April 30, 2024

Notice

Planned power outage at the data centre tomorrow will take the Brief offline for the day. Back on Thursday.

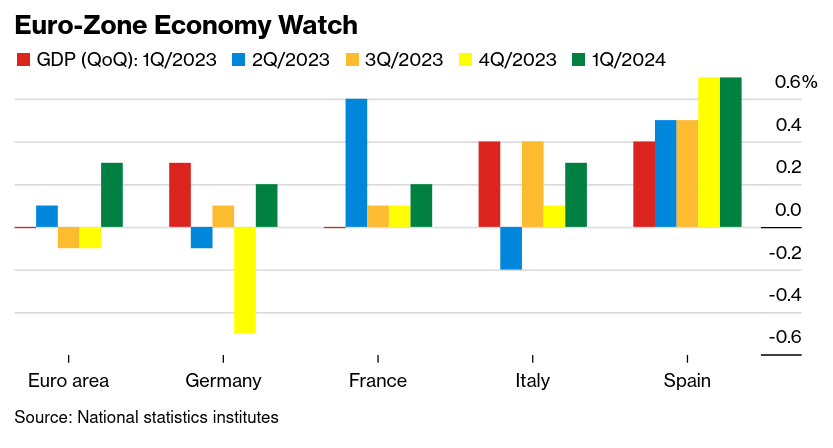

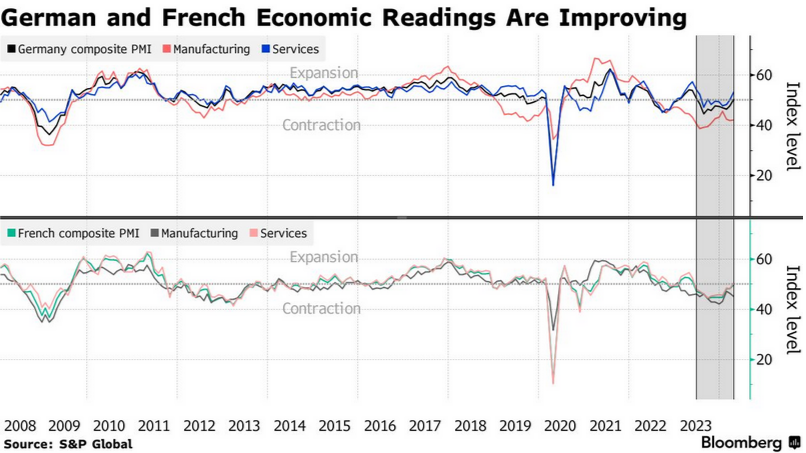

Europe is out of recession

Growth across Europe is significantly up. This is mostly a self-fulfilling action of the governments who pushed the economy into recession on purpose last year, supposedly to deal with inflation.

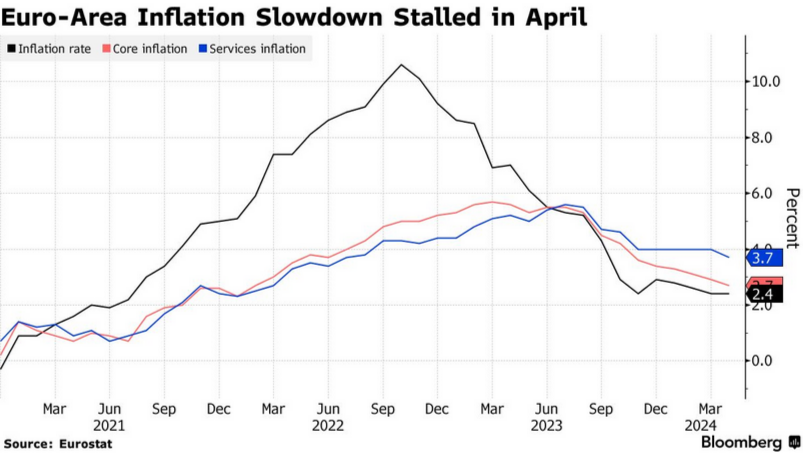

Their actions didn't deal with inflation, but it was enough to get private capital interested in "the other side" of the inflation wall anyway.

Higher for longer has been the mantra in Europe for the entire time inflation was high. The central banker focus has been more on wages being "too high" than other places.

