April 13, 2023

Subsidies for private green energy generation

It is a new era in profit subsidies. These are now called "incentives".

Volkswagen, Europe’s largest carmaker, put on hold plans for a battery plant in the continent. It is awaiting an EU response after estimating it could receive €10bn in US incentives.

[In a] radical departure in how state subsidies have been policed within the bloc.

Brussels has cleared the way for a subsidy race with the US over crucial technologies, allowing EU member states to “match” multi-billion dollar incentives as they fight to keep projects in Europe.

…

The state aid guidelines impose some conditions. Brussels will allow EU countries to match such subsidies up to the point where the project would be financially viable in Europe, an effort to prevent public money from inflating companies’ profits. (FT)

This is a sop to the rich European countries which have the economic firepower to actually do this. Poorer countries in the EU are out of luck as there is no money for them to try to get private investment and they are essentially banned from going into debt to spur their own public investment.

The response to these complaints has been a mild subsidy regime:

[Small] projects will be subject to an increased subsidy ceiling of up to €350mn for projects in less wealthy regions and those in wealthier areas will be eligible to receive subsidies of up to €150mn.

Why do we care about this? Because we have been told for years that such programs would:

- Destroy the global economic system of investment.

- Are the basis for banning the expansion of public/state-owned productive capacity.

Now that the state can "incentivize" investment by just giving money to capital investment, we make the following comments:

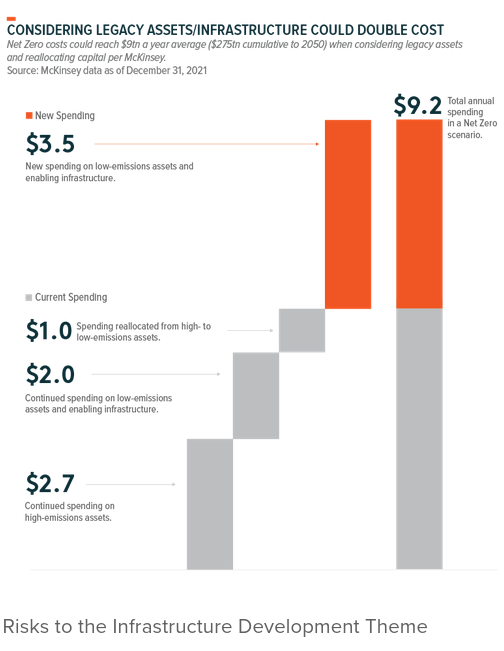

- Capitalist governments/policy makers are admitting that private capital does not have the ability to invest where we need them to. If we trusted capital to do that, there would be no need for such ridiculously high profit guarantees.

- That there is a limited amount of money available to make the transition to green energy. If there was an excess of money available to invest, then there would be no need to incentivize local investment.

- There is no reason at all that this production cannot be non-profit value creation via state-owned businesses. The threat of causing inflation through allocating huge profit subsidies at the expense of public services is highly regressive. Instead of expecting international capital investment, states can borrow and invest in their own foundational production.

My concern is that this is just shifting public profit subsidies from a policy of artificial, ultra-low interest rates to artificial, ultra-high tax credits. The lever is different, but the outcome is the same: no guarantee of investment where we need it and over-paying for investment we actually get.

Gap in investment

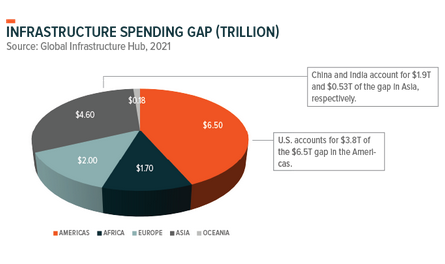

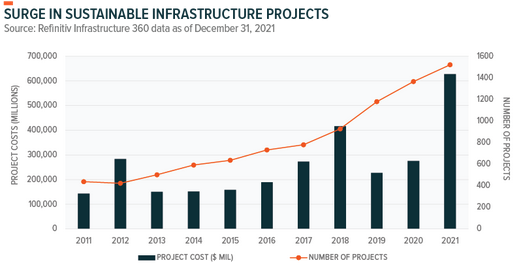

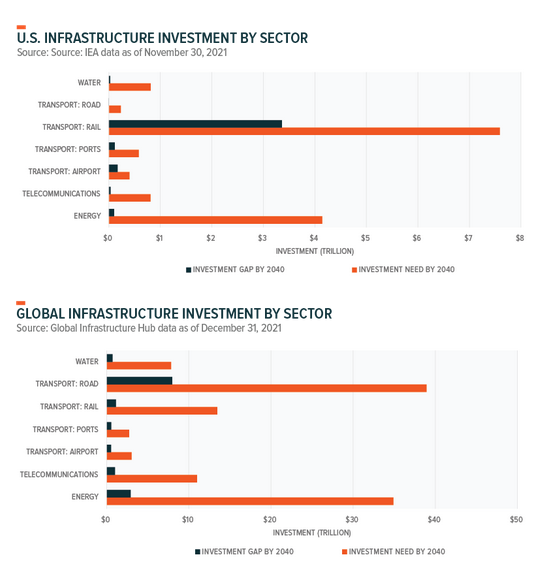

A research note from an investment firm has outlined some interesting (and large) gaps in infrastructure investment.

The needed investment, even under the current subsidy regime looks to fall far short of what is needed.

These are some very large numbers:

AI

The same argument made above also applies to the chip manufacturing sector. We have governments in the West falling-over themselves to "friendshore" (i.e., Not China) production of advanced microchips. The investment incentives provided in the USA are huge to try to get these large oligopolies to shift their production to states friendly to the USA.

In response, China is attempting to target some USA-based chip manufacturing companies in its borders. However, because China is very dependent, as we all are, on the few USA publicly traded companies that produce advanced microchips, there is a disequilibrium going on.

The knock on effects of changes in investment in microchips are a bit different from "green energy" investment.

First, the intellectual property monopoly rights regime sets the unequal playing field for investment and production of these computing components. We have allowed IP to be horded by just a few companies. As we move into higher demand for AI services, we are more reliant on these few companies.

Second, the amount of fixed capital investment and the number of workers needed to manufacture these chips—along with very long supply chains—makes chip manufacturing very much like aerospace and auto manufacturing. It takes very large companies a very long time to recoup investment.

Relocating these productive investments is going to cost a lot of money in the form of public subsidies. Building a production facility is about 5-10 times more expensive in the USA than it is in parts of Asia. Mostly because of labour and environmental standards, but also because of the technical know-how of the workers.

The solution to this may be in the RISC-V and other open source/libre hardware designs. Right now they are unable to compete with the large oligopolies for advanced chip development. But, a public research program that feeds money into public/non-profit research and development of open designs could shift some of the balance away from the oligopolies and remove some of the geopolitics of this sector.

That is, of course, not in capital's interest. The left are going to have to come to terms with the increased complexity of the world and start engaging with this material. Otherwise we will have abandoned any hope of having an alternative future decoupled from USA-style capitalism.