April 12, 2023

USA's economic blinders

Bloomberg this morning is reporting that there is significant distance between the position of the USA on one side and the IMF, World Bank economists, and the "market" on the other side at the IMF/World Bank meetings happening in Washington.

The IMF and the economists working for the global financial institutions who bet money on these things are estimating a downturn before the end of the year (a 65% chance of recession).

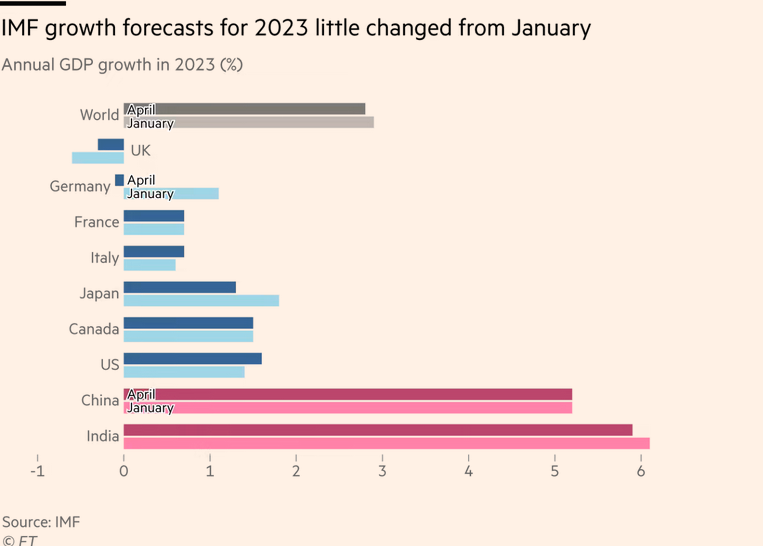

The IMF cut its outlook for the global economic growth.

The USA is saying the opposite. That the economy is actually going to do better than was predicted just six months ago.

Why the difference? A very slight difference in perspective and, believe it or not, ideology.

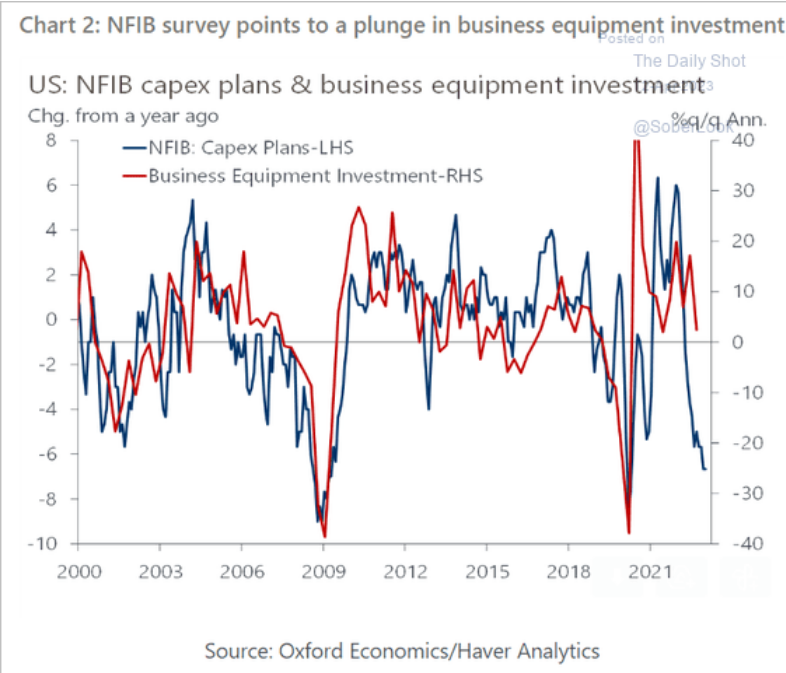

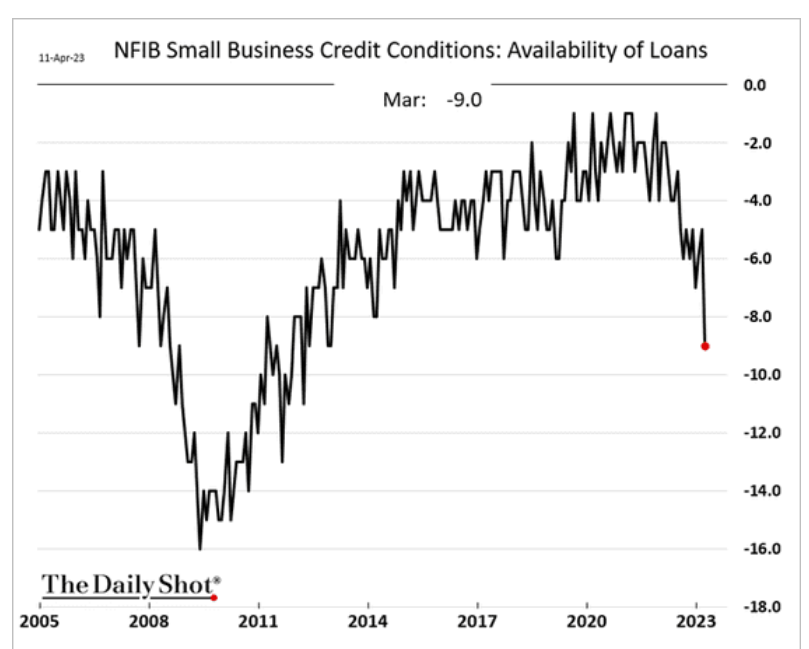

The government of the USA does not believe that the failures of banks in that country and the general malaise now being experienced in industrial investment is the result of "too high" interest rates.

