April 22, 2022

Earth Day Today

- Too bad it will do nothing to help stop the coming climate catastrophe.

Tech Stocks and Cheap Debt

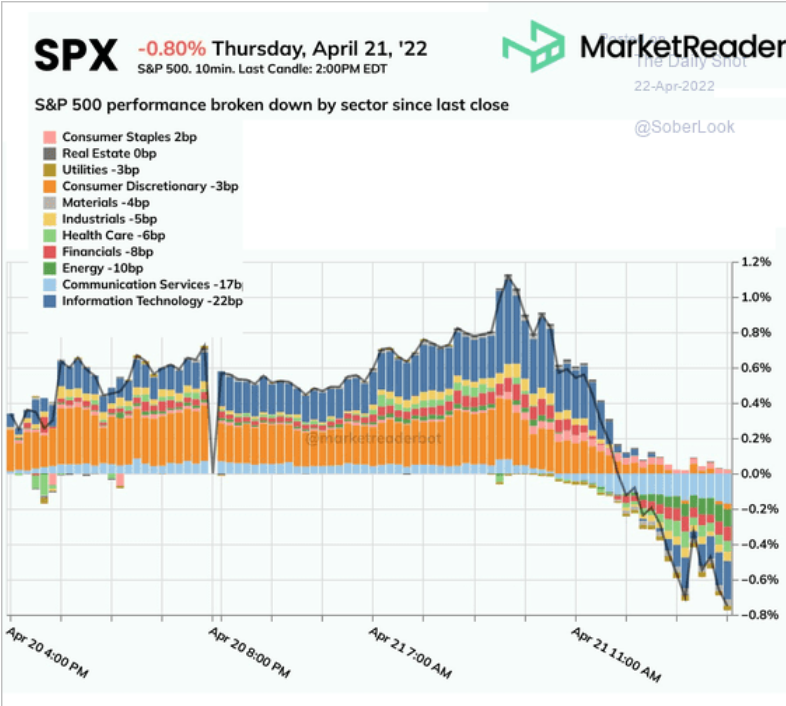

- Central Bank interest rates are going up faster than previously announced as inflation continue to outstrip (orthodox economist) consensus estimates.

- Bloomberg News: "Treasuries tumbled after Jerome Powell commented on the merits of "front-end loading" policy moves. Nomura now expects the Fed to lift rates by 75 bps at both its June and July meetings, following up on an expected 50 bps in May."

- Everything is down, which is not surprising.

Unhedged at the FT has a interesting analysis of Netflix:

- Tech Stocks, many of which are essentially zombie companies by design (they spend more on sustaining themselves than they take in), didn't take the announcements of interest rate rises that well.

- So, to clarify the Netflix issue, suddenly Netflix is reclassified as a "not a Tech company". Which is funny as funny gets given its position in "FANG" and now FAANM".

The argument goes:

- Tech companies are great investments because they “scale”. While the product (software, web searches, social network) may be expensive or tricky to set up, the marginal cost of adding new users/customers/revenue is extremely low, so when the companies get big, everyone makes tons of money.

- The most penetrating criticism of Netflix’s business is that it does not really scale. To grow, it has to keep adding new shows and movies, and these are expensive, creating strain on the balance sheet. Netflix is a media company, not a tech company. And the people who have been making this point did, in a sense, see the Netflix mess coming.

- The main point is that Netflix – like every company – borrows to invest but then claims that it is only what it pays out on that debt every year as "expenditures". So, it borrows $100M to do a new show, but then pays that back over 10 years so claims it is only spending $10M this year (per year over ten years) on that show.

- The problem – they say – is that Netflix isn't building infrastructure (inorganic captial) that produces commodities. So, the original loss is followed by more loses every year. The only thing that keeps this profit train moving is growth in new subscribers. When that stopped, there was nothing built that could keep growing as fast as their debt payment needs.

