April 17, 2023

Structural Adjustment

It might be a new dawn for economics in the USA, but it's international ideology is the same through the IMF.

Egypt is being forced to privatize most of its public assets to access foreign investment from Saudi Arabia and UAE. To access the funds from the IMF, Egypt's government also has to promise to float its currency.

The IMF blames "entrenched interests" for delaying the fire sale of public assets and liberalization of internal economic policy.

After fifty years of this kind of policy failing, it is hard to see how this is going to help Egypt sustain an economy.

A new state-ownership policy introduced in late 2022 clarifies the role of the public sector and is supposed to boost private-sector participation in development projects. Under the IMF pact, state-owned entities must also submit financial reports to the finance ministry. The lender, however, has warned of potential “resistance from vested interests.”

The government in February unveiled a list of 32 companies in which it would sell stakes within a year. Finance Minister Mohamed Maait has said that number may rise and some assets would go to the market in April. According to the IMF program, Egypt is expected to raise $2 billion from the sale of state-owned stakes during the current fiscal year that ends in June.

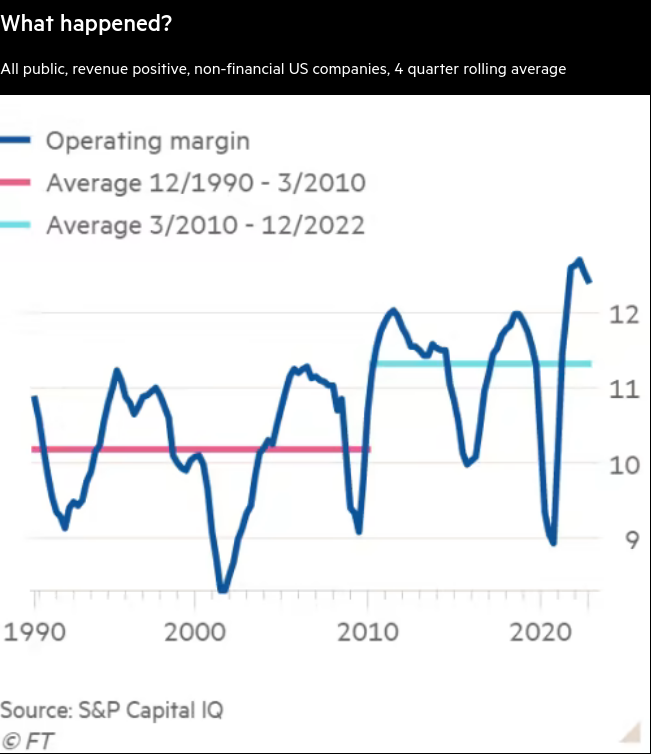

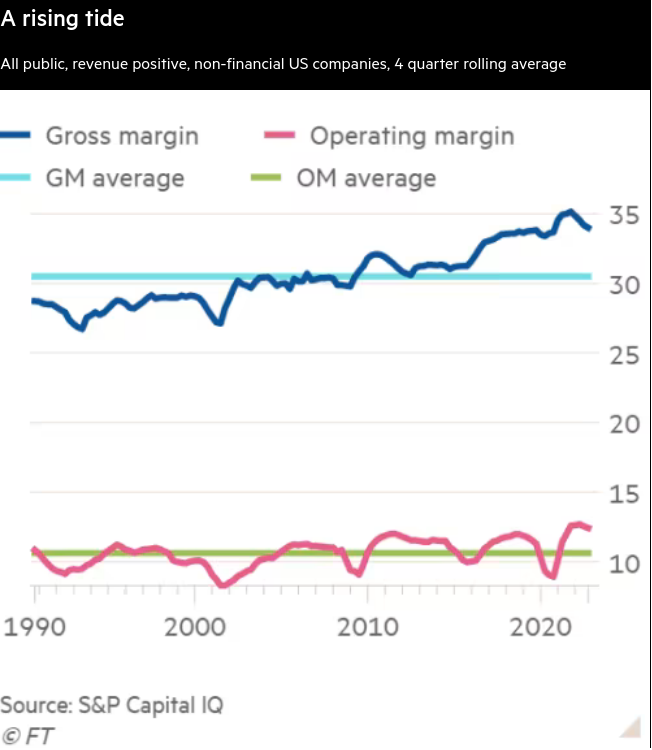

Profit subsidies and margins since 2009

Unhedged had a couple of graphs that were worth re-posting this morning.

