April 27, 2022

Forced decline

Policy makers are expected to announce the start of a new Quantitative Tightening campaign on May 4, alongside a half-point interest-rate increase. Within months, some $95 billion of bonds will be allowed to run off the balance sheet, every month.

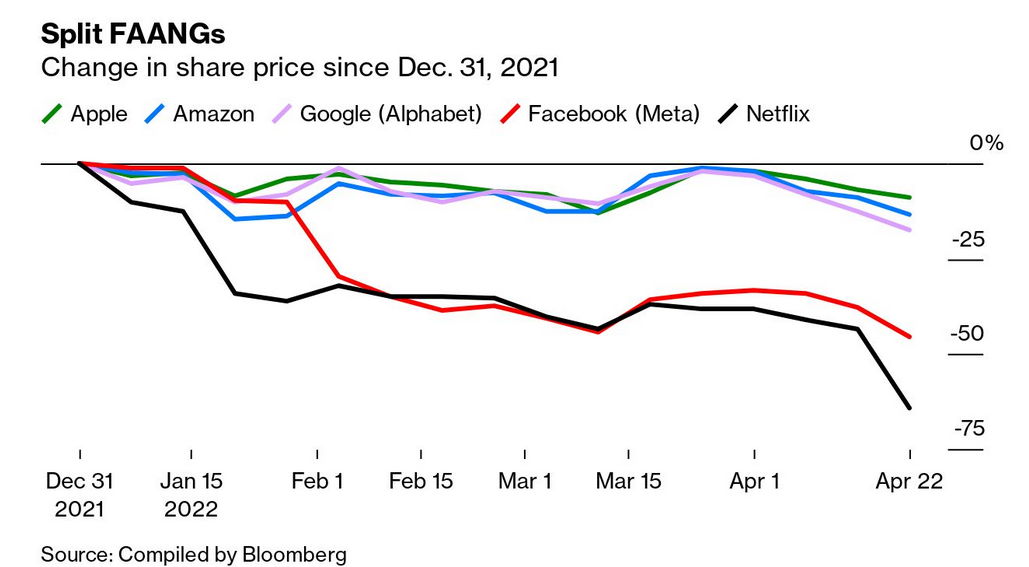

- Increasing borrowing costs are already having an effect on the high debt companies. Not to mention inflation and the prospects of a recession. This graph is before the Alphabet (Google) stock decline this morning:

