April 14, 2022

NATO expansion

- War begets war as Finland ramps up rhetoric to join NATO.

- Russian responds with promise to place nuclear weapons in the Baltic.

- We may not need to worry about climate change as nuclear winters trump CO2 warming.

Auditor General report on Laurentian mess

The report is out and outlines:

- Poor management of institutional finances by the admin.

- A non-transparent, non-accountable budgeting process used by management.

- The CCAA process was not necessary, but a sought-out choice made by the senior admin.

- There were other options to solve the financial crisis through already established processes with faculty and staff.

- CCAA is an inappropriate mechanism for public institutions to deal with financial issues.

- The government is to ultimately to blame for the mess as they had other financing options.

- All of this causing irreparable harm to Laurentian and undermining confidence in the Ontario PSE system.

I will also add that while this outcome is unique (so far), all universities are engaged in the same management practices of reducing transparency and accountability of their finances and are engaged in rather questionable decision making. All driven by the same government policies that drove Laurentian into the ground.

This is just the latest example of why treating public institutions like universities as private companies has predictable, unique, and broad negative outcomes.

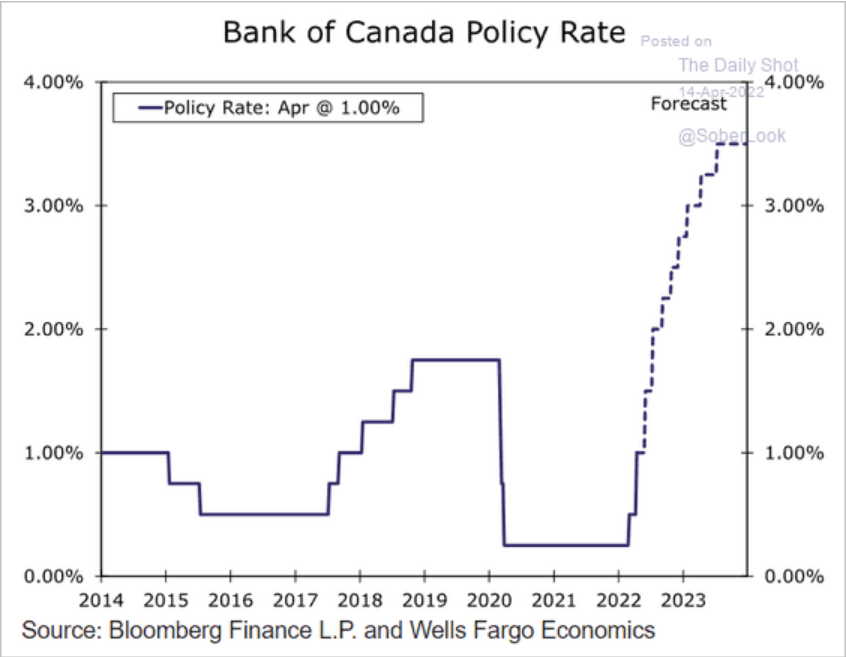

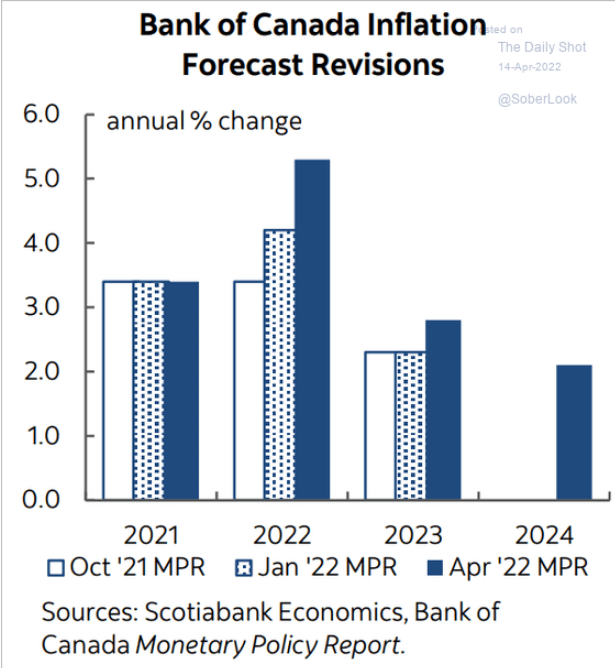

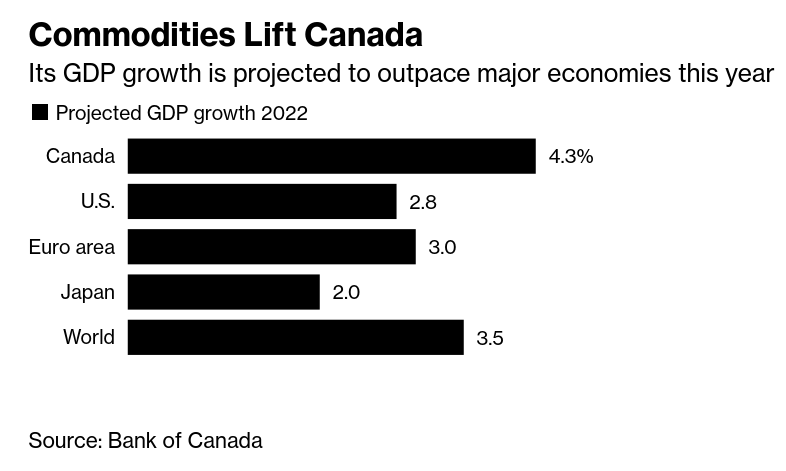

Canada interest rate increases

- Interest rates go to 1%, but they are likely going to go much higher.

