April 3, 2023

Oil prices

Geopolitics still rules oil prices. Saudi Arabia pushed prices up just before the OPEC+ meeting this week by saying it would cut production. Riyadh's move to cut production is in response to the USA's decision to not fill the strategic oil reserve quickly after it drained it an attempt to tame inflation.

The price of crude is now expected in the $100/barrel by the end of the year.

Up and down the prices go following war, inflation, and major predicted shifts in demand in the medium term. But, not enough to blunt announcements from the oil cartel.

Finland voted right

The pro-NATO social democrats have lost out to the xenophobic far right and anti-work centre right parties.

- National Coalition party (right-wing): 48 seats

- Finns party (fascist): 46 seats

- Social Democratic party: 43 seats

The social dems gained seats, but their coalition parties lost enough seats to hand it to the far right. Lower turn-out will be blamed, but it is clear that the internal political dynamics are really to blame.

The right and far-right are full steam on joining NATO, increasing defence spending, and cutting funding to social programs.

This is not a good sign as Spain heads to the polls soon.

The fight in Spain is around securing enough votes to gain a majority with the coalition:

Podemos is fighting at the top (and all the way through) the party opening the door for some social democratic up-swing. The person vying for that leadership is:

Yolanda Díaz

Díaz, who has focused on issues of economic wellbeing in government, said she wanted to do “useful politics” that “changes people’s lives”. Implicit in the statement was a contrast with Podemos, which has become associated with militancy and culture wars.

Born close to a shipyard in Galicia, north-western Spain, and the daughter of a trade union leader, Díaz is a member of the communist party who became a labour lawyer before entering politics.

The problem in Spain is that if Podemos lose some ability to attract working class votes, they tend to go to the far-right, not the centrist social dems.

In a classic winning (and failing) strategy the social dems are going to try to tell the far left they have no choice and tack to the centre. And, in a classic response to this strategy, it will be entirely dependent on failures on the far-right as opposed to an active organizing program of the social dems whether this will work or not.

Not really something most of us who care about real political change like to leave to chance.

Commercial real estate

As folks continue to look for deals to buy/rent/occupy homes, commercial real estate is in a little bit of trouble.

So much so that conversions of prime office towers in Manhattan's Wall Street are being turned into condos.

It is unclear what is going to happen to the residential market because of this, but non-bank investors are deep in red on the office blocks that are only two-thirds full.

Much of the investment in this kind of property comes from smaller banks (70% in the USA) and many of these banks are not in a strong position right now. Many investment firms focusing on real estate shifted to the nice returns on commercial property after the 2009 residential real estate collapse, egged-on by the ultra-low interest rates.

For example:

Canadian property group Brookfield stopped making payments on $734mn of LA office building debt (FT)

Match that with the fact that many of these debt are rolling over this year (at a point where rates are now very high) and the collapse of inflation-causing free money for banks, you have the potential for a problem.

Part of the government's response to this situation is supplying a slew of tax credits for investment in property. One of the targets of this money is the owners of large infrastructure that are under the weight of increased interest rates. While the central bank pushes rates up and taking money away from those who investment banks lend to, the government provides money on the other end of the ledger with a reduced tax rate (and free money in the form of refundable tax credits).

In the end, capital is getting a bail-out and workers are footing the bill with higher inflation and now higher debt rates.