Gas and Steel Tariffs

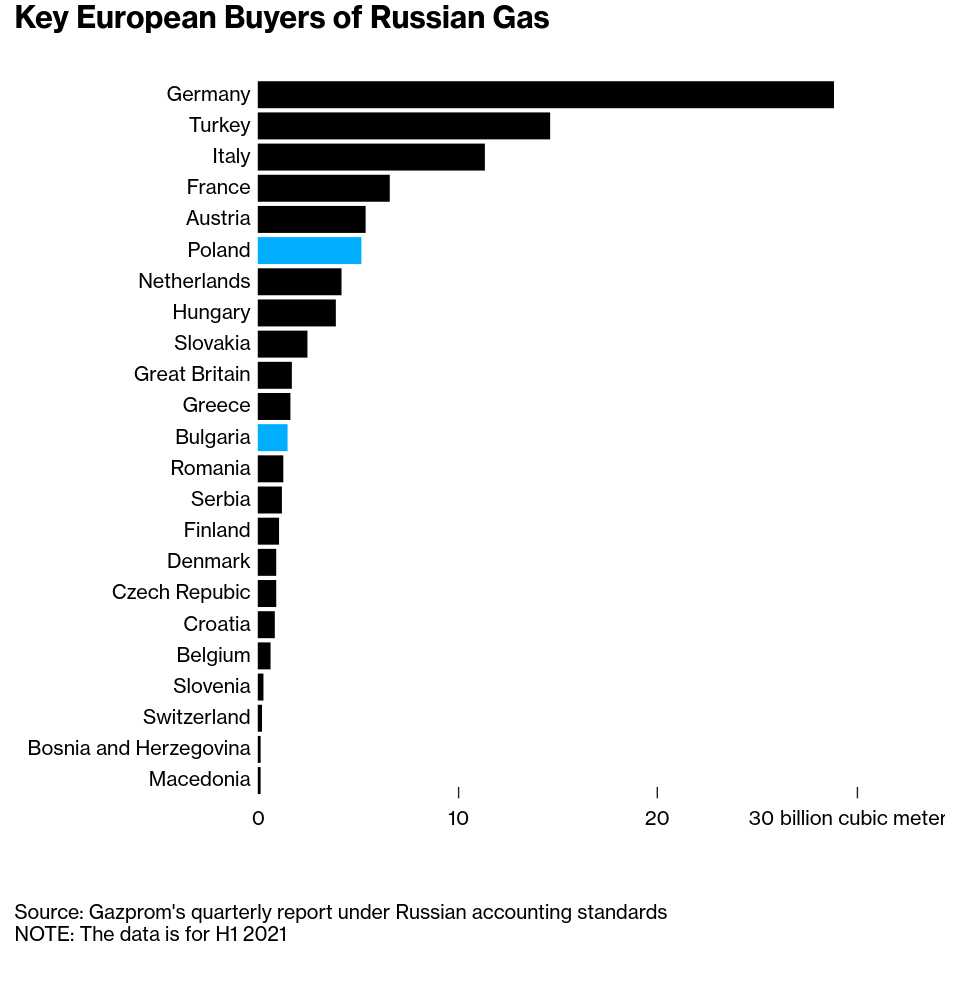

Poland has said it has enough gas in storage and that consumers won’t feel the hit. Bulgaria has secured supplies for “at least a month,” Energy Minister Alexander Nikolov told reporters in Sofia.

- Germany’s imports of Russian oil has fallen to about 12%, from 35% before the invasion of Ukraine.

- Investors in British companies can expect higher dividends this year than previously forecast, as higher oil and commodity prices brighten the outlook for shareholder payouts, an industry report has found.

- UK companies will pay out £92bn to shareholders in 2022, in line with last year. The forecast still put payouts 18 per cent lower than in 2019.

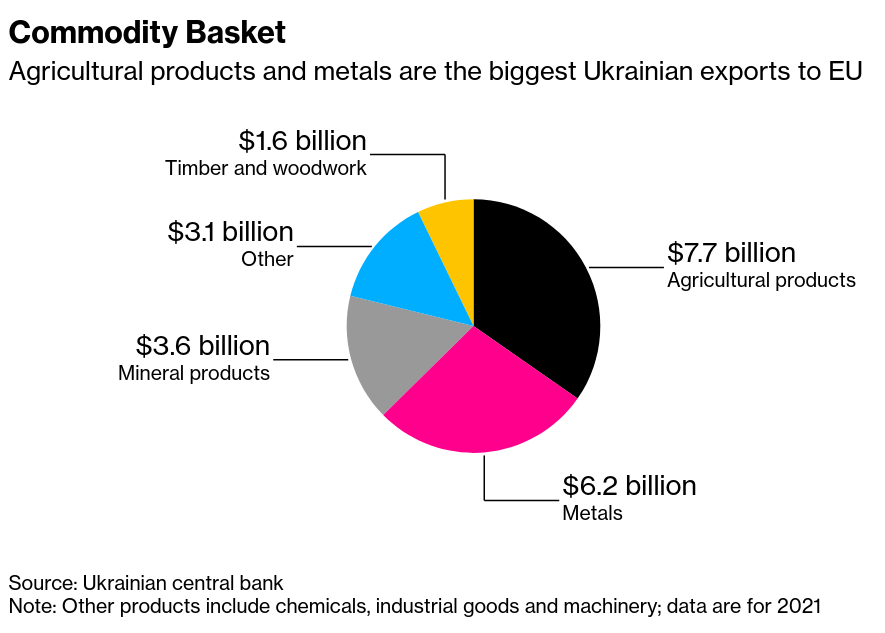

- USA will reduce the 25% import tariff on Ukraine steel, the world’s 13th-largest steel producer – accounting for 12% of Ukraine’s GDP. 80% of production exported.

Tax payments

Don't believe the (post-Keynesian) hype around tax fairness generating revenue for your healthcare, schools, and parks: tax revenues are spent on the class that paid them. If you want better healthcare then we should all dig deep and pay for it through higher taxes to fund efficient government programs.

That said, there is nothing wrong with whittling down profits of companies and putting it to use – or point out the fact that they are not redistributive and should be.

Some changes are coming from the tech industry which can abide higher corporate tax rates – because they mostly don't make any money.

According to the FT and Bloomberg:

- Amazon investors will next month vote on a shareholder proposal asking it to produce a tax transparency report, one aligned with global standards that include country-by-country reporting of taxes paid.

- Amazon has been singled out as a high-profile name that resonates with consumers. True, its disclosure is limited and, like most tech peers, it has form in aggressive tax planning. But juggernaut proportions haven’t always meant vast profits: the international consumer business made a loss last year.

- Nearly 80 per cent of multinationals in Deloitte’s global tax survey last year expected more scrutiny post-Covid; a third said they would increase voluntary disclosure.

Shanghai is through the wave

Shanghai hinted at an easing of lockdown measures as coronavirus infections dropped to the lowest in three weeks, while the number of new cases in Beijing remained below 50, in a potential sign authorities are starting to bring the twin outbreaks under control.

Poorer countries and climate change

Finance is trying to price-in the different impacts of climate change on different countries – so that they can price bonds appropriately. It isn't looking so good:

- "Around 12% of low to lower-middle income nations’ economic output will be under threat, compared to 3% for high and upper-middle income states, the ratings agency said in a report based on a “moderate” scenario. South Asia is particularly at risk – 10 times more so than Europe – due to its exposure to storms, floods and rising sea levels."

