April 19, 2022

Cyber war

- NATO is organizing and training state-directed "hackers" (called "Locked Shields" – worst name ever)

- Ukraine is engaged in direct cuber offensive against Russian targets

- The US is fully engaged in cyber defences

- Mostly, the focus involves protecting banks.

More oil, more coal, more gas, less future

- The US is "trying" to get off oil by drilling more, exporting more, and using more oil and gas.

Halliburton’s profits rose sharply in the first quarter as soaring crude prices in the wake of Russia’s invasion of Ukraine spurred strong demand for the oilfield services firm’s drilling equipment.

The company reported first-quarter profits of $294mn after impairment charges triggered by the war, up from $170mn in the same period last year. That was just shy of analyst estimates of $311mn, according to data compiled by S&P Capital IQ.

Halliburton’s first-quarter revenue was $4.3bn, up from $3.4bn in the same quarter last year.

… has seen its stock surge 72 per cent so far this year, to their highest level since 2018.

- China has moved to expand its oil and gas sector in response to the sanctions on Russia, the need to reduce imports, and the variability of global prices.

- China has basically stopped trading in carbon credits as coal becomes cheaper and reliance on fossil fuels around the world increase.

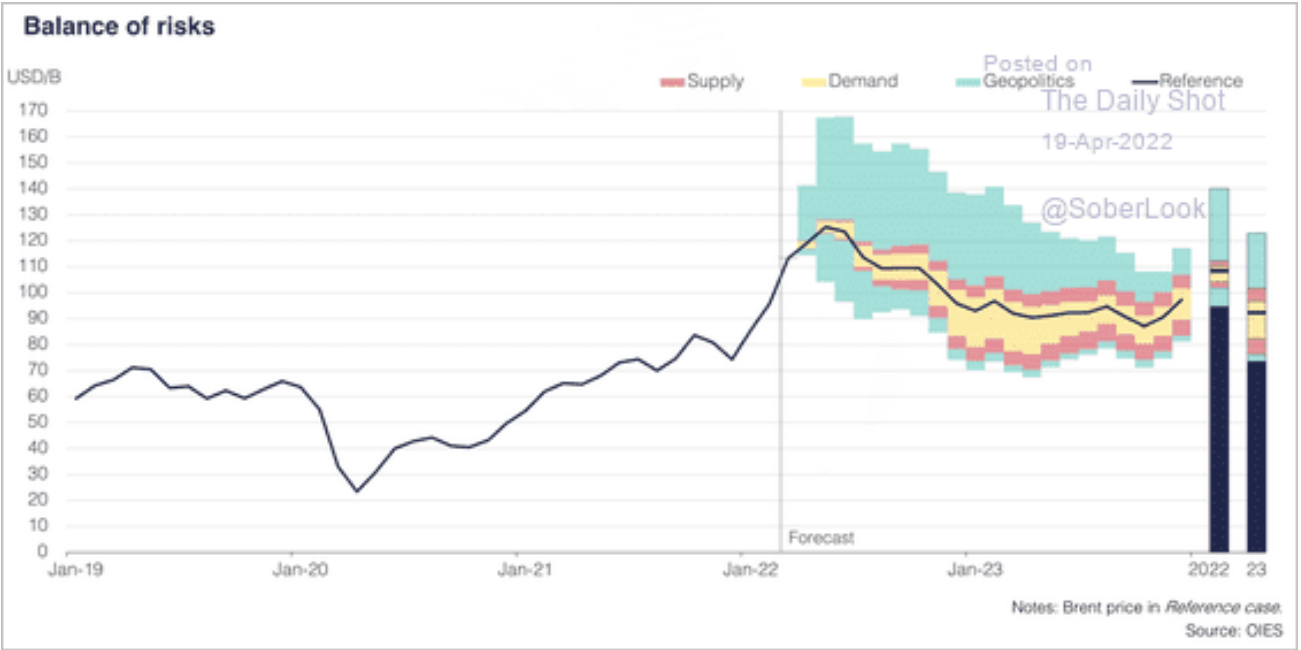

- Oil is predicted to be sustained at a higher price for longer.

- All of the oil activity is in response to a prediction that future oil needs will increase as the economy "comes back to life".