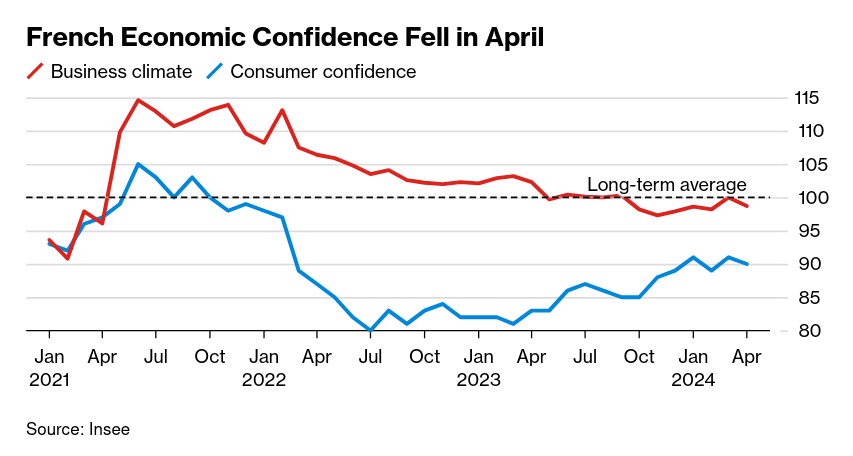

The impact on workers has been showing-up in every statistic including political ones. Folks blame Macron, as they should. Unfortunately, that has pushed working people to the far right who have taken on all sorts of narratives to trick workers they are on their side. Mostly on blaming immigration.

Macron's government has been stringing a fantasy of its own about how great the French economy is doing so that it implement further pro-business reforms because they believe overbearing bureaucracy is driving people to the far right. Which is idiotic since while Europeans love complaining about their bureaucracy more than any other place on Earth, they also love the state supports it brings.

All these move have driven Macron's party to polling well below the far right. We shall see just how bad it is in the European elections later this year.

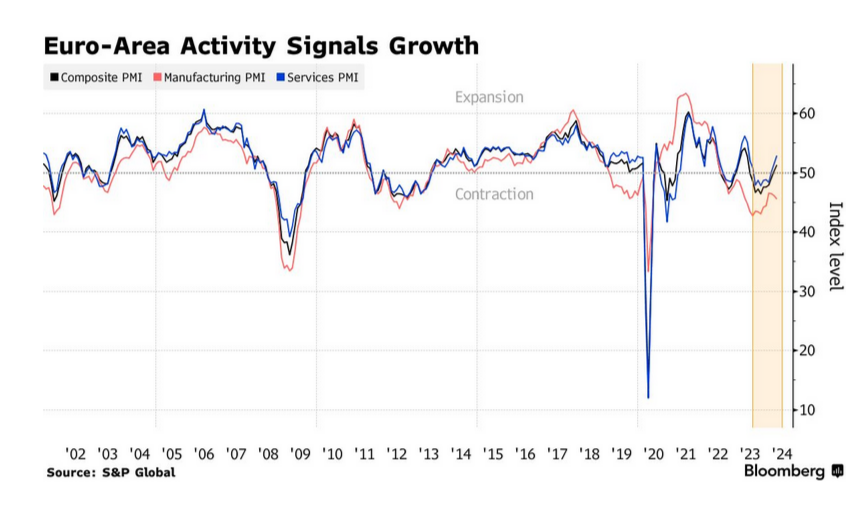

In Germany, the economic bounce-back is driven by consumers, not manufacturing. That means that it is likely not sustainable. Service sector growth (tourism is up, if you can believe it) can only drive the economy so-far, but Germany has yet to figure out how to revive industries hit by the collapse of their gas imports from Russia (such as their chemicals sector).

Tempering the scale of Germany’s rebound, however, is its outsized manufacturing sector, whose malaise is now approaching two years, according to S&P Global’s latest poll of purchasing managers. (BN)

Germany's government is also engaged in a budget cutting mood, taking €20 billion off the expenses side of the government's budget and giving away €3.2 billion in tax cuts.

Doesn't sound like a Centre-Left government.

It is a classic case of better is not good in Europe right now.