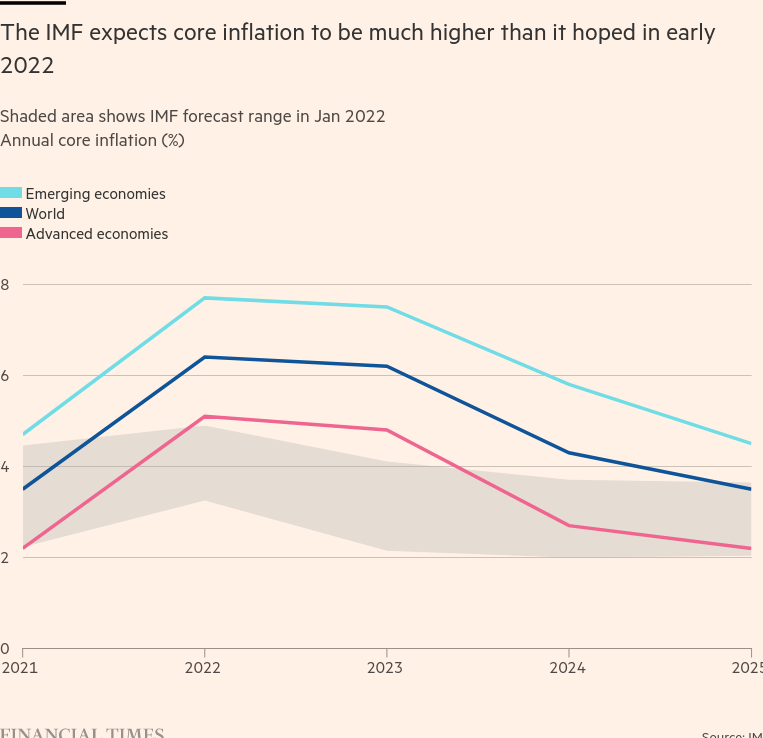

The IMF (and most other people in the neoclassical space) believe that the bank crisis, slowdown in investment and general hardship faced by emerging economies paying their debts is a real phenomenon tied to increased interest rates.

Essentially, the IMF believes that central bank ideology is being effective in reducing economic activity and the USA believes that their central bankers are Gods of Soft Landings.

I wish I could report a more detailed analysis of their models, but as you have probably guessed they do not really have analytical tools for this debate. One side believes in magic and the other side believes in fairies.

The entire debate is not a disagreement on inflation and what has caused it so much as the belief in the resilience of USA-style capitalism to overcome any recession that is thrown at it.

From our perspective, it is clear parts of the economy are experiencing recession in all the ways that matter.

- Employers received profit subsidies at the expense of their workers' wages that caused a spike in inflation.

- Workers have paid for inflation again through declining real wage.

- Technology continues to be implemented in work in the most socially regressive and unregulated way.

- Companies continue to borrow (for free) from the future with rising use of oil and gas to gain some economic growth today.

- Real cuts to public social and health programs continue to be rolled-out even as society is facing the multitude of crises that have come out of the pandemic.

- The savings rate for working families, which increased with pandemic-related supports, is now sharply declining. Consumers in the USA are using their credit cards heavily—an activity that will eventually run out of room.