- However, there is a problem with this analysis. Every single company is like this: companies will make profit so long as they grow fast enough to outpace their growth investment needs. But, as Marx pointed out, there is a declining rate of profit on capital investments. Just because it happened to Netflix faster (because they are highly leveraged) doesn't make it different.

As Unhedged pointed out, Amazon looks exactly the same as Netflix on paper. The difference they say is they are borrowing to expand "increasingly efficient production". To this I say, sure, until they cannot, then the same thing happens. It isn't like there is much more productivity that can be squeezed out of an Amazon warehouse.

As an aside, there is debate around this on the Left because we want the government to be able to do the same thing. The fact that it is not allowed to means that there is a built in incentive for privatization (through things like P3 infrastructure). This is because the "rent" on infrastructure looks cheaper than owning it – but, like Netflix, it is just an accounting trick.

China, USA mid-terms, supply chains, and negotiations

- The incessant attacks on China for daring to put their population ahead of USA consumer-driven economic activity have been tiring.

- The latest is that it will take 3 months for the supply shock to meet the shores of the USA, meaning the summer-fall is going to be rather terrible for consumer goods. Just in time for the USA mid-term elections.

- Dockworkers that are set to start negotiations on May 12 ahead of the current contract expiration on July 1.

- Labour power of West Coast dockworkers is growing for this round.

It takes an average of 111 days for goods to reach a warehouse in the U.S. from factories in Asia, the longest travel time since mid-February and more than double the trip in 2019, according to San Francisco-based freight-forwarder Flexport Inc.

