April 27, 2023

Semiconductor inputs

Semiconductors are printed very much like a photograph.

Photolithography, the process of printing semiconductor, is about 35% of total cost the of a wafer (thin slice of a semiconductor) processing costs.

Most of this cost is the very expensive machine, the very expensive labour, and the very expensive chemicals that allows for the photolithography to happen.

If you want to see where the trade war is happening around semiconductors, you need to look at the trade in chemicals.

Germany is in talks to limit the export of chemicals to China that are used to manufacture semiconductors as Berlin steps up efforts to reduce its economic exposure to the Asian nation.

Chemical companies such as BASF, which use a lot of natural gas and oil by-products in their processing, are unhappy about trade wars. They are also very unhappy about the move away from fossil fuel products.

There are not very many semiconductor companies.

.png)

The Dutch company AMSL is the largest and an easy target for limiting China's access to advanced (read: small) chip production. AMSL also happens to have the technical skill to make the smallest next generation chips.

The advancement in chips is debated heavily. Is limiting the most advanced chips from China really something that will affect much? China already has some chip development tech. That's why the focus is on the inputs, not necessarily limiting access to the knowledge of the technology. SMIC is a Chinese chip foundry and is rather advanced in its own right.

To keep ahead in the technology, the US and Europe will invest about $100 billion in semiconductor companies. But, this is a fraction of the money pouring into capital to get them to invest.

$420 billion in funding to incentivize the domestic production of chips and clean-energy technologies. Add the infrastructure bill Biden signed in 2021, which requires that all iron, steel and other construction materials used in public-works projects be made in the US, and you’ve got about $2 trillion in federal spending over 10 years.

Yoon in March announced South Korea’s intention to jump into the fray with a 550 trillion won ($413 billion) investment plan focused on public-private partnerships in chips, batteries, robots, EVs, displays, biotechnology and other areas.

In Japan, Taiwan Semiconductor Manufacturing Co., the world’s go-to maker of advanced chips, has made it known it’s looking for the government to pick up about half the $8 billion cost of a new fabrication plant under construction in Kumamoto Prefecture.

Chemical inputs

To develop/print semiconductor chips, the chips need to be emersed in a bath of pure water and some very nasty chemicals. You cannot run these machines without vast quantities of these chemicals. You also need a lot of power to run the lasers and electron guns that write the image on the chip with some very focused Ultraviolet light.

While Germany does not have advanced chip-making technologies, Merck and BASF provide firms around the world with critical chemicals required for making semiconductors.

Merck’s products or services are found in almost every single chip in the world, while BASF is a market leader in Europe and Asia, home to the world’s most important contract chipmakers including Taiwan Semiconductor Manufacturing Co. (BN)

For Canada, the question is are we going to get some of that production? Are we going to make the chemicals? Are we going to be able to sell the chemicals and to whom?

These are large questions around the new anti-China program. The access to production of advanced technology is similar to the any program of investment. Inputs are important.

Use is also important. Our societies run on semiconductors. Finding where out industries should be situated and investing in flexibility of production (maybe we do not need to be producing the most advanced chips) is important. Many manufacturing processes do not need the most advanced and smallest chips.

But ASML Chief Executive Officer Peter Wennink still believes the China blockade is a mistake, saying it will hasten that country’s efforts to develop its own chip equipment.

(Fun fact: "microchip" is the proprietary name for semiconductors. Like Kleenex is for tissues.)

