April 20, 2022

Canada Inflation Rate

- 12-month change: 6.7%

- StatCan Daily link

- Seasonally adjusted CPI month-over-month was 0.9% – that's an increase people should be looking at.

That is very high.

- The 12-month change for Ontario was 7% in March. Provincial CPI isn't inflation, but it does show where we are in the Canadian context, just higher than the middle. Kind of where you would expect Ontario to be.

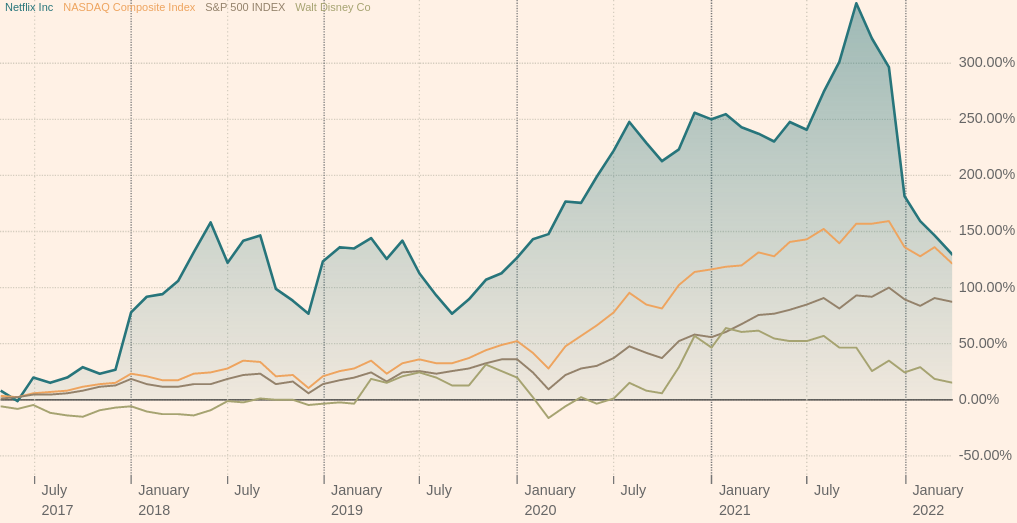

Netflix fall exposes the truth: it isn't worth that much

- If you don't grow, you fall.

- $42B wiped-out with 25% drop in stock price before Wall Street opens trading.

- So, not so much value as price.

- Video streaming platform plans ad-supported service and clampdown on password sharing.

- Basically, it will become TV.

Streaming services that sought to replace TV were thought to be "monopolies", but they do not set prices irrespective of their costs or competition, nor do they set their profit rate. Uber has seen similar collapses in trading price as people look at the price of the debt that keeps these companies liquid.

- That said, don't go rushing to Disney, it's share price has been on decline too. The growth model of tech investment and free money may be coming to an end.

Sweedish Trade Unions abandon politics on NATO?

- Sweeden's Social Democrats and the trade unions have historically supported the neutrality position with NATO. The position is based on understanding what NATO actually is, as opposed to the current weird narrative.

- However, there has been a shift because of effective war propaganda (on both sides) to live in fear of Russian aggression and to think that NATO can protect non-aligned countries.

- Much like climate change, the problem is not the current situation, it is the inevitable future we are trying avoid that is the problem.

Analysts said it was therefore highly significant that Aftonbladet, a tabloid partly owned by the trade union movement and seen as the house newspaper of the Social Democrats, published an editorial on Wednesday recommending Sweden join Nato.

An opinion poll, also published in Aftonbladet on Wednesday, showed 57 per cent of Swedes were in favour of Nato membership and only 21 per cent against. Strikingly, it found for the first time a plurality of Social Democrats backing membership, with 41 per cent in favour and 25 per cent against.

Aftonbladet on Wednesday Lindberg wrote: “I do not see how being militarily non-aligned is sufficient if Russia acts as it does today against equally non-aligned Ukraine. I do not think that Russia intends to stop there, so the Russian rhetoric has to be taken seriously.”

- The question is, will they feel the same way when the bill comes due.