- However, overall fossil fuel prices will drop as production over-estimates demand.

- At the same time, there is growing concern that prices for consumers of energy will go up as we go into the fall in places like the UK.

“I’m hugely concerned for people,” he said. “There are a lot of people for the first time facing this issue; they’ve never been in this position before.”

Rising wholesale prices for gas and electricity last year prompted Ofgem, the regulator, to raise the energy price cap 54 per cent from £1,277 for those households with average gas and electricity usage to £1,971 from April.

- As per usual, the market delivers the very opposite of what we all need.

- Not falling:

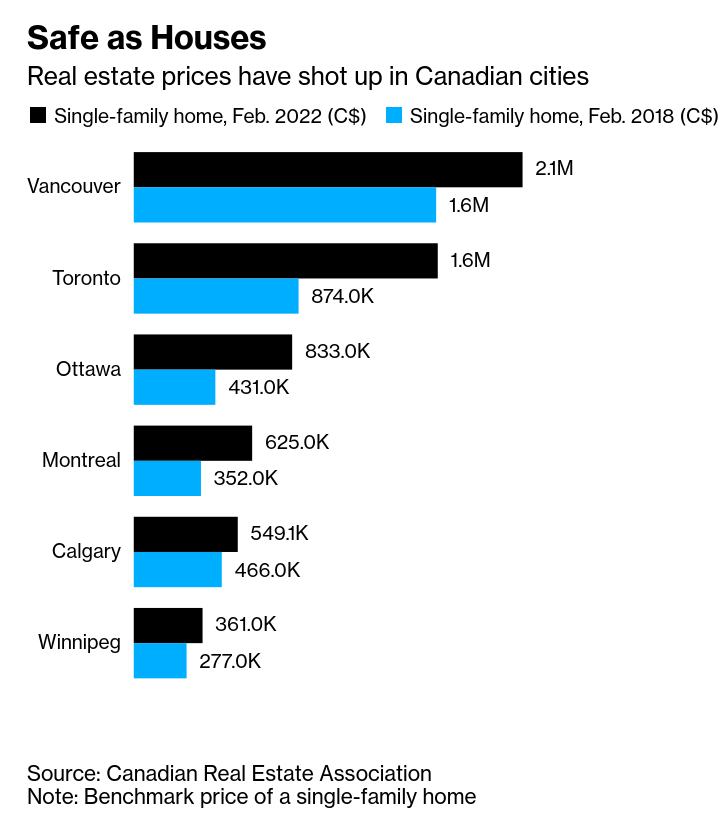

Housing and misunderstanding labour markets

- Canada wants to build more affordable homes. And, colleges is being tied to industry to train people to become trades workers.

- However, this is not how a labour market works. All training new construction workers does is reduce the wages of those workers.

- Behind the scenes is a plan to import construction-related labour to drive down wage costs.

- Investment must come in the way of actually building new homes, not trying to tease "markets" into wanting to build.

- Profits drive investment and while reducing wages is one way to drive profits generally, it is not a very good way of targeting one sector.

- It is the price of debt keeps houses from being built by the private sector – because people cannot afford to buy. So, the only people building are investors, which does not drive new housing stock, it just makes housing more expensive.

Recessionary Inflationary Growth

The IMF’s forecasts showed global growth of gross domestic product this year of 3.6 per cent, down 0.8 percentage points since the fund’s January projections and 1.3 percentage points lower compared with six months ago. In 2021, global growth was estimated at 6.1 per cent, the fund said.

- The financial markets are both optimistic and depressed.

- As interest rates rise, there is a lot of trading that will have to happen to set new normals. This means more bank profits (as many are making more money on their trading arms than on their regular banking/debt revenue arms.)

- Most small companies are seeing their earnings growth (and therefore profit growth) falling.

- Large companies that did not move all their production off-shore are seeing investment. However, they can only grow as fast as their slowest production part.

- Capitalist finance tends to forget the rest of the world when investing – but, the rest of the world is where most inputs come from.

- Inflation is affecting employment and demand around the world – which is the flip-side of supply.

- Food price inflation is going to affect production in many parts of the world.

- Increasing interest rates will also dig into profit expectations, reducing investment in supply. This is what it is supposed to do, but the impact is not positive for workers as they lose their jobs and cannot afford to buy necessities.

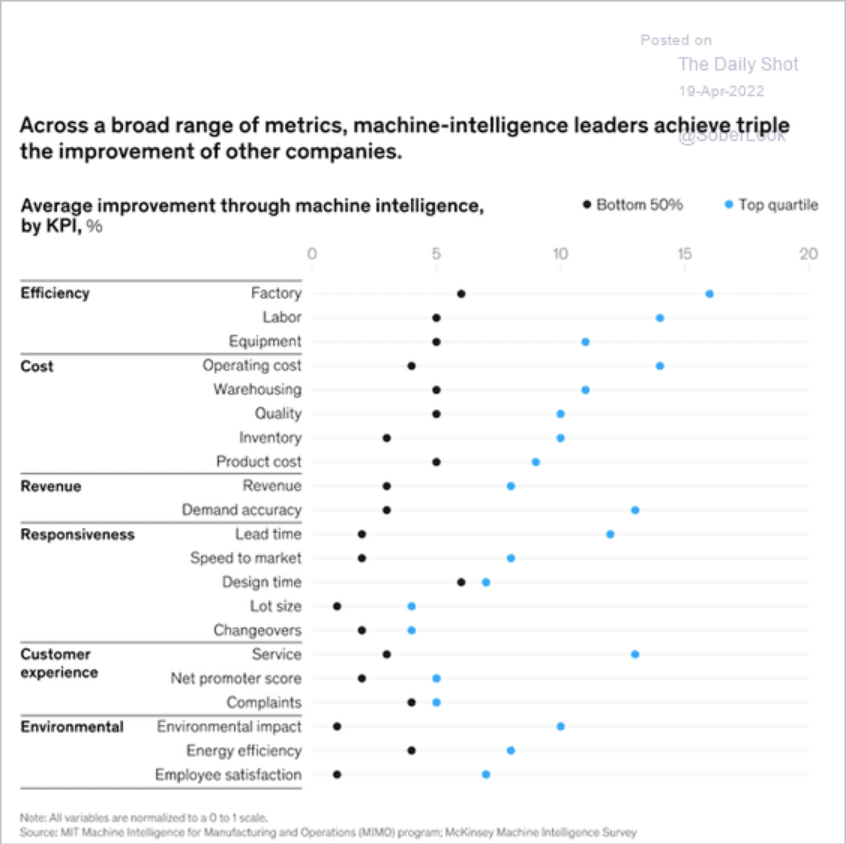

- Governments are trying to counteract this increase in inflation by driving the normal market response to inflation and increased wage share: drive up productivity by increasing the Organic Composition of Capital. (Notice all the money for "technology" in government budgets).

- The goal is to have real wages rise slower than the productivity rates – hoping that workers do not notice their share of profits is further reduced.

- Prices increases and general inflation are caused by similar issues, but are different things. Prices can go up without it being caused by inflation (if it is a "supply shock") as they likely will come back down. Inflation will drive prices up, but they are unlikely to come back down without some very nasty results in the economy.

- The debate continues to rage about the ratio of each mechanism we are seeing right now.

Machine Learning implementation and OCC

- For a better look at the role of organic composition of capital and where productivity leads to increased profits (over workers), look to Machine Learning implementations.

- Increasing the use of automated data and processes is about replacing higher-skilled (and more expensive) workers with outsourced digital services and those who train ML.

- Higher wage share = lower profits = More ML workers being trained = more growth of OCC = higher productivity = lower wage share for workers.

- Capitalism will move re-establish normal unemployment rates through replacing workers with machines.