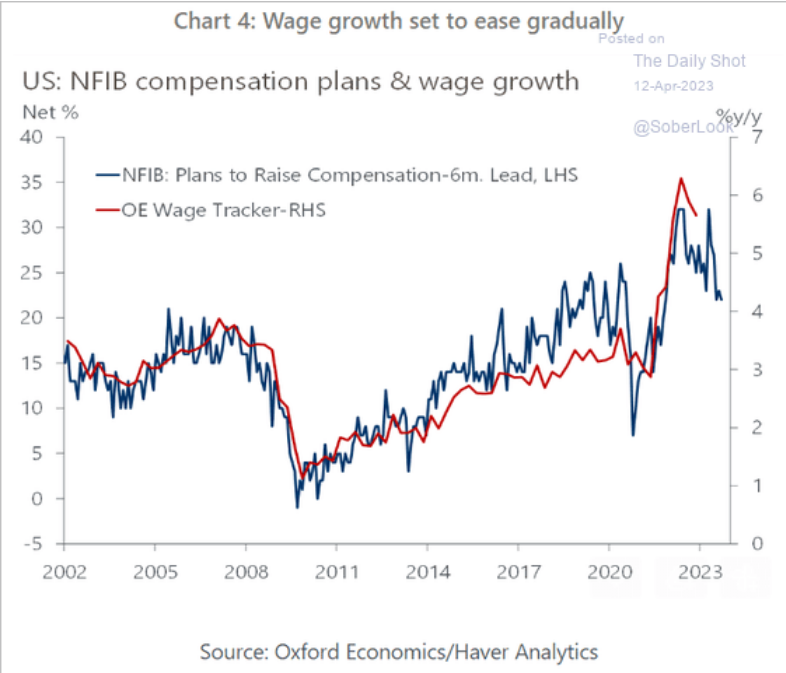

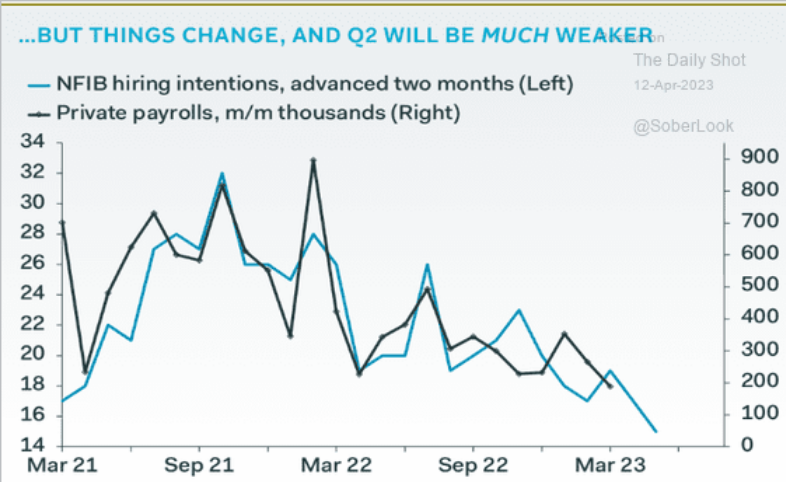

USA wages are likely going to stop growing:

As the tightness in the USA labour market wanes.

And, that is the rich world.

Saddled by surging inflation and a stronger dollar, more than 70 low-income nations face a collective $326 billion burden. About 15% of low-income countries are already in debt distress and another 45% face high debt vulnerabilities, with the list is growing. (BN)

The USA is actually not upset at the more global distress as they think that this will produce a drag on China. China has provided credit to most of these countries. Many indebted countries are in the process of restructuring that debt to pay China back.

While the impact on China is not as large as it would be if it was strictly a capitalist country lending money, the restructuring is not free. Their central bank is likely to ease their rates to stimulate growth to make up for the difference.

Canada

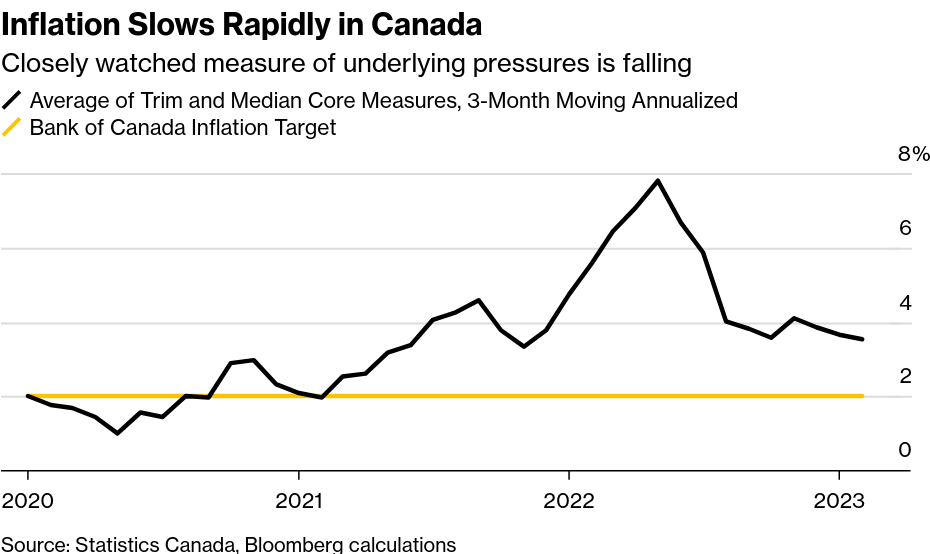

While the global debate about where inflation is, the debate here in Canada is a "half-full" versus "half-empty" kind of debate.

Is inflation coming doing quickly or is it persistent/sticky?

Is core inflation "high" or is it "much lower than it was"?

After peaking at 8.1% last June, the yearly change in the consumer price index slowed to 5.2% in February, thanks largely to base effects and falling energy prices.

Core inflation is around 5% annualized, but a shorter-term core measure — one that officials say they’re closely watching — has eased to 3.5%. That’s in line with falling price pressures in the US and elsewhere.

IMF growth forecasts continue to be rather modest and generally lower than the optimistic predictions of the government. At least when governments are not talking about debt and cuts to social services.