Childcare and labour markets

-

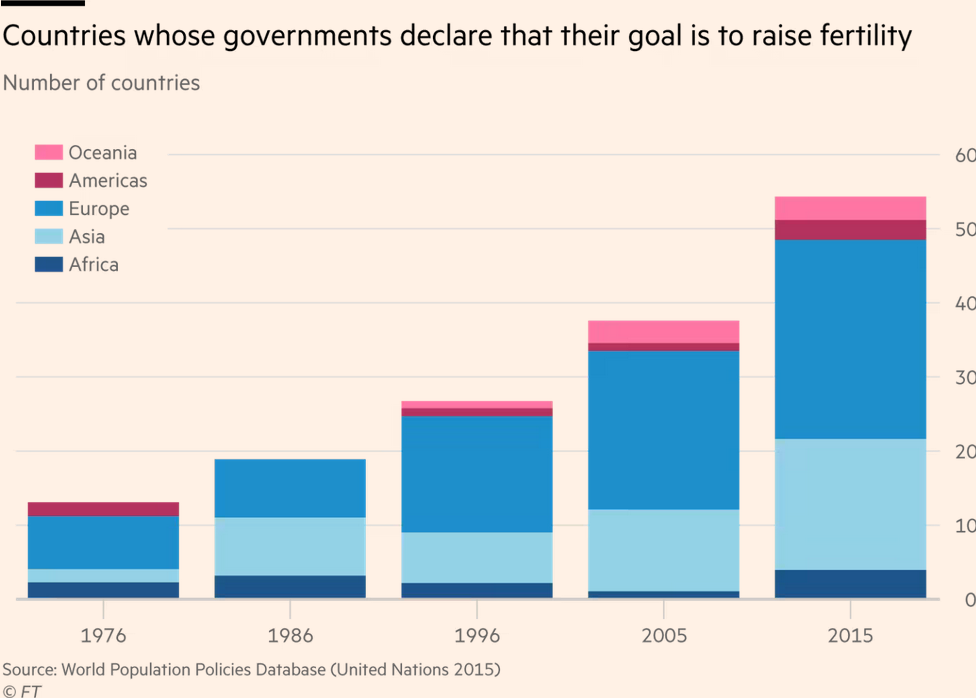

Labour markets are tightening, which is driving renewed talk of both:

- Having more children (so we do not have a "natural" crunch in labour supply in the future).

- Providing childcare so women can go into the workforce (so we can increase the labour supply now).

- Obviously, supporting childcare on the left has similar ambitions and we will take policies that introduce social supports for women, but one should not confuse the policy frame from the neoclassical/neoliberal model and the desires of equality on the left.

- Neoclassical/neoliberal economics is not about equality, it is about responding to the labour needs of capital. The result now is more women into jobs, but not if it costs more than the gain in unemployment.

- This makes The Liberal Party's "feminism" transitory, and their supports for childcare is attached to the private market because of this.