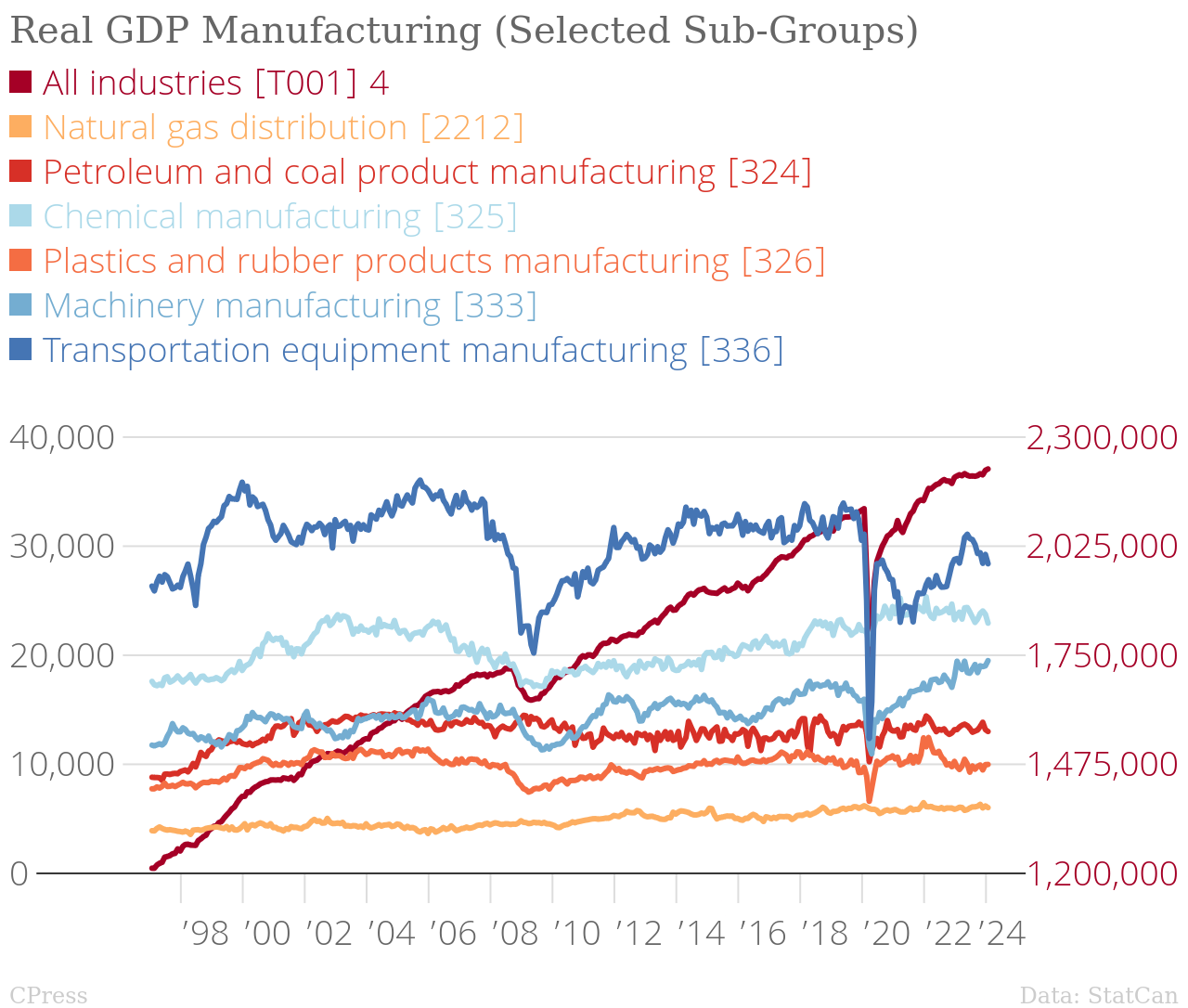

Canada's GDP numbers by industry are released today.

_Total_Manufacturing_All_Industries_Value_chartbuilder.png)

Auto, Chemical, and Plastics production are a drag on the value.

Machine manufacturing is up, which points to a potential for productivity gains in the pipeline if those machines are sold to firms in Canada. We shall have to wait and see where those orders are coming from.

California naloxone

California has bulk purchased naloxone (the anti-overdose drug) to distribute under it's own brand. It is the first state to do this in geared-up efforts to fight the overdose crisis.

If successful, it will consider expanding to other generics under CalRx. It already does this for insulin.

It is a small measure to drive down prices for necessary drugs, something that should be done everywhere.