April 17, 2024

Tariffs and free trade

In the supposed home of free trade ideology, tariffs are king.

US President Joe Biden is pushing for tariffs to triple on Chinese steel and aluminium, as he seeks to boost union support in the swing state of Pennsylvania.

In a meeting with United Steelworkers union members in Pittsburgh on Wednesday, Biden will call on trade representative Katherine Tai to triple the tariff on the imports from the current average of 7.5 per cent.(FT)

This is all about unfair (read: whenever the USA isn't winning) competition.

In response to the unfair competition, the USA government is launching probes, commissions, and studies into "exposing" how the Chinese state has supported their production through "unfair" state-lead industrial practices. Practices like investing in unprofitable parts of the supply chain so that their industries do not have to be reliant on expensive imports.

This is important part here is the word "expensive". Chinese production is cheaper in almost every way compared to the rest of the world. Lower prices and their resulting increased profit rates are the reason why Western production was moved there. It was not unfair when capital was making money along free trade principles and eliminating local production.

Why is it unfair now? Because China is a economic competitor to the USA.

Cheap production in India or Indonesia isn't a problem yet because they are not economic competitors to the USA.

Free trade still reigns as an ideology in the same way as it did before. The only thing that has changed is people are starting to notice the fine print* of that ideology.

(*) So long as private capital remains hegemonic

What this means for local production in the West? It is not clear to me. Canadian liberals (Liberals and Tories and some of the NDP) continue to believe that it will all work out in the end without anyone in the government doing anything to foster real endemic production. The very concept of industrial strategy is alien to them.

But, as we are witnessing south of the boarder and in some European countries, things are starting to shift. In the USA, it is driven by an economic war in full swing with China, which will likely lead to a real war at some point. In Europe, it is in response to the actual war of Russia against Ukraine and the interest in leveraging USA's angst around Chinese economic development.

Too bad it isn't driven by things that we actually need to solve, like climate change, poverty, housing, food production, and health care.

Federal budget

Some things that stuck out to me in this strange federal budget that was dropped yesterday.

-

Announcements that were not actually funded.

- VIA Rail's supposed purchase of new train sets for their "outside the corridor" routes. This was announced, but no money allocated. The reason given was that they are in negotiations. I am not sure that being in negotiations is a legitimate excuse for pretending that the purchase is going to cost nothing.

- In the estimates there were a lot of zeros in future years for programs. So many that I think that there is not just a little bit of fudging going on.

-

There was no funding for all the things that the USA is spending money on to support local production.

- No subway cars for Toronto's transit system

- No ship building

- No money for high tech production only for research

- No new money for NRC to expand industrial production support

- No attempt to expand passenger or other kinds of rail infrastructure except the already announced High Frequency Rail (HFR). They did announce HFR will be moved from Transport Canada to Infrastructure Canada. Which tells you the government cannot conceive of even passenger rail as a productive service, just as infrastructure to privatize.

- No investment in mid-stream processing for critical minerals.

- No investment mining supports.

-

Continuation of a policy based on the belief that the free market will solve problems and all the government needs to do is:

- Increase the supply of workers with specific types of skills

- Tax credits.

- Tax free savings accounts to "support" potential home buyers.

- Tax incentives for "entrepreneurs".

- Gift public land to private companies.

- Provide profit subsidies to developers.

-

The very real fear of increased spending beyond basic statutory things.

- P3s are still on the table for infrastructure.

- Leaning on the false belief that pension funds are not private capital. But, also clearly showing that they believe that privatization of public assets to pension funds removes that "cost" from the government's budget.

- Thinking that Crown Companies should take on more risk and act more like large companies.

- Explicit mention of government policy to reduce labour disputes in privately operated ports and along supply chains. There is something very regressive about having this mentioned in a federal budget.

- The continued belief that a free market in carbon prices works while explicitly stating that it is not working and requires $6B in direct carbon offset subsidies to stabilize/guarantee a carbon price for private investors.

While there are some progressive things in this budget, it is not a progressive budget. It is very liberal budget. And one that is both out of step with Canadian's reality and out of step with the direction of global State economic policies.

It is unfortunate, but not surprising.

A couple of good things:

- Amending the Copyright Act so farmers can hack their farm equipment without fear of being sued.

- Leveraging public land and assets to build non-profit and coop housing. I will gloss over the way that they are doing this, but the simple fact that the state should be constantly thinking about use of public assets and land is important. And, it should be to support non-profit/coop (better: public) housing.

- Some specific supports for indigenous communities that are not terrible.

- Increased funding to researchers and graduate students.

- Being specific that the success of Crown Companies should not be through comparison to private sector actors, but similar type of actors around the world.

The rest is a bit of a flop and has been talked about previously.

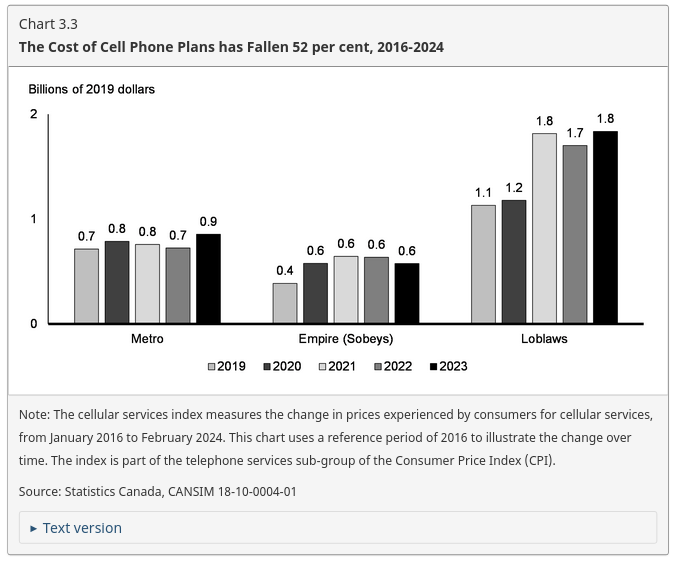

Also, this chart is all sorts of wrong. 10 Points for other major mistakes in the publication:

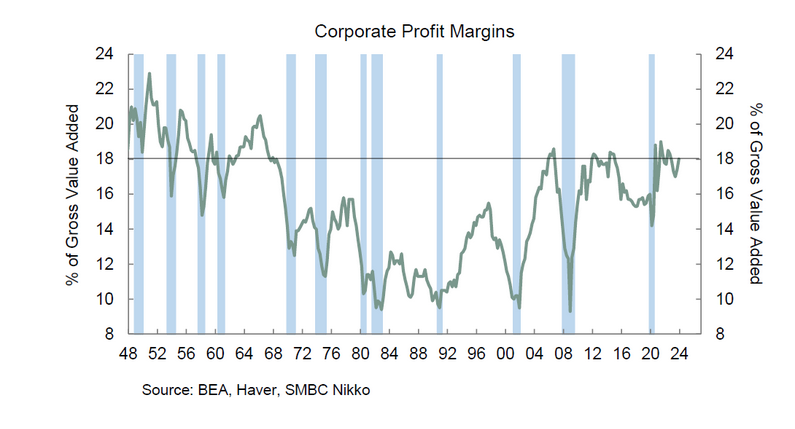

Profit margins

Broad capital profit margins have not been this high for a while.

This is a clear graph that, broadly, labour is losing in its battle with capital right now.