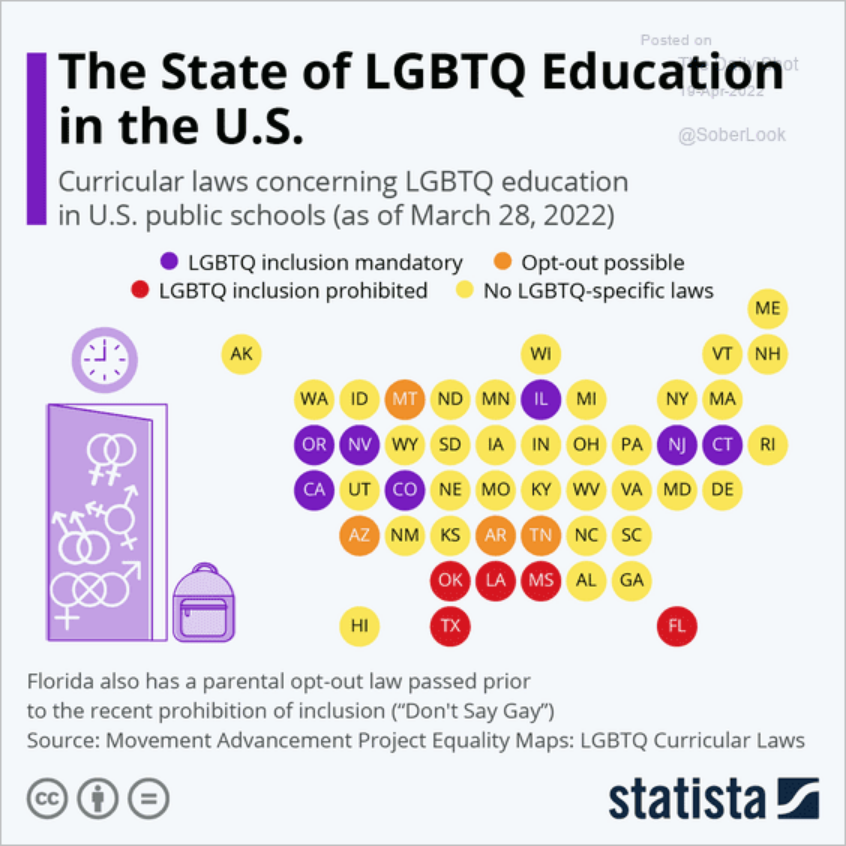

The US is diverging on LGBTQ politics in K-12

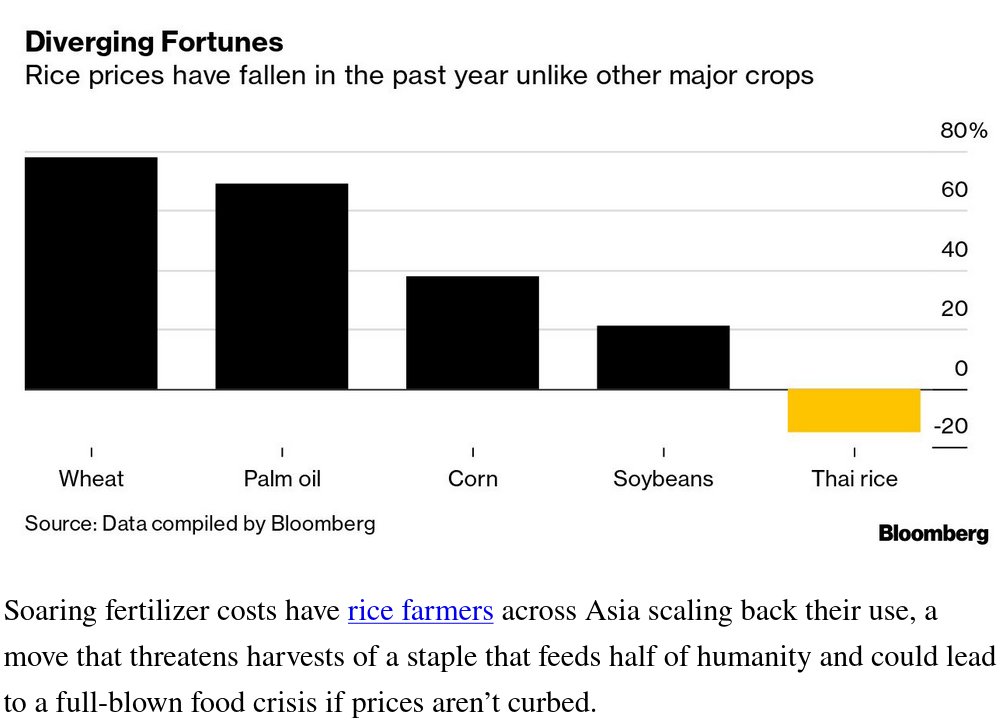

Rice

Brazil’s Central Bank Worker Strike

- Public servants demanding salary increases to offset inflation

- Wages are part of price indexation issue affecting Brazil

Employees of Brazil’s central bank and the economy ministry, including the internal revenue system, have been on strike or staging work stoppages for three weeks now, delaying customs operations, budget plans and key statistical data. On Monday, a widely-watched economic survey with forecasts from more than 100 analysts went unpublished for a third consecutive week.