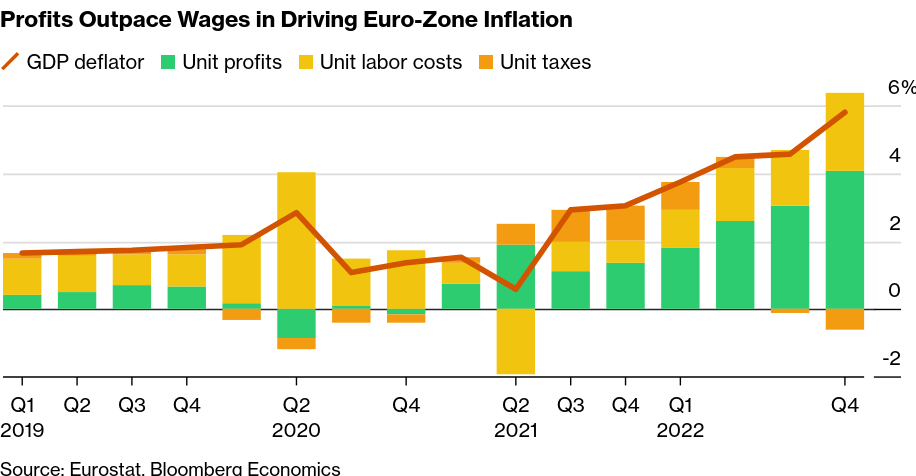

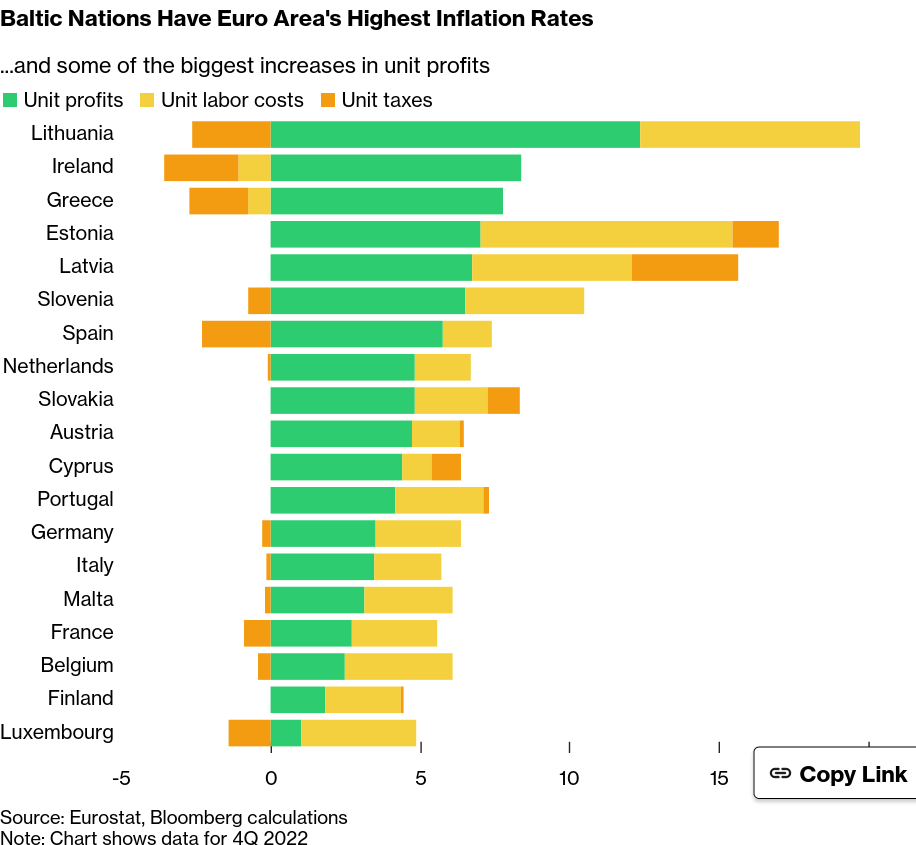

The debate over wages rages.

Publicly, capital is talking about wages driving inflation. But, there is growing acknowledgement that inflation is about profits, not wages.

The classical/Marxist view is that neither profits themselves nor wages drive inflation. But, Keynesian economists continue to blame one or the other. Greedflation is now the target.

As I have stated before, it is hard to be angry enough at this analysis to push back. A focus on profit margins is important.

You can also generate this kind of graph hiding the point behind percent growth in per-unit profits.

These look convincing. Profits are too high, no question.

However, profits compete with wages. So, when the economists are talking about "too high profits" this does not mean they think that those profits should go to wages. What they mean is that prices should come down.

For me, it is a strange argument that the Keynesian economists have. They talk about wages, but they do not want them to grow too much because they think they drive inflation. And, they want profits to come down, but do not have a mechanism to do this and so talk about "greedflation" and ask companies to not increase prices.

So, the only mechanism available to them to do this are some form of "price control"—which they are generally opposed to on principle.

In the end, the Keynesians (and growing number of "neoclassicals") are really just back to inflation should be controlled through interest rate hikes that seek to limit growth.

This is a dead end for the working class. Lower profits from higher interest rates in capitalism means lower investment, which means fewer jobs and lower pay.

The only alternative is more production. The USA policy folks almost instinctively understand this and are throwing money at the issue hoping to prop profits up for endemic companies. This will have large-reaching impacts. But, as I said yesterday, the USA can do this because there is not that much labour power relative to capital there.

Here in Canada we need to respond in a different way. We must invest in public, directed production. We must build an industrial strategy to diversify our economy through this public investment in production.

Providing the world the inputs they need is the historical position of Canada. It is not good enough. We need actual production here too.

AI Bargaining

If you thought AI is not going to be used by employers to undermine union bargaining. Think again: