April 19, 2023

PSAC on strike

![]()

155,000 workers are on strike. Probably the largest walkout in Canadian history.

Make no mistake, this is a strike against Capital and their nonsensical neoclassical ideology. The government thinks that by impoverishing federal public sector workers it is somehow fighting inflation.

We know the narrative that public sector workers' wage increases do not cause inflation. Folks need to make sure that the proper analysis is out there and our leadership is pushing back against any such sentiment.

If the government wants to deal with inflation, it should reduce profit subsidies and re-direct that money to workers.

Join a picket line today:

Reglobalization?

You will see the "word" reglobalization printed around the policy and economic internet.

What does it purport to mean? Even though capital is in the process of completely reorganizing supply chains in response to geopolitical conflict, they want you to know that they have not abandoned globalization.

Of course, the opposite is true. Globalization was the process of using trade to exploit developing countries no matter what their government structure was like. Even though no one really believes in it, policy makers would say things like "globalization and capitalism naturally brings democracy and raises standards of living". The idea being that markets are synonymous with democracy and freedom.

The previous 50 years have put the lie to any notion that an expansive capitalism is good for anyone except capital. Indeed, most of the global exit of poverty has been in spite of capitalist markets, not because of it.

The myth must live on however. So, the main focus is to convince the population that reglobalization (post-Trump and Brexit) is the way forward.

Friendshoring? Yes, that too is reglobalization. Maybe even de-re-globalization.

Or, maybe—hear me out here—just maybe, it is just capital doing what it does best: finding the cheapest pool of labour, the cheapest regulatory standards, and the largest tax-funded profits subsidies and investing in production there?

Here is how Bloomberg has put it:

“Reglobalization.” Why? Because the world isn’t deglobalizing: trade is as essential as ever to the world economy. The supply chains that bottlenecked during the first years of the pandemic aren’t being dismantled, they’re being reengineered for resiliency.

Yes, resiliency! Surely a system that brought us to the brink of a collapsed supply chain system during the pandemic will now, magically and without intervention, result in greater resiliency.

I think not.

What we are seeing is a fight over scarcity of resources to get all the money (which we gave to capital) to invest where we want it to. Capital is not obliging. Investment is down and financial markets are still providing greater returns than productive capacity development.

The only places we are seeing major investments is where the state is providing huge incentives to both build and promises to buy their products.

We gave all our money to capital, now we are borrowing to give them more. And, workers are paying for it through wage suppression, inflation, and a suite of policies that have forgotten that we are still fighting climate change.

Here is the EU reglobalizing:

EU also has proposed a Critical Raw Materials Act to safeguard supplies in strategic areas such as carbon reduction, digitization, aerospace and defense.