The left have been talking about profits during the inflation peak, but it goes back much farther than that.

Profit margins have been high since the 2009 financial crisis, pushed-up by an explicit policy of profit subsidies through low interest rates.

While profit margins are calculated before interest payments, interest rates were artificially low for banks and therefore for everyone else. Also, when interest rates are low, the debt you have does not drag on reinvestment activity.

Some will point to "monopoly" behaviour, but it is hard to say that the entire market is in monopoly without smirking.

French will work longer, unless they choose a different political class to lead them

The anti-worker, dictated increase in age of retirement has become law.

The protests are likely to continue, but there is a sense in France that the political elite just do not care what the population or even their elected representatives think.

It is a situation that the French are more than used to by now. It can only lead people to assume that the current political system does not work for them.

The questions continue to be, what is the alternative and how do they get there?

IMF meeting ends with confusion

The folks at the IMF did not come to any consensus about the state of the economy. I guess we should expect nothing more from an organization whose main objective is the stability of global capitalism when that system is in crisis.

Looking at the data seems to indicate that they are just ignoring the facts.

Manufacturing capacity utilization is back down to 2018 levels. It is even lower for durable goods. Lowering utilization shows that there has been a slow-down in production use in-line with what the central banks were attempting to do with higher interest rates.

You cannot just wind utilization up after there has also been a collapse of investment in new capacity. And, a collapse in new investment is what we have seen over the previous few years. It is going to take a long time to get that investment in new capacity (or even maintenance of the current capacity) back to where it "should" be.

This will be a drag on inflation growth, but it may not bring it down fast.

Workers feel the pinch of high prices as consumers, but also lower wage gains because of less production. And, consumer sentiment metrics have moderated across the USA showing this is the case.

The main issue for inflation is that, on one side, global interest rates are no longer low enough to support free money for the financial sector. On the other side, the state is giving money away to anyone who invests in "friendshoring" and green-ish production. The time-lag resulting from the shift from one profit subsidy regime to the other may slow inflation if investment happens, but that new investment may also just not happen.

There has been some uptake of the free money. An increase in investment commitments in the USA of about $200bn (82K jobs) because of the IRA and CHIPS was found by the FT. This seems like a lot until you realize that the IRA and the CHIPS Act include near $440bn in free money. And, it is even less impressive when you consider much of that investment was going to happen anyway.

It is even less impressive when you consider that local subsidies—in addition to IRA/CHIPS—are not reported and are thought to be the largest in history: likely well over $15B.

And, again, less impressive when you look at the companies getting the "new" incentives

So, are we going to see a reduction in inflation because of an increase in real production of value?

It is still very hard to say, but right now it is not looking great. Even with very low expectations from an organization that consistently over-estimates the positives of USA style capitalism to just "work", I get the feeling of overly tired feigned hope that things are "back to the way they were".

I realize everything is 90's again, but the policies that got us through the 90s are unlikely to be revisited like most politicians are expecting.

I guess the current crop of leaders grew-up in the 90s and so expect things to be like that when they are now in charge?

The 90s were not a great time for most working people and this is left out of the nostalgia for that emo-political style. The shift in technology, of where production was happening, and the economic malaise resulting from the gutting of smaller communities was extremely destructive across the world. But, that destruction—and the benefits capital gained from that—cannot happen again.

I think that we are going to run into some real problems of investment over the next few years in that it is going to be extremely unequal.