April 25, 2023

Energy News

Large energy companies are loath to create news headlines. Their goal is for no one to notice them or what they are doing.

The position of being out of the limelight stands at odds with the massive shift in investment and production of energy underway around the world. Not to mention some energy production's oversized impact on the history of the economy and climate.

In the USA, the hyperbolic named Inflation Reduction Act is driving a lot of talk of investment. The realities of the USA political system, however, mean that much of the actual activity is delayed.

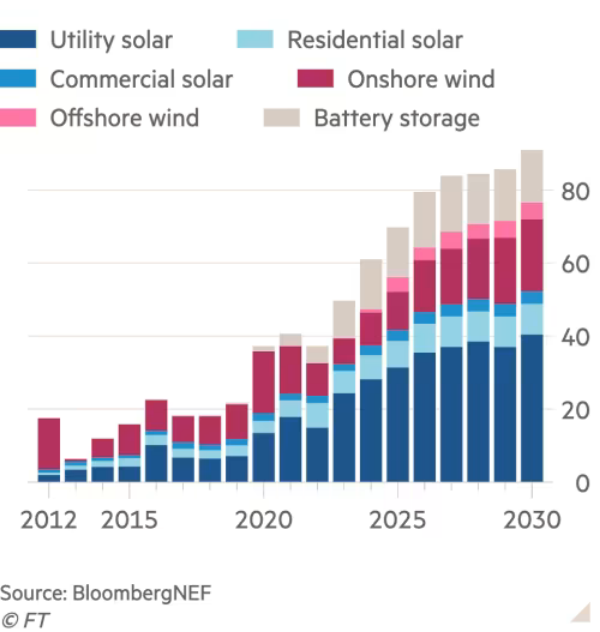

The numbers are large when measuring investment in private renewable installations—funded at least partly by the government:

- 600GW of solar, wind and energy storage by 2030.

However, many are saying that the IRA's investments will only come online well after 2025.

- onshore wind will fall 21 per cent this year to 2015 levels.

- 1,700GW of "clean" energy projects are in the pipeline to connect to electricity grids. A process that takes at least three years.

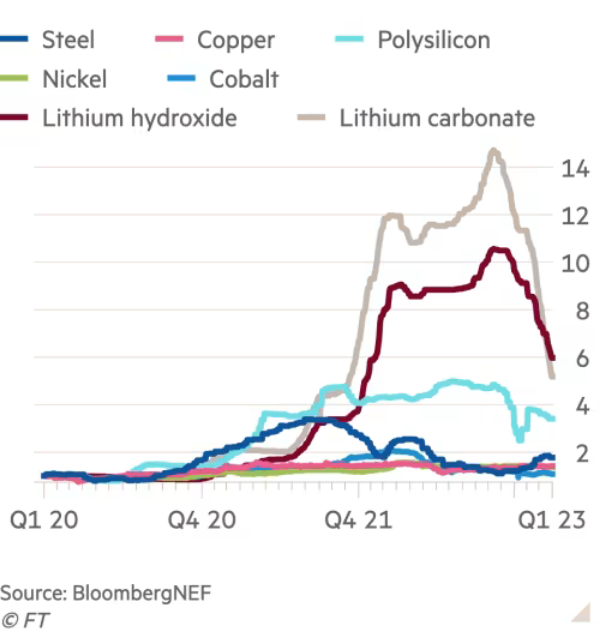

- Costs for solar and storage/batteries will continue to be expesive

- High prices and battles over tariffs on solar panels and their components continue to slow investment even with the massive subsidies.

- Adding to the slowing private investment is the fact that wind turbine technicians wages are up 29 per cent since 2020.

In the wake of all these numbers and the relative slowness of in the investment roll-out compared to political priorities, energy companies have united.

Oil companies and the oligopoly green energy companies have found common cause pushing governments to eliminate regulatory hurdles for new projects. These regulations are about managing the roll-out of new systems and making sure that they do not create problems in the energy market and undermine the policy goals. But, while their marketing might be different, all energy companies are backed by the same capital.