Inflation in Canada

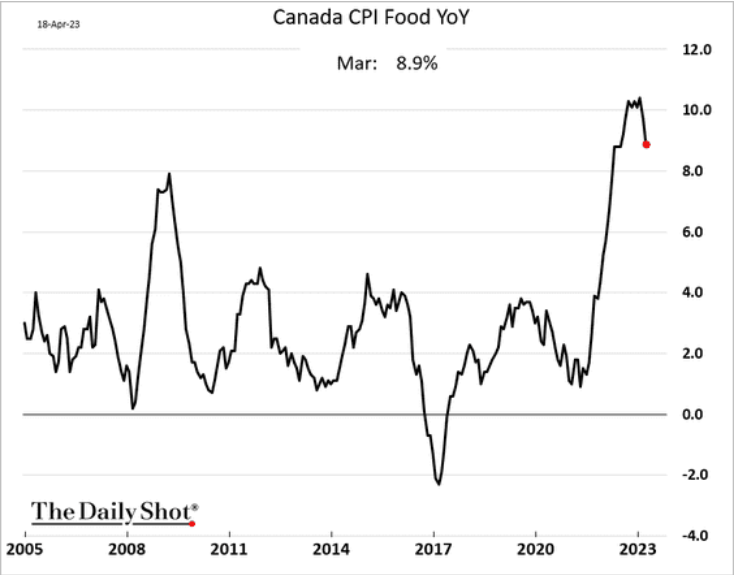

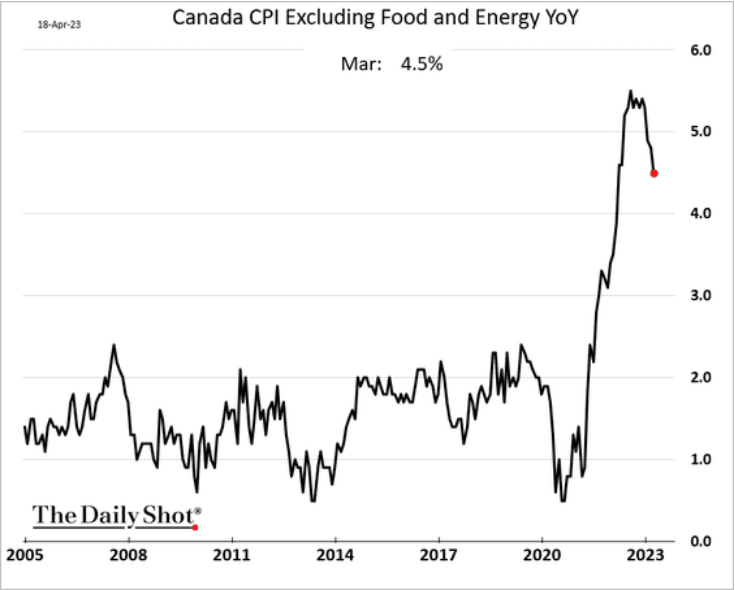

While headline inflation came down as of metrics released yesterday, the government is going to be pointing to "services" inflation in their response to PSAC.

These measures are not, as is being reported, caused by high wages. Services inflation is mainly caused by the price of fix (inorganic) capital costs and the price of food.

All of those fixed capital costs have gone up because of the previous year of high inflation.

Food will continue to grow in cost as we have not responded to the climate crisis' or the worker issues' effects on food production.

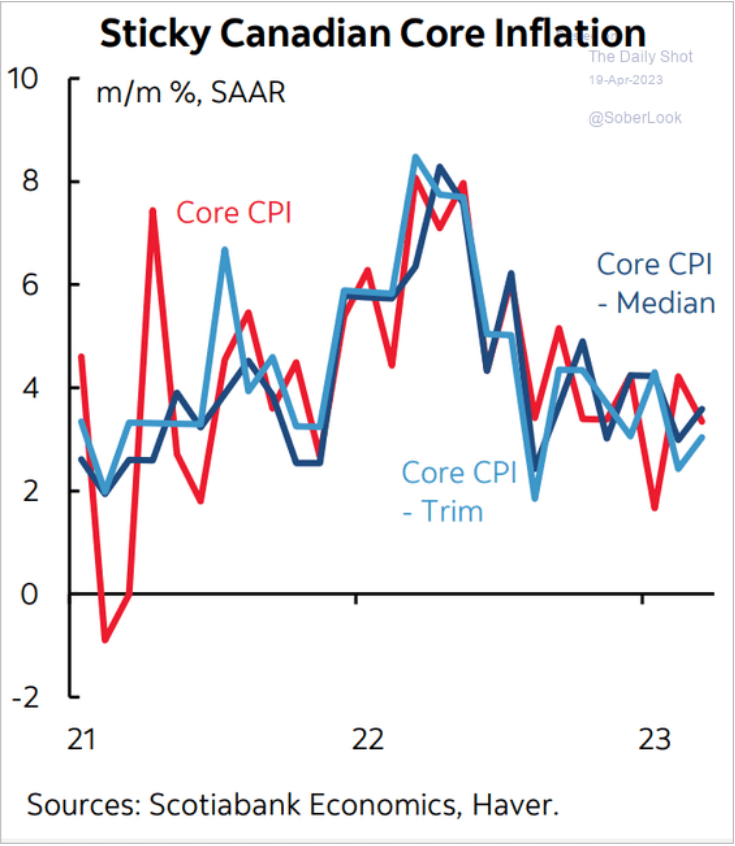

Scotiabank released this graph which is a better visual of how cost increases are not going anywhere.

The increased costs of goods and services is not a one-to-one relationship. Goods that were expensive previously (when they were purchased) are even more expensive to pay off because of higher interest rates. It is natural that those high costs we saw last year are now being seen in the costs of "services" this year (and likely next year).

If there is a recession, the prices will come down as businesses destroy borrowed money and value creation by going bankrupt. Of course, this is not exactly the progressive way to deal with high costs and inflation.