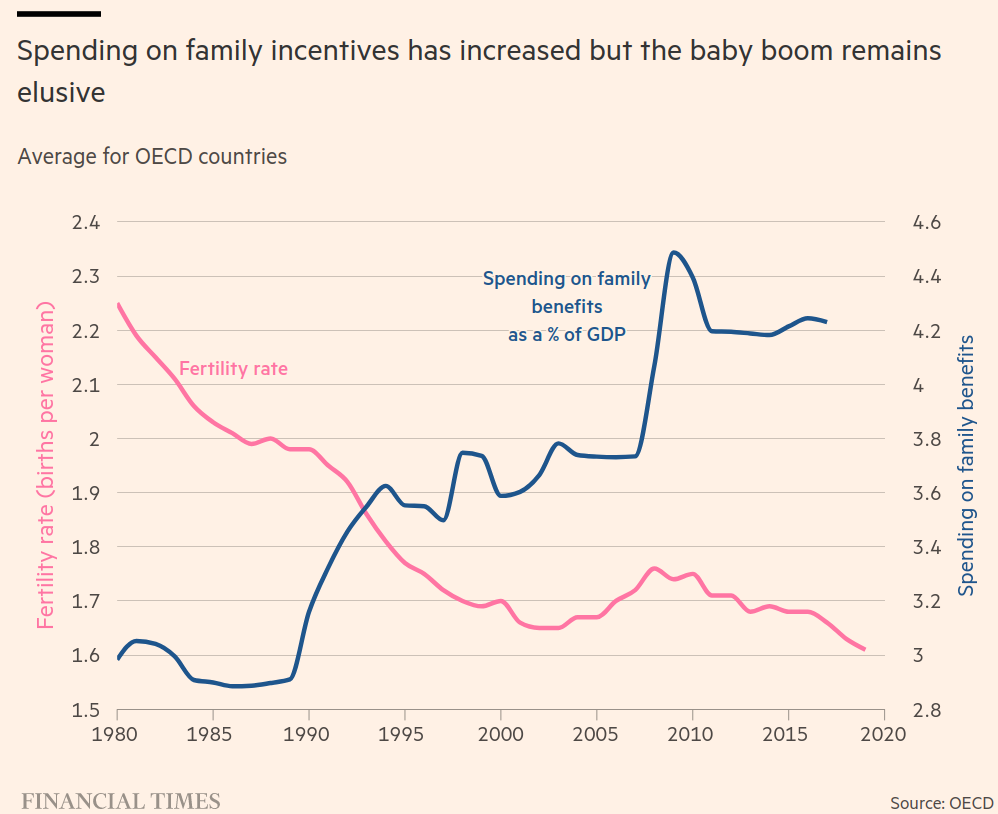

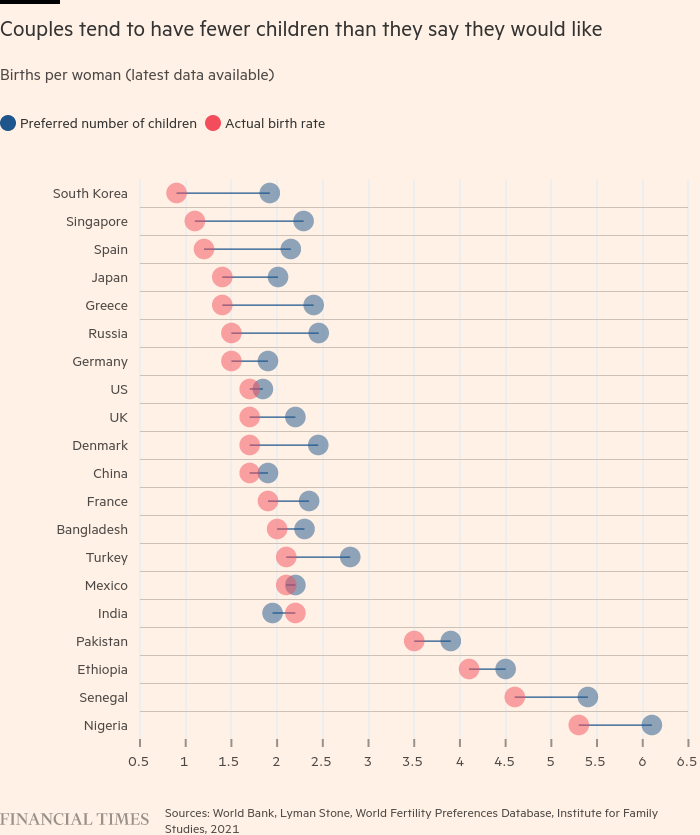

- "Fertility rates" (actually, the number of children women choose to have), and real cost increases of children are directly inversely related under modern capitalism.

- Current public spending on benefits have grown substantially in an attempt to counteract this issue, but it has not kept up with real costs of supporting children.

Masks, pandemics, and politics

- Stocks rallied in response to the dropping of the mask mandate. Of course.

- The USA's retraction of its mask mandate for travel is the latest sign that the country is well into the new Dark Ages of political propaganda over science.

- Short-term political gains have wiped out climate issues, good economic policy (even within the capitalist frame), and health measures that protect its population.

- This is nothing new for the USA, which is built on a false premise, but rather shocking that the institutions have turned so violently against their own citizens.