- "The study is mainly based on a scenario that projects an average temperature increase of 1.8°C, versus the Paris Agreement’s aim of limiting a temperature rise to “well below” 2°C."

So, not really useful for a reality of 4°C+ which we are galloping towards.

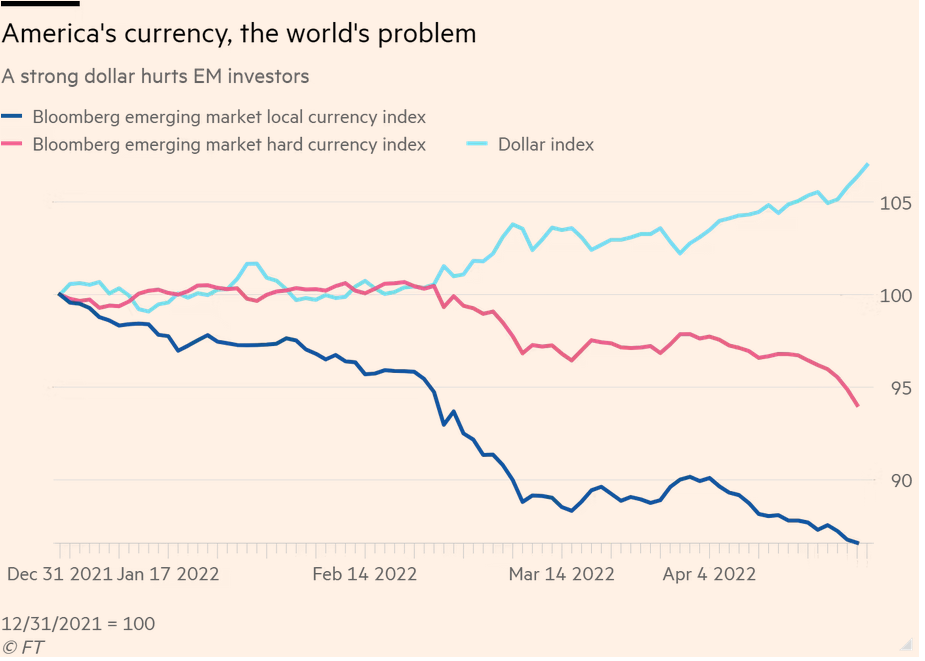

Not to worry though, it isn't like current USA monetary policy will help local investment in green technology.

But, it will help employment and job displacement in North America via technological change and weird new outsourcing like at Freshii's new "virtual" cashier.

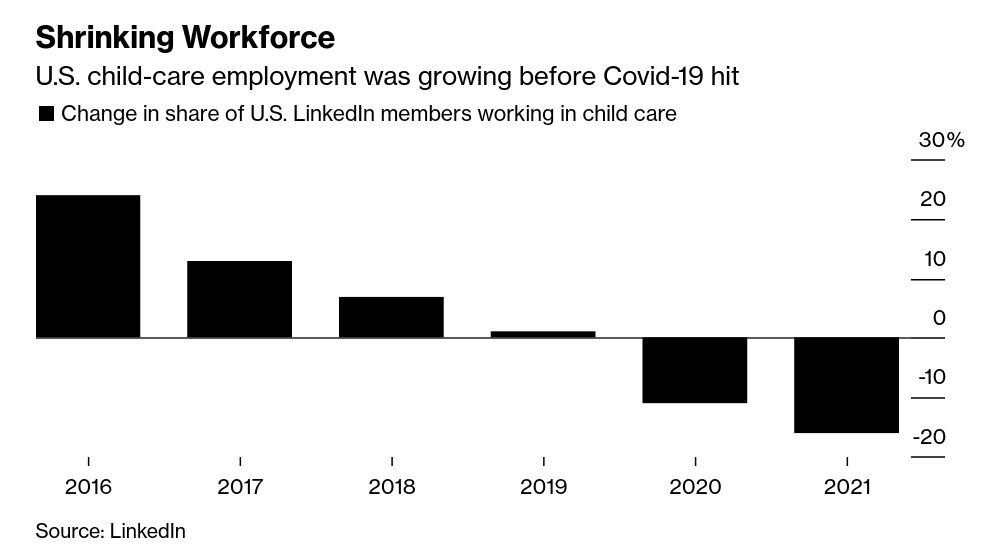

US Childcare Workers

Of course, the Canadian example is so much better with our feminist PM, right?

- Nearly 302,000 people worked in child care in Canada, making up 1.8 per cent of the total working population.

- Workers make less than half of the average national income or $24,100 annually.

- Canadian employment among child-care workers was 21 per cent lower in February 2021 than it was before the COVID-19 pandemic in February 2020.