April 26, 2024

USA data

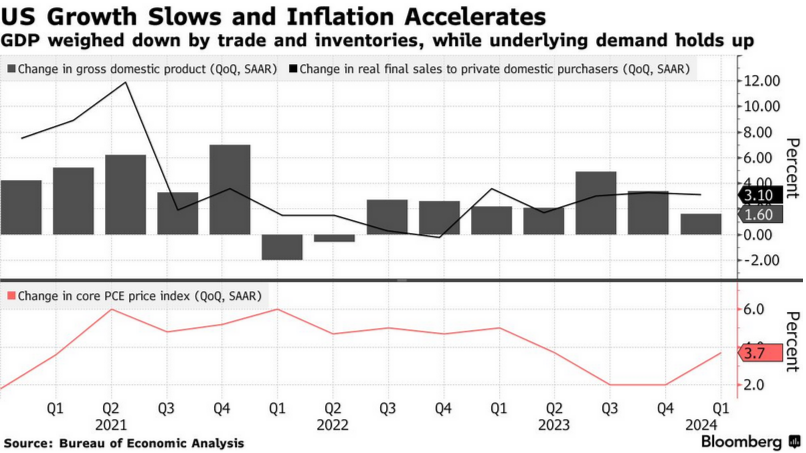

Thursday's numbers did not land well with investors trying to guess when interest rates might come down. There was even talk of stagflation as inflation remains higher than "expected" and headline economic growth is sputtering.

- First quarter GDP came in at 1.6%, below expectations.

- Service sector CPI is keeping inflation measures high.

- But, there is some confusion in how the American consumer is dealing with this. "Separate data out Thursday showed initial applications for unemployment benefits fell to 207,000 last week, the lowest level in two months. Continuing claims also decreased."

Consumption data is out this morning, which is likely a better gauge of the health of the American family's bank account.

All this to say, orthodox economics does not seem to be able to decide where things are at in the economy.

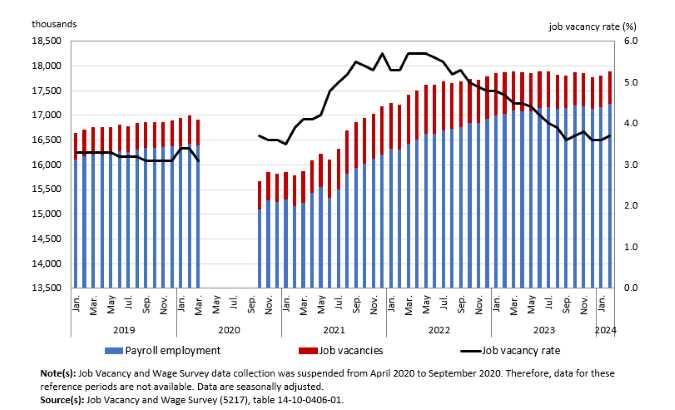

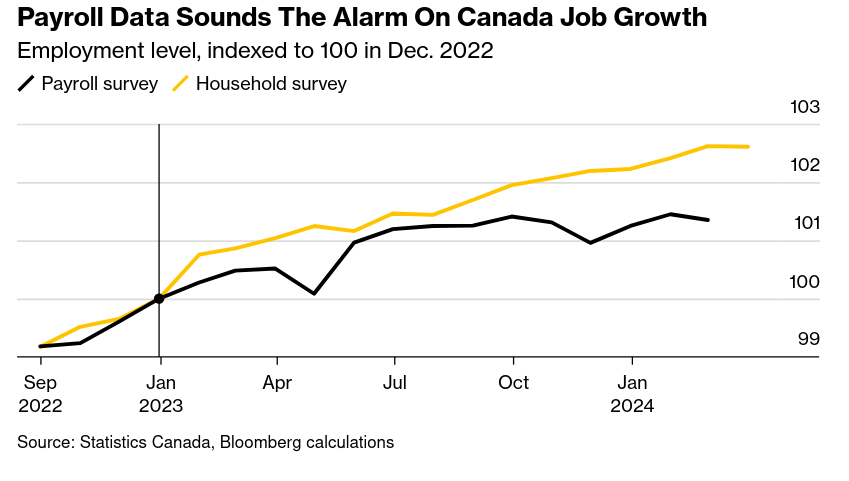

Canada employment data

- All the signs are negative, but the size of that negative is very very small.

- Number of hours: down .1%

- Food service payroll: down .8%

- Manufacturing payroll: down .6%

- Full service restaurant employment: down .9%

- Job vacancies for February: up 3.4%

- But, compared with February 2023, total job vacancies were down by 178,400 (-21.4%)

- Average weekly earnings: up .5% to $1,232.00 in February.

- Labour demand: -1% from Feb 2023

All signs point to a struggling economy for workers as their labour power declines and there are no major increases in high-quality jobs.