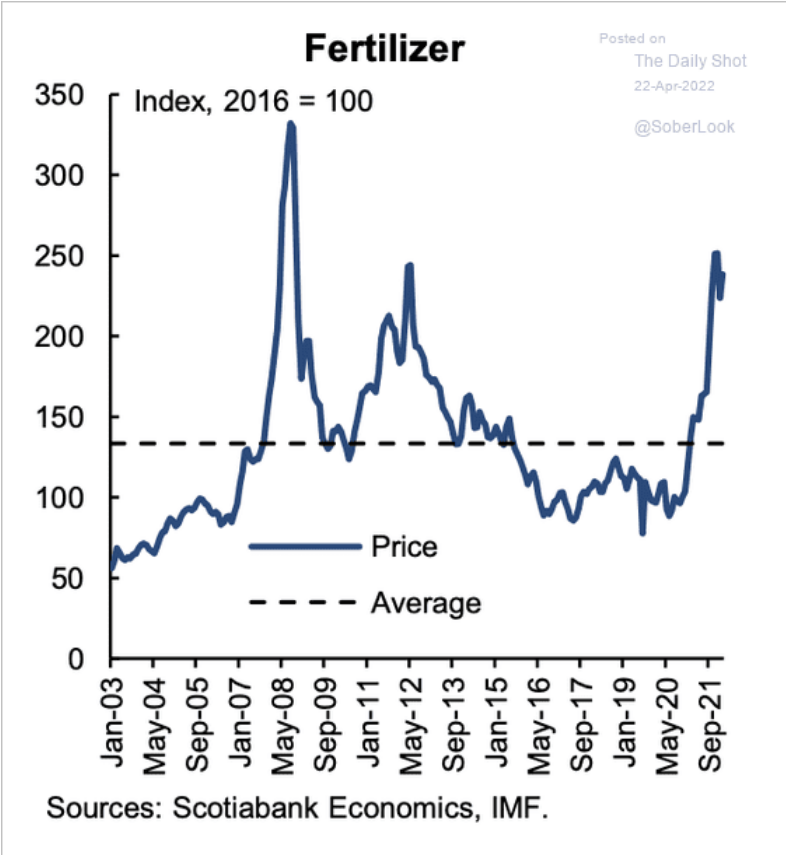

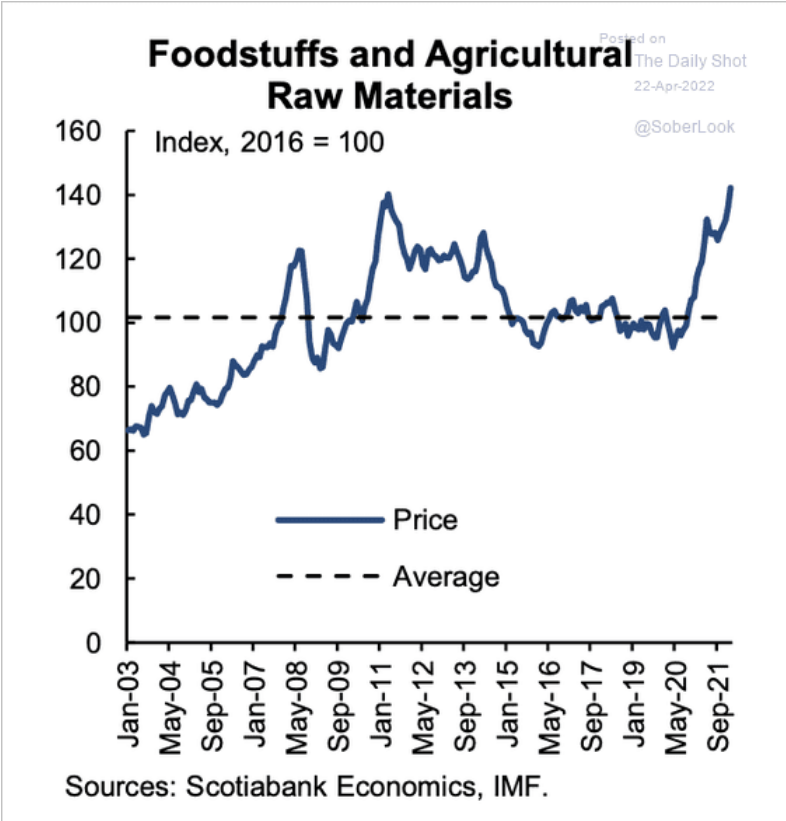

Food costs are not going to come down quickly

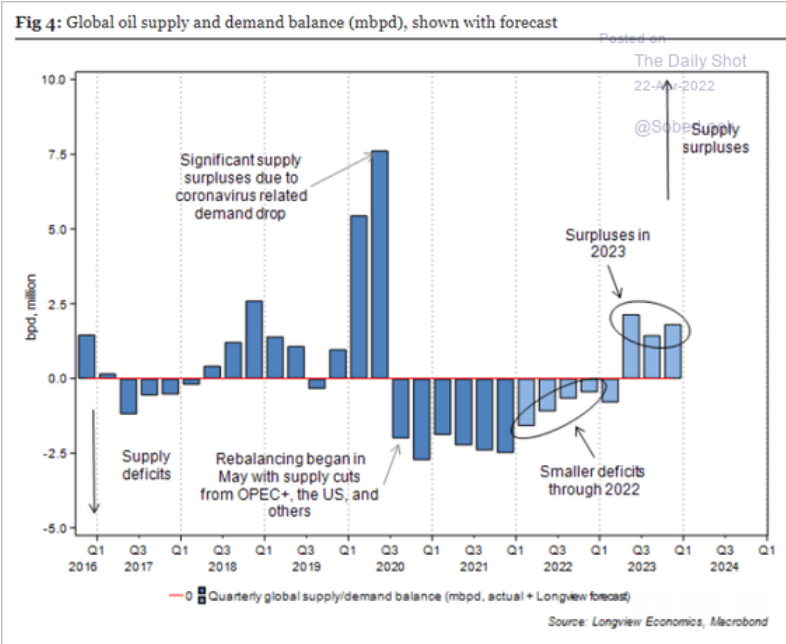

But, fuel costs will come down now that there looks to be a growing glut.