- Trying to deal with price increases this way hurts workers.

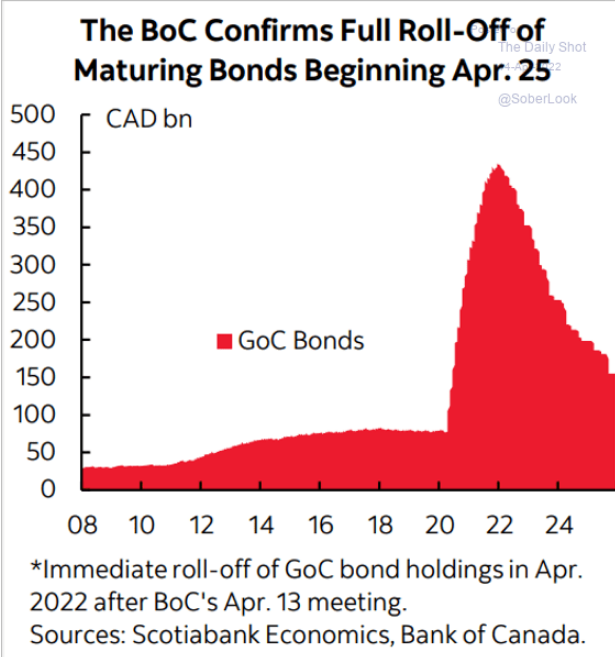

Quantitative Tightening

- We have gone from over a decade of Quantitative Easing to Quantitative Tightening.

- Easing was where the central banks of the world purchased bonds and other financial assets from the private sector with the goal of providing more liquidity (free money) into the economy (artificially driving down interest rates).

- Tightening is where they stop doing this and reduce the money supply attempting to push interest rates back up.

Since the Great Recession of 2008/09 (also called the Long Depression in some Marxist circles), banks have been trying to force the economy back on track by driving down the cost of bank debt. It has not worked, instead it just lead to a period of massive financial speculation growth leading to higher inequality.

Now, they are trying to slow an economy they think is overheating because they mistake high inflation and low "unemployment" for a booming economy. It too will likely not work.

Not working never stops them.

