April 29, 2024

Canadian income stats

-

Canada's official poverty rate is back up after pandemic-related government transfers were cut:

- 9.9% in 2022

- 7.4% in 2021 (with social supports)

- 10.3% in 2019 pre-pandemic

You can kind of see this with median inflation adjusted after tax income:

- $70,500 in 2022

- $73,000 in 2021

- $68,800 in 2019

People are feeling worse off because they are. Almost entirely to do with a reduction in government supports.

_Median_government_transfers_Median_after-tax_income_chartbuilder.png)

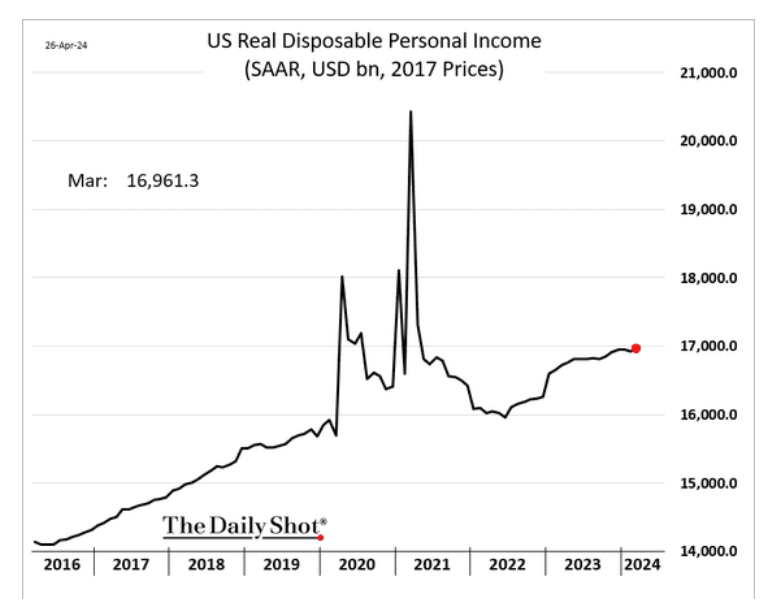

Not that you can compare these stats, but disposable personal income was released in the USA:

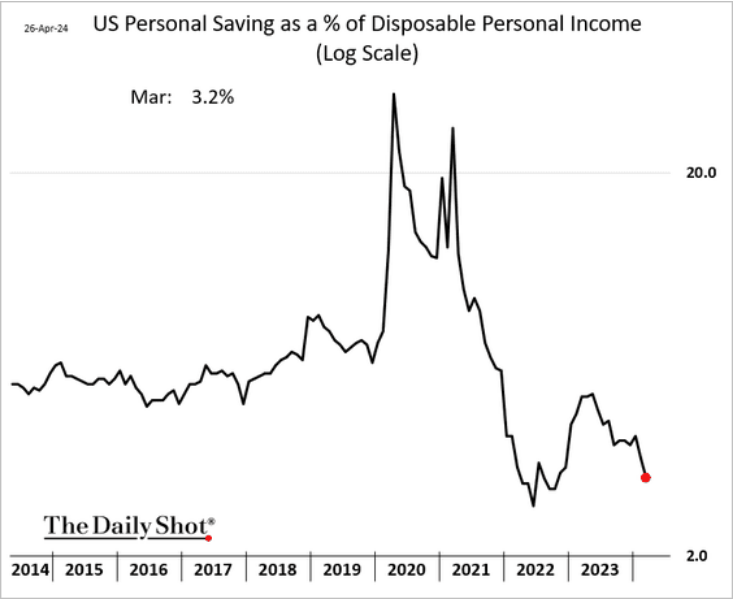

Up slightly, but have a look at the savings rate:

People do not have long memories, but compared to pre-pandemic (and the strange days of the pandemic), people are not going to be looking at their bank accounts and thinking "wow, I am better off today".

This is a problem in the USA as the election nears.

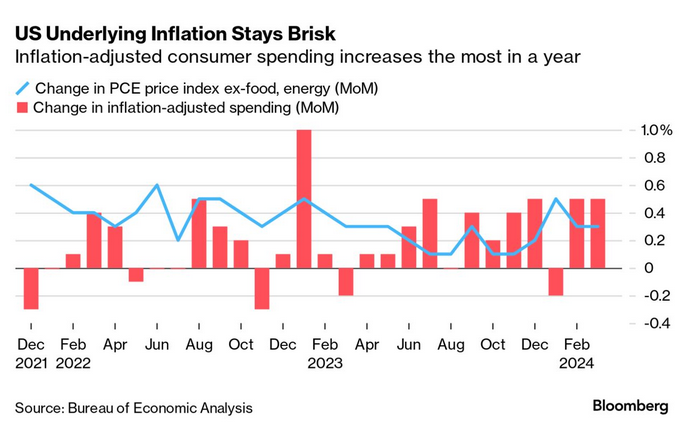

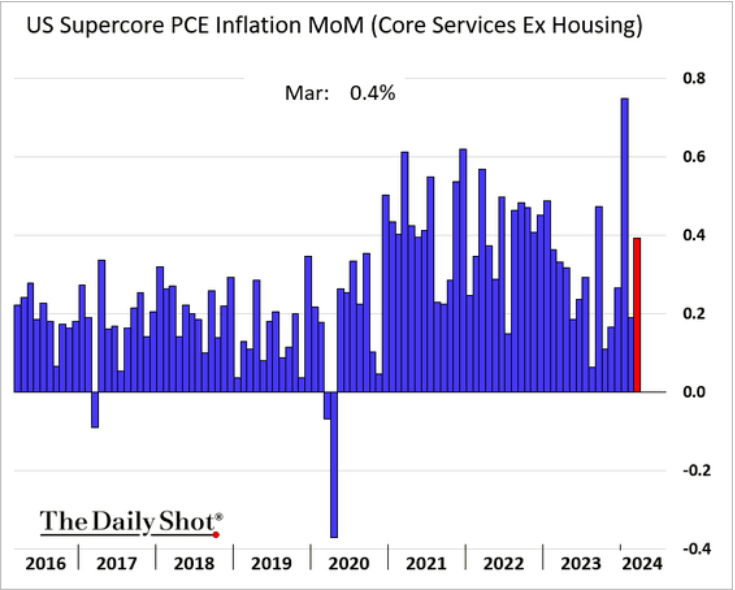

In the USA, it is inflation, interest rates, and cuts to supports acting in concert that drag people down:

High USA interest rates are also hurting some currencies around the world. Investors are focused on the Japanese Yen, but most currencies are affected. The higher rates mean that investors are in on USD over other currencies and that drives down the value of those currencies. Lower currency rates compared to USD means that it is easier to export (too bad the economy is not great), but also it makes things much more expensive to import.

This situation can cause crisis. Currency intervention is likely in some countries concerned about private markets taking advantage of these differences exchange rates and creating a crisis.

The G7 and now the IMF has announced policy programs to intervene. Private markets are not helpful at the best of times, but they are certainly dangerous in bad times.

“The key commitment is the recognition that excessive volatility and disorderly movements in exchange rates can have adverse implications for economic and financial stability.” (G7

Intervention can simply include removing the currency from trading. And, simply spending money to support buying of the Currency. In 2022, Japan spent around $60 billion supporting the Yen's price on exchanges.