April 29, 2022

Europe is not doing as well as it needs to

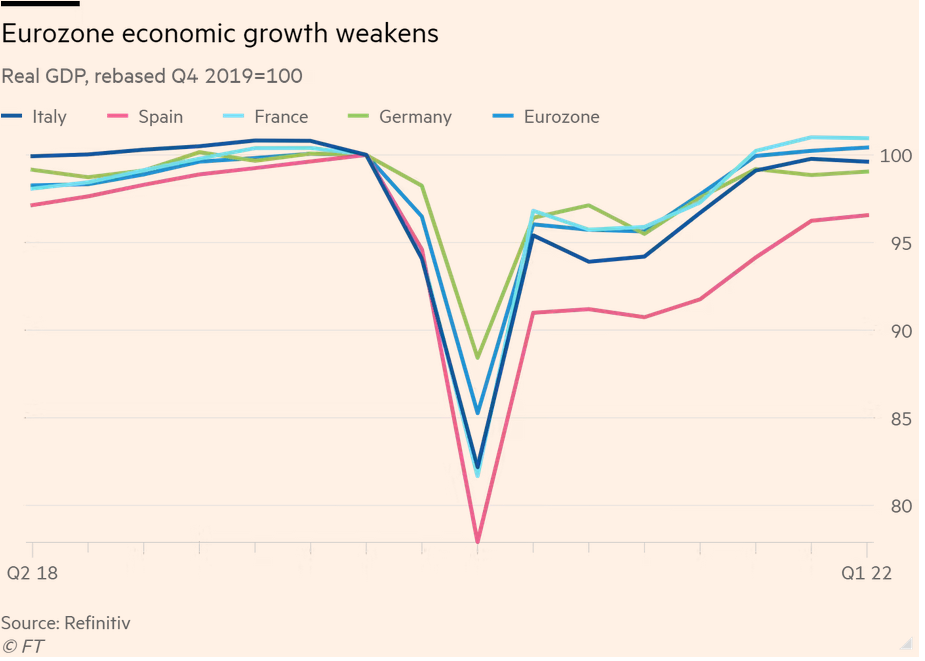

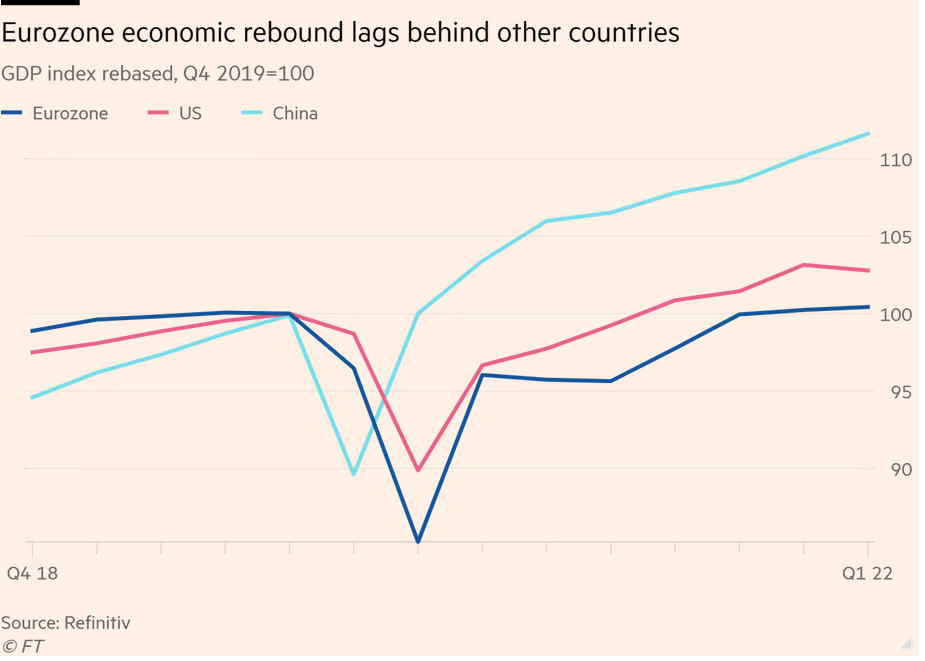

- Euro countries grew at an average 0.2% in the first quarter of the year.

- The prediction is contraction next year and likely recession in the Euro countries.