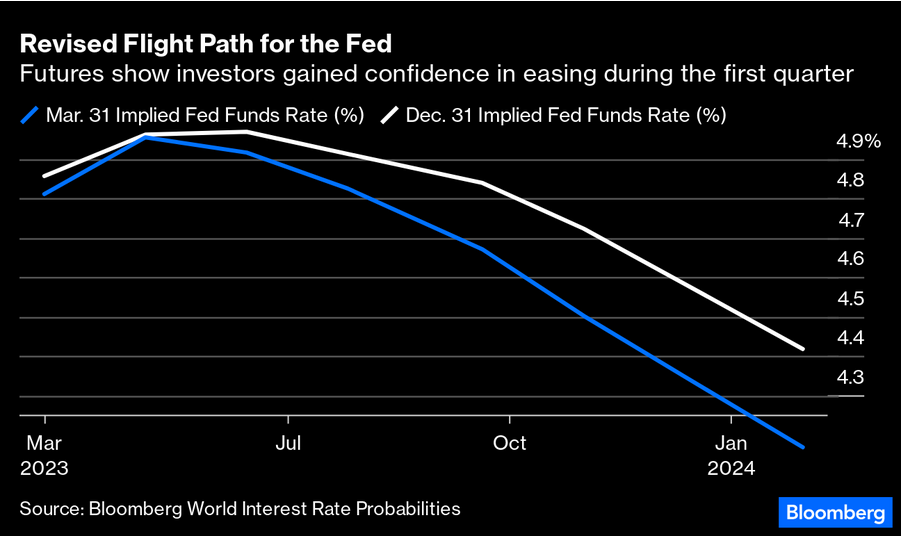

Interest rates

Higher. Longer

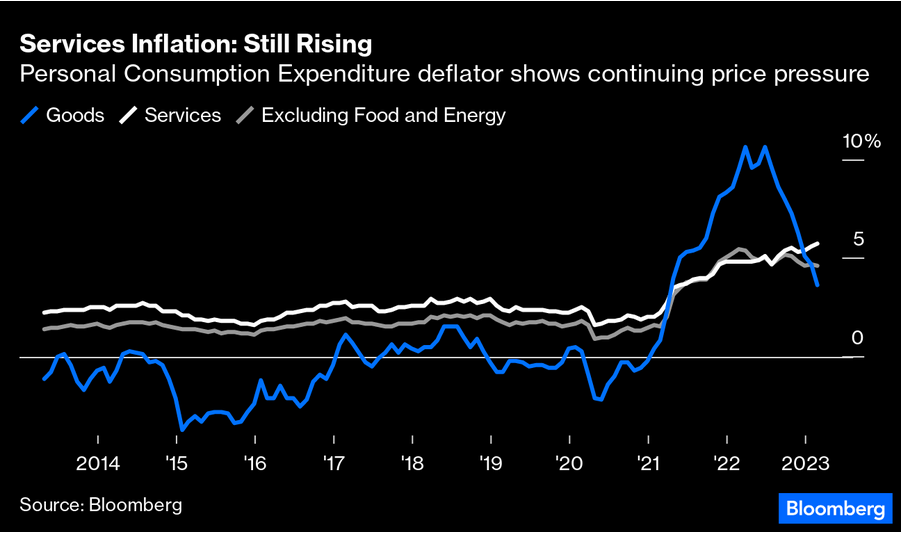

Why? "Service" prices (that is the cost of running services, investing in services, and sustaining service) is maintaining inflation metrics:

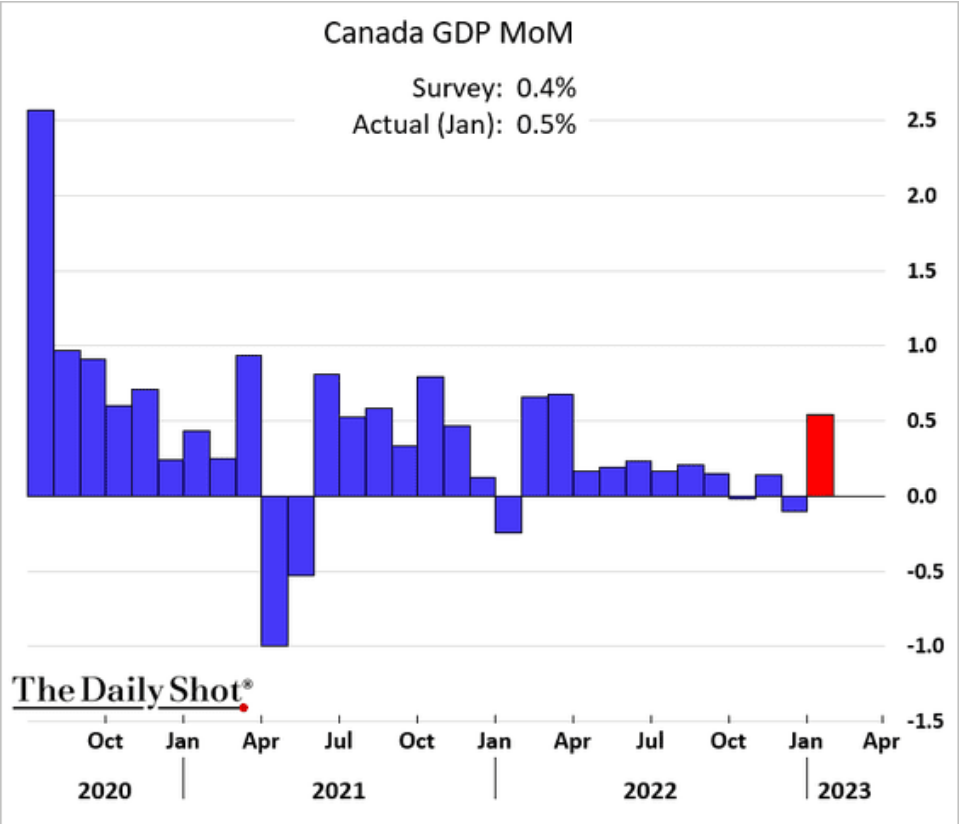

Canadian economic growth was higher than expected. Industrial production was up and so were "service", but agriculture, utilities and management of companies were down.

It could be that it is the prices of some natural resources or the announcement that central bank interest rate increases were going to pause. Either way, no reason to believe that interest rates are going to come down any time soon.