Average real wages have fallen 8.8% since the beginning of the pandemic, according to official data.

And now even the federal police, a key base of support for Bolsonaro, said it’s unhappy with the planned 5% increase, and demanded a career restructuring once promised by the president, which would entail higher salaries.

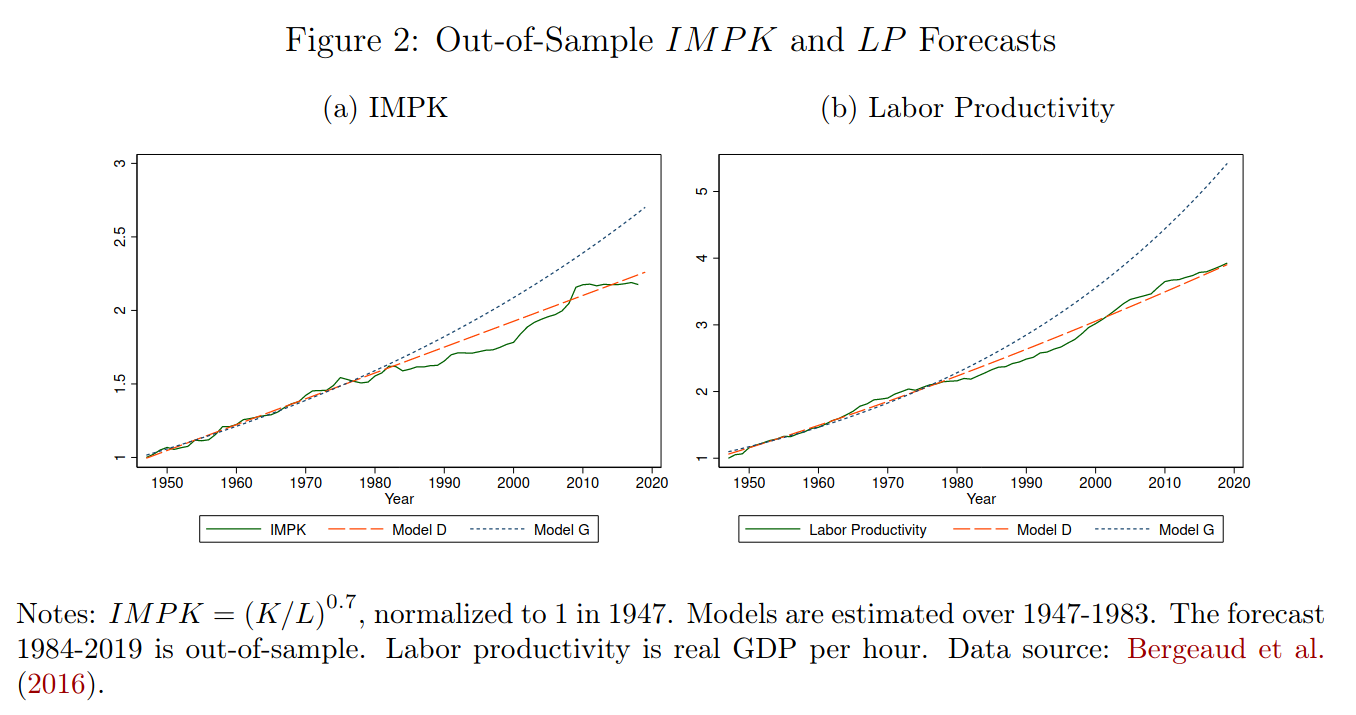

Neoclassical economists realize they are wrong, again, on productivity

Turns out neoclassical models of productivity growth (which are based on magic and hand waving) have been wrong all this time.

Productivity grows – as we would expect in Marxist economics – linearly, not exponentially. All that pushing on the string of funding "productivity" technology does not push things much out of this general trend.

https://www.nber.org/system/files/working_papers/w29950/w29950.pdf