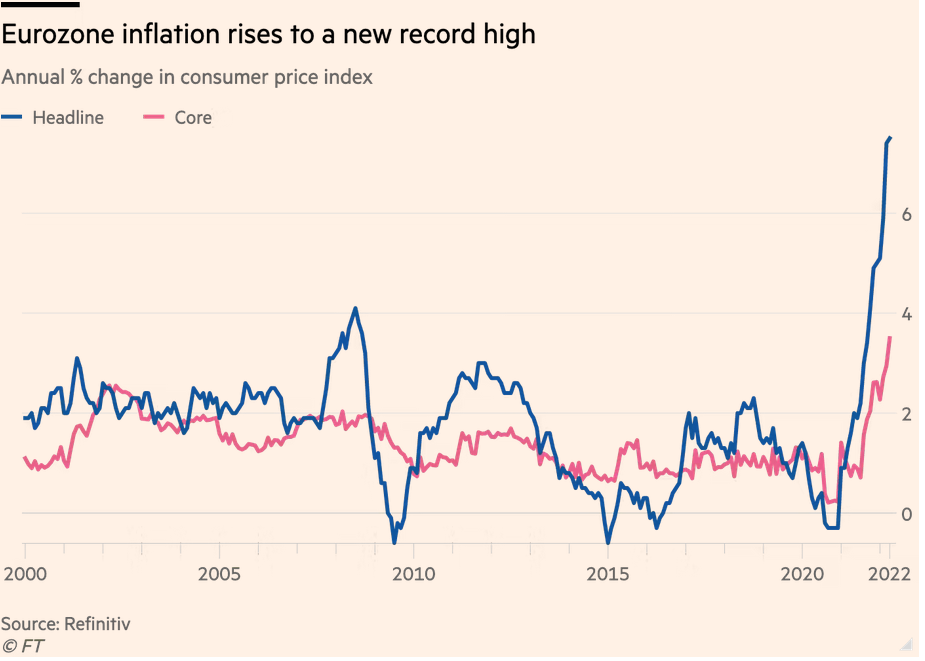

- The dreaded "stagflation" word is being thrown about.

- War, lower profit expectations, spending, and no one being particularly jubilant about Musk taking over Twitter are all (to different degrees) having an effect on the economy.

Currencies are all relative

- USA dollar is rising

- China's currency is falling

- Emerging market national currencies are falling faster

- Russia basically doesn't have a currency any more.

- It is the story that goes with the inflation, response to inflation, low (negative) growth of economies, and other aspects of the economy people do not really follow.

- China, unlike many fully capitalist nations, does have some control mechanisms it can deploy to stop the sell-off, but they all have knock-on effects of money coming into the economy from outside. At some point, there may be another re-thinking of how the state will respond.

Apple and Amazon

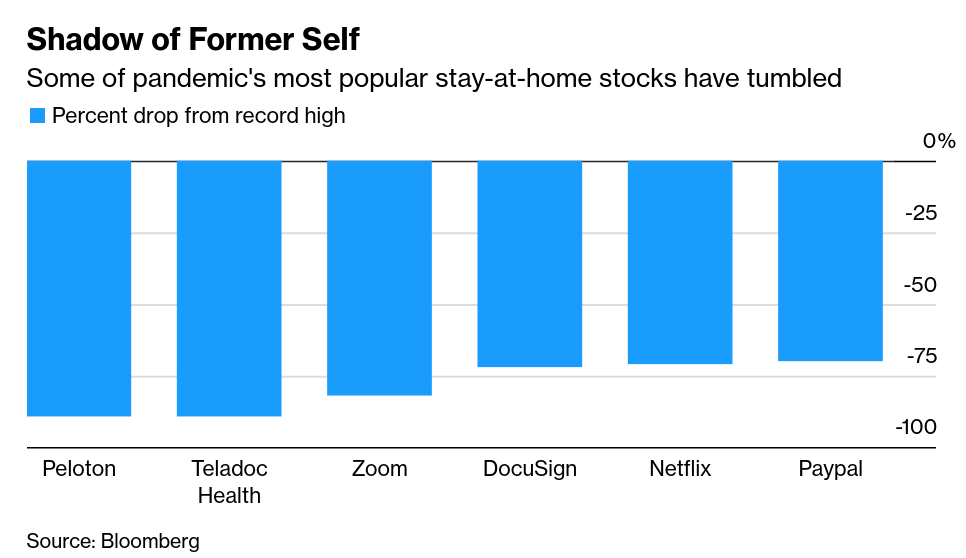

- Tech stocks have lost $1.8 Trillion in April. That's a lot of fake capital disappearing.