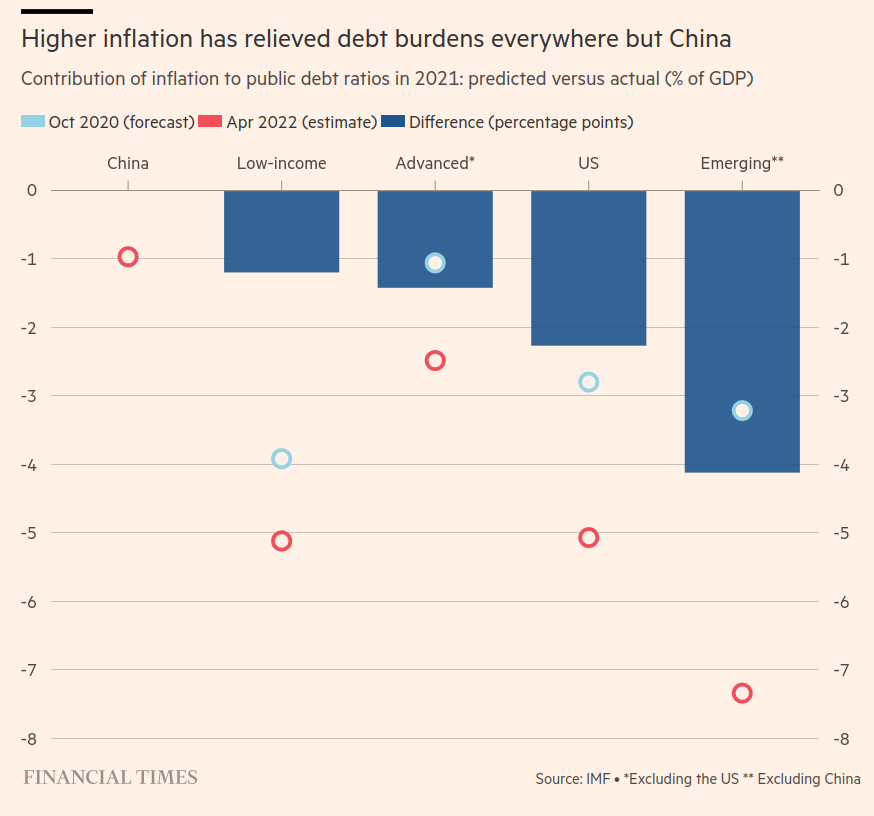

Inflation-related growth helping public finances not going to appear: IMF

- The IMF – along with most economic think tanks – are marking down the expected growth rates for the world. Bear in mind that the IMF is always too optimistic about growth.

- Some people think that inflation is good for public finances.

- The IMF have told these folks that they do not know what they are talking about.

- The new report warns that the surge in prices will not produce any long-term improvement in public finances.

- Price increases bring in more money for governments as their tax brings in more revenue. However, real prices increases affect governments as much as any other institution.

- The argument is that increasing inflation reduces the Debt to GDP ratio, resulting from the depreciation of the value of the "money" owed.

- However, this will be balanced out by higher interest rates in the future.

- It is almost a classical analysis coming from the IMF, except they have forgotten that governments also tax production, which is being negatively affected. They also think that it is a good policy to slow the economy (while ignoring the explicit impact of a slowing economy).

- Revenue, Expenses, and the price of debt are all necessary to take into account. And, when you do, there is little medium term benefit to the state from increasing inflation.

- For those not convinced, think about how inflation can be caused by printing too much money. If above a certain level of inflation was always good, why would there be a internal break on that practice?

- The market is also ignoring the current situation's impact on the future. Real yields of 10 year USA Treasuries (longer-term debt prices for the government) are growing into near positive territory as rates rise, but both bond traders and stock investors are not pricing-in a recession next year – yet.

- This could mean that the equity markets do not think that there will be a recession. Or, they think that the bank will return to giving them money.

- It is probably the latter.

Data point to Russia avoiding the worst economic consequences

- The worst predictions from the West have not materialized in Russia.

- But, it's economy is still doing very poorly.

- Capital controls work over the short-term, but it is unclear how long the state can avoid the inevitable drag on their economy from hitting consumers.