cent of CPI, and has a powerful impact even on core (ex-food and energy) CPI through transportation services, which has been a crucial swing factor in the inflation measures the Fed cares about most.

Cryptocurrency

Is directly related to the bailing-out of banks both over the previous decade and through the profit subsidies of the pandemic response AND right now bailing out the banks yet again:

the banking crisis, in forcing a new round of liquidity support, really has helped bitcoin beyond the narrative boost, though not for the reasons Srinivasan suggests. Systemic stresses lift bitcoin not because they discredit the financial system, but because the regulatory responses are good for speculators. (Ethan Wu of FT's Unhedged)

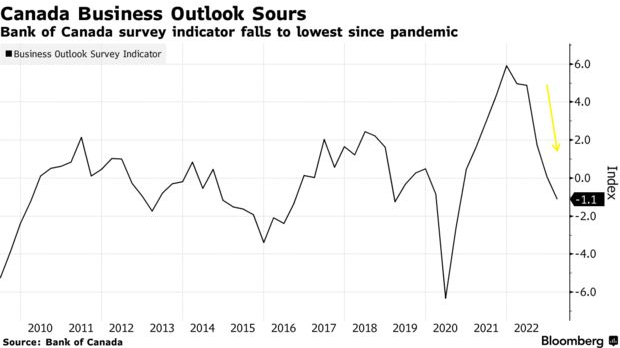

Canada's economy

The economy is not looking so hot right now:

The economy is being dragged-down by the increases in interest rates and the general cycle of business slowdown we are in. The recession is more like a "when" not an "if".

Even if the slow-down is short-lived, it is going to affect many workers across the entire economy. The slow-down is going to happen just as we need to ramp-up investment in climate-related transition, which is just odd.

There is also no indication that inflation and rates will both come down in the short to medium term. Central banks have been warning for months that they are not likely to return to the post-2008/9 days of artificially low rates.

The new world of more expensive debt is a problem for major investments. Productivity counts on massive infrastructure investments and it is unlikely AI can make-up the difference even if the tech sector is going to try really hard to sell that narrative—mostly because AI also takes a huge investment.

Return to the Organic Composition of Capital section of your textbooks and see that the state is going to lean very heavily on new kinds of profit subsidy to help drive investment. We have seen this in the tax credit regime (which will likely fail to spur new investment). The next stage is more obvious give-a-ways.

At some point the left have to start talking about public production. Well, I guess they do not have to, but they should.