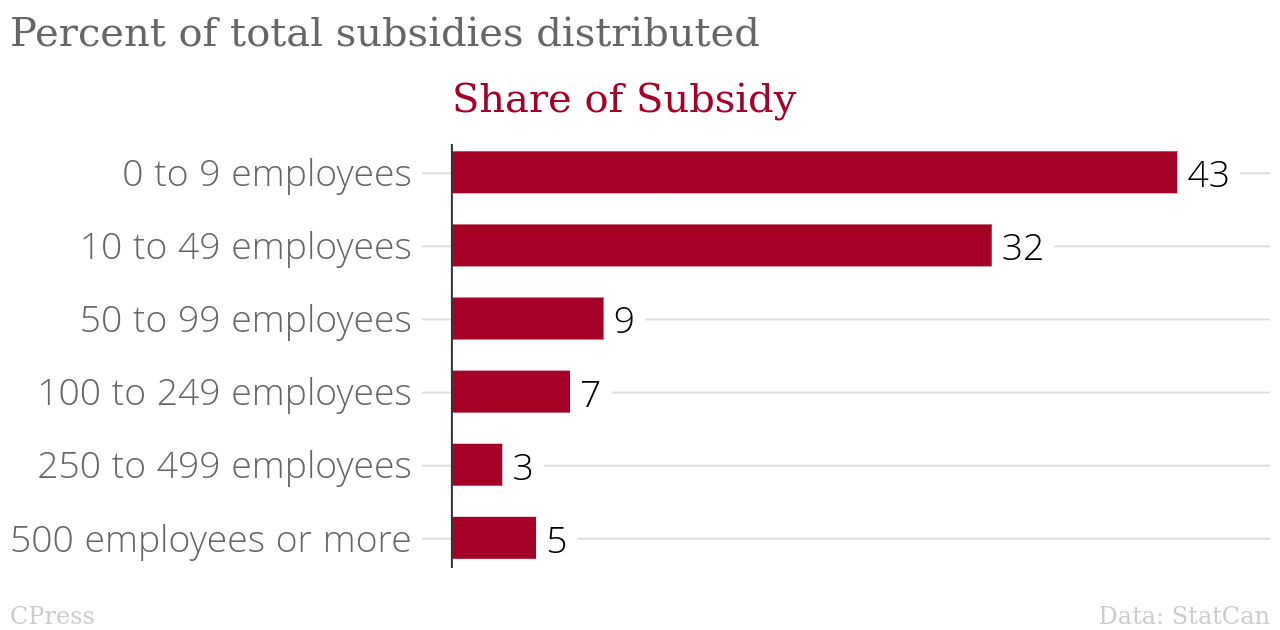

Research funding support

Canada has been spending a lot (incorrectly) for a while now on business innovation and growth supports (BIGS). BIGS is a funding program to support private-sector research and development, so called "innovation".

The issue is that the Canadian government thinks that profit subsidies are the best way to do this.

Statistics Canada released a study into the effect of this spending on the desired outcomes (i.e., more R&D spending and increased profits).

They broadly show that the support did not achieve the desired outcomes. No shock there to anyone who has been paying attention.

The findings are a little underwhelming:

- profit subsidies likely supported firm revenue and employment

- profit subsidies had a negative impact on general profit generation through covid. (i.e., profit subsidies supported unprofitable firms through the pandemic)

- profit subsides have small impacts whether negative or positive.

- More profit subsidies went to firms who made stuff for the domestic market.

- American-owned firms did more actual R&D with the profit subsidy than Canadian-owned firms. This is also just a consequence of the type of firm owned by Americans.

_in_millions_of_dollars_chartbuilder.png)

Most of the profit subsidy has gone to smaller firms, also known as "start-ups". We used to call these firms "small businesses". Either way, they are firms known to fail way more often than succeed. They are also firms not really large enough to leverage these profit subsidies into anything meaningful in terms of production.

Most of the money has gone to manufacturing and "professional services". For manufacturing, those are the larger firms receiving the subsidy.

Part of the problem here is the policy expectation of profit subsidies attempting to drive innovation.

We know from previous studies in the USA and elsewhere that the best way to drive investment in new things is to provide firms clear and easy answers to questions of achieving increased profitability with new technology.

Such a program is outlined by publicly funded industrial research, like that which happens in the National Research Council or in ministries like Natural Resources Canada.

Giving firms who focus on making something money to invest in research and development to innovate processes they already implemented is generally pointless. Private firms are generally not full of researchers who can do things with this money, unless they are structured that way from the get go.

One of the reasons we see increased revenue, but not increased profits from Canadian firms who take these profits subsidies is that they grow fast because of the government subsidy, but likely faster than the market can deal with. Or, more, faster than they can deal with. The subsidy essentially drives unsustainable growth.

This is not surprising from a classical perspective of the economy. But, it sure surprises the heck out of orthodoxy economics policy makers.

The take home? Canada should stop giving money away as profit subsidies and instead fund the NRC and other industrial research programs, develop an industrial strategy, and help firms invest in desired production and reap the rewards of the corresponding productivity gains.

But, to do that, we would need a real investment program, not just a profit subsidy regime.