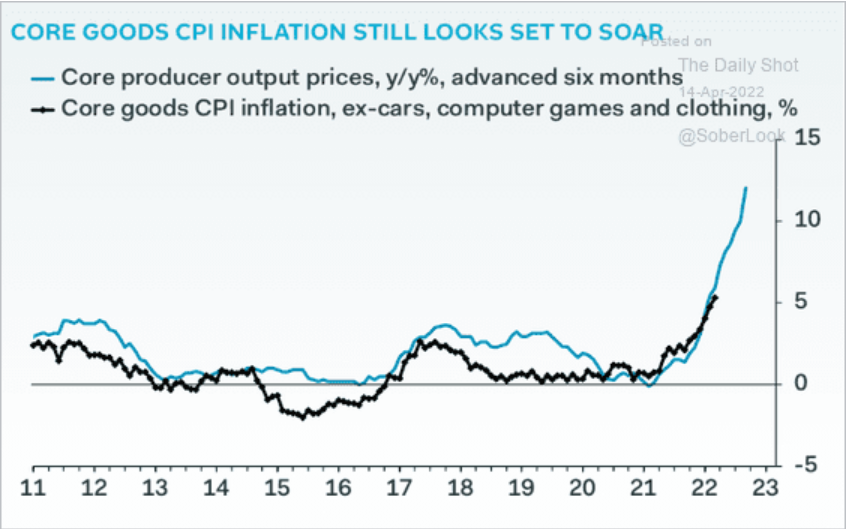

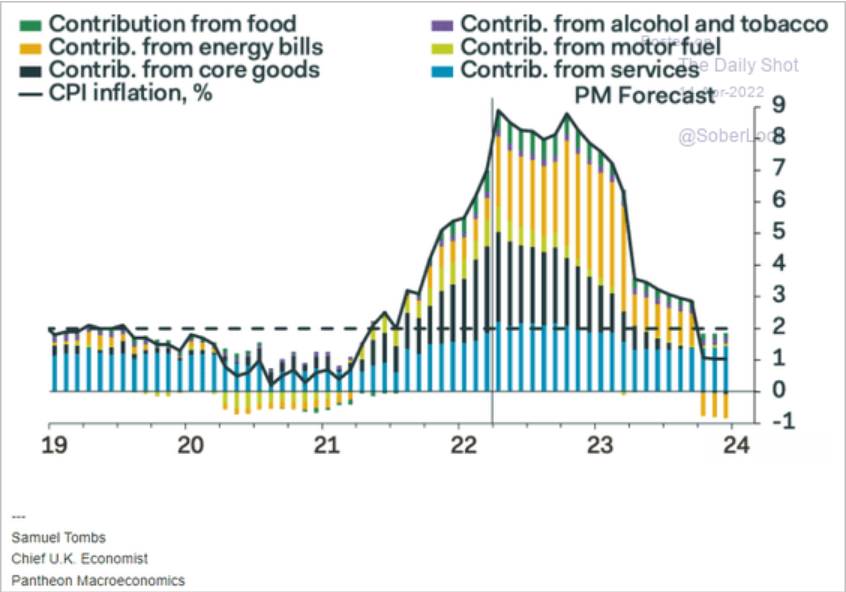

UK Inflation

- Just because I like to follow the UK.

- Costs are spiking but not peaking in the UK:

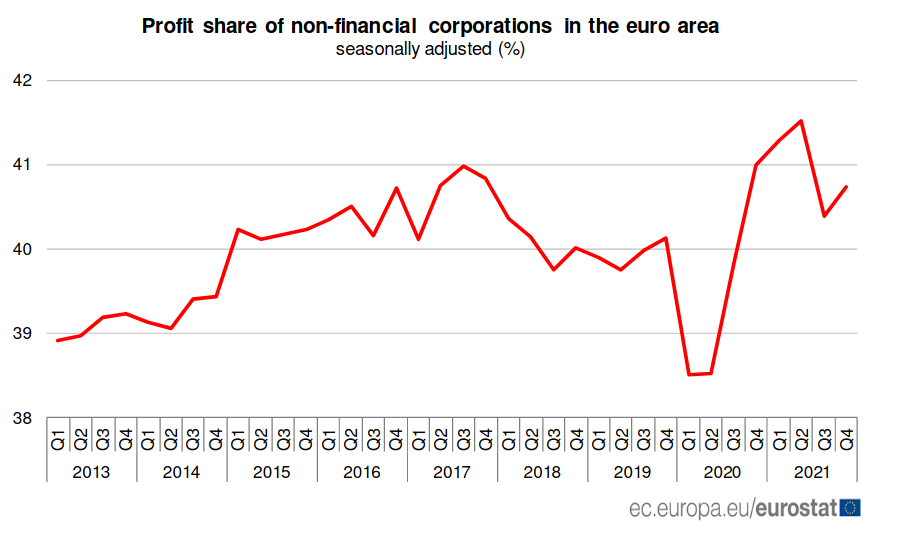

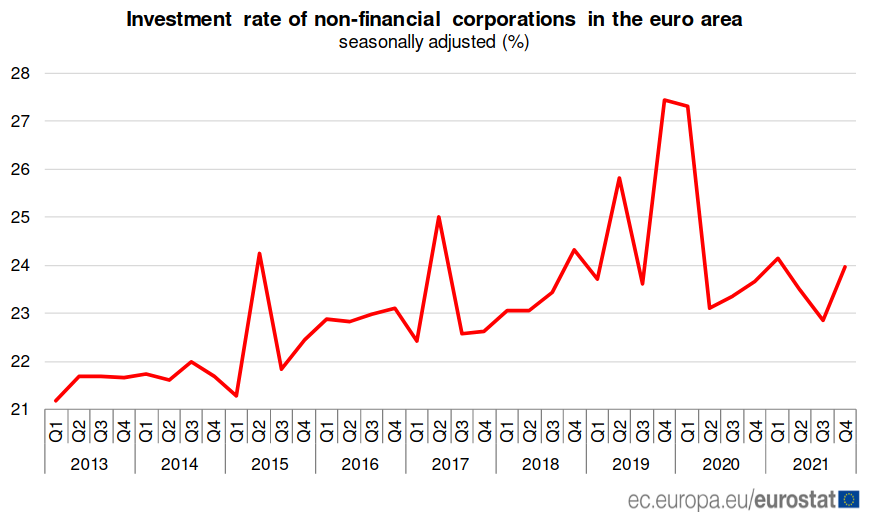

Europe not looking so good

- Profit share is unmoved and so is investment rate. Given the current situation in their economy, this does not bode well for private sector growth or wages.

The US-China conflict

- The economic war footing the US is taking towards China and its orbiting countries should worry people.

-

Points being made:

- Modernize trade integration

- Friend shoring (for supply chains)

- Private capital mobilization to "Support" developing countries

- The complaining about bi-polar world and then pushing countries to choose sides is not a great start.

Yellen, speaking a week before global finance chiefs meet in Washington, called Beijing to account for its ever-closer relationship with Moscow and blasted China for practices that “unfairly damage” the national-security interests of others. She alluded to the use of market positions – China is a key provider of crucial rare-earth metals – for “geopolitical leverage.”

While she said she didn’t want the evolution of a “bipolar” global system between U.S.-led and China-led elements, the Treasury chief said that Russia’s invasion of Ukraine marked a moment where nations need to decide where they sit. “The future of our international order, both for peaceful security and economic prosperity, is at stake,” she said.