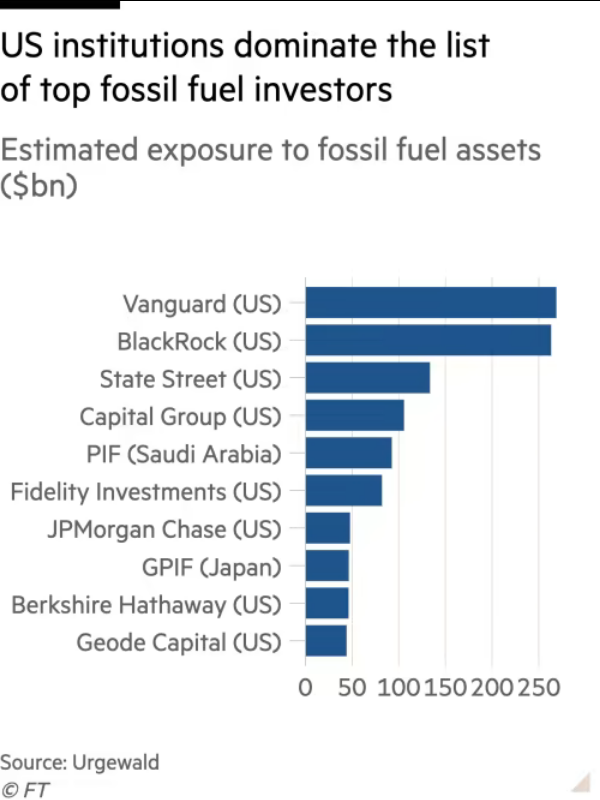

Private investment firms who own large sections of publicly traded energy companies own both sides. Even ones that pretend to be all about their climate investments.

BlackRock has positioned itself as one of the major proponents of ESG and touts its environmental credentials is still one of the largest investors in oil and gas.

And, if there is such a push to green energy, why do these companies continue to hold on to "legacy" energy companies?

Because the energy transition to "green" and "electricity" is limited by other pieces of infrastructure that need investment. Even in the USA where there is money flowing,

Academics at Princeton University say that unless the rate of transmission expansion is doubled from the current levels, the IRA could be as much as 80 per cent less effective in cutting emissions.

The same goes for oil and gas pipeline infrastructure. There is little public demand for expansion of long-distance transport infrastructure. Republicans and democrats are on the opposite side of the investment regime, but are likely to come together to expand both electricity and oil transportation infrastructure projects.

This leaves us with a large problem. Investment in production, waiving of regulation on transport, and extremely slow changes to use means little will change in terms of the total amount of CO2 released in the coming years.

The solution is to have a more integrated industrial power strategy, leveraging public assets and regulations on use. If we want to change the production mix from fossil fuels to green electricity, it will take more than market forces and bad politics.

Investment in changes to regulations on heating, charging stations, electricity generation, grid expansion (and local generation and storage), and the production of consumer and industrial-scale uses of green electricity is going to be necessary.

Toronto Transit Commission and Electric Buses

The government has announced money for the TTC to purchase fully electric buses.

- Ottawa to spend $349M while Toronto will contribute $351M for joint purchase

This announcement will be followed by an announcement of which company will be awarded the contract from the RFP.

As such, there was no announcement of which company will win the contract to deliver the electric buses.

In a recent study done by the TTC, New Flyer buses were the best all-around ebuses compare to BYD Canada, and Proterra options.

- New Flyer (in Manitoba) is unionized. BYD and Proterra are not.

- New Flyer is producing the electric version of their buses for the international market in a joint venture with Mitsubishi.

It is unclear to me who is in the RFP process right now. Novabus makes many of the hybrid buses currently being used by the TTC. It also is the base comparison used in the testing report linked above. However, they did not have any fully electric buses on offer during the study. I believe they do have an all electric bus either in production or available now. Novabus is the other unionized bus assembly, located in Quebec.

Funding will come from the Federal Government's Zero Emission Transit Fund and the City of Toronto.

The TTC's Green Bus Program includes the procurement of only zero-emission buses by 2024, with a target of having the whole fleet zero-emissions by 2040, which is aligned to the City of Toronto's Transform TO target of zero emissions by 2040.

The announcement of the electric buses comes after the announcement only last week (April 19) that the TTC was getting a new hybrid-electric buses delivery.

The hybrid-electric buses were also purchased using funding from the Federal Government's Zero Emission Transit Fund.

The original announcement of the contracts being awarded for the hybrid buses was in 2022.

Unifor represents employees at both employers supplying the hybrid buses:

- Nova Bus: member of the Volvo Group in Quebec (Unifor 1004)

- New Flyer: Manitoba (Unifor 3003)

From the TTC release:

In Feb. 2022, the TTC awarded contracts for 336 hybrid-electric buses to be delivered in 2023 and 2024 as follows:

- Nova Bus: 134 forty-foot hybrid-electric buses

- New Flyer Industries: 134 forty-foot hybrid-electric buses

- New Flyer Industries: 68 sixty-foot hybrid-electric buses With this procurement, one third of the TTC’s bus fleet will be made up of low or zero-emissions buses by mid-2024. This is the final hybrid-electric bus procurement before the TTC transitions to eBus-only vehicle purchases moving forward.