- Up and then down: Apple pleases with revenue in the first quarter to say it will lose this quarter (because: supply chains).

- Investors are happy because the response to this bad news briefing from Apple was for Apple to give capital more of its profits back through buybacks and increased dividends.

-

Amazon earnings weighed down by falling sales and high costs. Company says push to expand during pandemic left it ‘overstaffed’ and predicts more sluggish growth

- That just means its labour costs are going up and people are buying less, so it is making less profit.

- Most of the growth in these companies is from the services that they provide. This is likely because the costs for maintaining these (web and streaming) services lags the increased costs of the infrastructure that runs these services.

- It all adds up to more losses for the tech market.

We may have pensions backwards

- I have been thinking about pensions. And I wrote about it.

- We think pensions are deferred wages that we get back at retirement.

- Pensions are actually on the other side of the ledger: not wages, but profit.

- Pension funds monies are part of the investment bill within capitalism – which is part of the surplus workers create but do not receive.

- The investment bill for an individual capital is dependent on expected growth of new investment. The investment bill for all of capital is determined by the individual capitals and the net investment bill is the sum of all these together.

- Pension money is invested and some of the return on that investment is provided to workers.

- This means that a "retirement income" from these investments is just the price of the investment process.

- However, since the investment of "your wage" is forever (you never get that back in an employer plan, you only get the promised return), the question is how much is being made over the life of the invested money that you are not getting?

- This (could) mean that pension plans are not deferred wage, but simply capital deferring payment of your wage on the bet that it doesn't have to pay it.

- The cost of doing this is the cost of paying it out, which is still a cost to capital, but one that less than the cost of paying you your actual wage.

- Where does the money come from that pays you later? Still looking into this, but it is likely a transfer of wealth from some other worker. Which means that the pension fund system has some very regressive impacts on the class and very real limits on expansion.

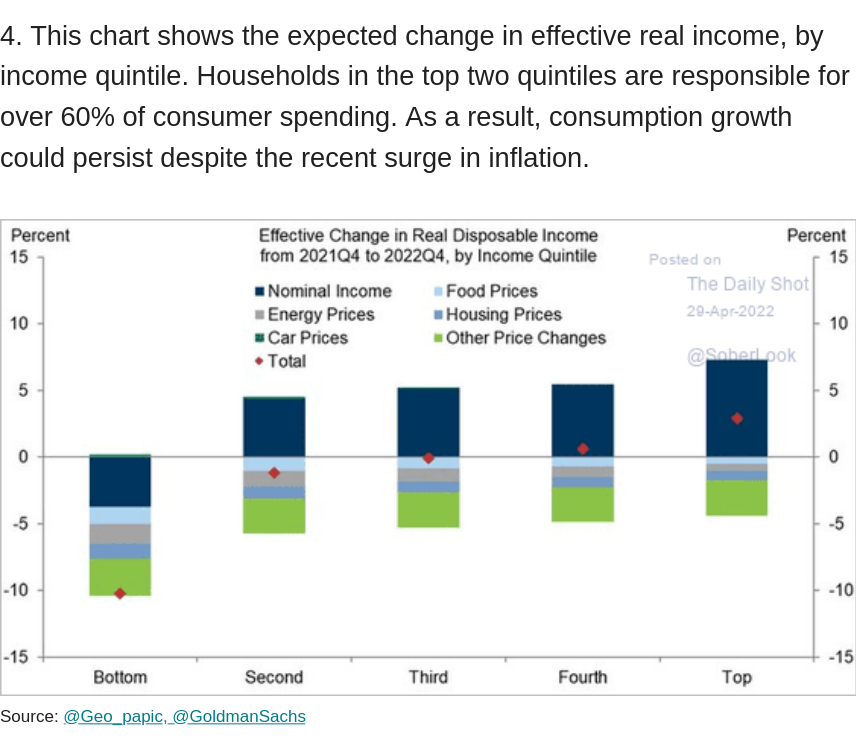

Consumer impact of inflation on "disposable" wages